Fixed deposits have always been a trusted choice for Indian investors who prefer stability over risk. Even in today’s fast changing financial environment, FDs continue to play a key role in personal finance planning. Among the various options available, the Bank of Baroda Special FD has gained significant attention due to its attractive interest rates and unique short term tenure. This scheme is especially appealing to people who want assured returns without locking their money away for several years. The Bank of Baroda Special FD is designed for investors who want a balance of safety, liquidity, and competitive returns. With a tenure of just 333 days, it fits perfectly for short term goals while still offering better interest than many regular fixed deposits. If you are planning to invest ₹1,00,000 and want clarity on returns, features, and benefits, this detailed guide covers everything you need to know.

The Bank of Baroda Special FD is a limited period fixed deposit scheme introduced to offer higher interest rates for a specific tenure. Unlike standard FDs that usually follow common tenures like one year or three years, this scheme stands out because of its 333-day duration. This makes it ideal for investors who do not want long lock in periods but still want returns that are better than savings accounts or short-term deposits. Since Bank of Baroda is a government owned bank, the scheme carries a high level of trust and reliability. Interest rates are fixed at the time of investment, ensuring predictable returns. Senior citizens also receive additional interest benefits, making this scheme particularly suitable for retirees who depend on stable income sources.

Bank of Baroda Special FD

| Details | Information |

|---|---|

| Scheme Name | Bank Of Baroda FD Scheme 333 Day Special Deposit |

| Tenure | 333 Days |

| Interest Rate For General Public | Around 7.15 Percent Per Annum |

| Interest Rate For Senior Citizens | Around 7.65 Percent Per Annum |

| Minimum Investment | ₹1,000 |

| Maximum Investment | No Upper Limit |

| Risk Level | Very Low |

| Premature Withdrawal | Allowed With Penalty |

| Interest Payout Options | Cumulative And Non Cumulative |

The Bank of Baroda Special FD is a well-designed fixed deposit scheme for investors seeking short term, low risk, and assured returns. With its unique 333-day tenure, competitive interest rates, and added benefits for senior citizens, it stands out among traditional FD options. For those planning to invest ₹1,00,000 and looking for security along with reasonable growth, this scheme offers a reliable and stress-free investment opportunity in the current financial landscape.

Interest Rates Under the Scheme

- Interest rate is one of the most important factors while choosing a fixed deposit. The Bank of Baroda Special FD offers competitive rates that are higher than many standard short term deposits. For general investors, the interest rate is around 7.15 percent per annum. Senior citizens enjoy an additional benefit, earning around 7.65 percent per annum.

- These rates remain fixed for the entire tenure, regardless of changes in market conditions or repo rate fluctuations. This feature makes the scheme attractive for conservative investors who want certainty in returns. In the current financial year, when interest rates are under constant review, locking into a higher rate for 333 days can be a smart move.

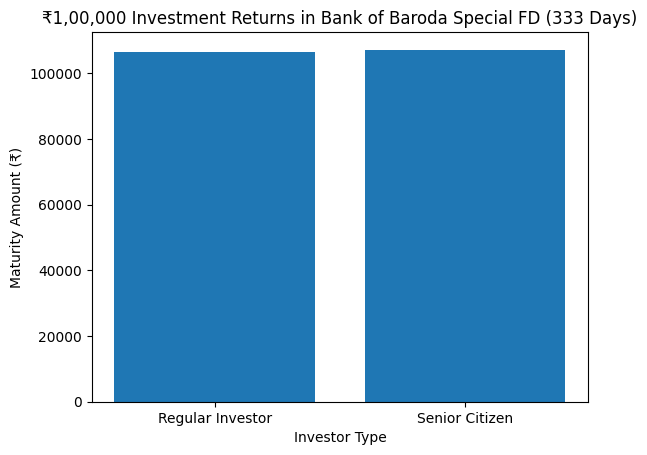

Returns On ₹1,00,000 Fixed Deposit

- Understanding returns is essential before making any investment decision. If you invest ₹1,00,000 in the Bank of Baroda Special FD, the maturity amount will depend on your category and payout option.

