Retirement is supposed to be a phase of comfort and stability, but for many private-sector retirees in India, it has become a period of financial stress. Over the years, rising inflation, medical costs, and everyday expenses have slowly eroded the value of pensions.

This is why the EPFO Pension Update 2026 has become such a widely discussed topic. Pensioners, employees, and even working professionals who are still years away from retirement are closely following every update, hoping for meaningful change. The EPFO Pension Update 2026 is especially important because the minimum pension under the Employees’ Pension Scheme has remained unchanged for a long time. While the economy has grown and salaries have increased, pensions have not kept pace. As a result, expectations are high that 2026 could finally bring reforms that reflect current living realities and provide pensioners with a more dignified post-retirement life.

The EPFO Pension Update 2026 refers to the ongoing discussions and expectations around revising the minimum pension provided under the Employees’ Pension Scheme. At present, the minimum pension amount is considered insufficient by most pensioners, particularly in urban and semi-urban areas. This update has drawn attention because it highlights long-standing concerns about social security for private-sector workers. While several proposals and demands are being discussed publicly, no official announcement has been made yet. Still, the conversation itself signals that pension reform has become a priority issue.

EPFO Pension Update 2026

| Key Detail | Information |

|---|---|

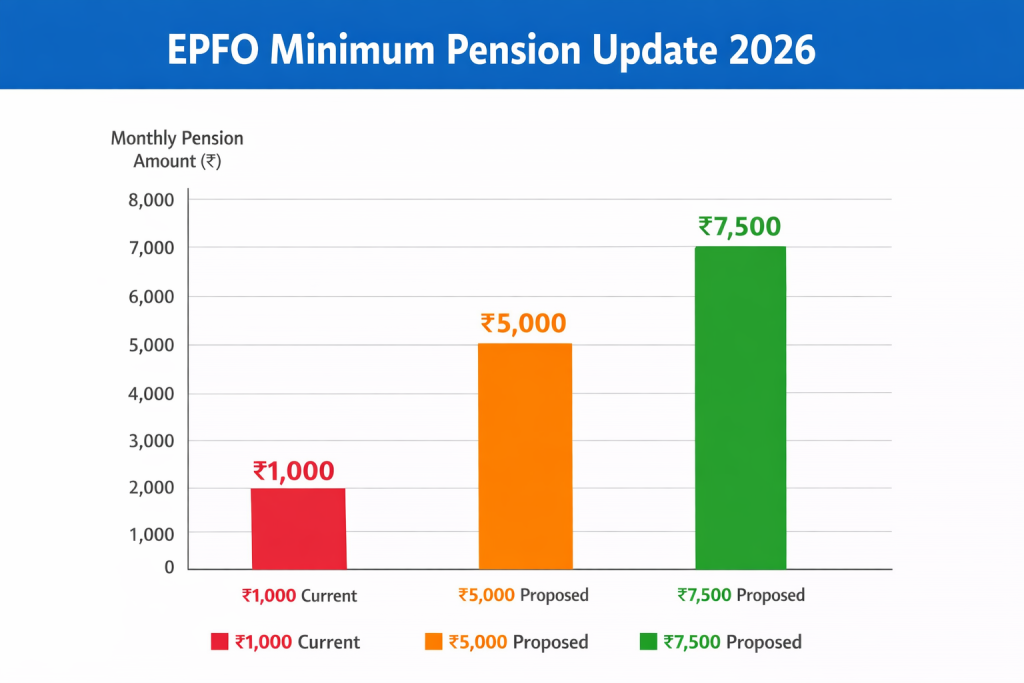

| Current Minimum Pension | ₹1,000 per month |

| Scheme Name | Employees’ Pension Scheme |

| Last Revision | Over a decade ago |

| Proposed Figures | ₹5,000 to ₹7,500 (under discussion) |

| Official Confirmation | Not announced yet |

| Main Reason for Update | Rising cost of living |

The EPFO Pension Update 2026 represents a crucial moment for India’s private-sector pension system. Although no official increase has been announced yet, the growing discussion reflects widespread recognition of pensioners’ challenges. A meaningful update could transform retirement for millions, offering financial security and dignity after years of service. Until concrete decisions are made, patience and awareness are key. Pensioners and employees alike should stay informed, manage expectations realistically, and prepare for possible changes. Whether or not 2026 brings the long-awaited pension hike, the conversation itself marks an important step toward strengthening social security in India.

