Singapore’s CPF Withdrawal Rules 2025 introduce a simpler and faster process for members aged 55 and above to access their savings. According to the Central Provident Fund (CPF) Board, the changes, effective from 19 January 2025, are designed to improve convenience and transparency while maintaining Singapore’s long-standing commitment to retirement adequacy.

Major Change: Closure of the Special Account

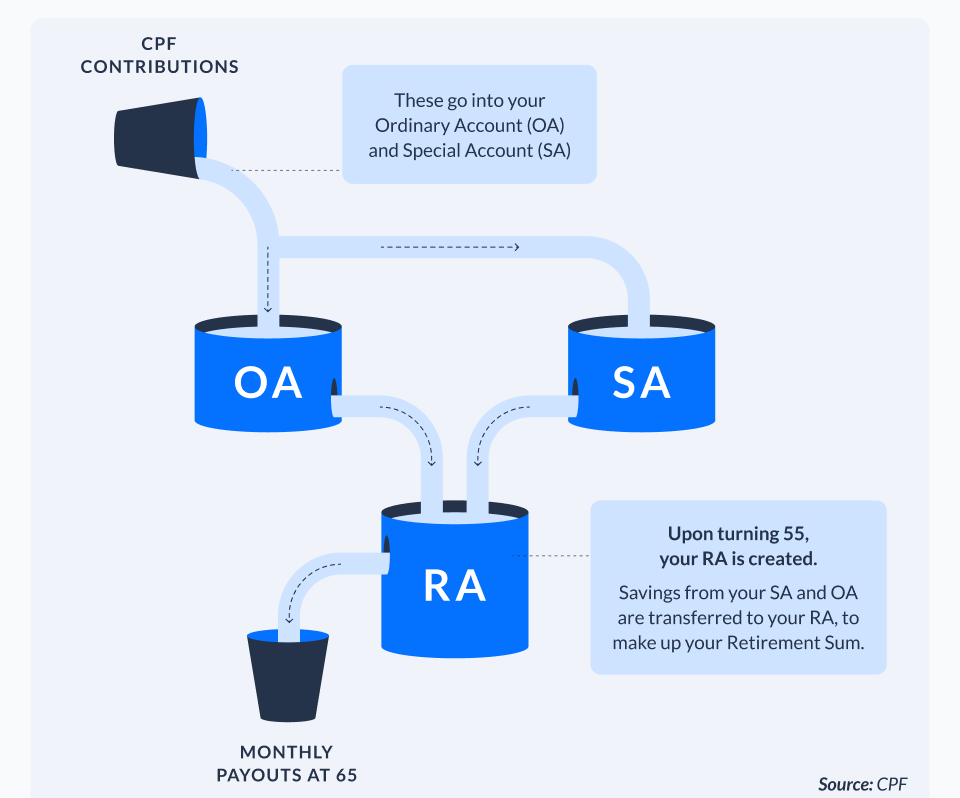

The most significant change under the CPF Withdrawal Rules 2025 is the closure of the Special Account (SA) for members aged 55 and above. Balances in the SA will be automatically transferred first to the Retirement Account (RA), up to the Full Retirement Sum (FRS), and any remaining funds will move to the Ordinary Account (OA).

The CPF Board said the consolidation aims to reduce confusion about how savings are distributed after age 55.

“This streamlining ensures members can access their savings more intuitively without compromising their long-term retirement security,” the CPF Board explained in an October 2024 statement.

The move aligns with Singapore’s broader goal of simplifying public financial systems as more citizens approach retirement age.

Higher Limits to Strengthen Retirement Security

From 2025, the Enhanced Retirement Sum (ERS) will increase from three times to four times the Basic Retirement Sum (BRS). This allows members who wish to secure larger monthly payouts through CPF LIFE—Singapore’s lifelong annuity scheme—to set aside more funds voluntarily.

For 2025, the BRS is S$102,900, making the FRS S$205,800 and the new ERS S$411,600.

Economists say the revision reflects longer life expectancies and a shift toward self-funded retirement planning.

“The higher ERS provides more flexibility for members who can afford it, especially those planning for healthcare or longevity risks,” said Dr. Lee Chen, Senior Fellow at the Institute of Policy Studies (IPS). “It acknowledges that retirement planning is no longer one-size-fits-all.”

