Let us clear the air at the start and then walk through exactly what changed, what did not, and how to use the new rules to your advantage without risking your future pension under the EPFO framework. Despite viral chatter, the monthly EPS pension still requires at least 10 years of EPS membership at pensionable age, while the 2025 updates mainly streamline EPF withdrawals, extend the EPS final withdrawal window, and digitize payments to protect long term social security for members and their families.

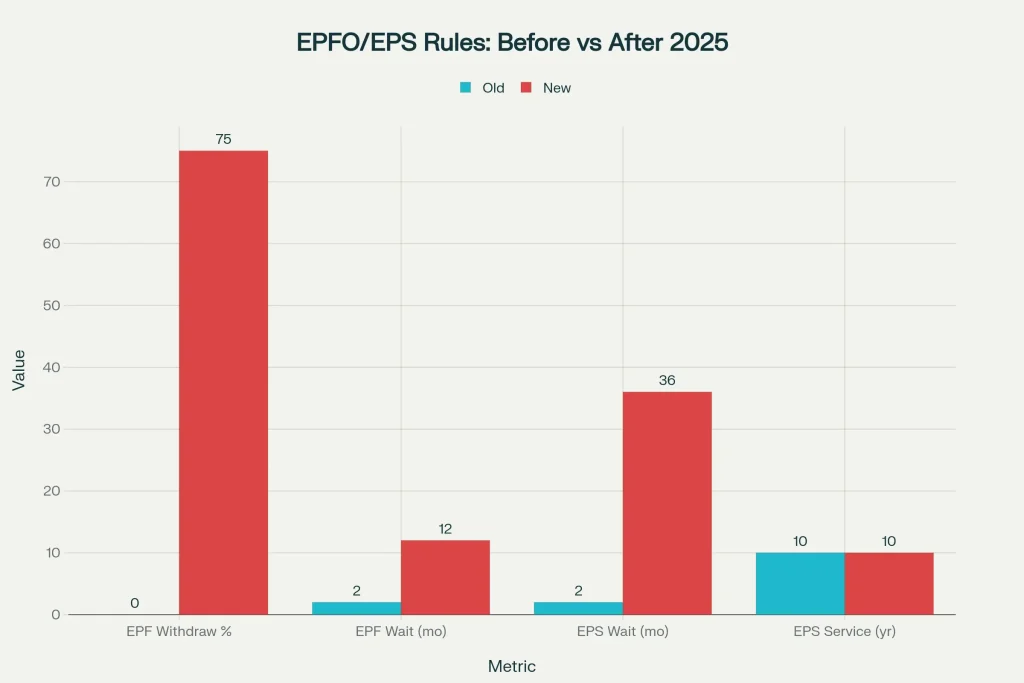

Here is the reality behind the headlines about the EPFO Pension Rule, written plainly so you can decide confidently and avoid costly missteps that could end your pension eligibility later on. First, your entitlement to a monthly EPS pension at age 58 continues to rest on completing a minimum of 10 years as an EPS member, which has not been scrapped by any 2025 change despite the noise online. Second, liquidity has improved for those who lose their jobs, with up to 75 percent of EPF available immediately and the remaining 25 percent after 12 months of unemployment, giving you breathing room without forcing a full exit from the system. Third, EPS final withdrawal now requires a 36 month wait after unemployment rather than two months earlier, intentionally reducing premature exits that erase future pension rights and family coverage.

EPFO Pension Rule

What Are The New Withdrawal Rules

The withdrawal framework has been redesigned to balance immediate needs with long term retirement security, ensuring members can access money without unintentionally collapsing their pension path under the EPFO Pension Rule. If you become unemployed, up to 75 percent of your EPF balance can be accessed right away, with the remaining 25 percent available after 12 months of continued unemployment to reduce the risk of draining the entire corpus too early. The partial withdrawal maze has been simplified by merging numerous categories into a clearer structure, aligning service thresholds and including employer contributions where applicable to improve approval rates and speed.

Why Was The Change Introduced

The Labour Ministry and EPFO saw that frequent, early withdrawals were leaving many members with very small final balances, undermining the social security purpose of the provident fund and the EPS pension promise that depends on sustained participation. By phasing EPF access into two steps and extending the EPS final withdrawal window to 36 months, the system gives you space to re enter employment and keep accumulating service toward the 10 year milestone under the EPFO Pension Rule. The simplification is designed to preserve compounding at the declared rate while still providing efficient, documented routes to money when life events demand it.

How Does It Affect Pension Eligibility

Your path to a monthly EPS pension remains the same core rule of at least 10 years of EPS membership at pensionable age, which is unchanged in 2025 and central to the EPFO Pension Rule. Withdrawing EPS accumulations before completing 10 years ends membership and erases the future monthly pension entitlement, which is why the new timelines aim to reduce premature exits and protect family pension coverage during gaps. If a job break occurs, keeping EPS intact for up to 36 months preserves continuity and the chance to hit 10 years when employment resumes, avoiding a decision you may regret later.

Fact Check

The viral claim that a worker can start receiving an EPS pension after one month confuses membership initiation with pension eligibility, since contributions can begin with the first month but entitlement to a monthly pension still requires 10 years of service at the statutory age under the EPFO Pension Rule. Official and mainstream clarifications consistently frame the 2025 changes as withdrawal and process reforms, not a scrapping of the 10 year pension threshold for EPS. The big wins for members are smarter liquidity and more time to avoid shutting the door on pension rights, not a magic shortcut to monthly pension without the required years.

Pension Eligibility Remains Unchanged

To secure a lifelong EPS pension, complete at least 10 years as an EPS member and reach pensionable age, which remains the bedrock of the EPFO Pension Rule in 2025. If you switch jobs, ensure service continuity by moving your account and records promptly so the 10 year clock keeps running without a damaging final settlement. The redesigned waiting periods and simplified withdrawals exist to help you keep that clock running while still meeting near term cash needs sensibly.

What Else Is New And Useful

A centralized pension payment system now makes pension credits faster and bank agnostic, reducing friction for retirees who change branches or relocate after superannuation under the EPFO Pension Rule. Policy discussion continues on improving the minimum EPS pension, with recommendations under review that may improve adequacy for lower income retirees if and when adopted. There is also clarity for those who contributed toward higher pension eligibility based on actual higher wages, aligning administration with judicial guidance and member expectations.

Practical Steps To Take Now

- Do not withdraw EPS before completing 10 years if you want a monthly pension, and use the 36 month window to preserve your path during unemployment under the EPFO Pension Rule.

- If unemployed, evaluate taking 75 percent of EPF immediately and the remaining 25 percent after 12 months only if necessary, to keep compounding working for retirement.

- When you change employers, transfer your account details without delay to maintain continuous service for EPS pension eligibility rather than resetting your progress.

- Treat sensational headlines with caution and rely on official clarifications and structured summaries to make decisions that protect your statutory benefits.

Aim for uninterrupted EPS membership of at least 10 years, use phased EPF access only as needed during unemployment, and avoid early EPS withdrawal so you preserve your right to a monthly pension at retirement under the EPFO Pension Rule.