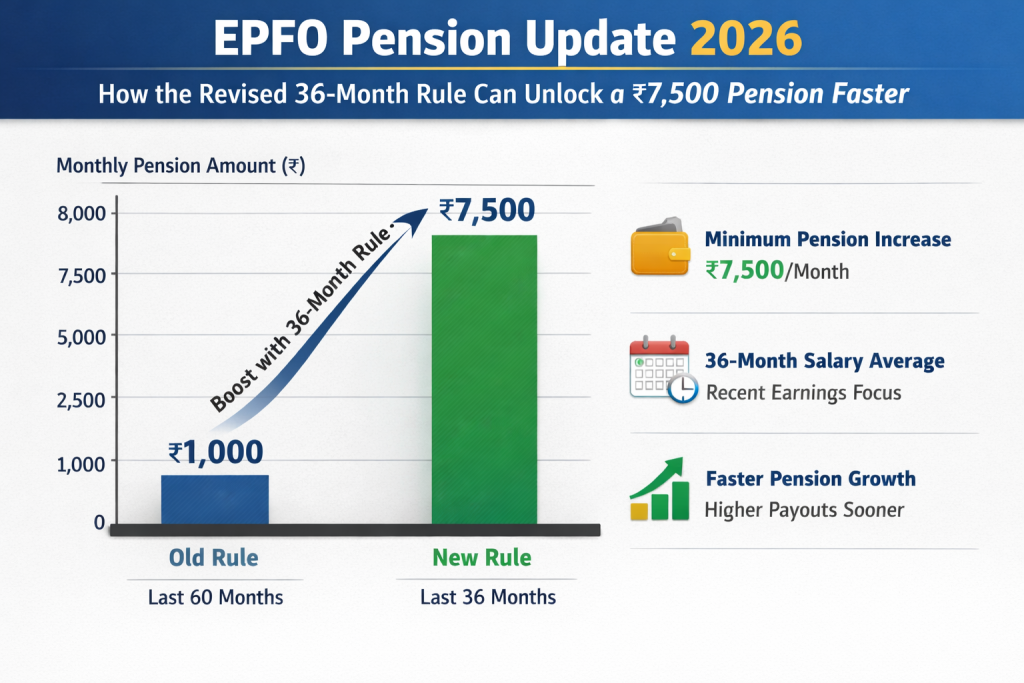

If you are a salaried employee, a retiree, or someone planning for long term financial security, the EPFO Pension Update 2026 is something you cannot afford to ignore. For years, pensioners under the Employees Pension Scheme have struggled with a minimum pension amount that failed to keep up with inflation, healthcare costs, and everyday living expenses. A monthly pension of ₹1,000 was never enough, especially for retirees who depended solely on it for survival. That is why the EPFO Pension Update 2026 has become one of the most talked about policy discussions in recent times. With the government considering a major increase in the minimum pension to ₹7,500 and revising the pension calculation formula, this update could reshape retirement planning for millions of Indians. One of the most important changes proposed is the revised 36-month salary rule, which could help eligible members reach a higher pension amount much faster than before.

The EPFO Pension Update 2026 represents a structural reform rather than a minor adjustment. The update focuses on improving pension adequacy and fairness by addressing two long standing problems. The first is the extremely low minimum pension amount. The second is the outdated method of calculating pensionable salary using the average of the last 60 months. Under the proposed changes, the salary averaging period may be reduced to 36 months. This means pensions will be calculated using more recent salary figures, which are typically higher. Combined with the proposed increase in the minimum pension, this reform could significantly improve post-retirement income for both existing and future pensioners.

EPFO Pension Update 2026

| Category | Existing System | Proposed Update 2026 |

|---|---|---|

| Minimum Monthly Pension | ₹1,000 | ₹7,500 |

| Salary Calculation Period | Last 60 months | Last 36 months |

| Applicable Members | EPS pensioners | EPS pensioners and future retirees |

| Main Objective | Basic pension support | Improved retirement income |

| Expected Rollout | Already active | From 2026 |

Minimum Pension Hike To ₹7,500

One of the most significant elements of this reform is the proposed increase in the minimum pension from ₹1,000 to ₹7,500. This change has been demanded by pensioners’ associations for years. With inflation steadily rising, the existing pension amount has become largely symbolic rather than practical. A higher minimum pension would provide immediate relief to retirees, especially those without additional income sources. It could help cover essential expenses such as food, electricity, rent, and basic healthcare. For many low-income pensioners, this hike could restore a sense of financial dignity and independence after retirement.

