EPFO 3.0 is changing how employees look at provident fund and pension claims in 2025 because the new rules are simpler and the process is moving faster through digital systems. EPFO 3.0 is also being talked about so much because it directly impacts the two things people care about most during a job change or financial emergency: how quickly money can be accessed and how pension eligibility stays protected. If you’ve ever felt confused about partial withdrawals, eligibility conditions, or why claims get delayed, EPFO 3.0 is meant to reduce that frustration. EPFO 3.0 focuses on quicker online claim movement, standardised service rules for many withdrawals, and tighter pension withdrawal rules so members don’t accidentally weaken their long-term retirement safety net.

EPFO 3.0 is a broad reform approach that blends rule simplification with more digital-first claim handling. The idea is straightforward fewer confusing withdrawal categories, clearer service requirements, and smoother processing so members can track and complete claims with less back-and-forth. It doesn’t mean withdraw anything anytime, but it does aim to make legitimate claims easier, quicker, and more predictable. What makes EPFO 3.0 different from earlier updates is the way it tries to bring consistency across common withdrawal reasons (like housing or unemployment) while also discouraging frequent full exits that can damage retirement savings. If you are planning major expenses in 2025, or you recently switched jobs, understanding these updates can help you avoid mistakes that cost time, money, or future pension eligibility.

EPFO 3.0 Pension Rules

| Update Area | What Changed | Member Impact |

|---|---|---|

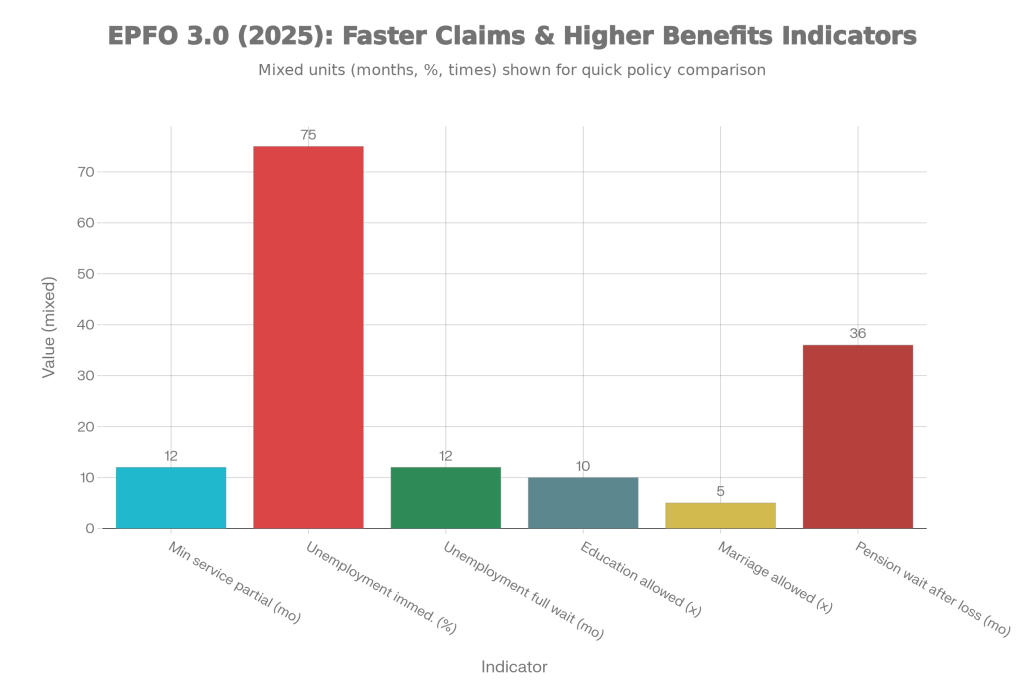

| Service Eligibility | Many partial withdrawals are aligned around a simpler minimum service rule (commonly 12 months for several cases). | Easier to understand eligibility and fewer surprises during claim filing. |

| Unemployment Withdrawal | Up to 75% of EPF balance can be accessed earlier during unemployment; remaining amount can be accessed later based on conditions. | Faster financial relief during job loss while still protecting part of retirement savings. |

| Pension (EPS) Withdrawal | Pension withdrawal after job loss is made stricter, with a longer waiting period compared to older practice. | Helps protect long-term pension continuity and discourages early EPS exit. |

| Education Withdrawal | Education withdrawals allowed multiple times over service (expanded frequency). | More practical support for recurring education expenses across years. |

| Marriage Withdrawal | Marriage withdrawal allowed multiple times over service (expanded frequency). | Better flexibility for families with multiple marriage-related expenses over time. |

| Housing Withdrawal | Housing-related eligibility becomes easier mainly via reduced service requirement; limits remain as per rules. | More employees qualify earlier for home-related PF support. |

| Digital Claims | Push toward faster, more transparent digital claim settlement and fewer manual interventions. | Faster processing, better tracking, fewer delays caused by paperwork loops. |

