The Application Process is not only about monthly financial support; it is a structured way to enter the insurance sector with proper training and backing from LIC. Under this initiative, women are selected, trained, and supported with a fixed stipend for three years so that they can focus on building their base of policyholders without worrying too much about immediate earnings.

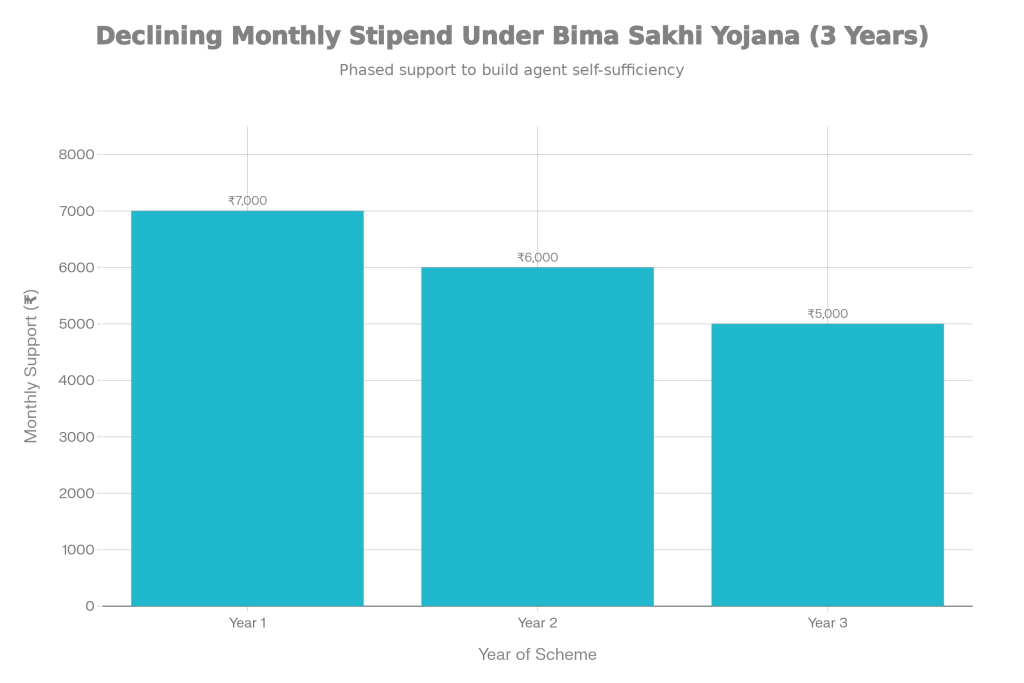

In the first year, the monthly support can go up to ₹7,000, followed by slightly lower but still assured support in the second and third year, depending on simple performance conditions such as keeping a certain percentage of policies active. As your experience grows and your client base expands, your commission income can gradually become higher than the stipend, turning this scheme into a full-time, sustainable career.

Bima Sakhi Yojana

| Point | Details |

|---|---|

| Scheme Name | Bima Sakhi Yojana / LIC Bima Sakhi |

| Main Objective | To empower women by training them as LIC Bima Sakhi (career agents) with fixed stipend and commission-based earnings |

| Monthly Support | Year 1: Up to ₹7,000 per month; Year 2: Around ₹6,000 per month; Year 3: Around ₹5,000 per month (linked to basic performance and policy retention) |

| Income Structure | Fixed stipend for 3 years + commission on policies + performance incentives |

| Eligibility – Age | Generally, 18 to around 70 years (as per prevailing LIC norms) |

| Eligibility – Education | Minimum Class 10 pass; higher education is welcome but not mandatory |

| Target Beneficiaries | Homemakers, rural and semi-urban women, SHG members, and women seeking flexible earning options |

| Who Cannot Apply | Existing LIC agents, ex-agents, retired LIC staff, and close relatives of current LIC agents/employees |

| Mode Of Application | Mainly online through LIC’s official website; assistance may be available at local LIC branches |

| Nature Of Work | Part-time or full-time agency work: policy sales, servicing, premium follow-up, and customer support |

What Is LIC Bima Sakhi Yojana

LIC Bima Sakhi Yojana is a stipend-based programme where women are given fixed financial support for three years so that they can establish themselves as life insurance agents with confidence. During this period, they receive training on the basics of life insurance, product details, how to understand a customer’s needs, and how to recommend suitable plans. You do not just earn money; you also learn a professional skill that can support you for many years ahead.

Bima Sakhi Yojana: Women Can Receive ₹7,000 Monthly Support Check Step-by-Step Application Process has been created especially for women who want to earn on their own but cannot commit to a strict 9–5 office job. Here, you are free to manage your time, work in your own area, and gradually build your network and earnings. It blends the flexibility of self-employment with the backing of a strong and trusted brand like LIC.

Benefits Of Bima Sakhi Yojana

The biggest advantage of Bima Sakhi Yojana is that it provides you with assured income right from the beginning. In the first year, you can receive up to ₹7,000 per month, with slightly lower support in the second and third year. This steady amount over three years boosts your confidence and helps you manage your basic expenses like travel, phone, internet, and small marketing activities. It removes the fear of “what if I don’t earn in the first few months?” which many beginners usually have.

On top of the stipend, the real earning potential comes from commissions. As you sell more policies, renew existing ones, and gain new customers through referrals, your commission income keeps rising. After some time, many agents earn enough commission that they are no longer dependent on the stipend. In this way, Bima Sakhi Yojana not only supports your start but also guides you towards building a long-term, growing income stream from your own insurance agency work.

