Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business is mainly designed for farmers, rural youth, small entrepreneurs, SHGs and producer organisations who want to set up or expand a dairy unit with structured bank finance. Different banks, NABARD-linked schemes, and animal husbandry programmes allow funding for milch animals, shed construction, feed units, and small-scale processing or chilling units, often with attractive subsidy components.

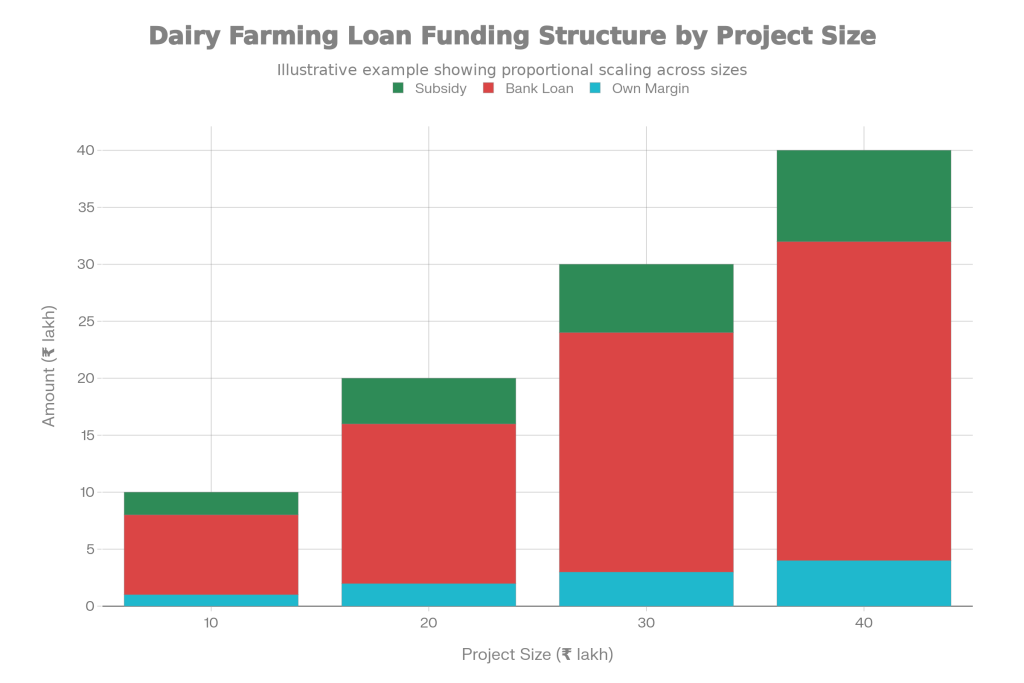

In practical terms, you can design a project in the range of ₹10–₹40 lakh where your own contribution covers a small part of the cost, a major portion comes as a bank loan, and the remaining part is supported through government subsidy. This structure reduces your effective debt burden and makes EMI management easier in the initial years. As of 2025, many public, private and cooperative banks actively promote dairy loans, and some programmes also offer interest subvention and moratorium so that your unit stabilises before full EMIs start.

Dairy Farming Loan 2025

| Point | Details |

|---|---|

| Scheme Focus | Finance for starting or expanding dairy farms with support for animals, sheds, feed and basic processing infrastructure. |

| Loan Amount Range | Generally from about ₹10 lakh to ₹40 lakh, depending on project scale, bank product and chosen scheme. |

| Interest Rate | Typically lower than standard business loans; effective rate may reduce further where subsidy or interest subvention applies. |

| Subsidy Component | Capital subsidy often in the range of roughly 25% for general beneficiaries and higher for special categories, subject to scheme rules. |

| Eligible Activities | Purchase of cows/buffaloes, shed construction, feed and fodder units, milking machinery, chilling or mini-processing set-ups. |

| Eligible Beneficiaries | Individual farmers, existing dairy owners, rural youth, SHGs, FPOs, cooperative societies, and small dairy enterprises. |

| Repayment Tenure | Usually around 3–10 years with possible moratorium at the beginning to allow the unit to stabilise. |

| Key Institutions | Public sector banks, private banks, regional rural banks, cooperative banks and schemes routed through development finance institutions. |

What Is Dairy Farming Loan Yojana 2025

Dairy Farming Loan Yojana 2025 works like a financial framework where the government and banks together provide affordable and organised capital for the dairy sector. Its main aim is to help rural farmers, livestock owners and unemployed youth start a dairy unit based on cows or buffaloes, or upgrade an existing small farm into a more modern, commercial-scale unit.

Under these schemes, you can take a loan of ₹10 lakh, ₹20 lakh, ₹30 lakh or up to ₹40 lakh depending on the size and design of your dairy project. In many cases, you also get capital subsidy on the project cost and interest concession, which reduces your overall repayment burden. With proper planning, Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business can create both steady monthly cash flow and long-term assets for you.

What Dairy Farming Loan 2025 Can Be Used For

Dairy Farming Loan 2025 is not limited to just buying animals; it is designed to cover the entire dairy ecosystem. You can use this loan to purchase good quality cows or buffaloes, construct a dairy shed, build feed and fodder storage, arrange reliable water and electricity facilities, and set up basic manure and waste management structures.