- For regular investors, an investment of ₹1,00,000 at around 7.15 percent for 333 days can generate interest of approximately ₹6,500 to ₹7,000. The maturity amount can be expected to be around ₹1,06,500 or slightly higher, depending on compounding.

- Senior citizens investing the same amount benefit from the higher interest rate. At around 7.65 percent, the interest earned can cross ₹7,000, taking the maturity value beyond ₹1,07,000. These returns are impressive for a short term, low risk investment and are completely predictable.

Key Features of The 333 Day Special Deposit

- One of the biggest strengths of the Bank of Baroda Special FD is capital protection. Being a public sector bank, Bank of Baroda offers strong financial stability and reliability. This makes the scheme suitable for risk averse investors.

- Another key feature is the unique tenure. The 333 day duration allows investors to plan for short term goals such as travel, education expenses, or emergency funds. The scheme also offers both cumulative and non cumulative interest payout options, giving flexibility based on individual income needs.

- Premature withdrawal is allowed, which adds liquidity. Although a small penalty may apply, having access to funds in case of emergencies is a valuable feature.

Eligibility Criteria for Bank of Baroda Special FD

- The Bank of Baroda Special FD is open to resident Indian individuals. Both single and joint account holders can invest in this scheme. Senior citizens are eligible for higher interest rates.

- The scheme is also available to Hindu Undivided Families and certain other eligible entities as per bank rules. This wide eligibility makes it accessible to a large section of investors looking for safe investment options.

How To Invest In Bank Of Baroda Special FD

- Investing in this scheme is simple and convenient. Existing Bank of Baroda customers can open the fixed deposit through internet banking or mobile banking. The online process is quick and requires minimal effort.

- Alternatively, investors can visit the nearest Bank of Baroda branch and open the FD by submitting basic KYC documents. The investment amount can be transferred directly from the savings account, making the process hassle free even for first time investors.

Taxation Rules on Bank of Baroda Special FD

- Interest earned from the Bank of Baroda Special FD is taxable according to the investor’s income tax slab. If the total interest income exceeds the applicable threshold, tax may be deducted at source.

- Senior citizens can submit Form 15H, while other eligible investors can submit Form 15G to avoid TDS if their total income falls below the taxable limit. It is important to declare FD interest income while filing income tax returns to remain compliant with tax regulations.

Comparison With Regular Fixed Deposits

- Compared to regular fixed deposits, the Bank of Baroda Special FD offers a better interest rate for a shorter tenure. While standard FDs often require a one year or longer lock in to earn higher returns, this scheme provides similar benefits in just 333 days.

- For investors who want flexibility and better liquidity, this scheme is more attractive than long term FDs. It also works well for those who want to reinvest their funds sooner depending on future interest rate movements.

Soil Health Card Scheme — How It Helps Farmers Use Fertilizers More Effectively

Who Should Invest In This Scheme

- The Bank of Baroda Special FD is suitable for conservative investors who prioritize safety and predictable returns. It is ideal for senior citizens looking for stable income, salaried individuals planning short term savings, and anyone who wants to park surplus funds without taking market risks.

- If you have a short-term financial goal and do not want exposure to volatility, this scheme can be a practical choice. It also fits well as a part of a diversified investment portfolio.

FAQs on Bank of Baroda Special FD

Is The Interest Rate Fixed For Entire Period

Yes, the interest rate remains fixed from the date of investment until maturity.

Can I Withdraw The FD Before Maturity

Premature withdrawal is allowed, but a penalty may apply as per bank policy.

Do Senior Citizens Get Extra Benefits

Yes, senior citizens receive a higher interest rate compared to regular investors.

Is Bank of Baroda Special FD A Safe Investment

Yes, it is considered very safe as it is offered by a government owned bank.