Starting November 2025, India’s seniors step into a far more secure benefits landscape. From free cashless hospital treatment for the 70-plus age group to streamlined pension continuity and steady income support for low-income elders, the focus has shifted from piecemeal relief to a cohesive safety net. The message is simple: your health costs should not drain your savings, your pension should not stop over paperwork, and predictable income plus tax reliefs should help you live with dignity. This guide breaks down the five big benefits, how they work, who qualifies, and the exact steps to claim them without jargon, delays, or guesswork. Whether you’re helping a parent enroll or you’re a senior planning ahead, everything you need is here, in one place.

Senior Benefits November 2025 is the focus keyword that captures the most important upgrades you can claim right now. Senior Benefits November 2025 means prioritizing three actions immediately: activate the Ayushman senior card if you’re 70 or above, submit your Digital Life Certificate in November to keep your pension flowing, and organize proofs for your key tax deductions so your money works harder through FY 2025–26. For lower-income seniors, add the baseline social pension to stabilize monthly cash flow and check state top-ups. When combined, these steps shield your family from surprise hospital bills, stop pension interruptions, and reduce your yearly tax outgo. Consider this your November checklist and tick it off this week.

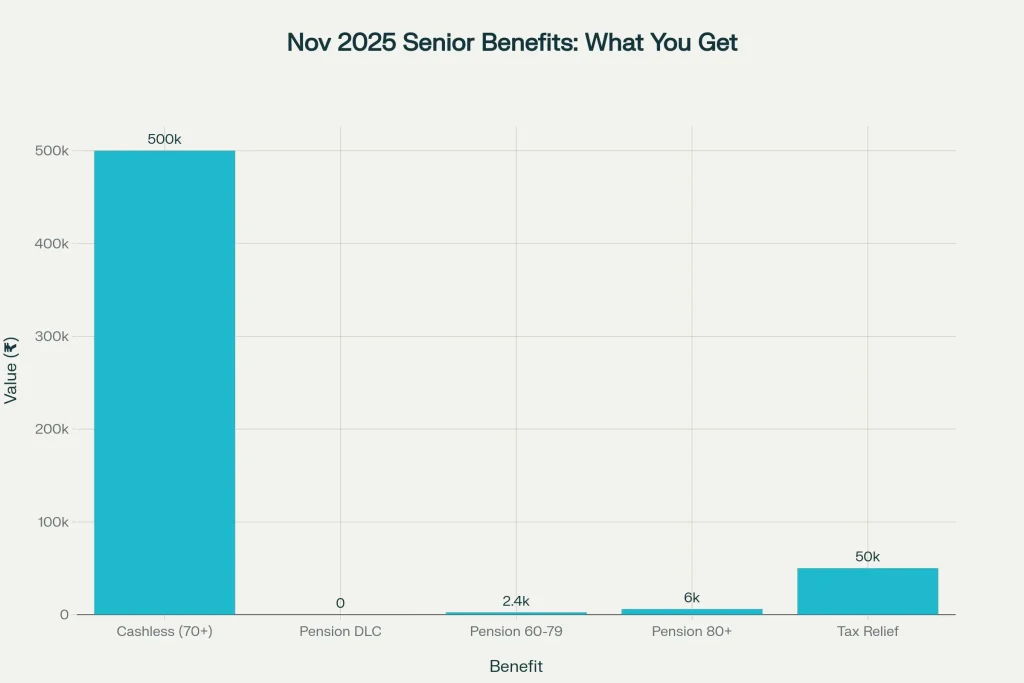

5 Big Government Benefits Seniors Can Claim

| Benefit | What You Get | Who Qualifies | Where/When | How To Claim |

|---|---|---|---|---|

| Free ₹5 Lakh Cashless Treatment | Annual hospitalization cover at empanelled hospitals; cashless at point of care | All citizens aged 70+ | Nationwide, active from November 2025 | Enroll on Ayushman portal/app; generate senior Ayushman card; present at hospital desk |

| Pension Continuity Via Digital Life Certificate | Prevents pension stoppage with quick digital verification | Central/state pensioners and EPS retirees | November campaign window (nationwide camps, bank/IPPB, CSCs) | Submit Jeevan Pramaan via face auth/device, bank, CSC, or doorstep |

| Social Pensions (Baseline) | Monthly pension for eligible BPL seniors; state top-ups vary | Age 60+ meeting income/BPL criteria | Ongoing via DBT | Apply through district/state portal or local authorities with proofs |

| Senior Tax Reliefs | Higher slab benefits and deductions (80D/80DDB, etc.) | Resident seniors and very seniors | FY 2025–26 filing | Preserve bills/certificates; claim in ITR |

| Elderly Health Packages Expansion | Broader geriatric packages under public schemes | Seniors seeking care under Ayushman/public facilities | Phased additions | Use Ayushman card/ID at empanelled/public hospitals |

The November window concentrates the most important actions into a single month so seniors and their families can lock in healthcare security, uninterrupted pensions, and lower yearly costs. Treat the Ayushman 70+ card as non-negotiable, submit the Digital Life Certificate on time, verify social pension eligibility and state top-ups, and organize your tax documents early. Do this now, and you transform reactive, stressful spending into a stable, predictable plan for the year ahead.

Free Healthcare: ₹5 Lakh Cashless Cover For 70+

This is the headline change, and it’s a game-changer. Every Indian aged 70 or above can get cashless hospitalization coverage up to ₹5 lakh a year at empanelled hospitals across the country. The network spans government and private hospitals, and the process on the ground is simple: enroll, generate your Ayushman card, and show it at the hospital’s PM-JAY desk to initiate pre-authorization for eligible procedures. There’s no income test for this age band, which is why families should treat this as a universal right for seniors aged 70+. If your household already uses PM-JAY, check that the senior’s entitlement is correctly reflected and is not mixed with the general family pool. For practical planning, keep a digital and printed copy of the card, and identify two nearby empanelled hospitals in advance so you’re not searching on a tough day.

