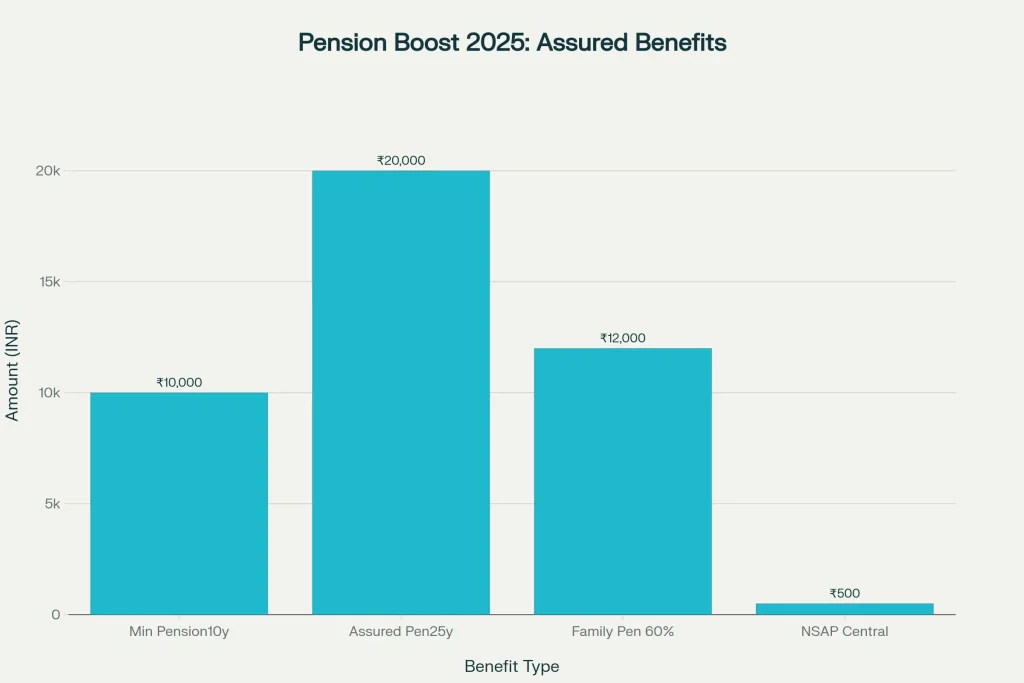

India’s pension landscape gets a meaningful upgrade in 2025, with a clear, assured floor of ₹10,000 per month for eligible Central Government employees at superannuation, provided they complete at least 10 years of qualifying service. The move formalizes predictability in retirement income by pairing a guaranteed minimum with an assurance of 50% of the average basic pay for those completing 25 years of service, bringing long-requested clarity for planning family finances. The framework also provides proportionate benefits for service between 10 and 25 years, so employees don’t face a cliff-edge as they approach retirement.

It’s a structural promise that marries a ₹10,000 monthly minimum with a wage-linked assurance of 50% of the last 12 months’ average basic pay after 25 years of qualifying service. Pension Boost For 2025 also embeds indexation through Dearness Relief on the assured pension, assured family pension (set at 60% of the pension immediately before demise), and the minimum pension, protecting real value across inflation cycles. With an integrated rollout under the existing pension platform, employees gain portability, clear timelines to exercise options, and transparent payout rules that make budgeting far more straightforward.

Pension Boost for 2025

| Aspect | Details |

|---|---|

| Scheme | Unified Pension Scheme (UPS) for Central Government employees, effective April 1, 2025 |

| Minimum Pension | ₹10,000 per month on superannuation with at least 10 years of qualifying service |

| Full Assurance | 50% of average basic pay (last 12 months) after 25 years of qualifying service |

| Proportionate Payout | Pro-rata assurance between 10 and 25 years of service |

| Family Pension | 60% of the pension immediately before the pensioner’s demise |

| Indexation | Dearness Relief applies to assured pension, family pension, and minimum pension |

| Lump Sum | 1/10 of monthly emoluments (Basic + DA) per completed 6 months of service at superannuation; does not reduce assured pension |

| Option Timelines | Choice window for eligible employees; new recruits follow defined onboarding timelines |

| Contribution Logic | Employee and government contributions within an integrated pension architecture |

Pension Boost For 2025 brings long-sought certainty to retirement planning for Central Government employees: a guaranteed ₹10,000 monthly minimum with 10 years of service and a 50% pay-linked assurance after 25 years. The structure balances modern contributory principles with clear, inflation-indexed outcomes, integrates a defined survivor benefit, and preserves a separate lump sum for transition needs. If eligible, evaluate service length, final-year basic pay, and family requirements, then exercise the one-time option within the notified window to lock in the assurance most aligned with your retirement goals.

What The Policy Guarantees

The policy provides two anchors. First, a firm floor: ₹10,000 per month at superannuation for those meeting the 10-year minimum qualifying service. Second, a wage-linked guarantee: 50% of the average basic pay over the final 12 months for those completing 25 years of service. Employees with 10–25 years receive proportionate assurance, which preserves fairness across variable career lengths. Together, these features turn retirement planning from guesswork into a predictable income stream.

