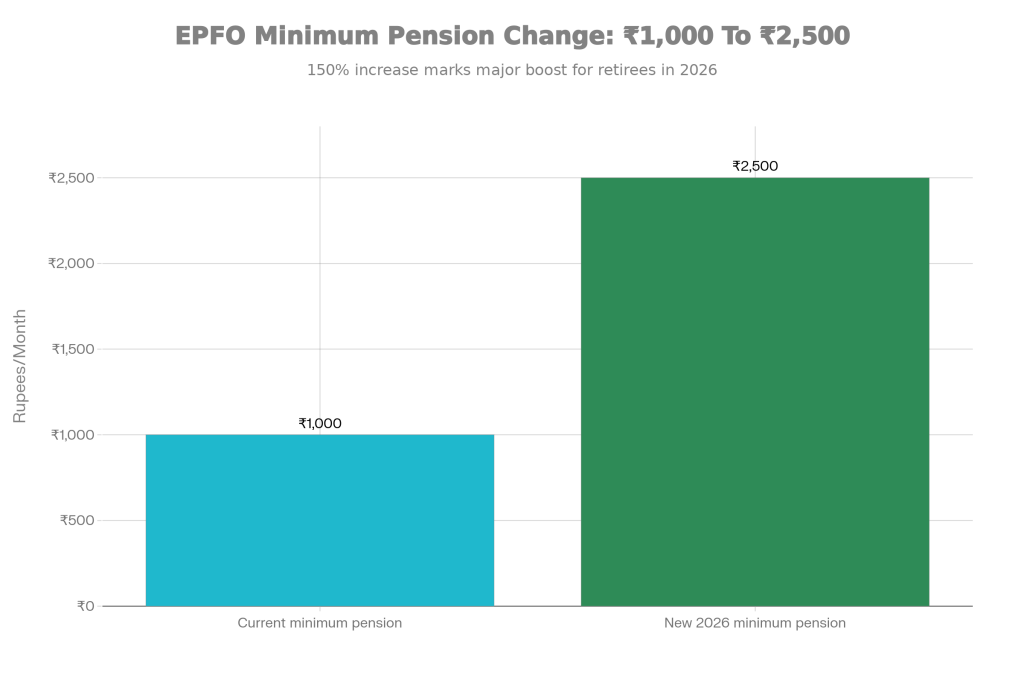

EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 is in the spotlight because millions of retired employees want to know how much extra money will actually come into their bank accounts from 2026. Under EPS-95, the current minimum pension is just ₹1,000, and the proposed changes aim to lift this basic amount to around ₹2,500, which is being seen as a much-needed relief in today’s high-inflation environment. EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 is not just a catchy headline; it could become a real gamechanger for EPS members. The new formula being discussed is expected to link pension calculation more realistically with salary, years of service, and EPS contribution. Once the minimum pension moves closer to ₹2,500 and any future inflation-linked benefits are added, small pensioners may finally see a noticeable difference in their monthly cash flow, especially those whose current pension barely covers essential expenses.

Under the EPFO Pension Rule Change New ₹2,500 Monthly Pension To Begin For Retirees In 2026 update, the focus is on raising the minimum pension floor and improving the pension formula itself. At present, EPS-95 pension is calculated using an older formula that mainly considers pensionable salary and service period. The new model being discussed could use the average salary of the last 12 months, introduce more flexibility in service conditions, and strengthen EPS contributions to deliver a more meaningful pension. This shift is especially important for retirees who have been surviving on very low pensions and have been waiting for a more dignified level of income in retirement.

EPFO Pension Rule Change

| Point | Key Details |

|---|---|

| Scheme | Pension under the Employees’ Pension Scheme (EPS-95) managed by EPFO |

| Current Minimum Pension | Around ₹1,000 per month, continuing as the base floor since 2014. |

| Proposed New Minimum Pension | Plan to raise the effective minimum pension to about ₹2,500 per month from 2026. |

| ₹7,500 Update | Some discussions mention moving the base floor to ₹7,500 and, in practice, showing an entry-level pension of about ₹2,500 for smaller pensioners under the new formula. |

| New Pension Formula | Focus on last 12 months’ average salary, more flexible service rules, and improved EPS contribution structure to increase pension. |

| Implementation Timeline | Targeted from 2026, subject to EPFO board approval and government notification. |

| Expected Beneficiaries | Lakhs of EPS-95 pensioners as well as future retirees expected to benefit directly. |

| Main Objective | To provide a more dignified, inflation-aligned minimum pension and stronger social security in retirement. |

Why A Major Change In EPFO Pension Was Needed

For over a decade, EPS-95 pensioners have been stuck with a minimum pension of just ₹1,000, while costs of healthcare, rent, groceries, and transportation have risen sharply. Pensioners’ associations and trade unions have consistently demanded that the minimum pension be raised into the ₹2,500–₹7,500 range so that retired employees can at least manage basic living expenses without constant financial stress.

EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 is being seen as a practical outcome of this long struggle. The idea is to balance EPS fund strength, government support, and contribution patterns to lift the minimum pension to a level that feels more realistic. If implemented properly, this change can positively affect retirees’ financial planning, medical budgets, and their ability to support their families without depending heavily on others.

What The New Epfo Pension Formula Might Look Like

The new EPFO pension formula is not only about raising the minimum amount but also about making the entire calculation more realistic and transparent. In the current setup, long averaging periods can dilute the benefit of higher salaries earned towards the end of a career. Under the proposed approach, the average salary of the last 12 months – or a shorter relevant period – could be used so that the pension reflects the retiree’s actual income closer to retirement.

There is also talk of making the pensionable service period more flexible so that job changes or short gaps in employment do not hit the final pension too severely. Within the EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 framework, this updated formula could pull up the pensions of small earners, helping their effective minimum reach closer to the ₹2,500 mark and giving them more stability in old age.

Which Retirees Stand to Benefit the Most From EPFO Pension Rule Change

The biggest beneficiaries are likely to be EPS-95 members who have completed 10 or more years of eligible service but are currently drawing very low pensions. There are many examples of workers who contributed for 15–20 years or more and still receive only ₹1,000–₹1,500 per month today, which is hardly enough for basic survival. For such pensioners, a revised formula combined with a higher minimum pension could mean a direct and meaningful jump in their monthly income.

EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 also brings hope to retired employees from the private sector who fall in the low or mid-income bracket and rely heavily on EPS for their old-age income. Those whose calculated pension is already above ₹2,500 may not see a drastic change in the basic amount, but they can still benefit from better system stability, smoother digital processes, faster claim handling, and any future inflation-linked adjustments that might be introduced.

How The ₹7,500 Floor Links with the ₹2,500 Practical Minimum

Several discussions around the 2025–26 period mention lifting the EPS-95 minimum pension floor to ₹7,500. This is viewed as a structural reform intended to break away from the outdated ₹1,000 base and reset the system at a more relevant level. Parallel to this, ground-level analysis suggests that for many small pensioners, the practical entry-level benefit under the new calculation rules may work out around ₹2,500.

In other words, the ₹7,500 figure represents more of a policy-level benchmark, while the ₹2,500 amount looks like the realistic minimum that many low-salary, long-service pensioners may actually see in their accounts. EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 has therefore become a relatable number for common pensioners, symbolising a basic assurance “at least this much pension should come every month” once the new structure is fully in place.

What Pensioners Should Do Before 2026

Until the government and EPFO publish an official notification, the smartest move for pensioners and active members is to clean up their records. That means checking EPS service history, joining and exit dates, name, date of birth, Aadhaar, bank account details, PAN, and KYC status, and ensuring everything is correctly linked to the UAN. When EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 gets implemented, clean records reduce the chances of delays, disputes, or mismatches in pension calculation.

Regularly checking pension slips and bank credit statements is also a good habit, as it helps you quickly spot any changes or errors. Employees who are still working should verify that EPF and EPS contributions are being deposited correctly every month. If you see gaps or discrepancies in contributions or service history, getting them fixed early will protect your future pension, because the revised formula will still rely heavily on accurate salary and service data.

Work From Home Yojana 2025: Women Can Earn ₹15,000 Per Month from Home — Apply Online Today

What Will Happen After Official Notification

Once the EPFO board and the government approve the final structure, a detailed notification and separate circulars will be issued. These will clarify from which date EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 takes effect, which categories of members are covered, and whether existing pensioners will receive the higher amount automatically or need to submit any additional forms or requests.

In many such reforms, EPFO recalculates pensions centrally and sends revised pension amounts directly to banks, so pensioners simply see higher credits in their accounts. However, in special situations such as errors in joining or exit dates, breaks in service, or missing documents pensioners may have to contact their local office or use the online portal to update details. This is another reason why keeping documents and records accurate and up to date is crucial well before any major rule change goes live.

FAQs on EPFO Pension Rule Change

Q1. Is EPFO Pension Rule Change: New ₹2,500 Monthly Pension to Begin for Retirees in 2026 fully confirmed?

Not yet. It is a strong proposal and an emerging policy direction, but it cannot be treated as fully implemented until the formal notification and detailed guidelines are issued. Only then will the exact amounts, dates, and categories be officially confirmed.

Q2. Who is most likely to receive the new ₹2,500 monthly pension?

The largest gains are expected for EPS-95 pensioners with 10 or more years of service who are currently drawing very low pensions. For many such retirees, the combination of a revised formula and a higher minimum could lift their monthly income to around ₹2,500 or slightly higher.

Q3. Will dearness allowance or inflation protection be added to EPS pension?

There is growing interest in linking EPS pension with inflation in some manner so that its real value does not erode over time. While ideas like DA or cost-of-living adjustments are being discussed, the exact structure, rate, and review cycle are yet to be finalised and will depend on future policy decisions.

Q4. Is this change only for existing pensioners or for future retirees as well?

This reform matters for both groups. Existing pensioners may see a direct increase in their monthly pension once the new rules apply, while current workers stand to benefit from a stronger formula that should naturally deliver higher pensions when they retire.