India’s Budget 2026 income tax slabs remained unchanged when Finance Minister Nirmala Sitharaman presented the Union Budget in Parliament on 1 February. Despite strong expectations of relief from salaried taxpayers facing rising living costs, the government retained existing tax rates and instead introduced compliance reforms and administrative simplification measures aimed at strengthening the country’s tax system and long-term economic growth.

Budget 2026 Income Tax Slabs: Continuity Instead of Relief

The most anticipated announcement in the budget concerned personal income taxation, especially for salaried employees who form a significant portion of India’s urban middle class.

However, the government kept both the old and the new tax regimes unchanged. The decision means there is no reduction in tax rates, no expansion of income brackets, and no increase in the basic exemption threshold.

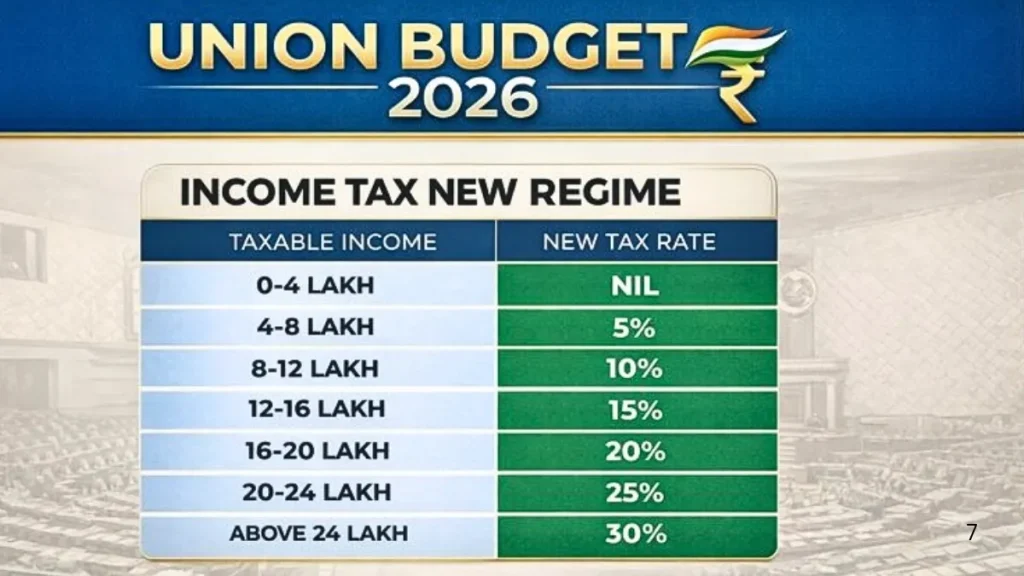

Under the current structure of the new tax regime:

| Income Range | Tax Rate |

|---|---|

| Up to ₹4 lakh | 0% |

| ₹4–8 lakh | 5% |

| ₹8–12 lakh | 10% |

| ₹12–16 lakh | 15% |

| ₹16–20 lakh | 20% |

| ₹20–24 lakh | 25% |

| Above ₹24 lakh | 30% |

Because of rebate provisions, individuals with taxable income up to ₹12 lakh effectively pay zero tax. The ₹75,000 standard deduction for salaried employees increases the tax-free level further.

Tax policy experts said the unchanged structure was not unexpected.

“Given the fiscal deficit targets and ongoing capital expenditure programmes, large tax cuts were unlikely,” said D.K. Srivastava, Chief Policy Advisor at EY India.

Why Middle-Class Tax Relief Was Expected

Expectations of tax relief had built steadily in the months preceding the budget.

Urban households have experienced higher costs in key spending areas, including rent, school fees, healthcare and transportation. Inflation in services — not just food — has particularly affected salaried workers.

Industry groups argued that reducing income tax could boost consumption demand, which has slowed in some sectors. Economists note that middle-income households are the primary drivers of discretionary spending in consumer goods, automobiles and housing.

The Confederation of Indian Industry (CII) recommended:

- Raising the basic exemption limit

- Increasing the standard deduction

- Expanding the highest tax bracket threshold

“Personal income tax rationalisation would stimulate consumption and economic momentum,” the organisation stated in its pre-budget recommendations.

Yet the government took a different view.

Government Strategy: Fiscal Stability First

India is currently pursuing an ambitious public investment programme. Large spending commitments exist in infrastructure development, manufacturing incentives, digital infrastructure, and defence modernisation.

