If you use ATMs regularly, there’s a big change you need to prepare for. From May 1, 2025, most banks in India are moving to a higher post-limit ATM fee up to ₹23 per transaction after you exhaust your monthly free transactions, plus taxes where applicable. The number of free transactions remains limited based on location, so how you plan your withdrawals will decide whether you pay the new fee or avoid it altogether. New ATM Fee Changes Ahead is the focus keyword to keep front and center because it captures exactly what’s happening and why it matters now. New ATM Fee Changes Ahead also signals that this isn’t a bank-by-bank rumor but a system-wide alignment with the updated cap for post-limit transactions, including cash withdrawals and some non-financial transactions after your free limits run out.

Think of this change as a reset on how ATM usage is priced once you pass your monthly free quota. You’ll still get a limited number of free transactions each month typically three in metro cities and five in non-metro areas but beyond that, each qualifying transaction can cost up to ₹23, plus GST. Some banks are also clarifying that the same logic extends to Cash Recycler Machines (CRMs) when used for non-deposit activities. The headline takeaway: track your usage, consolidate withdrawals, and favor your own bank’s network to cut avoidable fees.

ATM Fee Changes

| Item | What Changes | When It Starts | Who’s Affected | Key Notes |

|---|---|---|---|---|

| Post-Limit Fee Cap | Up to ₹23 per transaction after free limit | May 1, 2025 | All bank customers exceeding free limits | Taxes apply; applies to financial and some non-financial transactions |

| Free Transaction Limits | 3 free in metros; 5 free in non-metros per month | Continuing from May 1, 2025 | Customers using any ATM network | Free count typically includes both financial and non-financial activities |

| Bank-Level Policies | Banks aligning tariffs to new cap | May–July 2025 (varies by bank) | HDFC, PNB, Axis, IndusInd, others | Some banks set lower fees for post-limit non-financial transactions |

| Cash Recycler Machines | Non-deposit uses can count toward limits | From May 1, 2025 | Users of CRMs | Cash deposits remain exempt; other CRM uses can trigger post-limit charges |

| Taxes | GST extra on applicable fees | Ongoing | All customers | Final debit = Fee + GST as per rules |

What’s Changing and Why

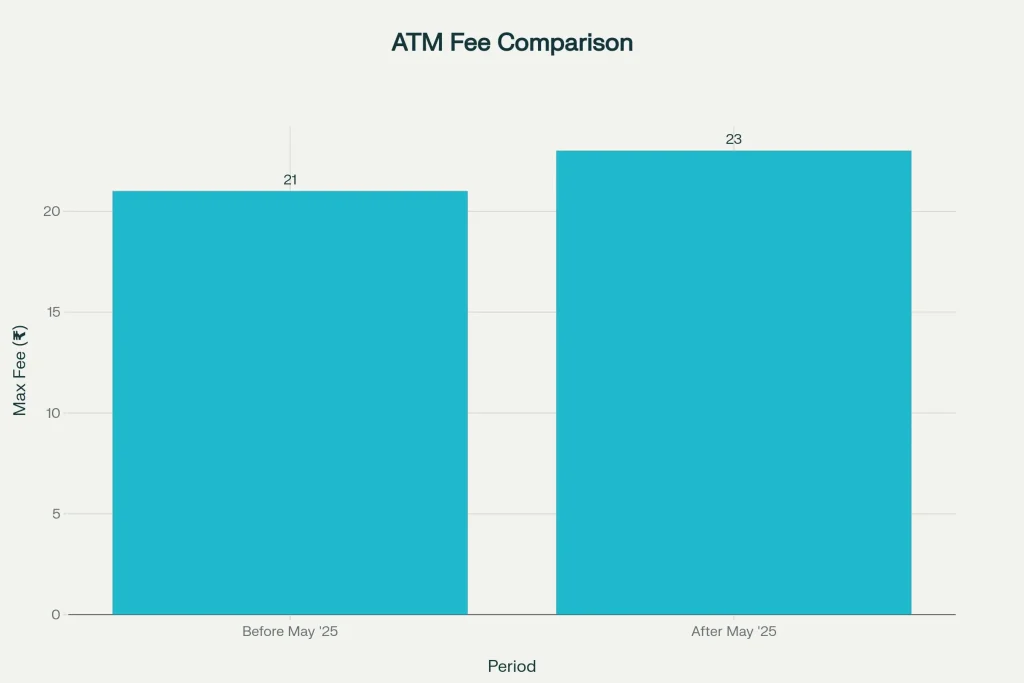

The allowed maximum customer charge after you run out of free transactions is moving to ₹23, up from the earlier ₹21 level. This adjustment is meant to reflect higher costs of maintaining ATM infrastructure, security upgrades, cash logistics, and network operations. For customers, the number to remember is ₹23 per transaction after the free quota budget for it if you frequently use ATMs late in the month or rely on out-of-network machines.

How Many Free ATM Transactions You Get

- Metro areas: 3 free ATM transactions per month.

- Non-metro areas: 5 free ATM transactions per month.

- What counts: Both financial (cash withdrawals) and non-financial (balance inquiry, mini statement, PIN change) usually count toward the free quota, though some banks may waive non-financial charges at their own ATMs.

- Own-bank vs other-bank ATMs: You may also have a separate free limit at your own bank’s ATMs before post-limit charges apply. Always check your bank’s schedule of charges to confirm specifics.

