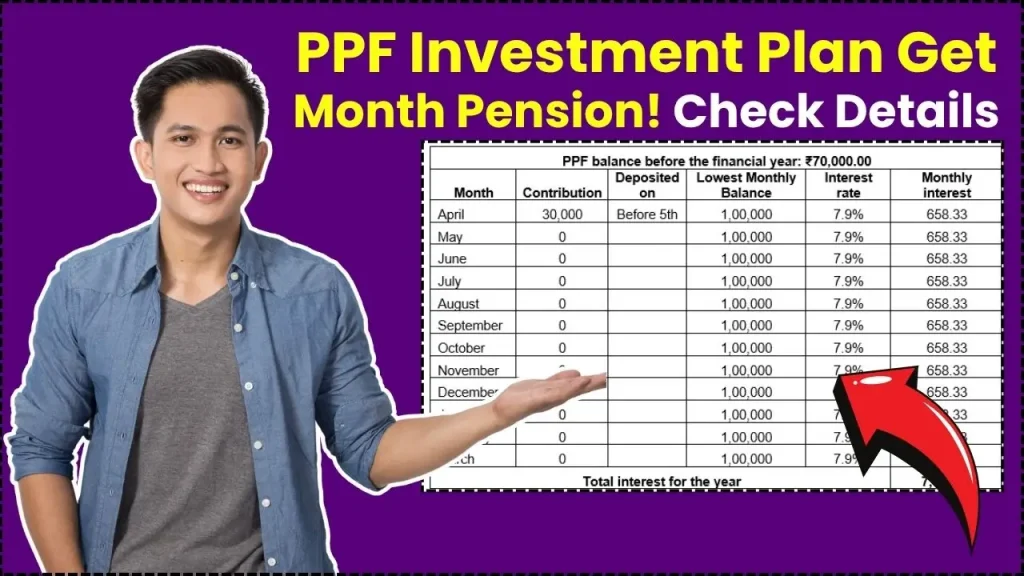

If you’re looking for a safe, tax-efficient way to unlock steady income in retirement, a simple Public Provident Fund strategy can do the heavy lifting without market risk or complicated products. The focus keyword here is How to Get a ₹24,000 Monthly Pension Through a Simple PPF Investment Plan, and yes, it’s achievable with discipline, compounding, and the smart use of PPF’s post-maturity extension. By consistently investing up to the annual limit and then treating the earned interest as your “pension,” you can turn a long-term savings habit into a reliable monthly cash flow.

How to Get a ₹24,000 Monthly Pension Through a Simple PPF Investment Plan revolves around three moves: contribute ₹12,500 per month (₹1.5 lakh yearly) for 15 years, let the balance compound at the notified PPF rate, and then extend the account for five years without new contributions. During the extension, withdraw only the annual interest, which, on a corpus near ₹40.68 lakh at 7.1%, translates to roughly ₹2.88 lakh a year about ₹24,000 per month when averaged. The approach respects PPF’s rules, preserves principal, and keeps the income tax-free under current norms.

PPF Investment Plan

| Item | Key Detail |

|---|---|

| Scheme | Public Provident Fund (PPF), government-backed small savings |

| Current Interest Rate | 7.1% per annum, compounded annually, reviewed quarterly |

| Annual Investment Limit | ₹500 minimum; ₹1.5 lakh maximum |

| Typical Plan For ₹24k/Month | Invest ₹12,500 per month for 15 years; extend 5 years without fresh deposits |

| Estimated Corpus After 15 Years | ~₹40.68 lakh at 7.1% with max contributions |

| Annual Interest In Extension | ~₹2.88 lakh on ₹40.68 lakh corpus at 7.1% |

| Indicative Monthly Income | ~₹24,000 by spreading annual interest across months |

| Tax Treatment | EEE: Section 80C deduction, tax-free interest, tax-free maturity |

| Extension Option | Extend in 5-year blocks with or without contributions; withdrawals allowed annually |

How to Get a ₹24,000 Monthly Pension Through a Simple PPF Investment Plan is less about financial wizardry and more about consistency and structure. Max the contribution for 15 years, extend without contribution, and live off the interest while preserving principal. Keep an eye on the PPF rate each quarter, but don’t let short-term noise derail a long-term plan that’s safe, tax-free, and proven. With this blueprint, your PPF doesn’t just mature—it matures into a practical, low-risk income stream that can anchor your retirement cash flow for years.

Here’s How PPF Investment Can Be Planned

The PPF’s 15-year maturity is the foundation. Set an automatic monthly contribution aligned to the annual limit ₹12,500 per month keeps you on track without scrambling at year-end. Depositing before the 5th of each month helps maximize interest crediting because PPF calculates interest based on the lowest balance between the 5th and the month’s end. On maturity, choose a five-year extension without contribution so the entire principal keeps compounding while you take out just the interest annually. That’s what turns a PPF corpus into a pension-like stream without touching the principal.

PPF Calculator – Monthly Investment Of Rs 5,000

Investing ₹5,000 per month for 15 years totals ₹9,00,000 in contributions. Assuming a steady 7.1%, the corpus can grow to roughly ₹16.27 lakh. In the extension phase, annual interest around this corpus would be near ₹1.16 lakh, which works out to about ₹9,600 per month if you spread it evenly. This path suits savers who want safety and tax-free income but have a smaller budget, accepting a proportionally smaller pension outcome.

PPF Calculator – Monthly Investment Of Rs 10,000

At ₹10,000 per month, your total contribution across 15 years is ₹18,00,000. With 7.1% compounding, the corpus can approximate ₹32.54 lakh. In the extension, that can generate about ₹2.31 lakh in annual interest—roughly ₹19,000 per month on a smoothed basis. It’s a strong middle ground for those targeting meaningful tax-free income without hitting the absolute PPF ceiling every year.