Higher And Smoother Pensions: Don’t Miss November

Every year, many pensioners face payment holds simply because the life certificate wasn’t submitted on time. November fixes the bottleneck. The Digital Life Certificate campaign runs nationwide this month, bringing camps closer to residential areas, offering bank and IPPB doorstep services, and enabling Aadhaar-based face authentication so you can submit without a fingerprint device. What you’ll need handy: Aadhaar, PPO number, bank details, and the mobile number linked to your Aadhaar. Submit once, save your receipt or Pramaan ID, and you’re set. If your pension has already stopped, submit immediately and inform your disbursing bank so they can resume payments per their cycle. For EPS retirees, align your submission window with the November campaign to avoid any disruption.

Social Pensions: Baseline Income Support That Adds Up

For economically vulnerable seniors, the central government’s old age pension framework provides a baseline monthly amount, with many states adding their own top-ups. While central support is modest on its own, state contributions can meaningfully raise the total to a level that helps with groceries, medicines, and transport. If you’re nearing 80, remember the central share increases in that band; verify your district’s documentation checklist in advance and ensure your bank account is correctly linked for DBT. Pair this monthly pension with the Ayushman senior cover so hospitalization doesn’t wipe out savings while your routine expenses continue without stress.

Tax Reliefs That Reduce Real Costs

Tax benefits for seniors are more than just numbers on paper they directly reduce your yearly cash outflow. Health insurance premiums qualify for higher deductions for seniors, and specified illnesses can be claimed under separate provisions with larger caps for very senior citizens. If premiums aren’t feasible at your age, check the provision for medical expenditure claims where applicable. Keep discharge summaries, medical certificates, and all bills in one file and share a simple checklist with your CA or e-filing helper. The smart play: use Ayushman for major hospitalizations, maintain a basic private cover if appropriate, and leverage 80D and 80DDB strategically to bring down your effective annual costs.

Elderly Care Packages: More Than Admission and Surgery

As India’s elderly population grows, public programs are progressively broadening geriatric care packages covering longer stays, dementia-related support areas, and rehabilitation where available. For families, this means two things: first, care pathways are becoming more predictable inside public schemes; second, you should ask the hospital’s PM-JAY desk about package eligibility even for conditions that were historically excluded or unclear. While rollouts can be staggered by state and hospital, frontline staff at empanelled facilities can tell you what’s live today and what’s expected soon. Keep a notebook or phone note of package names used in your hospital interactions it speeds up future approvals.

How To Claim Each Benefit Without Getting Stuck

- Ayushman 70+ Enrollment: Use the official portal/app to generate your Ayushman card. Complete e-KYC. Keep a soft copy and a printout. At admission, present the card and a government ID at the hospital PM-JAY desk for cashless pre-authorization.

- PM-JAY Families: If you already have PM-JAY, confirm the senior’s individual entitlement and that it’s recorded separately so benefits aren’t exhausted by younger members.

- Digital Life Certificate (DLC): Submit during November using Jeevan Pramaan with Aadhaar-based face authentication, or go to a camp, CSC, or your bank. For mobility issues, request IPPB doorstep assistance where available. Save the receipt/Pramaan ID.

- Social Pensions: Check eligibility on your state/district portal. Prepare age proof, income/BPL proof, Aadhaar, bank details, and recent photographs. Track DBT credits monthly.

- Tax Reliefs: Maintain a single folder (physical or cloud) for premium receipts, hospital bills, prescriptions, and medical certificates. Reconcile during ITR filing to capture every deduction.

What’s New and Why It Matters

The biggest shift is universality for the 70+ age group in hospitalization coverage no income filter, nationwide portability, and cashless access at the point of care. Pairing this with a concentrated Digital Life Certificate campaign each November greatly reduces pension stoppages that previously stemmed from missed submissions or accessibility issues. Meanwhile, the baseline pension plus state top-ups continue to provide minimum income support, and tax reliefs cut the total cost of staying healthy. Together, these changes move seniors from reactive crisis spending toward a more stable, planned financial life in retirement.

Senior Benefits November 2025 isn’t just a headline it’s your action plan. If there’s one sequence to follow this week, do this: enroll the 70+ family member for the Ayushman card, submit the life certificate before month-end, and create a single folder for all medical and tax documents. That single folder will save hours during emergencies and at tax time.

FAQs on 5 Big Government Benefits Seniors Can Claim

Is the ₹5 lakh free healthcare really available to everyone aged 70 and above?

Yes. The coverage is designed as universal for citizens aged 70 and above at empanelled hospitals, with cashless treatment at the PM-JAY helpdesk once your senior Ayushman card is active.

How can I submit a Digital Life Certificate if I can’t visit a bank?

Use Aadhaar-based face authentication through Jeevan Pramaan, visit a local campaign camp or CSC, or request IPPB doorstep service where available during the November campaign window.

What if my pension stopped because I missed the life certificate deadline?

Submit a fresh Digital Life Certificate immediately. Then notify your pension disbursing bank with the acknowledgement so they can resume credits per their processing cycle.

Can I claim social pensions and use Ayushman Bharat together?

Absolutely. The social pension provides monthly income support while Ayushman handles hospitalization costs. Use both to stabilize monthly cash flow and cap medical risk.