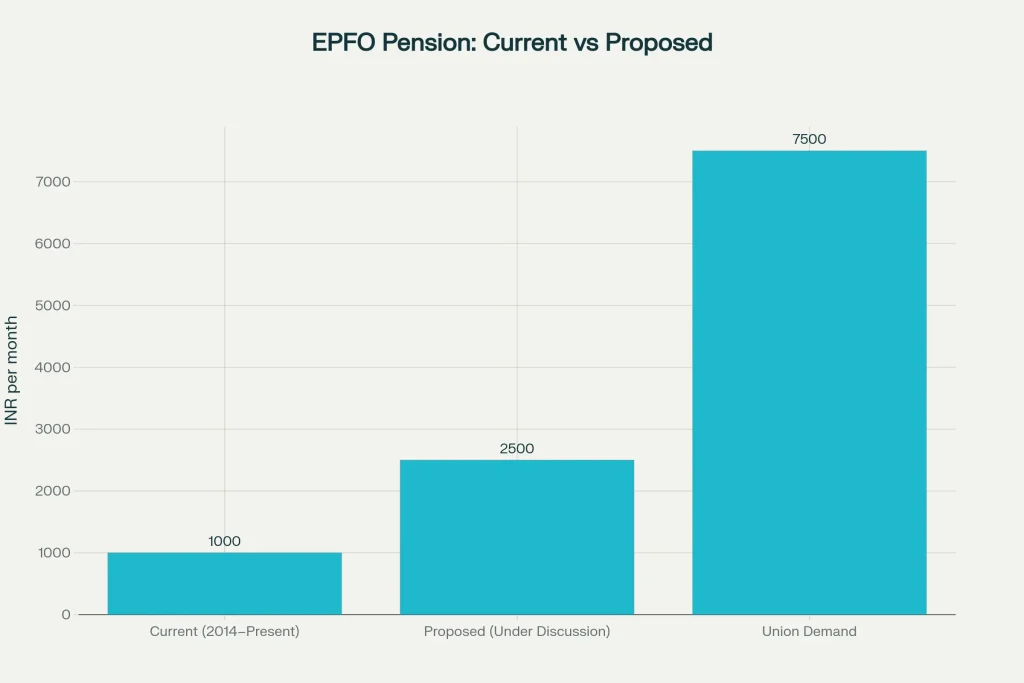

The Employees’ Provident Fund Organisation is moving toward the first meaningful reset of the EPS-95 minimum pension in more than a decade, a step long sought by pensioners battling higher prices and rising healthcare costs. The conversation has zeroed in on lifting the ₹1,000 floor set in 2014, aligning benefits with today’s realities and setting a clearer path for periodic adjustments so retirees don’t lose ground to inflation over time.

When people talk about “EPFO plans first revision to minimum pension after 11 years,” they mean an overdue correction to the EPS-95 base pension that has remained at ₹1,000 since 2014 even as living costs climbed year after year. The expected change reflects two priorities: restore basic adequacy now and build a system where future adjustments are not delayed for another decade. From what’s been discussed in policy circles, a mid-path increase has the strongest feasibility signal, with broader modernization under EPFO 3.0 designed to make implementation smoother and faster.

EPFO Plans First Revision to Minimum Pension After 11 Years

| Item | Current | Proposed/Discussed | What It Means |

|---|---|---|---|

| Minimum EPS-95 Pension | ₹1,000/month | Higher floor under active consideration | First reset since 2014 to improve adequacy |

| Union/Public Demand | — | Up to ₹7,500 | Demand pressure exceeds feasibility in near term |

| Indexation Approach | Limited in practice | DA/AICPI linkage discussed | Aim to preserve value against inflation |

| Decision Flow | — | Board resolution then government approval | Formal notification will set figure and date |

| Rollout Enabler | Legacy processes | EPFO 3.0 digitization | Faster recalculation and payments at scale |

| Beneficiary Impact | Low base support | Stronger floor security | Better protection for low earners/short service |

EPFO plans the first revision to minimum pension after 11 years to restore basic adequacy for EPS-95 pensioners and to reduce the risk of future value erosion. Expect a clearer framework that pairs a higher floor with stronger systems under EPFO 3.0, so calculations, payments, and grievance handling keep pace with policy and retirees get timely, predictable support when it matters most.