PPF Calculator – Monthly Investment Of Rs 12,500

This is the cleanest route to the target. Contributing ₹12,500 per month (₹1.5 lakh a year) for 15 years builds a corpus in the ₹40.6–₹40.7 lakh range at 7.1% assumptions. Extend for five years without fresh deposits, and you can withdraw the interest about ₹2.88 lakh annually as a de facto pension. When averaged across months, it comes to roughly ₹24,000 while principal remains intact and tax treatment stays favorable.

Why This “PPF Pension” Plan Works Now

PPF’s appeal rests on three pillars: safety, tax efficiency, and structured flexibility. As a government-backed small savings scheme, it minimizes credit risk. The EEE framework means contributions can qualify under Section 80C, interest is tax-free, and maturity proceeds are exempt. Finally, post-maturity extension in five-year blocks gives you a built-in way to draw income annually without dismantling the core principal. While the interest rate is reviewed quarterly, the 7.1% figure has been stable long enough to make planning illustrations practical. Still, always check the prevailing rate when you’re near your extension window.

Practical Execution Tips

- Automate deposits: Set a standing instruction for ₹12,500 monthly to avoid missing contributions and to benefit from consistent compounding.

- Time your payments: Try to invest before the 5th each month to align with PPF’s interest calculation method.

- Choose the right extension: Extending without contributions keeps withdrawals simpler and lets you treat interest as income; extending with contributions imposes additional withdrawal constraints.

- Withdraw annually, budget monthly: PPF allows one withdrawal per year during extension. Take that amount and budget it across 12 months to simulate a monthly pension.

- Keep rate awareness: Since rates are reviewed quarterly, revisit your projections as you approach maturity to fine-tune the expected income.

Common Misconceptions And Nuances

- Guaranteed vs. indicative: The ₹24,000 figure is an illustration based on a specific corpus and interest rate. PPF rates can change, so income can vary.

- One account per person: Don’t try to open multiple PPF accounts for the same individual. Instead, a spouse can open a separate account to build a second income stream.

- Deposit timing matters: Interest is calculated on the lowest balance between the 5th and the end of the month; late deposits can slightly reduce credited interest.

- Liquidity: PPF is a long-term vehicle. Loans and partial withdrawals are possible under defined rules, but the real power is in staying the course for 15 years and beyond.

- Scaling strategy: If ₹12,500 monthly is heavy, scale up gradually. Even starting at ₹5,000 and stepping up each year moves you closer to the end goal.

Risk And Suitability Check

PPF is designed for conservative savers prioritizing capital protection and tax-free compounding over market-linked upside. If you need higher potential returns and can handle volatility, consider layering PPF with NPS (for equity exposure), a diversified mutual fund SIP, or a small allocation to dynamic bonds while keeping PPF as the safety core. For those nearing retirement with low-risk appetite, the PPF extension method offers predictable, simple cash flows without annuity lock-ins or surrender penalties.

Step-By-Step Plan To Hit ₹24,000

- Open a PPF account with a bank or post office.

- Set a monthly auto-debit of ₹12,500.

- Make deposits before the 5th each month.

- Stay invested for 15 full years avoid early withdrawals unless essential.

- On maturity, opt for a 5-year extension without contribution.

- Each year, withdraw an amount approximately equal to that year’s interest credit.

- Treat the withdrawal as your “pension,” budgeting it as ~₹24,000 per month.

- Review the PPF rate each quarter and adjust expectations or complementary investments if needed.

Who Should Use This Strategy

- First-time savers who want guaranteed, tax-efficient growth without market risk.

- Salaried and self-employed individuals maxing Section 80C and seeking a disciplined retirement buffer.

- Retirees who prefer a simple, rule-based, and tax-free income draw without buying an annuity.

- Conservative households aiming to build two tax-free income streams via separate PPF accounts for each spouse.

Advanced Considerations for Optimizers

- Laddering extensions: If both spouses have PPFs maturing in different years, stagger extensions so at least one interest withdrawal arrives each calendar year at a complementary time to other cash flows.

- Combining with SCSS or RBI bonds: After the 5-year extension, consider moving part of the principal to SCSS (subject to limits) or sovereign-backed bonds to diversify income sources while keeping credit risk low.

- Inflation guard: PPF is safe but not inflation-linked. Offset inflation risk by pairing with a modest equity allocation elsewhere (NPS or index funds) to preserve long-term purchasing power.

- Tax planning: Even though PPF proceeds are tax-free, coordinate with other income sources to manage overall tax brackets and optimize Section 80C usage.

FAQs on PPF Investment Plan

Is The ₹24,000 Monthly Income Guaranteed?

No. It’s an estimate based on a corpus around ₹40.68 lakh and the prevailing 7.1% rate. Since rates are reviewed quarterly, the actual income can be higher or lower depending on notified rates at the time of extension.

What If I Invest Less Than ₹12,500 Per Month?

Your final corpus and the interest-driven income scale proportionally. For instance, ₹10,000 monthly may build a corpus near ₹32.5 lakh, translating to an indicative ~₹19,000 per month during extension. Adjust contributions to match your target income.

Can I Extend with Contributions Instead of Without?

Yes, but withdrawal flexibility changes. If you extend with contributions, there are caps on withdrawals during the 5-year block. For a clean “pension-like” setup, extending without contributions is generally simpler.

Is The Interest and Maturity Amount Taxable?

Under current rules, PPF enjoys EEE treatment: eligible contributions under Section 80C, tax-free interest, and tax-free maturity. This is why the effective post-tax income is compelling compared to many fixed-income options.