If you still treat the ATM like a “free cash machine”, 2025 is the year that can quietly shake up your monthly budget. ATM charges changing in 2025 does not just mean a tiny increase of a few rupees – it means that every extra, unplanned withdrawal after your free limit can now cost you a noticeable amount. Earlier, people would walk up to an ATM multiple times a month for small withdrawals or just to check their balance without thinking twice. Now, the same habit can show up as a series of small but painful fees on your bank statement. Understanding ATM charges changing in 2025 is the first step to making sure you are not paying extra just to access your own money.

In today’s increasingly cash‑light economy, both banks and the regulator want customers to use ATMs more thoughtfully and rely more on digital payments. The updated fee structure is designed to keep your basic quota of free transactions intact, but to make every trip beyond that limit a clear, paid decision. If you are someone who uses the ATM only a few times a month, the impact may be limited. But if you are in the habit of withdrawing cash frequently, especially in small amounts, the new charges can add up quickly and quietly.

ATM Charges Changing in 2025

| Point | What The 2025 Rules Say | What It Means For You |

|---|---|---|

| Free monthly limit | Fixed number of free transactions at your own bank’s ATMs and a smaller, location‑based free limit at other banks’ ATMs (metro vs non‑metro) | Stay within these limits and you avoid most charges |

| Fee after free limit | A higher per‑transaction charge after you exhaust your free quota, plus applicable taxes | Every extra withdrawal or transaction now comes with a clear cost |

| Financial vs non‑financial | Cash withdrawals always count; non‑financial actions like balance enquiry or mini statement may also count at other banks’ ATMs | Even “just checking” your balance can eat into your free quota |

| Interchange cost | Banks pay more to each other when customers use other banks’ ATMs | A part of this higher cost is passed on to you through revised fees |

| Who is covered | Almost all major banks and white‑label ATMs fall under the same framework | You are affected regardless of which popular bank you use |

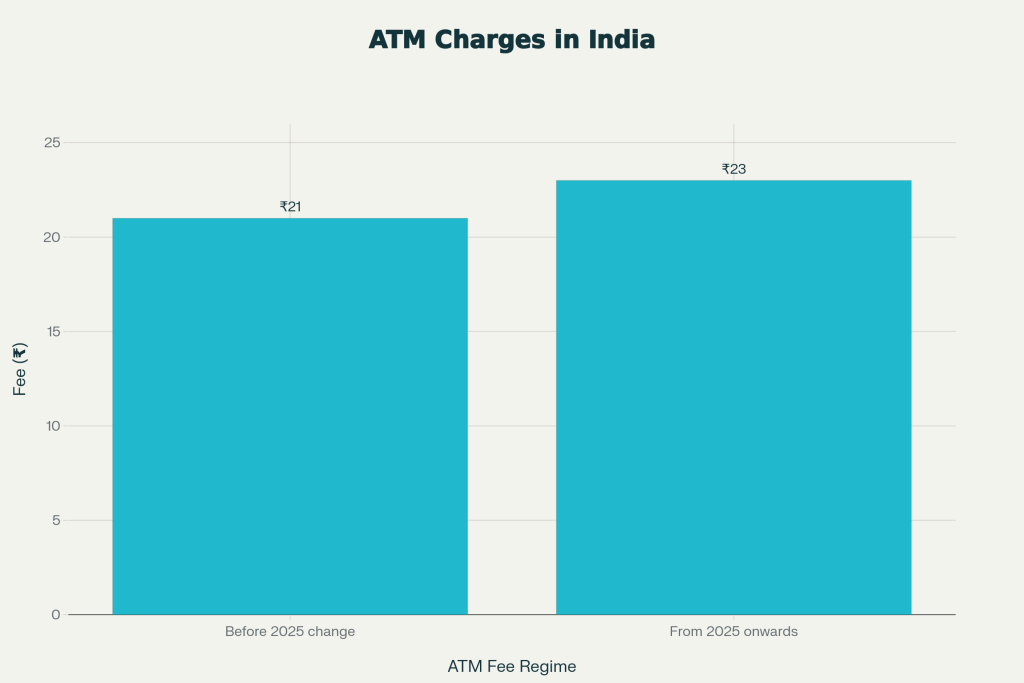

The core feature of ATM charges changing in 2025 is simple: the free transaction count has broadly remained the same, but the fee you pay after crossing that limit has gone up. You still get a fixed number of free withdrawals and non‑financial transactions at your own bank’s ATMs every month, and a separate free quota when you use other banks’ ATMs. Once you cross those slabs, though, every additional visit becomes a paid service. This applies even more strongly at other banks’ ATMs, where your balance enquiry and mini statement can also count towards the free quota.

In practice, this means that making frequent, small withdrawals is no longer harmless. The new pricing model reflects the higher cost of running and securing ATM networks, but for you as a customer, the impact is direct: more careless usage equals more fees. If you used to withdraw cash eight or ten times a month and only occasionally got charged, now the same pattern can trigger multiple fee deductions. The rules are the same nationwide, which means you cannot simply escape the change by switching from one major bank to another.

How Many Transactions Are Truly Free?

To use the new rules smartly, you must first know how many transactions you actually get for free. Typically, your own bank allows a fixed number of free ATM transactions at its own machines each month. These free transactions may include both financial (cash withdrawal) and non‑financial services like balance enquiry, mini statements or PIN changes. If you use these wisely, you can complete most of your essential tasks without paying a rupee in fees. The trouble starts when you use another bank’s ATM for everything, including basic checks that could have been done on your phone.

