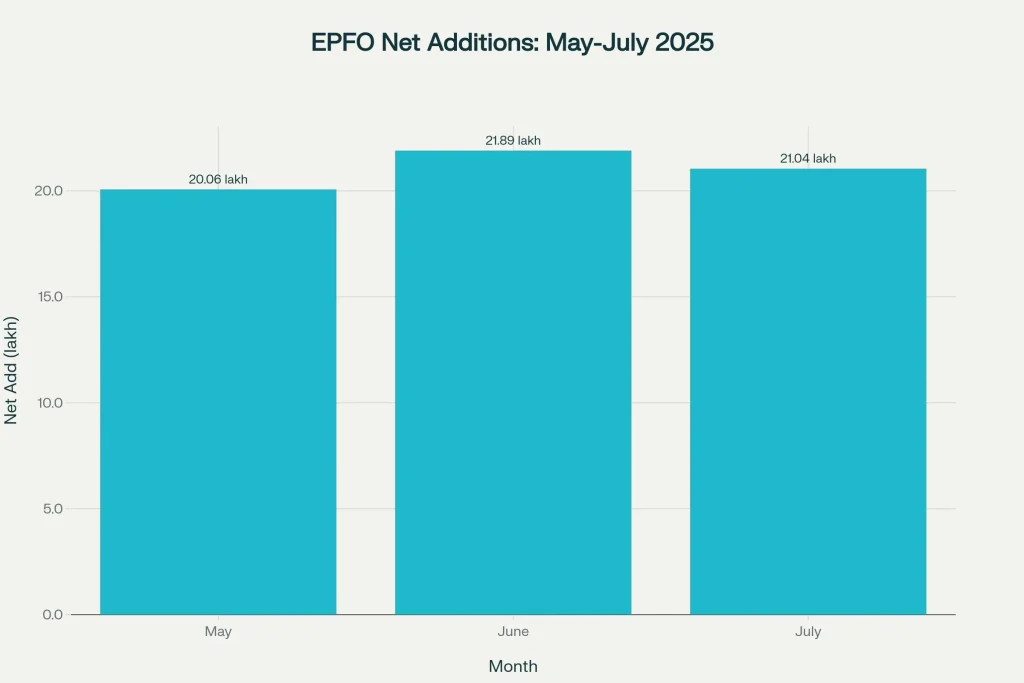

India’s formal employment engine shifted into a higher gear through mid-2025, with record-breaking payroll prints and broad-based sectoral momentum that point to resilient hiring and deeper social security coverage. June delivered the highest-ever net additions since EPFO payroll tracking began, followed by a strong July that kept the trend intact. The data underscores three themes shaping this year’s labour story: youth-led first-time enrolments, high volumes of rejoiners transferring PF during job switches, and diversification of gains beyond traditional hubs into healthcare, education, trading, and travel-linked services.

The EPFO Payroll Insights Report 2025 captures the scale and texture of formal job creation, led by unprecedented net additions in June and a firm follow-through in July. Youth aged 18–25 remained the backbone of new enrolments, while states like Maharashtra led regional contribution to net payroll. On the sectoral side, expert services continued to anchor growth, alongside notable month-on-month gains in hospitals, universities, garments, mining, trading, and travel agencies signalling that formalisation is deepening across a wider swathe of the economy. The narrative is complemented by rising job mobility, with rejoiners opting for PF transfers rather than exits, strengthening continuity and social security safeguards.

EPFO Payroll Insights Report 2025

| Metric | 2025 Snapshot | Why It Matters |

|---|---|---|

| Record net additions | June reached the highest net addition since tracking began | Confirms robust formalisation and hiring depth |

| July net additions | Stayed above the 21 lakh mark with positive YoY growth | Shows the mid-year surge wasn’t a one-off |

| New subscribers | Strong momentum across summer months | Reflects fresh hiring and EPFO outreach |

| 18–25 share | Around 60–61% of new subscribers mid-year | Youth-led intake and first-time job entry |

| 18–25 net additions | Consistently above 9 lakh in peak months | Sustained pipeline from campuses to corporates |

| Rejoined members | Over 16 lakh in peak months | PF continuity during job switches boosts net payroll |

| Leading states | Maharashtra on top; southern and western hubs strong | Industrial and services clusters drive growth |

| Top sectors | Expert services; garments; hospitals; universities; mining; trading; travel | Wider services and selective manufacturing traction |