What Is EPFO 3.0 Pension Rules

EPFO 3.0 is the next step in modernising provident fund and pension services, so they work more like a clean digital financial platform and less like a complicated office process. For most employees, the change is felt in two ways: rules are being simplified so eligibility is clearer, and the system is leaning toward faster online claim handling, so payouts don’t take unnecessarily long.

- Earlier, many members got stuck because the same question had different answers depending on the withdrawal reason. Some withdrawals had one service condition, others had another, and people often discovered the rule only after the claim was filed and returned. Under EPFO 3.0, the direction is to reduce that confusion by creating more uniform benchmarks and cleaner pathways for the most common claim types.

- Just as importantly, EPFO 3.0 tries to balance two competing realities. One, people do need access to money during life events like job loss, education fees, or buying a home. Two, frequent withdrawals can quietly destroy the retirement corpus that EPF is designed to build. So EPFO 3.0 attempts to make genuine withdrawals easier while still nudging members to keep a meaningful portion saved for retirement.

EPFO 3.0 Key Highlights Latest EPF Rules Update

The key highlights of EPFO 3.0 are practical, not theoretical. This is not just another update that only HR understands. These changes can affect how much you can withdraw, how soon you can withdraw, and what happens to your pension eligibility if you leave a job or take money out too early.

- One of the biggest improvements is that multiple complicated partial withdrawal provisions are being simplified into fewer, clearer buckets. The second big improvement is standardisation: instead of different service year requirements for different reasons, the rules increasingly push toward a more consistent minimum service period for many withdrawal categories.

- The third major highlight is the shift in how unemployment withdrawals are handled. When income stops, speed matters. EPFO 3.0 allows a structured way to access a significant portion earlier while still preventing a full wipeout immediately. At the same time, the pension side is made stricter, because pension eligibility is often lost not by intention, but by a quick withdrawal decision made during stress.

- Finally, EPFO 3.0 is connected to a faster, more digital claim process. While real-world speed still depends on KYC accuracy and system readiness, the overall direction is clearly toward reduced manual steps, easier corrections, and faster settlement.

EPFO 3.0 Withdrawal Rules Old Vs New Comparison Table

- When people compare the old and new approach, they usually focus only on how much I can withdraw. But the real difference is broader: EPFO 3.0 is trying to create a predictable withdrawal experience while protecting long-term retirement outcomes.

- Earlier, withdrawal conditions were often scattered. Members had to interpret different rules for different needs, which increased mistakes and delays. Now, the trend is toward simpler service eligibility for many common withdrawals. For unemployment, the approach is more structured: early access to a large portion, followed by access to the rest after a longer period if unemployment continues.

- On the pension side, EPFO 3.0 makes early exit harder. This is important because EPS is not designed as an “instant cash” product. It’s designed as a retirement income layer. Tightening the pension withdrawal timeline discourages short-term decisions that create long-term regret.

- Easier and faster access where genuine need is common, but stricter rules where early exit can permanently reduce social security benefits later.

EPF Withdrawal News What Has Changed In Practice

Unemployment Withdrawals

- This is the update most employees immediately care about because job loss is often unpredictable. Under EPFO 3.0, the rules allow earlier access to a large share of the EPF balance during unemployment. That means the system acknowledges that when salary stops, people need cash for rent, EMIs, and household expenses.

- But EPFO 3.0 also builds in a safeguard by not encouraging immediate full withdrawal. The idea is to give real relief now, while still keeping some savings protected so the retirement corpus doesn’t get completely wiped out at the first shock.

- From a planning perspective, this is a good time to think strategically. If you can manage with partial support, consider leaving the remaining portion invested so your compounding continues. EPF is not just savings; it’s long-term, relatively stable retirement accumulation, and losing that compounding can be more expensive than it feels in the moment.