In metro areas, the free quota at other banks’ ATMs is usually lower than in non‑metro regions. That means if you live in a big city and your own bank’s ATM is not nearby, your “room to make mistakes” becomes even smaller. Every time you choose a different bank’s ATM just because it is convenient, you risk burning through your free quota faster. After that point, ATM charges changing in 2025 start to hurt, because the same action that cost you nothing last year may now cost you on each additional visit.

Per‑Transaction Fee: Every Visit Has A Price Tag Now

The real bite of the new structure appears after you cross your free limits. At that point, each extra ATM visit attracts a revised fee, plus taxes. On paper, the amount might look small, but in real life it can add up quickly if you are not careful. Four or five extra withdrawals in a month can easily translate into a few hundred rupees in pure charges – money you get nothing for, except the right to access your own balance one more time. For people who withdraw in small, frequent chunks instead of planning ahead, this difference becomes very visible very fast.

Other banks’ ATMs can be even more expensive in this context. There, not only do extra cash withdrawals cost you more, but non‑financial transactions may also be counted once your quota is used up. That means using an ATM to check your balance twice and withdraw a couple of times can finish your free allowance in no time. After that, ATM charges changing in 2025 ensure that every subsequent visit becomes a cost centre on your statement. The message is clear: ATMs are no longer meant for casual, repeated checking and small withdrawals.

Why Did Banks And The Regulator Change The Rules?

- It is natural to wonder why these fees had to be raised at all. Over the past few years, the cost of operating ATMs has increased sharply. Banks must pay for maintenance, physical security, cash refilling, surveillance systems, software upgrades and protection against fraud and cyber‑attacks. On top of that, whenever you use an ATM that does not belong to your bank, your bank has to pay an interchange fee to the ATM‑owning bank. As these underlying costs rise, ATM transactions become less profitable for banks if fees stay frozen.

- The updated fee framework is an attempt to balance these operational realities with customer convenience. Instead of cutting free usage drastically, the system keeps your basic free quota intact but asks you to pay a bit more once you go beyond it. At the same time, the financial ecosystem is steadily nudging users towards digital transactions such as UPI, net banking and card payments. ATM charges changing in 2025 fit into this bigger picture: they make heavy cash dependence slightly more expensive and digital usage relatively more attractive.

How ATM Charges Changing In 2025 Affect Your Daily Life

If your lifestyle is cash‑heavy – for example, if you pay most local expenses in cash and withdraw frequently – these new rules directly affect your day‑to‑day habits. The “little and often” withdrawal style that used to feel harmless now becomes the costliest way to use an ATM. A smarter approach is to withdraw money in fewer, slightly larger instalments, while staying within your free transaction limits. When you plan like this, the new fees barely touch you; when you do not, they show up as a series of avoidable deductions.

The broader impact is that many people will naturally move further towards digital payments. Groceries, fuel, restaurants, bills and shopping can already be paid easily via UPI or cards. And as soon as withdrawing cash itself starts to feel expensive, the incentive to go digital gets stronger. This shift has side benefits: you carry less cash, reduce the risk of loss or theft, and gain a clearer digital record of your spending. ATM charges changing in 2025 may feel like a burden at first, but they also act as a push towards more modern, convenient payment habits.

भारत के 3 सबसे सेफ बैंक कौन से हैं, RBI ने जारी की लिस्ट, इनमें से किसमें है आपका खाता

Smart Ways to Avoid Paying Extra ATM Fees

In the new environment, planning is the difference between smooth banking and constant irritation. A few practical habits can save you a lot over the year:

- Estimate your cash needs at the start of the month or around salary credit and withdraw in two or three planned transactions instead of many small ones.

- As far as possible, use your own bank’s ATMs so you can maximise your free quota and avoid unnecessary charges on non‑financial actions.

- Do balance enquiries and mini statements through your mobile banking app or net banking, rather than through ATMs, so they do not eat into your free limit.

- If you hold accounts with more than one bank, compare their ATM fee structures and use the account that best matches your transaction habits.

- Shift everyday payments to UPI, debit cards and other digital modes so your need for cash – and therefore for ATM visits – naturally reduces.

When you apply these strategies consistently, the impact of ATM charges changing in 2025 becomes much smaller. Instead of feeling punished by the new rules, you use them as a signal to tighten your planning and modernise your payment behaviour.

FAQs on ATM Charges Changing in 2025

Q1. Who is hit the hardest by ATM charges changing in 2025?

The hardest hit are customers who frequently withdraw cash, especially from other banks’ ATMs, or who often use ATMs for non‑financial tasks like checking balances. The more you go beyond your free limits, the more fees you rack up.

Q2. Are ATM charges changing in 2025 the same for all banks?

The overall framework and maximum fee caps are broadly common, but each bank can structure its charges differently within those limits. Some banks may charge lower fees or provide more free transactions for certain account types, such as salary, premium or priority accounts.

Q3. Will balance enquiry and mini statement also attract charges now?

At your own bank’s ATMs, many banks keep non‑financial transactions like balance enquiry and mini statements free, at least up to the specified limit. At other banks’ ATMs, though, these actions often count towards your free quota, and once that is exhausted, they can become chargeable.

Q4. Do senior citizens or premium customers get any relief?

Several banks offer special benefits to senior citizens and premium or priority customers, such as more free transactions or lower charges. The details vary from bank to bank and from product to product.