Why The Pension Hike Is Long Overdue

- When the minimum pension was set at ₹1,000, the cost of living was far lower than it is today. Medical expenses were cheaper, housing costs were manageable, and daily necessities were affordable. Over the years, prices have increased sharply, but pension amounts have remained stagnant.

- The EPFO Pension Update 2026 acknowledges this gap. By raising the minimum pension, the government aims to align retirement benefits with present day economic realities. This move also reflects a growing focus on social security for senior citizens.

Revised 36 Month Rule Explained

- Earlier, the Employees’ Pension Scheme calculated pensions based on the average salary of the last 60 months of service. While this method appeared fair, it often reduced pension payouts, especially for employee’s who experienced salary growth in their final working years.

- Under the revised 36-month rule, only the last three years average salary will be used for pension calculation. Since salaries are usually highest during this phase, the pensionable salary increases. This change ensures that pension benefits more accurately reflect an employee’s earning capacity closer to retirement.

How The 36 Month Rule Helps Unlock ₹7,500 Faster

- The revised calculation period plays a crucial role in helping members reach the ₹7,500 pension threshold faster. When higher recent salaries are considered, the pension amount naturally increases. Employees who received promotions, increments, or revised pay scales near retirement stand to benefit the most.

- This rule reduces the dilution effect caused by older, lower salaries. Combined with the proposed minimum pension hike, the revised formula could make ₹7,500 a realistic monthly pension for a much larger group of retirees under the EPFO Pension Update 2026.

Impact On Employees Nearing Retirement

- Employees who are close to retirement are among the biggest beneficiaries of this update. Many workers see their highest salary levels during the last few years of service. Under the old system, these higher earnings had limited impact on pension calculations.

- With the revised 36-month rule, pensions will better reflect final earnings. This means employees may not need extended service periods or legal interventions to claim higher pensions. The system becomes simpler, fairer, and more transparent.

Benefits For Existing Pensioners

- Existing pensioners have long been the most affected by the low minimum pension. For many retirees, ₹1,000 per month barely covered basic necessities. If the proposed hike to ₹7,500 is implemented universally, it could significantly improve their quality of life.

- However, the final benefit will depend on implementation guidelines. Clear communication and automatic revisions will be essential to ensure existing pensioners actually receive the enhanced pension without procedural delays.

Government’s Policy Direction Behind The Reform

The EPFO Pension Update 2026 aligns with the government’s broader goal of strengthening social security frameworks. With life expectancy increasing, retirees now spend more years without regular income. A weak pension system puts additional pressure on families and public welfare schemes. By updating pension calculations and minimum payouts, the government aims to modernize the Employees’ Pension Scheme and restore confidence among salaried workers. This reform also encourages long term participation in EPFO by making retirement benefits more meaningful.

What EPFO Members Should Do Right Now

Although the proposed changes are expected to take effect from 2026, EPFO members should start preparing early. Ensure that your service records, salary details, and EPS contribution history are accurate and updated in EPFO records. Employees nearing retirement should review how the EPFO Pension Update 2026 could impact their pension eligibility. Staying informed and proactive now can help avoid complications later when the new rules are implemented.

Tenant Rights 2026 – 5 Legal Protections Every Renter Should Check Before Signing a Lease

Long Term Impact on Retirement Planning

- This update could change how employees view retirement planning. A higher pension amount reduces dependence on personal savings and family support. It also encourages workers to remain within the formal employment system and continue EPFO contributions.

- Over time, the revised pension structure may help create a more stable and predictable retirement ecosystem, particularly for middle- and lower-income earners.

The EPFO Pension Update 2026 has the potential to be a landmark reform in India’s pension system. By increasing the minimum pension and introducing the revised 36 month salary rule, the government is addressing long ignored issues faced by retirees. If implemented smoothly, these changes could unlock a ₹7,500 monthly pension faster for millions of employees and pensioners. More importantly, it could offer financial security, independence, and dignity during retirement.

FAQs on EPFO Pension Update 2026

What Is the EPFO Pension Update 2026

It is a proposed reform aimed at increasing the minimum pension and revising the pension calculation method under EPS.

How Does The 36 Month Rule Affect Pension Calculation

It uses the average salary of the last 36 months instead of 60 months, usually resulting in a higher pension.

Will Existing Pensioners Get ₹7,500 Pension

Existing pensioners may benefit if the revised minimum pension is implemented universally.

When Will the New Pension Rules Be Implemented

The proposed changes are expected to be implemented from 2026, subject to final government approval.