The EPFO Payroll Insights Report 2025 points to a pivotal mid-year stretch for India’s formal employment story. Record-breaking net additions, a resilient July follow-through, and the dominance of youth-led enrolments show that the engine is not just revving it’s pulling more people into the social security net earlier in their careers. High rejoiner volumes reflect a cultural and procedural shift toward PF continuity, while sectoral breadth signals healthier diffusion of job creation beyond a few headline industries. For employers and jobseekers, the message is practical and clear: align hiring, skilling, and retention strategies with these currents, and use payroll trends as a real-time compass to make better decisions, faster.

Hiring Momentum Is Broad-Based

The headline story is the surge in net additions: a new peak in June followed by a high plateau in July. This back-to-back strength suggests employers continued to add headcount even as seasonal factors and order cycles varied across industries. The trend points to a maturing formal ecosystem where both large corporates and compliant MSMEs are absorbing talent, aided by digital KYC, Aadhaar-validated UAN processes, and easier PF transfer mechanisms. For jobseekers and HR teams alike, these months offered clear, high-frequency signals that organised-sector hiring remained robust.

Youth-Led First-Time Enrolments

One of the most important signals in the EPFO Payroll Insights Report 2025 is the dominance of the 18–25 age cohort in new subscriber flow. A roughly 60–61% share through peak months reflects healthy campus pipelines, apprenticeship conversion, and steady absorption of first-time job seekers into the formal net. This matters beyond the month-to-month print: early EPFO participation lifts long-run retirement savings through compounding, while also enabling insurance and pension-linked security from the start of a career. For employers, it confirms an active entry-level market where onboarding, skilling, and retention strategies can deliver outsized long-term returns.

Job Mobility and PF Continuity

Rejoiners remained a sizable pillar of the mid-2025 momentum, with more than 16 lakh members re-entering EPFO coverage in peak months as they changed jobs. The shift toward PF transfers rather than withdrawals is significant. It shows rising awareness of the long-term value of continuity, reduces leakage from retirement corpus building, and sustains net additions even when new hiring normalises. For employers, making PF transfers seamless during onboarding isn’t just a compliance checkbox it’s a retention lever and a brand-positive employee experience.

Top Performing Sectors

Expert services continued to anchor net additions, capturing manpower supply, staffing, and outsourcing demand across multiple industries. Crucially, momentum broadened. Mining pockets such as iron ore saw activity, while hospitals and universities reflected healthcare and education demand that tends to be more structural than cyclical. Garment manufacturing and beedi-making highlighted labour-intensive segments absorbing formal workers, while trading/commercial establishments and travel agencies indicated services expansion aligned with consumption and mobility. This diversified mix signals that formalisation in 2025 is not confined to a few marquee sectors; it is spreading into day-to-day service economies as well.

Leading States and Regional Clusters

Maharashtra led state-wise contributions with a notable share of net payroll additions, and southern and western hubs sustained their dominance. These regions benefit from dense supply chains, a deep services ecosystem, and an employer base with stronger compliance maturity. While concentration remains high, diffusion is visible: more centres are stepping up as labour practices formalise, digital record-keeping improves, and enterprises leverage standardised PF processes. For policymakers and ecosystem builders, the task now is to accelerate this diffusion with skilling, industrial infrastructure, and ease-of-doing-business reforms tailored to second- and third-tier cities.

How To Use These Insights

- Workforce planning: Watch the 18–25 share to time campus intakes and apprenticeships. A strong youth ratio signals deeper pools for entry-level roles and rotational programs.

- Sector expansion: The growth spread beyond expert services highlights opportunity zones healthcare, education, garments, trading, and travel—where incremental hiring can align with demand pockets.

- Retention and onboarding: Streamline PF transfers and KYC, pre-empt friction in the first 90 days, and communicate the value of EPFO-linked benefits clearly to reduce early attrition.