Reducing income tax rates could reduce government revenue at a time when borrowing costs remain sensitive to fiscal deficits.

The government’s medium-term fiscal policy aims to bring the fiscal deficit down to 4.5% of GDP in coming years.

Economists said this objective influenced the decision.

“The government is balancing growth with macroeconomic stability. Tax cuts would boost consumption immediately, but fiscal discipline supports long-term investment,” said Aditi Nayar, Chief Economist at ICRA Ratings.

Focus on the New Tax Regime and Simplification

Rather than altering tax rates, the budget focused on structural reform.

The Finance Minister described the policy direction as creating “a simple, transparent and efficient tax system.”

Key reforms include:

Expanded pre-filled returns

More taxpayer information will be automatically filled in tax forms, reducing compliance burden.

Faceless assessments

Digital assessments aim to minimise disputes between taxpayers and tax authorities.

Reduced litigation

Officials intend to resolve long-pending tax cases through faster processes.

New Income-Tax Act rollout

A revised Income-Tax Act, expected to take effect in April 2026, will reorganise and simplify existing provisions.

Tax consultants say the government is encouraging taxpayers to move fully to the new tax regime, which removes deductions but offers lower rates and simpler filing.

“The objective is behavioural change — simplify first, then rationalise rates later,” said Sudhir Kapadia, partner at EY India.

How India’s Personal Tax Policy Has Evolved

India’s income tax structure has undergone several major changes in recent years.

- 2020: Introduction of optional new tax regime

- 2023: New regime made default option

- 2024–2025: Standard deduction introduced and rebate limit expanded

- 2026: Administrative simplification instead of rate reduction

The long-term direction suggests India is moving toward a system similar to those in many developed economies, where fewer deductions exist and compliance is automated.

International Comparison

India’s top personal income tax rate of 30% is moderate compared with advanced economies.

| Country | Top Personal Tax Rate |

|---|---|

| India | 30% |

| United Kingdom | ~45% |

| United States | ~37% federal (excluding state taxes) |

| Germany | ~45% |

However, economists say the burden depends not only on rates but also on purchasing power and cost of living.

“In India, the challenge is that middle-income households face high private spending on education and healthcare, which taxes indirectly through expenses,” said a public finance researcher at the National Institute of Public Finance and Policy (NIPFP).

Impact on Salaried Employees

The absence of slab changes means most salaried taxpayers will see little change in take-home salary.

Example calculation

Annual salary: ₹10 lakh

- After standard deduction: ₹9.25 lakh taxable

- Effective tax: close to zero due to rebate

Annual salary: ₹18 lakh

- Tax payable: approximately ₹1.95–2.1 lakh depending on deductions

For many urban professionals, the budget neither worsens nor improves immediate financial conditions.

Market and Public Reaction on Budget 2026

Market reaction was subdued. Analysts said investors were more focused on infrastructure spending and industrial policy.

Public reaction, however, was more emotional.

Many salaried professionals had expected some relief due to rising costs.

“I was hoping at least the 30% bracket would move higher,” said a Bengaluru software engineer.

Financial planners advised taxpayers to adjust expectations.

“Tax planning should now focus on regime selection rather than expecting annual tax cuts,” said a Mumbai-based chartered accountant.

Broader Economic Implications

The government’s strategy suggests a long-term policy trade-off:

Short-term tax relief vs long-term economic stability

Public capital expenditure has been a major driver of economic growth in recent years. Economists warn that cutting taxes too early could reduce investment capacity.

Credit rating agencies monitor fiscal discipline closely because it affects India’s borrowing costs and investor confidence.

Conclusion

The Budget 2026 income tax slabs decision signals policy continuity rather than populism. By maintaining tax rates and prioritising administrative reform, the government aims to stabilise public finances while transitioning to a simpler tax system.

For salaried taxpayers, the immediate benefit is limited. But the long-term objective appears to be a predictable, easier-to-comply tax framework that supports sustained economic growth.

FAQs About Budget 2026

Will income tax slabs change soon?

Experts believe changes may come after fiscal deficit targets are achieved.

Should taxpayers choose old or new regime?

Individuals with many deductions (housing loan, insurance, investments) may still benefit from the old regime. Others may benefit from the new one.

Does the budget reduce tax burden indirectly?

Simplification may reduce compliance costs, penalties and disputes.