EPF Pension Latest News Stricter Withdrawal Rules

- EPFO 3.0 is more protective about pension continuity. In practical terms, pension withdrawal after job loss is restricted with a longer waiting window than earlier norms. That means members can’t treat EPS like a quick cash-out option shortly after leaving a job.

- This matters because pension is not about a one-time withdrawal; it’s about income stability later in life. Many employees don’t realise that exiting EPS early can reduce or eliminate future pension eligibility. EPFO 3.0 aims to reduce those accidental pension breaks by making early withdrawal less immediate.

- If you are close to completing the eligibility period for pension, the smarter move may be to preserve continuity rather than withdraw. A short-term withdrawal can feel helpful today but cost far more in long-term security.

Education And Marriage Withdrawals Greater Flexibility

- EPFO 3.0 increases flexibility by allowing education-related withdrawals more times over a career, and marriage-related withdrawals also more times than before. This is a practical change because education and marriage are not one-time events for many families. People may pay for their own education, later for a sibling, then for children, and the expenses can come in waves.

- The bigger benefit here is predictability. Instead of being forced into one-and-done type withdrawals, members get structured flexibility across their service period. This can reduce reliance on high-interest debt for these life milestones.

- Still, a smart approach is to withdraw only what’s necessary. Even though EPF access becomes more flexible, it’s still retirement money. Use it intentionally, not casually.

Housing Related Withdrawals

- Housing withdrawals under EPFO 3.0 become more accessible mainly because the service requirement is reduced in many housing-related scenarios, while the withdrawal limits and structure remain based on the existing framework.

- For younger employees, this is significant. Earlier, people often had to wait longer service periods before they could become eligible for housing-related EPF support. Now, qualifying sooner can help in down payment planning, construction costs, or home loan-related expenses, depending on the permitted use.

- But housing withdrawals should be treated like a financial tool, not a free payout. If the withdrawal reduces your EPF corpus too much, you may end up under-saving for retirement and depending heavily on other instruments later.

What This EPFO News Means for Employees and HR Teams

For employees, EPFO 3.0 is mainly about clarity and speed. Clearer rules reduce anxiety. Faster digital processing reduces repeated follow-ups. And a more structured withdrawal framework helps members make better decisions without accidentally damaging long-term savings. For HR teams, EPFO 3.0 reduces the number of confusing exceptions. When rules become more uniform, eligibility guidance becomes easier, and fewer employees file claims that get rejected due to misunderstanding. In an ideal implementation, HR also spends less time resolving PF tickets and more time focusing on higher-value employee support. That said, the practical success of EPFO 3.0 still depends on clean member data. Many delays happen not because of rules but because of mismatched KYC, bank account issues, missing details, or name mismatches across documents. So, the biggest action step for both employees and HR is to keep records clean and updated.

SBI Bank KYC Rule Update – Why Account Holders Must Complete KYC to Avoid Service Issues

How To Avoid Claim Delays In 2025

Even with EPFO 3.0 pushing faster claims, delays can still happen if basic data is wrong. Here’s what typically helps:

- Ensure KYC details are complete and verified before filing a claim.

- Match name spelling across Aadhaar, PAN, bank records, and EPFO profile.

- Use the correct reason category while filing partial withdrawal claims.

- Keep supporting documents ready for cases where documentation is required.

- Track claim status and respond quickly if clarification is requested.

This is where EPFO 3.0’s digital direction can genuinely help: when the system is streamlined, clean data becomes the fastest path to fast money.

FAQs on EPFO 3.0 Pension Rules

What Is EPFO 3.0

EPFO 3.0 is the updated framework that simplifies withdrawal rules and pushes faster digital claim processing, so members get clearer eligibility and quicker service.

Can I Withdraw Full EPF Immediately After Losing My Job

EPFO 3.0 supports earlier access to a large portion during unemployment, while full withdrawal is structured with conditions and time-based requirements rather than immediate full exit.

Are Pension Withdrawal Rules Now Stricter

Yes, EPFO 3.0 makes pension withdrawal after job loss stricter by extending the timeline, mainly to protect long-term pension continuity.

What Is the Minimum Service Period For Partial Withdrawal

EPFO 3.0 aligns many partial withdrawals around a simpler service eligibility benchmark, commonly set at 12 months for several categories.

How Many Times Can I Withdraw for Education or Marriage

EPFO 3.0 expands flexibility by allowing education withdrawals multiple times (up to 10 times across service) and marriage withdrawals multiple times (up to 5 times across service), subject to eligibility and rules.