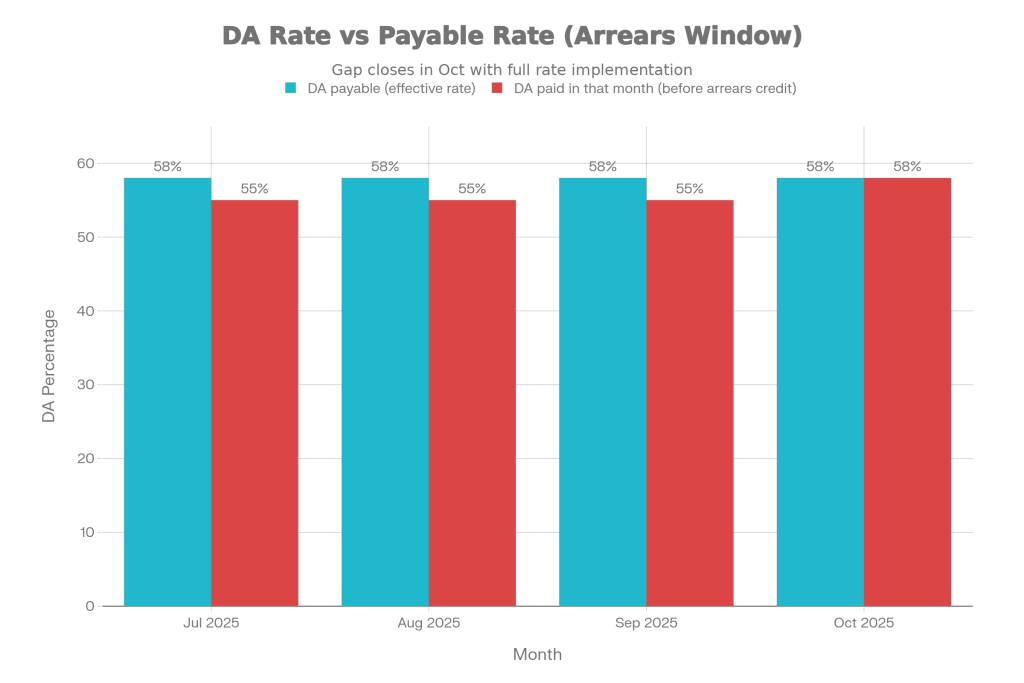

The 3% hike in DA and DR has been approved with retrospective effect from 1 July 2025. In simple terms, that means employees and pensioners were technically entitled to the higher rate from July itself, even though the formal announcement came later in the year. Because of this gap between the effective date and the implementation date, arrears are now payable for three full months: July, August, and September 2025.

This increase takes DA/DR from 55% to 58% of basic pay or basic pension. For many employees in the middle pay bands, this translates to an additional few hundred to a few thousand rupees per month, and when multiplied by three months, the arrears amount becomes quite noticeable. For pensioners and family pensioners, the same 3% rise in Dearness Relief ensures they are not left behind and get equivalent inflation compensation on their pensions.

DA Arrears Update

| Detail | Information 2025 |

|---|---|

| Type Of Change | 3% DA/DR hike from 55% to 58% of basic pay/pension |

| Effective Date | 1 July 2025 (retrospective) |

| Arrears Period | July, August, September 2025 |

| Likely Credit Month | With October or November 2025 salary/pension, depending on department and bank processing |

| Beneficiaries | Around 48–49 lakh employees and 64–68 lakh pensioners |

| Revision Basis | CPI-IW linked formula under 7th Pay Commission |

| DA Revision Frequency | Twice a year: January and July (often notified later) |

| Broader Context | Expected to be the last DA hike under 7th CPC before 8th Pay Commission starts from 2026 |

What The 3% DA Hike Really Means for You

DA is meant to offset inflation and maintain the purchasing power of salaries and pensions. A 3% hike may sound small on paper, but when applied on basic pay plus the volume of beneficiaries, it has a meaningful impact at both household and national levels. For an employee with a basic pay of ₹30,000, the extra 3% means an additional ₹900 per month in DA. Over three months of arrears, that works out to ₹2,700 in one shot, excluding tax or other deductions.

If the basic pay is ₹40,000, the additional DA comes to ₹1,200 per month, or around ₹3,600 for the three arrear months. Those in higher pay levels will obviously see even larger figures. Pensioners get the same percentage benefit on their basic pension, which is especially significant for retired families relying solely on pension income with limited flexibility to increase earnings from other sources.

When Central Govt Employees Will Get Paid

The most practical concern for most employees is the timeline of payment. While the DA hike is effective from 1 July 2025, ministries and departments usually take a few weeks to update their systems, issue internal orders, and coordinate with banks and accounts offices. In this cycle, the revised DA at 58% is being aligned with salaries from October 2025 onward in many departments.

The arrears for July, August, and September are generally planned to be paid in one lump sum, usually along with the October or sometimes November salary. Different departments or autonomous bodies that follow central DA orders may schedule the credit slightly differently, but the broad pattern remains the same: three months’ arrears plus revised DA in the same window, rather than spreading arrears over several months. Pensioners should expect a similar pattern in their bank accounts through the pension disbursal authorities.