What Is Changing and Why It Matters

- The ₹1,000 minimum has been unchanged since 2014, which means its purchasing power is far lower today; a higher floor is the quickest way to restore basic protection for retirees with modest service histories or lifetime wages.

- A revised minimum is expected to be paired with clearer rules on periodic adjustments so the base pension doesn’t again fall far behind inflation, particularly for essential expenses like food, utilities, and medicines.

How EPS-95 Pension Is Calculated

- The EPS formula commonly used in practice is: Pension = (Pensionable Salary × Pensionable Service) ÷ 70.

- “Pensionable salary” generally refers to the average of the last 60 months’ basic plus DA, subject to the prevailing wage ceiling for EPS calculations.

- Eligibility typically requires at least 10 years of contributory service, with full pension vesting at age 58; early exit or deferred options can alter the payable amount.

What A Higher Minimum Means for You

- If your calculated pension is below the new floor, the notified minimum becomes your payable amount, so the hike immediately lifts your monthly credit without you needing to change past contributions.

- Those whose computed pension is already above the new floor won’t see a change from the minimum itself, but may still benefit if periodic indexation is confirmed and applied.

Funding, Feasibility and Approvals

- A higher minimum implies additional fiscal support beyond standard employer contributions to EPS, so final numbers typically balance pension adequacy with budgetary feasibility.

- The formal path runs through the EPFO trustee board’s resolution followed by government approval; the effective date, computation rules, and any DA linkage are notified only after final sign-off.

EPFO 3.0: The Operational Backbone

- The EPFO’s modernization drive aims for paperless, near real-time processing centralized pension payments, streamlined claim corrections, and cleaner KYC flows.

- This backbone is essential for a smooth shift to a new minimum: recalculations, statement updates, and bank credits need to be synchronized and error-free at scale.

Who Benefits The Most

- Workers with lower lifetime wages or fewer contributory years whose computed pension often falls below the minimum see the biggest absolute gain from a higher floor.

- Widows/widowers and family pension recipients also benefit where payable amounts are pegged to the minimum, subject to scheme rules.

How To Prepare as a Pensioner

- Keep bank details, KYC, and Aadhaar updated in your pension records to avoid credit delays when the revised minimum goes live.

- Download and review your latest pension statement after the change is notified to confirm the new amount and check for discrepancies in service or salary history.

Practical Scenarios

- Short-Service Worker: A private security guard with 12 years of service and wages near the ceiling may see the revised minimum applied because the formula outcome can be modest; the higher floor directly increases monthly income.

- Long-Service Worker Near Ceiling: A salaried employee with about 35 years at or near the ceiling may already be above the minimum; the change may not boost the base amount but could benefit from any adopted indexation.

- Family Pension Case: Where the scheme ties family pension to a percentage linked to the minimum, an increase in the base can flow through proportionally, improving survivor protection.

- EPS-95 minimum pension revision, Central Board of Trustees decision, DA linkage to AICPI, pension adequacy and inflation, EPFO 3.0 digital rollout, EPS formula and eligibility, higher pension operations, pension payment system, implementation timeline, pensioner KYC and bank update.

FAQs on EPFO Plans First Revision to Minimum Pension After 11 Years

Is the minimum pension hike confirmed and from when will it apply?

A higher floor has been actively discussed with strong intent to correct the decade-old ₹1,000 baseline; the effective amount and date are finalized only through formal notification. Once notified, recalculations reflect in pension credits automatically for eligible beneficiaries.

Will there be DA or inflation indexation going forward?

Indexation linked with AICPI has been part of policy conversations to protect real value over time. The notification will specify whether and how DA adjustments are incorporated and how frequently they will apply.

How does the EPS formula interact with the minimum floor?

Your computed pension from the formula is compared with the notified minimum; if the calculation is lower than the floor, you receive the minimum.

What documentation should I keep updated to avoid delays?

Keep Aadhaar, bank account details, PAN (where applicable), and mobile/email updated in EPFO records. Ensure your service history is accurate; discrepancies should be raised early for correction to prevent payout issues.