If you have been seeing headlines about “zero tax on ₹19 lakh salary” and wondering whether it is real or just a catchy claim, you are not alone. Many salaried taxpayers are confused after the new tax regime changes, raised rebate limits, and revised slabs. The truth is simple but slightly technical: you cannot magically make a flat ₹19 lakh fully tax-free, but with smart salary structuring and the new rules, you can bring your taxable income down so much that a CTC around ₹18–19 lakh can attract little to almost zero tax. This article walks you through that logic in plain language, so you actually understand where the benefit comes from.

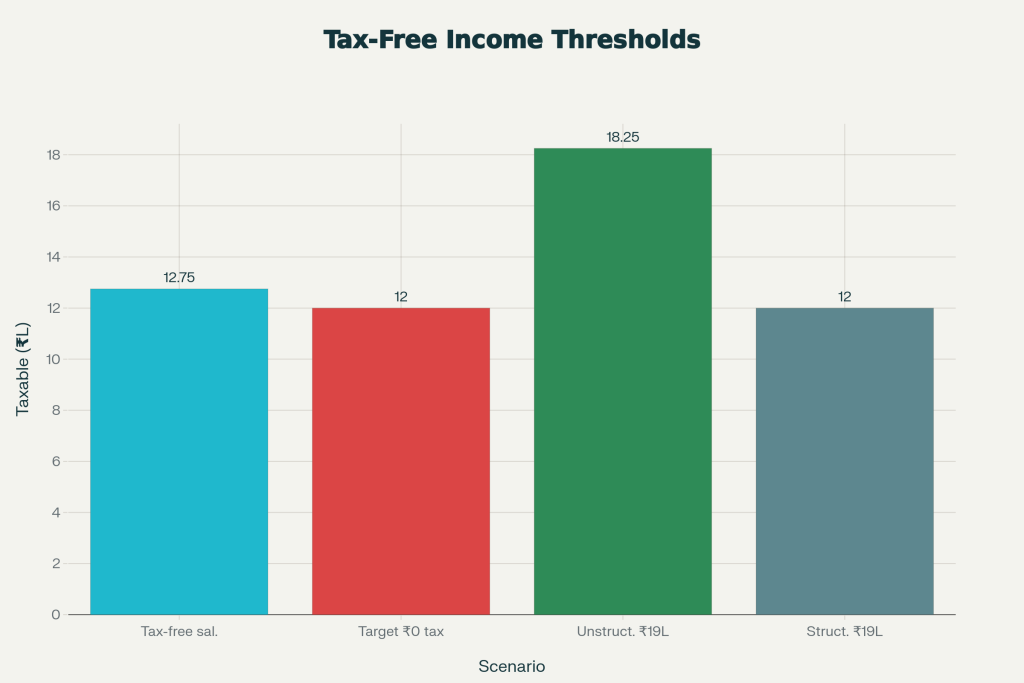

Under the latest new tax regime, the government has made income up to ₹12 lakh effectively tax-free for resident individuals by combining relaxed slabs with a higher rebate. For salaried people, the standard deduction pushes this effective relief up to ₹12.75 lakh of salary. Beyond that level, tax still applies, but if your company helps structure your CTC with elements like employer NPS contribution, tax-free reimbursements, and allowances, your gross package can be close to ₹19 lakh while your taxable income still sits within the “zero tax” band. That’s the real story behind earning up to ₹19 lakh tax free, not some hidden loophole.

New Income Tax Calculations

| Point | Explanation |

|---|---|

| Basic new regime slabs | Nil tax on the lowest band, with gradual slab hikes instead of a sudden jump at higher income. |

| Effective tax-free income | Income up to a defined level (around ₹12 lakh) can be fully covered by rebate, making tax zero. |

| Standard deduction benefit | Salaried taxpayers get a flat deduction before tax is computed, reducing taxable income. |

| CTC vs taxable income | Not all CTC is taxable; some items like NPS, PF, and bill-based reimbursements are partly/fully exempt. |

| Target for 19 lakh idea | Plan the CTC so only around ₹12 lakh ends up taxable, even if the total package is near ₹19 lakh. |

In practical terms, “Earn Up To ₹19 Lakh Tax Free New Income Tax Calculations Explained Step By Step” means understanding the gap between CTC and taxable income. Your CTC may show a large number on paper, but not every rupee in that figure is taxed. Some components like employer’s NPS share, PF, certain reimbursements, and properly structured allowances do not fully count as taxable income. When these are maximised, and the new regime’s rebate and standard deduction are applied, you can legally enjoy a high CTC with a surprisingly low tax bill. For a typical salaried person, the key is to aim for taxable income of ₹12 lakh or lower under the new regime. Once that happens, the rebate cancels your tax. The standard deduction of ₹75,000 already helps you move in that direction. The remaining distance is covered by using tax-efficient components in your salary break-up. So the “₹19 lakh tax-free” idea is really a result of planning and structuring, not blind hope.

What Changed in the New Tax Regime

The latest changes shifted the focus firmly towards the new tax regime by making it more attractive for most salaried individuals. Slab bands were relaxed so that a bigger portion of your income is either tax-free or taxed at a lower rate before it hits the high rates. At the same time, the rebate limit was increased, so people with moderate incomes could walk away with no tax liability at all.