Bank-By-Bank Implementation of New ATM Fee Changes

Most large banks are aligning to the ₹23 cap, but fine print differs:

- Some banks explicitly keep non-financial transactions free at their own ATMs, charging only for post-limit cash withdrawals there.

- At other banks’ ATMs, both financial and non-financial transactions commonly count toward your free quota. After you run out, banks may charge up to ₹23 per transaction for cash withdrawals and may set a lower price point (for example, ₹10–₹11) for non-financial transactions, plus taxes.

- A few banks have staggered effective dates for revised tariffs, especially where broader fee schedules change on quarterly cycles.

What Counts as Non-Financial Transactions

Non-financial includes:

- Balance inquiry

- Mini statement

- PIN change

- Cheque book request (where available at the terminal)

These are often counted toward your free quota at other-bank ATMs. Your own bank’s ATMs may waive non-financial fees within policy, but once you exhaust free limits, published charges apply. Always verify your account type benefits—some premium tiers keep certain non-financial actions free even beyond the general limit.

Cash Recycler Machines And Hidden Triggers

CRMs are increasingly treated like ATMs for non-deposit uses. That means:

- Cash deposits at CRMs are not charged as ATM transactions.

- Non-deposit uses at CRMs (like balance inquiry or mini statements) can count toward your free limit and trigger post-limit fees.

- If you rely on CRMs at grocery stores or malls for convenience, treat those interactions like an ATM visit for fee planning.

How To Avoid or Reduce the New ATM Fees

- Consolidate withdrawals: Fewer, larger cash withdrawals help you stay within free limits.

- Use your own bank’s ATMs: Your own network typically offers the most generous policy and fewer surprises.

- Check your location classification: If you travel between metro and non-metro areas, remember free limits differ; plan usage accordingly.

- Set alerts: Many banking apps can show the count of ATM transactions used this month enable notifications to avoid crossing the threshold unintentionally.

- Upgrade your account if it makes sense: Premium account tiers sometimes reimburse domestic ATM fees or offer higher free limits. Do the math against your average monthly usage and fee exposure.

- Go digital when possible: UPI, card payments, and wallet transfers reduce reliance on cash and, therefore, on ATMs.

- Avoid non-essential non-financial transactions at other-bank ATMs: Do balance checks and statements in-app or online to preserve your free count.

What To Watch in Statements

- Look for line items like “ATM Usage Fee,” “ATM Transaction Charge,” or “Non-Financial Transaction Fee.”

- Cross-check the charged figure: Fee should not exceed ₹23 per transaction after free limits for cash withdrawals; non-financial post-limit charges may be lower as per your bank’s tariff.

- Confirm GST was applied correctly.

- If you notice discrepancies, contact your bank quickly with date, time, ATM ID, and transaction reference.

Real-World Scenarios

- Metro user example: You make three withdrawals by the 10th. Your fourth withdrawal on the 18th at any ATM can incur up to ₹23 plus taxes. To avoid it, plan a single larger withdrawal earlier or switch to digital payments for daily needs.

- Non-metro user example: You used two withdrawals and two balance checks at other-bank ATMs. That’s four transactions. Your next non-financial action at another-bank ATM may become the fifth (still free), but the sixth could be charged post-limit even if it’s just a mini statement.

- Mixed network example: You used your own bank’s ATM twice and another bank’s ATM twice in a metro city. If your bank counts both sets toward the same metro free limit of three, your fifth total ATM interaction can be charged. Always check how your bank aggregates counts across networks.

Action Plan Before the Hike

- Review your bank’s Schedule of Charges today.

- Audit last three months of ATM usage count financial and non-financial interactions.

- Decide a monthly “cash plan”: one or two purposeful withdrawals timed with bill cycles or salary credit.

- Favor your bank’s ATMs and avoid casual non-financial actions at other-bank ATMs.

- Update your app alerts so you get a reminder when you hit your free limit.

- If you often exceed limits, consider an account tier that reimburses ATM fees or offers higher free counts.

RBI Rule Change After November 15 — Why Your Bank Account Could Be Temporarily Blocked

What To Do Now

The change is straightforward but impactful: after your free transactions, expect up to ₹23 per transaction, plus tax. Get ahead of it by planning fewer, larger withdrawals, prioritizing your bank’s ATMs, and switching routine checks to your banking app. If your lifestyle or work forces frequent ATM visits, consider an account that offers reimbursements or higher free limits. A couple of simple adjustments can keep your monthly banking costs predictable and low.

FAQs on New ATM Fee Changes

How many free ATM transactions do I get each month?

Typically, three in metro cities and five in non-metro areas. Both financial and non-financial transactions can count toward that quota, depending on your bank’s policy.

What happens after I exceed my free transactions?

Your bank can charge up to ₹23 per transaction for cash withdrawals post-limit, plus GST. Some banks set a lower fee for post-limit non-financial transactions.

Do these rules apply to Cash Recycler Machines?

Yes, for non-deposit activities. Using a CRM to check balance or print a mini statement can count toward your monthly free limit and may incur post-limit charges; cash deposits are excluded.

Do all banks charge the same amount?

The cap is uniform at ₹23 for post-limit transactions, but implementation differs. Some banks keep non-financial transactions free at their own ATMs, while others publish separate lower fees (for example, ₹10–₹11) for non-financial post-limit actions at other-bank ATMs.