The Canara Bank 310-Day FD Scheme 2025 has captured interest among Indian savers seeking secure, short-term investment options. The public-sector bank is offering interest rates up to 7.25 percent per annum, positioning the scheme as a dependable and flexible choice in an environment of stable monetary policy.

Understanding the 310-Day Fixed Deposit

The 310-day tenure represents a special short-term fixed deposit designed to bridge the gap between a six-month deposit and a one-year term.

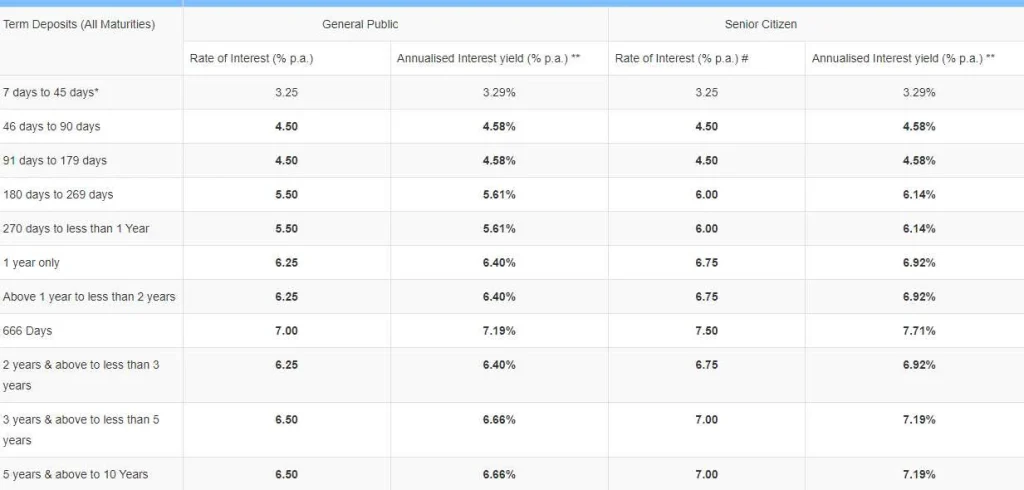

According to Canara Bank’s published details, the scheme offers 6.75 percent per annum for general customers and 7.25 percent for senior citizens. The minimum investment starts at ₹1,000, with no maximum limit.

Depositors can choose how they receive interest — at maturity, quarterly, or half-yearly. The deposit can be opened online through Canara ai1, the bank’s mobile app, or in person at any branch.

“This short-term product was introduced to balance liquidity and steady returns for customers who prefer guaranteed income,” said a Canara Bank spokesperson.

Why Canara Bank Introduced a 310-Day Tenure

Bank Strategy and Financial Balance

Banks continuously adjust deposit tenures to manage cash flow and align with loan demand. The 310-day FD helps Canara Bank attract fresh deposits without locking funds for extended periods, giving it flexibility in managing short-term liquidity.

This also appeals to investors who prefer fixed income but are hesitant to commit for a full year or longer.

“Special tenures such as 310 days allow banks to mobilise funds efficiently while offering slightly better returns than traditional options,” said Dr. Ananya Gupta, a financial analyst based in New Delhi.

Customer Convenience

Many investors use such deposits for specific goals — tuition fees, travel plans, or upcoming purchases — where they need funds within a year. A 310-day FD fits these timelines better than a 12-month one, providing both yield and predictability.

Comparing Interest Rates with Other Banks

As of November 2025, most major Indian banks offer interest rates between 6.50% and 7.25% for deposits under one year.

- State Bank of India (SBI): ~6.8% (senior citizens 7.3%)

- Punjab National Bank (PNB): ~6.75%

- HDFC Bank: ~7.10% (senior citizens 7.60%)

- Bank of Baroda: ~6.85%

Canara Bank’s 310-day rate therefore places it among the more competitive public-sector options, especially for senior citizens.

For a ₹1 lakh deposit, an investor would earn about ₹1,815 in interest over 310 days at 6.75%. A senior citizen would earn around ₹1,950 at 7.25%, before taxes.

Investor Appeal and Suitability

Ideal for Conservative Investors

This deposit suits investors who prioritise safety and liquidity over high returns. As a public-sector bank, Canara Bank provides additional assurance of government backing and regulatory oversight.

Deposits are insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to ₹5 lakh per depositor per bank, ensuring safety even in extreme scenarios.

The scheme’s short term is especially appealing for retirees, small businesses, or individuals holding temporary surplus funds.

Key Considerations

- Premature Withdrawal: Allowed after seven days, but may incur a penalty of 1% on the applicable interest rate.