Who Will Benefit from Pension Boost for 2025

The primary beneficiaries are Central Government employees who opt for the Unified Pension Scheme and meet the qualifying service thresholds. Those with lengthy tenures will generally see the 50% pay-linked assurance exceed the ₹10,000 floor, while mid-tenure employees are protected by the proportionate rule. Families also benefit: the assured family pension at 60% of the pension ensures income continuity, which is crucial for household stability after the pensioner’s demise.

How It Works

The scheme is implemented within the existing national pension infrastructure, combining the administrative efficiency of the current platform with the certainty of defined assurances. Employees contribute a fixed share of basic pay plus DA, and the government provides an enhanced contribution framework to support the guarantees. Dearness Relief is applied periodically to the assured pension, family pension, and minimum pension, ensuring that the benefit keeps pace at least partially with inflation trends.

Why This Matters Now

Pension Boost For 2025 responds to a decade of debate around post-retirement predictability. By introducing a minimum pension and a wage-linked assurance, the framework reduces the volatility inherent in purely market-linked outcomes. For most families, that translates into better budgeting, a clearer insurance strategy, and more confident decisions on housing, healthcare, and education support for dependents. It also brings the comfort of a survivor benefit that is pre-defined rather than left to annuity configuration alone.

Key Features Explained

- Assured Minimum: The ₹10,000 monthly floor ensures no eligible retiree with at least 10 years of service falls below a basic income threshold.

- Wage-Linked Assurance: The 50% of last 12 months’ average basic pay after 25 years directly tracks career progression, bringing OPS-like predictability into a modern contributory system.

- Proportionate Scale: For 10–25 years of service, the benefit scales proportionately, which avoids an all-or-nothing leap at year 25.

- Family Pension: A standard 60% of the assured pension provides a defined survivor pathway rather than relying solely on variable annuity outcomes.

- Dearness Relief: Indexation sustains purchasing power over time and aligns benefit adjustments with broader civil pay cycles.

- Lump Sum Add-on: A separate lump sum at superannuation 1/10 of monthly emoluments for every completed six months supports transition expenses without reducing the assured pension amount.

Eligibility And Option Window for Pension Boost for 2025

Eligibility focuses on Central Government employees. New recruits from April 1, 2025, will follow the defined onboarding process into the pension framework. Existing employees and certain retirees within the stipulated window have a one-time choice to opt into the Unified Pension Scheme by the notified deadline. Because the choice is typically irreversible, employees should evaluate projected service length, expected basic pay trajectory, and household needs before electing.

Payout Mechanics and Planning

For those reaching 25 years of qualifying service, plan around a pension equivalent to 50% of the average basic pay over the 12 months before retirement. If retiring with 10–25 years, estimate a proportional share of that benchmark, but never below ₹10,000 if the 10-year minimum is met. Consider Dearness Relief adjustments in retirement cash flow models, and factor in the separate lump sum for one-time needs like relocation, medical contingencies, or debt closure. Survivors should note the 60% family pension, which provides recurring support for a spouse.

Comparison With Other Pensions

Unlike social assistance programs where central contributions are modest and often require state top-ups, this structure is designed for Central Government employees and ties benefits to earnings with a much higher floor. It also removes the uncertainty of fully market-linked outcomes by locking in an assured payout structure. While private annuities and voluntary retirement products can supplement income, the core assurance here substantially lowers baseline risk for public employees planning long retirements.

Action Steps For Employees

- Audit Service Record: Confirm qualifying service years and projected retirement date.

- Estimate Payout: Use average basic pay projections for the final year to approximate the assured pension under both scenarios 50% after 25 years or the proportionate band between 10 and 25 years.

- Consider Family Security: Align insurance and emergency funds with the 60% survivor benefit to fill any gaps.

- Plan Tax And Cash Flow: Map Dearness Relief adjustments into annual budgets and decide how to use the lump sum without jeopardizing long-run liquidity.

- Elect Within The Window: Because the option is typically one-time, decide within the notified timeline after comparing outcomes with alternatives.

Common Misconceptions

- “Only 25-year veterans benefit.” Not true; proportionate benefits exist between 10 and 25 years, and the ₹10,000 floor applies at 10 years.

- “Lump sum reduces my pension.” The superannuation lump sum does not reduce the assured monthly payout; it’s an addition to gratuity.

- “No inflation protection.” Dearness Relief is applied on the assured payouts and survivor benefits, anchoring them to cost-of-living changes.

- “Family pension depends on annuity choice.” Here, the 60% survivor rule is embedded, providing clarity independent of annuity selection.

FAQs on Pension Boost for 2025

Who qualifies for the ₹10,000 minimum pension

Any eligible Central Government employee who opts for the scheme and completes at least 10 years of qualifying service at superannuation.

What does 50% assurance mean after 25 years

It means the pension equals 50% of the average basic pay over the last 12 months before retirement, provided at least 25 years of qualifying service is completed.

How is the family pension calculated

The spouse receives 60% of the pension the employee was receiving or assured immediately before demise, with Dearness Relief applied as notified.

Does the lump sum reduce my monthly pension

No. The superannuation lump sum 1/10 of monthly emoluments for every completed six months of service does not reduce the assured pension; it is paid in addition to gratuity.