Another big change for salaried employees is the standard deduction. This is a flat amount automatically reduced from your salary income before tax is calculated. That single change alone pushes the tax-free threshold slightly above the headline rebate limit. When combined, these tweaks mean that a mid-level salaried person can often pay much less tax than before, even without leaning heavily on old-style deductions.

Why A Straight 19 Lakh Salary Is Not Automatically Tax Free

This is where a lot of misconceptions start. If you simply take a salary of about ₹19 lakh, treat all of it as straightforward taxable income, and then apply new regime slab rates, you will definitely get a sizeable tax amount. Slab by slab, the income will be taxed at increasing percentages, and the rebate will not apply because your taxable income is above the eligible limit.

So, if your company pays you a flat salary with hardly any benefits, reimbursements, or employer contributions, you should not expect your tax to suddenly vanish. The “Earn Up To ₹19 Lakh Tax Free New Income Tax Calculations Explained Step by Step” claim is not about such plain-vanilla structures. It is about using every allowed provision to redesign what part of your CTC is actually taxable and what part is shielded by exemptions or deductions.

Step-By-Step Logic Behind the Zero Tax Concept

To understand the step-by-step logic, start with the end goal: taxable income needs to sit within the rebate band. For a salaried person, that means making sure that after subtracting the standard deduction and other permissible amounts, the final figure used for tax computation does not cross the rebate threshold. Anything above it begins to attract normal tax.

Now, imagine a CTC near ₹19 lakh that is not fully taxable. A portion of it can be employer contribution to NPS (within limits), which is deductible. Another chunk can be PF or gratuity, which is not fully taxed like monthly salary. Add to that a basket of reimbursements such as phone bills, internet, fuel for official work, or other genuine expense-based components which are exempt if claimed correctly. At the end of this restructuring exercise, the taxable portion of your CTC may shrink to roughly ₹12 lakh. Once that happens, the rebate kicks in and wipes out your calculated tax.

New Regime Vs Old Regime for Higher Salary

For salaries in the 18–20 lakh range, the old regime only works well if you have a long list of heavy deductions: large home loan interest, full Section 80C usage, medical insurance deductions, and more. The new regime, on the other hand, offers fewer traditional deductions but compensates with simpler slabs and a more generous rebate for mid-level incomes.

If your main aim aligns with Earn Up To ₹19 Lakh Tax Free New Income Tax Calculations Explained Step By Step, you are almost always looking at the new regime, not the old one. The new regime rewards structured CTC more than deduction-heavy investing. That means your conversation with HR or payroll about how your CTC is built becomes more important than just buying extra financial products for deductions.

Practical Ways to Reduce Tax On 18–20 Lakh Salary

Even if you cannot hit absolute zero tax, there are practical steps to bring your tax burden down meaningfully:

- Ask HR if your pay can include more bill-based reimbursements: mobile, internet, or fuel actually used for work and claimed with proof.

- Check whether your employer can raise their NPS contribution percentage within the permitted limit so you get a bigger deduction without reducing your in-hand salary too much.

- Avoid keeping a big chunk of your CTC as a single, fully taxable “special allowance” without structure; try to split it into smarter components.

- If you live on rent and your employer allows a proper HRA component, ensure your rent receipts and documentation are in order so you can fully claim the benefit where applicable.

- Review your full salary break-up annually against the latest rules rather than assuming last year’s pattern is still optimal.

These real-world adjustments are the difference between a theoretical calculation and an actual lower tax liability in your Form 16 and return.

Common Mistakes People Make While Chasing Zero Tax

Many people hear about Earn Up To ₹19 Lakh Tax Free New Income Tax Calculations Explained Step by Step and immediately assume their current salary structure will qualify them for no tax. The first mistake is ignoring the split between CTC and taxable income and assuming both are identical. The second mistake is not talking to HR early enough in the financial year, when the structure can still be adjusted smoothly.

Another frequent error is switching blindly between old and new regime without comparing both using one’s actual numbers. Depending on your home loan, investments, and personal situation, the best choice can change from year to year. Finally, some taxpayers forget to consider extra income like interest, side gigs, or capital gains, which can push them above the rebate limit even if salary itself looks optimised.

FAQs on New Income Tax Calculations

1. Can Everyone with A 19 Lakh Salary Pay Zero Tax?

No. Only someone whose 19 lakh CTC is carefully structured so that the taxable part falls within the rebate limit can hope to pay zero tax. For most straight-salary cases, some tax will definitely be payable.

2. Is The New Tax Regime Better For All High Earners?

Not always. If you claim large deductions in the old regime (like big home loan interest and full 80C), the old system may still suit you. The new regime usually works better when your deductions are limited but your salary is well structured.

3. What Is the Maximum Income That Can Be Fully Tax Free Now?

In the latest setup, resident individuals can effectively pay zero tax up to the rebate threshold, and salaried people benefit slightly beyond that due to the standard deduction. Beyond this band, tax begins to apply.

4. How Do I Know Which Regime to Choose Each Year?

The simplest method is to calculate your tax under both regimes using your actual figures: salary, investments, loans, and other income. Whichever regime results in lower tax for that year is the one you should choose.