- Taxation: Interest is taxable as “Income from Other Sources” and subject to TDS if it exceeds the annual threshold.

- Inflation Impact: With inflation hovering around 4–5%, real returns remain positive but modest.

- Renewal Option: Customers can opt for auto-renewal at the prevailing rate on maturity.

Example: Smart Use of a 310-Day FD

Consider a family saving ₹3 lakh for a wedding scheduled in 10 months. Instead of leaving the funds in a savings account earning ~3.5%, they invest in the 310-day FD at 6.75%. Upon maturity, they receive about ₹3,054 in interest, maintaining liquidity while earning a higher return — without exposure to market risk.

Similarly, senior citizens relying on fixed income can ladder such deposits, opening one every few months to ensure regular cash inflow.

How to Open the 310-Day FD

Opening the Canara Bank 310-Day FD Scheme 2025 requires minimal paperwork. The process includes:

- Logging into the Canara Bank net banking or Canara ai1 app.

- Selecting “Fixed Deposit” → “Special Tenure – 310 Days.”

- Entering the amount, tenure, and preferred interest payout.

- Reviewing terms and confirming.

Alternatively, customers may visit their nearest branch with PAN, Aadhaar, and address proof. On maturity, proceeds can be withdrawn or renewed automatically.

The bank also allows joint deposits, nomination facilities, and linking the FD to overdraft accounts.

Broader Economic Context

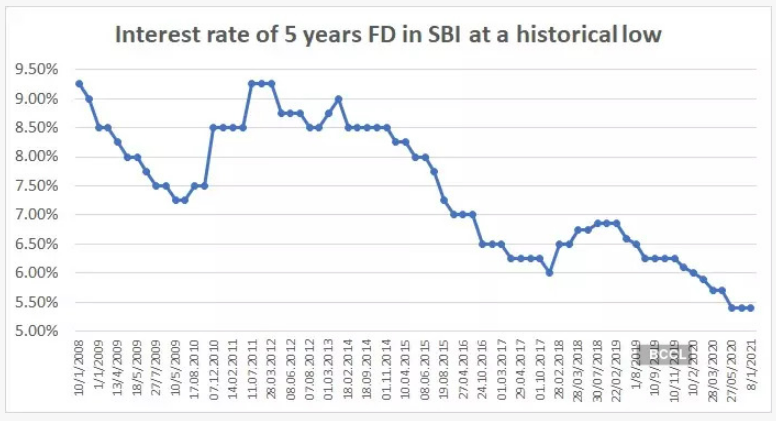

India’s interest rate environment has stabilised since early 2024, following the Reserve Bank of India’s decision to hold the repo rate at 6.5% for several policy cycles.

Stable rates have encouraged banks to introduce innovative deposit tenures like 222-day, 310-day, and 444-day schemes to attract fresh funds.

Economists expect moderate rate reductions in 2026, suggesting that locking into current rates could benefit investors.

“Short-term fixed deposits remain appealing because they provide certainty and liquidity at a time when market-linked instruments are volatile,” said Dr. Prakash Sinha, a banking policy researcher.

How It Compares with Other Investment Options

While the 310-day FD offers security and simplicity, investors may also consider alternatives:

- Recurring Deposits (RDs): For those saving monthly rather than lump-sum.

- Debt Mutual Funds: Offer liquidity and potentially higher returns, but carry market risk.

- Government Savings Schemes: Such as the Senior Citizen Savings Scheme or Post Office Term Deposits, which may provide marginally better yields but require longer lock-ins.

- Sweep-in Accounts: Provide flexibility by automatically moving surplus funds into FDs and back to savings when needed.

For most conservative investors, however, the Canara Bank FD remains a “sleep well at night” choice — low risk, transparent, and predictable.

Expert Outlook

Financial planners suggest using this deposit as part of a laddering strategy — spreading multiple FDs over different maturities to balance returns and liquidity.

“By combining the 310-day and 444-day tenures, investors can maintain flexibility while earning better yields,” noted Rajiv Menon, Certified Financial Planner at Finwise Advisory Services.

Experts agree that while the 310-day FD won’t beat inflation by wide margins, it provides stability during economic uncertainty, particularly when markets fluctuate or interest-rate directions are unclear.

The Bottom Line

The Canara Bank 310-Day FD Scheme 2025 stands out for its balance of liquidity, security, and decent returns. It is a practical option for individuals who value guaranteed income, especially senior citizens and short-term savers.

In an era when financial prudence matters as much as profit, this fixed deposit offers a dependable bridge between idle cash and long-term commitment — a steady choice for conservative investors navigating India’s evolving financial landscape.