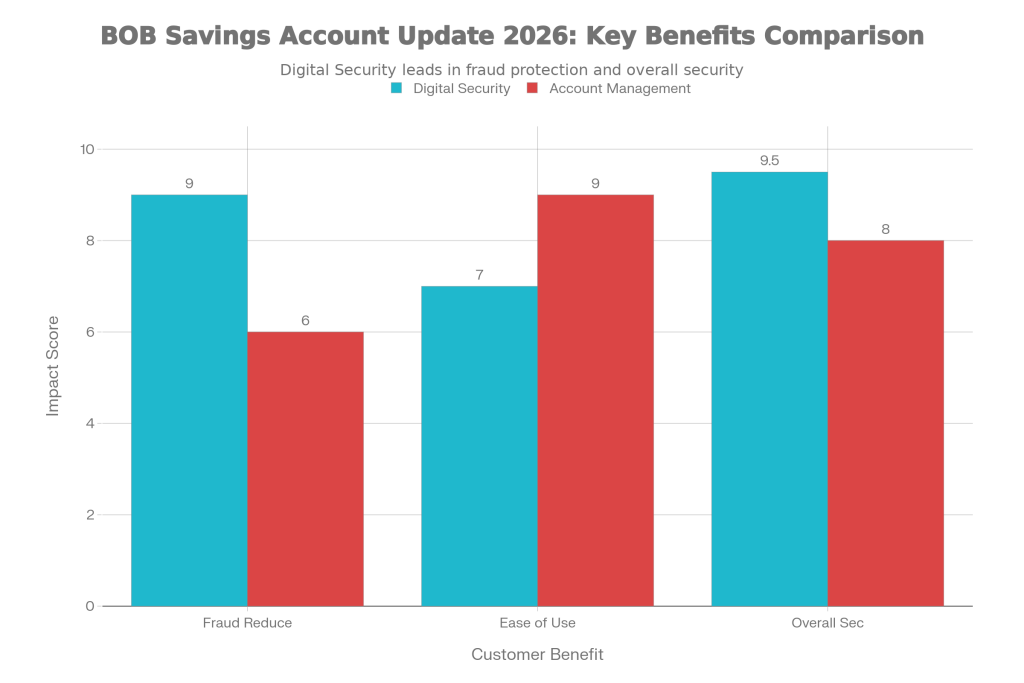

If you have a savings account in Bank of Baroda or any other bank, these 2026 banking changes are something you really need to know about. Today, most people handle everything from UPI payments and mobile banking to bill payments and account checks online. When a bank announces new rules or updates, it directly impacts your daily transactions, security, and account settings. That’s why BOB Savings Account Update 2026 is making waves right now. In simple terms, BOB Savings Account Update 2026 focuses on two key areas: strengthening digital security and making account management more organized. If you want your account to run smoothly without any fraud risks or interruptions, you can’t ignore this update. It’s not just about rules it’s about keeping your money safe in an increasingly digital world.

BOB Savings Account Update 2026 isn’t just a minor tweak; it’s a shift toward tighter security and better account handling starting this year. With cyber frauds on the rise fake calls pretending to be from banks, phishing links stealing details, and OTP scams emptying accounts banks are stepping up. This update signals stronger protections at the bank level, which is great news for everyday users. The second part emphasizes account management, covering things like KYC updates, profile details, mobile number linking, and alert services. If your info is outdated or KYC is pending, you might face hurdles soon. Think of BOB Savings Account Update 2026 as a wake-up call to get prepared, turning potential hassles into seamless banking.

BOB Savings Account Update 2026

| Update Area | Key Change/Focus | Customer Benefit |

|---|---|---|

| Digital Security | Emphasis on securing online banking | Reduced fraud risk, safer transactions |

| Account Management | Streamlining account processes | Easier KYC, updates, and alerts |

Bank of Baroda customers and anyone with a savings account in any bank now have clear guidance on navigating BOB Savings Account Update 2026 successfully. These two major updates focused on digital security and streamlined account management promise safer transactions and fewer hassles if you act proactively. Update your KYC, secure your credentials, enable alerts, and stay vigilant against fraud to fully benefit.