Has The Minimum EPFO Pension Been Raised In 2026?

One of the most common questions surrounding the EPFO Pension Update 2026 is whether the minimum pension has already been increased. The simple answer is no. As of now, there has been no official notification confirming a hike in the minimum pension amount. Despite multiple news articles, social media posts, and online discussions suggesting otherwise, the pension remains unchanged. This confusion largely arises because proposals and demands are often mistaken for approved decisions. Pensioners’ associations have been vocal about their expectations, and these demands sometimes get reported as confirmed updates. It is important for pensioners to rely only on official announcements to avoid false hope or misinformation.

Why A Pension Increase Is Being Discussed

- The demand for an increase did not emerge overnight. The existing pension amount was fixed years ago, at a time when the cost of living was significantly lower. Since then, inflation has steadily increased the prices of essential goods, healthcare services, and utilities. For many retirees, managing monthly expenses on the current pension amount has become nearly impossible.

- Another reason the EPFO Pension Update 2026 is being discussed is the growing awareness of social security rights. Pensioners argue that after decades of service and contribution, they deserve a pension that allows them to live with dignity rather than depend on family members. This sentiment has gained support from labor unions and employee groups across the country.

What Proposed Pension Figures Mean For Monthly Pay

- Several figures have been mentioned during discussions about pension revision. While none of them are official, they help illustrate what a change could mean in real terms. A modest increase would offer limited relief, but a substantial revision could significantly improve retirees’ quality of life.

- If the minimum pension were raised to ₹5,000, pensioners would be better equipped to cover basic expenses such as groceries, electricity bills, and routine medical costs. A higher figure, such as ₹7,500, could provide even greater stability, especially for elderly pensioners who face frequent healthcare needs.

- The EPFO Pension Update 2026 is therefore not just about numbers. It is about ensuring financial independence, reducing stress, and allowing retirees to manage their lives without constant worry about money.

What Would A Pension Hike Mean For Pensioners?

A confirmed pension hike would have far-reaching effects. Financially, it would ease the pressure on retirees who currently rely on personal savings or family support. Socially, it would enhance their sense of independence and self-respect. Beyond immediate financial relief, the EPFO Pension Update 2026 could also rebuild trust in the pension system. Many working professionals today question whether their contributions will be enough to support them after retirement. A meaningful pension revision would send a strong message that the system values long-term contributors and is willing to adapt to changing economic conditions.

Financial Sustainability and Government Considerations

While the demand for higher pensions is justified, authorities must also consider the financial sustainability of the pension system. Any increase in pension payouts requires careful planning to ensure that funds remain stable in the long run. This balancing act is one of the main reasons why decisions around pension hikes take time. The EPFO Pension Update 2026 is expected to take into account factors such as contribution levels, fund reserves, and long-term obligations. Policymakers aim to find a solution that benefits pensioners without putting excessive strain on the system.

What Pensioners Should Do Now

Until there is an official update, pensioners should focus on staying informed through reliable sources. Regularly checking official EPFO communications can help avoid confusion. It is also advisable to keep personal records updated, including bank details and life certificates, to ensure uninterrupted pension payments. While waiting for clarity on the EPFO Pension Update 2026, retirees may consider basic financial planning strategies to manage expenses more efficiently. Even small steps, such as budgeting and prioritizing essential spending, can make a noticeable difference.

Pashu Palan Loan Yojana 2026 — How Farmers Can Apply for Loans Up to ₹5 Lakh

Impact On Future Retirees

- The outcome of the EPFO Pension Update 2026 will not only affect current pensioners but also future retirees. A revised pension structure could influence how employees plan their careers and savings. Knowing that pensions are periodically reviewed and adjusted may encourage greater trust in the system.

- For younger employees, this update serves as a reminder of the importance of long-term financial planning. While pensions are a critical safety net, additional savings and investments remain essential for a comfortable retirement.

FAQs on EPFO Pension Update 2026

What Is the Current Minimum Pension Under EPFO

The current minimum pension under the Employees’ Pension Scheme is ₹1,000 per month.

Has The EPFO Pension Update 2026 Been Officially Announced

No, there has been no official announcement confirming a pension hike as of now.

Why Are Pensioners Demanding an Increase?

Pensioners argue that the existing amount is too low to meet basic living expenses due to inflation and rising costs.

What Pension Amounts Are Being Discussed?

Figures such as ₹5,000 and ₹7,500 are being discussed, but they are proposals, not confirmed decisions.