Key Withdrawal Rules in 2025

The fundamental withdrawal structure remains consistent but is now more streamlined.

At Age 55

- Members can withdraw S$5,000 from their CPF savings, regardless of balance.

- If total savings exceed the FRS, members may withdraw the excess.

- Property owners with leases extending to at least age 95 can choose to set aside only the BRS, allowing larger withdrawals.

At Age 65

Members born in or after 1958 may withdraw up to 20% of their Retirement Account savings, inclusive of the initial S$5,000. This additional option enhances flexibility without jeopardising monthly CPF LIFE payouts.

For Non-Residents

Foreigners and former Permanent Residents who leave Singapore or Malaysia permanently can withdraw their full CPF balances, subject to verification and documentation.

According to the Ministry of Manpower (MOM), the changes balance “flexibility and sustainability,” ensuring members retain sufficient funds to support them through retirement.

Simplified Digital Access

A major feature of the new framework is its emphasis on digitalisation. Withdrawals can now be completed fully online via the CPF Mobile App or official website, reducing processing times to five working days.

Security features, including multi-factor authentication and cooling periods for bank account changes, protect against unauthorised transactions.

“Digital transformation has made CPF services more accessible, secure, and efficient for older members,” said Ng Mei Ling, Senior Director at CPF’s Member Services Division. “This upgrade reflects how Singapore’s public systems are adapting to a digital-first population.”

Historical Context: Evolution of CPF Withdrawals

The CPF system, established in 1955, began as a mandatory savings plan for workers. Over time, it evolved into a multi-purpose social security scheme supporting housing, healthcare, and retirement.

The withdrawal framework has been periodically refined to reflect demographic changes and policy goals. In 1987, the Retirement Account was introduced to ensure members retained funds for old age. Later adjustments, such as the CPF LIFE scheme in 2009 and the retirement sum system in 2016, focused on balancing flexibility with sustainability.

“CPF policies have continually evolved to reflect Singapore’s changing social and economic realities,” said Prof. Tan Kian Wee, economist at the National University of Singapore (NUS). “The 2025 rules are another step in aligning the system with the realities of longer lifespans and higher financial literacy.”

Step-by-Step Guide: How to Withdraw CPF Savings

- Check eligibility – Log in to the CPF portal to confirm your withdrawal eligibility based on age and balance.

- Verify bank details – Ensure that your Singapore bank account information is accurate.

- Submit online application – Use the CPF Mobile App or CPF website to apply for withdrawal.

- Choose withdrawal amount – Select the eligible amount (minimum S$5,000 or more, depending on conditions).

- Wait for processing – Most applications are completed within five working days, and funds are credited directly.

CPF officials encourage members to consult the CPF Retirement Estimator tool before making withdrawals to understand their future monthly payouts.

Comparative Perspective: How Singapore Stands Globally

Singapore’s CPF model is often compared to other national pension systems. Unlike Australia’s Superannuation or Malaysia’s Employees Provident Fund (EPF), CPF balances are divided across multiple purposes—housing, healthcare, and retirement—providing integrated financial security.

A World Bank 2025 review ranked Singapore’s system among the most sustainable in Asia, citing strong fiscal discipline and high member trust. However, it also noted the need for ongoing financial education to help citizens make informed decisions about withdrawals and annuity options.

Looking Ahead: Future Policy Directions

While 2025 reforms focus on simplification, analysts expect further adjustments in the coming years. Areas of potential development include greater portability of CPF savings for overseas Singaporeans and enhanced integration of CPF data with private retirement tools.

“The CPF system must continue evolving to meet the needs of an ageing, digitally connected society,” said Dr. Yeo An Ling, a financial policy analyst at OCBC Global Research. “Automation, financial literacy, and flexibility will shape the next decade of reforms.”

The government has also signalled continued efforts to align CPF rules with broader social policies, such as housing affordability and healthcare support.

RBI Announces New Minimum Balance Rules for Bank Accounts, Effective November 10

Conclusion

The CPF Withdrawal Rules 2025 mark a strategic step in modernising Singapore’s social security system. By closing the Special Account, increasing withdrawal clarity, and expanding online accessibility, the CPF Board aims to simplify the member experience while protecting retirement adequacy.

As Singapore’s population continues to age, these reforms underscore a central message: retirement policy must evolve not only to safeguard savings but also to empower citizens with choice, clarity, and confidence.