Beyond this, you can also finance milking machines, bulk milk coolers, small chilling plants, mini processing units and starter-level facilities for making paneer, curd, ghee and other value-added products. If you plan a higher-value project up to ₹40 lakh, then under Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business, a part of the cost can come from your own funds, a larger share from bank finance, and the rest from subsidy support.

Eligibility And Required Documents for Dairy Farming Loan 2025

Most banks and schemes consider Indian citizenship and a minimum age (often 18 years) as basic eligibility criteria. The upper age limit may vary by bank, but typically applicants up to 65–70 years can be considered. If you are already running a dairy, some products may require 1–3 years of business experience and a stable banking track record, while government-supported options are often more flexible for new entrants.

Key documents generally include Aadhaar card, PAN card, passport-size photographs, address proof (such as ration card or electricity bill), bank passbook, land documents or lease agreement, and a solid project report. For Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business, your project report should clearly show number and breed of animals, expected milk output, detailed costs (feed, labour, medicine, utilities), expected sale price, monthly cash flow and your EMI repayment capacity.

Interest Rate, Subsidy and Repayment

In Dairy Farming Loan 2025, interest rates are usually kept lower than regular business loans because dairy is treated as part of agriculture and allied activities. Different banks fix their own rates based on their cost of funds, risk profile, and your credit score, but with a strong project and good credit history, you can negotiate competitive pricing.

Where government or development-linked schemes are involved, you may get both capital subsidy on project cost and interest subvention on the loan. Repayment tenure commonly ranges from 3 to 10 years, and many schemes offer a moratorium period at the start, during which either only interest is payable or EMIs begin after a grace period. When you take Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business, make sure you clearly understand processing fees, prepayment charges and any hidden costs before signing.

Dairy Farming Loan 2025 Apply Process

The Dairy Farming Loan 2025 apply process is straightforward, but your preparation decides how smooth it will be. First, you must be clear about how many animals you want to maintain, what land or shed space you have, how you will arrange fodder, and where and at what rate you will sell the milk in your local area. Based on these factors, you can fix a realistic project size of 10, 20 or 40 lakh.

Next, you visit the nearest bank branch or use the bank’s website or mobile app to apply for a farm loan or dairy business loan. You need to attach all required documents along with your project report. The bank verifies your identity, documents, credit history and project viability, and may also conduct a site visit. If everything is satisfactory, the loan is sanctioned and usually disbursed in phases – for example, first for animal purchase, then for shed construction, then for machinery and equipment.

If your project is eligible for subsidy, the concerned department or agency processes the subsidy claim at a later stage and the approved amount is adjusted against your loan outstanding. In this way, Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business not only reduces your upfront investment pressure but also helps lower your future EMI burden.

Sukanya Samriddhi Yojana: How to Apply and What Returns You Can Expect

How To Make Your Dairy Business Profitable

- Like any loan, the real success of Dairy Farming Loan 2025 depends on how wisely you use the borrowed money. Start with choosing the right and productive breed suited to your local climate; higher-yield animals with good adaptation give better output for the same or slightly higher feed cost. Balanced nutrition, clean water, hygienic sheds and regular vaccination keep animals healthy, which directly supports better milk yield and reduces medical expenses.

- The next crucial factor is marketing and sales. Ideally, you should explore supply options with local milk collection centres, cooperative dairies or private dairy plants even before availing Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business. If you can handle direct retail, door-to-door milk delivery, tie-ups with hotels, restaurants and small shops, and gradual introduction of value-added products can significantly increase your per-litre margin.

- Cost control is equally important. Growing a significant portion of your own green and dry fodder, using crop residues wisely, and converting dung into biogas or organic manure can save expenses and create extra income streams. Once your unit is stable, you can slowly move from just selling raw milk to building a small brand around curd, paneer, ghee or flavoured milk, turning your Dairy Farming Loan 2025 project into a more diversified and resilient dairy enterprise.

FAQs on Dairy Farming Loan 2025

1. Who benefits the most from Dairy Farming Loan 2025: Apply for Funding Up to ₹40 Lakh to Start or Expand Your Dairy Business?

This loan is especially beneficial for farmers, livestock owners, rural youth, SHGs, FPOs and small entrepreneurs who want to run dairy as a serious business.

2. Can everyone get a dairy loan up to ₹40 lakh?

No. The loan amount depends on your project size, bank policy, repayment capacity and sometimes your credit history. For many new or small farmers, an initial project of 10–20 lakh is more practical, while experienced or larger entrepreneurs may qualify for 30–40 lakh or even higher exposure, depending on the proposal.

3. Is collateral always required when applying for Dairy Farming Loan 2025?

For smaller ticket sizes, some banks may offer loans with limited security or only hypothecation of animals and assets, especially where some form of credit guarantee is available

4. How long does it usually take to see profit after taking a dairy loan?

If you choose the right breed, manage feed well and secure a reliable sales channel, cash flow usually starts to stabilise within 6–18 months.