How DA Arrears Are Calculated

The calculation method for DA arrears is straightforward if you break it down step by step. First, identify your basic pay (or basic pension, for retirees) for each of the months for which arrears are due. Then, calculate the difference between the old DA rate and the new DA rate. In this case, the difference is 3 percentage points: from 55% to 58%.

For each month under arrears, multiply your basic pay by 3%. For example:

- Basic pay ₹30,000 → additional DA per month = 3% of 30,000 = ₹900

- Over three months → arrears = ₹900 × 3 = ₹2,700

Similarly, with basic pay ₹50,000, the monthly difference would be ₹1,500, and for three months, ₹4,500. The same formula is used for pensioners on their basic pension. Once these amounts are calculated, they are aggregated and credited as a single arrears payment, usually visible as a separate line item in the salary slip or pension statement.

Impact On Pensioners and Family Pensioners

Pensioners are fully included in this DA arrears update. Dearness Relief, which is essentially DA for pensioners, is increased by the same 3%, taking it from 55% to 58% of basic pension. This ensures that retired employees are not disadvantaged vis-à-vis serving staff when it comes to inflation protection.

Family pensioners, who often have tighter finances, also benefit from this increase. Their DR is calculated on the basic family pension, and the arrears for July to September are credited in the same way through the banks handling pension disbursement. For many retired households, this arrears payout can help fill important gaps such as medical bills, loan repayments, or emergency expenses that may have been postponed due to cash constraints.

DA, Inflation and The 7th–8th Pay Commission Transition

All DA arrears update 3% increase approved move is anchored in inflation data. The government uses the Consumer Price Index for Industrial Workers (CPI-IW) to decide how much DA needs to be revised so that real incomes do not erode quickly. Under the 7th Pay Commission formula, DA is reviewed twice a year January and July. However, the formal announcement and actual payment often come later, which is why arrears accumulate.

This particular 3% DA hike is widely seen as one of the last, if not the final, DA revisions under the 7th Pay Commission. The 8th Pay Commission is expected to take effect from January 2026, bringing a fresh structure of pay, allowances, and possibly even a re-base of DA. That makes this arrears payout a kind of “bridge benefit” between the old and the new regimes. For employees and pensioners, it is an important opportunity to shore up savings ahead of the transition.

Why There Is Always a Delay Between Effective Date And Payment

Many employees wonder why DA is effective from July but paid only later in the year. The reason lies in the process. First, inflation data has to be compiled and analyzed over a period of months. Then, the DA calculation is done using the approved formula. After that, the proposal is placed before the Cabinet, debated, and finally approved. Only after formal approval are official orders issued and circulated to all departments. Departments then update their payroll software and coordinate with banks or treasury systems. This naturally takes time, and by the time the first salary at the new DA rate gets processed, two or three months may already have passed. Those months are then covered through arrears. It may feel like a delay, but the arrears ensure that financially, employees and pensioners do not lose out on what is due to them from the notified effective date.

Unified Pension Scheme 2025: How the New Rules Change Retirement Options for Govt Employees

How Employees and Pensioners Should Use the Arrears Wisely

- The DA arrears update 3% increase approved decision gives a one-time lump sum that many people may be tempted to spend quickly. However, from a financial planning perspective, it is smarter to treat arrears as an opportunity to strengthen your money position. Clearing high-interest debt such as credit card dues, personal loans, or overdue EMIs is one of the best uses of this extra cash.

- Another smart option is to build or top up an emergency fund, ideally covering at least three to six months of essential expenses. For those who are already comfortable on these fronts, channeling a part of the arrears into safe or moderately conservative investments like recurring deposits, balanced mutual funds, or voluntary provident fund contributions can help grow wealth over the long term. Pensioners may prefer low-risk options such as Senior Citizen Savings Schemes or fixed deposits with reputable banks.

FAQs on DA Arrears Update

1. When will the 3% DA arrears actually be credited?

In most cases, arrears for July, August, and September 2025 are likely to be paid along with the October or November 2025 salary or pension. The exact date can vary slightly by department and bank, so it is important to keep an eye on your payslip or pension statement.

2. Will pensioners get the same percentage increase as employees?

Yes. Pensioners and family pensioners receive a 3% increase in Dearness Relief, taking it from 55% to 58% of basic pension. They also get arrears for the same three-month period, credited through their existing pension disbursal channels.

3. Is this DA hike connected to the 8th Pay Commission?

No, this DA arrears update 3% increase approved move is under the existing 7th Pay Commission rules. The 8th Pay Commission is expected to start from January 2026 and will bring separate changes to pay scales and allowances.

4. Can there be another DA hike before the 8th Pay Commission takes effect?

In theory, yes, if inflation data justifies it and the government decides to approve another revision. In practice, this 3% hike is widely expected to be the final or one of the last DA revisions under the 7th CPC before the new pay structure is introduced.