Bank Of Baroda Rules Update 2026 What Is It

In plain English, the Bank of Baroda Rules Update 2026 is like a package of changes aimed at securing digital banking for customers and simplifying account-related tasks. Many treat savings accounts as simple money holders, but today they’re the backbone for UPI, EMIs, auto-debits, online shopping, and more. Updates like this ripple through all your banking activities. BOB Savings Account Update 2026 gains extra importance because banking regulations often introduce new security requirements or mandatory settings. If you’re a regular digital banking user, expect more emphasis on safety compliance ahead. Staying ahead means fewer surprises and smoother operations.

2 Big Updates

Let’s dive into those 2 big updates everyone’s talking about. Not every bank change means extra charges or losses often, it’s about better protection and service. The first major update targets digital security: enhancing online transactions, OTP handling, login protections, and fraud prevention. The second focuses on account management, including KYC, account status checks, profile verification, and essential settings. That’s why BOB Savings Account Update 2026 shouldn’t be limited to BOB customers alone. If you bank anywhere and use digital tools, these signal broader 2026 trends toward secure, rule-based banking. Proactive steps now pay off later.

Digital Security And Customer Safety

- User errors fuel most frauds today: sharing OTPs with fake bank callers, clicking suspicious links, or screen-sharing details. Banks focusing on digital security is spot-on, but customers must follow basics too. Under BOB Savings Account Update 2026, treat OTPs, MPINs, and passwords as your account’s keys never share them, no matter who asks.

- Avoid logging into banking apps via unknown links. Keep your mobile banking app updated for the latest security patches. These habits align perfectly with the update, making your banking reliable and fraud-proof.

Account Management

Many change phone numbers after opening accounts but forget to update banks. Emails go stale, addresses shift, KYC lapses then big transactions or logins fail because OTPs hit old numbers. BOB Savings Account Update 2026 stresses organized account management to fix this. Banks want current info for seamless alerts and verifications. Pending KYC? Update it now. Wrong mobile or email? Fix it. Turn on transaction alerts at minimum. Simple maintenance prevents major headaches.

What Customers Should Do

Wondering what ordinary account holders can do to avoid issues and keep services running? Here are practical steps you can take today:

- Check and update your registered mobile number and email with the bank.

- Use strong passwords for net and mobile banking, changing them periodically.

- Never share UPI MPIN, ATM PIN, or OTPs, even with supposed bank staff.

- Verify links or calls claiming KYC updates before acting.

- Respond promptly to any bank requests for KYC or verification.

- Enable transaction alerts to spot suspicious activity instantly.

Following these ensures BOB Savings Account Update 2026 works for you, boosting overall security.

Old Pension Scheme 2026 – Supreme Court Ruling and What It Means for ₹10,000 Monthly Pension

Who Needs This Update Most

While relevant for all, certain users should pay extra attention:

- Daily UPI payers or online shoppers.

- Accounts with regular salary credits or high transactions.

- Net banking or mobile app users.

- Those with pending KYC or outdated profiles.

- People who disable SMS/email alerts and miss transaction details.

In 2026’s digital banking landscape, preparation turns potential challenges into advantages. Regular checks on your account details ensure seamless UPI payments, online shopping, and everyday banking without interruptions. BOB Savings Account Update 2026 ultimately empowers you with better protection and efficiency, so start implementing these steps today for peace of mind tomorrow. Your money deserves that extra layer of care.

FAQs on BOB Savings Account Update 2026

1. What Is the Biggest Benefit of Bob Savings Account Update 2026

It strengthens digital security and organizes account processes for hassle-free banking.

2. Does This Change Apply Only to Bank of Baroda

Primarily for BOB, but 2026 banking trends in security and management apply broadly.

3. Why Update KYC Now

Current KYC ensures uninterrupted verifications, alerts, and services delays cause blocks.

4. Simplest Way to Avoid Digital Fraud

Never share OTPs, MPINs, or passwords; ignore suspicious links or calls.