Eligibility Criteria For Bima Sakhi Yojana

To join this scheme, you must meet a few simple eligibility conditions. First, you should be at least 18 years old. The upper age limit is generally quite flexible (up to senior age, depending on LIC rules), so women in different life stages students, young mothers, middle-aged homemakers, and even senior women can get a chance.

In terms of education, you must have passed at least Class 10. This basic qualification ensures that you are comfortable handling simple calculations, filling forms, reading policy documents, and using a smartphone or basic digital tools. Higher education is certainly an advantage, but it is not a strict requirement, which makes the scheme accessible to a large number of women.

Who Cannot Apply for Bima Sakhi Yojana

Like every scheme, Bima Sakhi Yojana also has some exclusions to keep the system fair and transparent. If you are already working as an LIC agent, have previously worked as one, or are a retired LIC employee, you typically cannot enroll under this specific programme. The scheme is meant for fresh entrants, not for those who are already part of LIC’s agency network.

Similarly, if you are a close relative of a current LIC agent or employee for example, a spouse, child, parent, or real brother/sister you may not be considered eligible. The idea behind these rules is to avoid conflicts of interest and ensure that new, independent candidates get a fair opportunity to start their career through Bima Sakhi Yojana.

Required Documents for Bima Sakhi Yojana

When you apply for this scheme, you need to keep a few key documents ready. A recent passport-size photograph is usually required for uploading with the online application form. For identity proof, documents such as Aadhaar card and PAN card are commonly used.

You also need an address proof, which could be a ration card, electricity bill, bank passbook, or any government-issued document showing your current address. To prove your age and education, you can use your birth certificate, school leaving certificate, or Class 10 mark sheet or certificate. Additionally, an active mobile number and email ID are essential, because all communication about verification, OTPs, and next steps will be sent through these.

Step-By-Step Application Process for Bima Sakhi Yojana

- To understand Bima Sakhi Yojana: Women Can Receive ₹7,000 Monthly Support Check Step-by-Step Application Process, it helps to look at the online application journey in order. First, open the official website of LIC in any browser. On the homepage, scroll down or navigate to the section where you see an option or banner related to “Bima Sakhi”. Clicking this link will take you to the registration or information page for the scheme.

- Next, you will see an online registration form where you must fill in your personal details such as your name, date of birth, address, district, state, mobile number, email ID, and educational qualification. You may also be asked to declare whether you are currently an LIC agent, ex-agent, retired staff, or closely related to any existing LIC agent or employee. After filling all fields carefully, you must upload the scanned copies of your required documents.

- Once everything is filled and the documents are uploaded, you enter the captcha code and submit the form. If the submission is successful, you will usually see a confirmation message on the screen, and you may receive a registration ID or confirmation via SMS or email. After this, the nearby LIC office or development officer may contact you for an interview, counselling session, or further verification. If you clear the process and are selected, you are formally onboarded as a Bima Sakhi and your training and stipend-based journey begins.

What Does a Bima Sakhi Do

As a Bima Sakhi, your role goes beyond simply selling policies. You act as a financial awareness ambassador in your community. You meet families, understand their goals such as children’s education, marriage, retirement planning, or health protection—and then guide them towards suitable life insurance plans. This gives you income and, at the same time, provides those families with financial security and peace of mind.

Your responsibilities also include reminding customers about premium due dates, helping them with basic documentation, guiding them on claims, and maintaining a long-term relationship. The training provided under Bima Sakhi Yojana: Women Can Receive ₹7,000 Monthly Support Check Step-by-Step Application Process prepares you for all these tasks. You learn how to communicate clearly, handle objections, build trust, and manage your time effectively so that you can grow your client base steadily.

Abha Health Card: करोड़ों लोग बनवा रहे हैं! आभा हेल्थ कार्ड क्या है, बेनिफिट और बनाने का तरीका जानें

Is Bima Sakhi Yojana Right For You

If you are willing to step out a little, talk to people, and learn something new, Bima Sakhi Yojana can be a strong and realistic option for you. It is not a permanent government job, but it combines the security of a fixed stipend in the beginning with the growth potential of a commission-based career. You work under the umbrella of a well-known and trusted brand, yet you enjoy the freedom of flexible hours and self-driven income.

The true power of Bima Sakhi Yojana: Women Can Receive ₹7,000 Monthly Support Check Step-by-Step Application Process lies in consistency. The first few months may feel like a learning phase, but as your confidence grows and your network expands, both your commission and respect in the community increase. If you are serious about building your own identity, want to support your family financially, and are ready to stay committed for the long term, this scheme can become a solid pillar of your financial independence.

FAQs on Bima Sakhi Yojana

Is Bima Sakhi Yojana a government job?

No, Bima Sakhi Yojana is not a permanent government job. It is a stipend-based agency programme of LIC where you work as a career agent or Bima Sakhi and your earnings come from both fixed support and commissions.

How much can I earn under Bima Sakhi Yojana?

For the first three years, you receive a fixed stipend every month, which can be up to ₹7,000 in the first year and slightly less in the following years.

Can women with less than Class 10 education apply?

Generally, the minimum educational qualification required for Bima Sakhi Yojana is Class 10 pass. If your education is below this level, direct eligibility may be an issue, but you can encourage a Class 10-pass family member to apply and support them in field activities.

How long does selection under Bima Sakhi Yojana take?

After you submit your online form, the time taken for selection depends on the number of applications in your area and the processing speed of the local LIC office.