- Location strategy: Consider expanding in states where compliance ecosystems are strong but costs remain competitive. Pair regional hubs with satellite centres to tap diverse talent pools.

EPFO Payroll Insights Report 2025 is the clearest window into how formal job creation is evolving in India this year, from record net additions to the growing share of youth in first-time enrolments. The sustained momentum through June and July shows hiring is resilient and widely distributed across services and manufacturing pockets. With rejoiners transferring PF during job switches and states like Maharashtra leading contributions, the map of formalisation is both deepening and widening. For employers, EPFO Payroll Insights Report 2025 is a practical guide to align campus hiring, sector bets, and retention playbooks with on-ground labour market realities.

Hiring Momentum: What Changed In 2025

Two changes stand out in 2025. First, the system’s capacity to absorb new workers has improved at scale, with months posting all-time-high net additions followed by sustained strength rather than sharp reversals. Second, payroll continuity via transfers is becoming the norm, not the exception. Together, these shifts reduce volatility in the formal labour base and create a sturdier foundation for benefits administration, lending confidence to both employers and employees.

Women’s Participation And The Road Ahead

Women’s enrolments saw incremental gains mid-year, supported by sectors like healthcare, education, retail, and services where policies around safety, flexibility, and returnship programs can unlock participation. While headroom remains, the direction is encouraging. Employers aiming for durable diversity gains can double down on role redesign for flexibility, childcare support partnerships, and structured upskilling to enable lateral transitions into higher-productivity roles.

Compliance, Digital Rails, And Ease of Doing Payroll

The formal jobs surge sits on a foundation of steady improvements in compliance and digital processes. Aadhaar-validated UAN flows, a more streamlined contribution filing experience, and consistency in monthly returns have reduced friction across the payroll lifecycle. For MSMEs stepping into formal hiring, the practical takeaway is simple: invest early in clean processes and vendor support for PF, because smooth onboarding and transfers now have a direct bearing on talent attraction and retention.

Signals To Watch in the Coming Months

- Net additions staying near or above the 20 lakh mark indicate strong hiring momentum and a broad formalisation push.

- The 18–25 age share near 60% reflects the strength of entry-level pipelines; any drift lower could flag slower campus or apprenticeship absorption.

- Sector breadth matters: continued gains beyond expert services such as garments, healthcare, universities, trading, and travel signal healthier diffusion of opportunities.

- Rejoiner volumes are a bellwether of PF continuity and mobility; sustained strength here can keep net additions elevated even if new hiring eases.

8th Pay Commission Update: New Pay Matrix Coming from January 1, 2026 – Big Salary Hike Expected

Practical Takeaways for Employers and Jobseekers

- Employers: Use EPFO age-bucket and sector splits to fine-tune compensation bands, training calendars, and deployment models for new hires. Build PF-transfer playbooks to minimise friction for joiners switching jobs.

- Jobseekers: Prioritise keeping UAN details updated, ensure PF transfer during job switches, and understand the insurance and pension benefits linked to EPFO membership. Early continuity compounds financial security.

- Policy and ecosystem: Maintain the emphasis on compliance simplification, digital rails, and skilling aligned with sectors showing consistent MoM traction.

FAQs on EPFO Payroll Insights Report 2025

What Is EPFO Payroll Data and Why Does It Matter?

EPFO payroll data is the monthly estimate of net additions, new subscribers, and rejoiners in India’s organised sector. It serves as a high-frequency indicator of formal job creation, labour market health, and the pace of workforce formalisation.

Who Is Driving New Enrolments In 2025?

Youth aged 18–25 remain the dominant driver of fresh subscriptions, reflecting first-time job seekers moving from campuses and training programs into the formal workforce.

Which Sectors Are Leading the Gains?

Expert services anchor the momentum, with additional strength visible in healthcare (hospitals), education (universities), garments, mining, trading/commercial establishments, and travel agencies—indicating broad-based service and manufacturing traction.

Which States Are Contributing the Most?

Maharashtra leads state-wise contributions, with strong support from southern and western hubs that host dense industrial clusters and mature services ecosystems. Over time, diffusion is extending into more centres as compliance practices deepen.