A major shift in lending norms has arrived, and its good news for borrowers who’ve felt shut out of the system because of a thin or low credit file. Under the latest framework, banks and NBFCs are not permitted to reject first-time borrowers solely due to a missing CIBIL score, and there is no regulator-mandated minimum score for sanction. In simple terms, a low or zero score doesn’t automatically kill your loan hopes anymore; lenders must judge the whole picture income, stability, obligations, and repayment capacity before taking a call.

The CIBIL Score Rule Change ensures lenders treat your credit score as one input among several, not the decisive gatekeeper. First-time borrowers can be evaluated on tangible indicators like salary credits, ITRs, bank statement patterns, GST returns, and overall affordability instead of a hard cutoff. Alongside this inclusion push, 2025 reporting standards have tightened: lenders must refresh bureau data twice a month so your latest good behavior shows up faster, supporting fairer pricing and quicker reassessments when you improve your finances.

CIBIL Score Rule Change

| Item | Update |

|---|---|

| Minimum Score Requirement | No regulator-prescribed minimum CIBIL score for sanction; first-time borrowers cannot be rejected just for no history. |

| Decision Basis | Holistic underwriting: income, FOIR/DTI, bank statement quality, employment/business stability, documentation. |

| Rejection Solely on Score | Not permitted for new-to-credit applicants; score is one factor among many. |

| Reporting Cadence | Bi-monthly bureau updates (15th and month-end) to reflect recent behavior faster. |

| Who Benefits | New-to-credit, thin-file borrowers, and those rebuilding after past issues. |

| Lender Discretion | Banks/NBFCs apply board-approved policies, risk-based pricing, and due diligence. |

| What Stays | Full KYC, background verification, affordability checks, and policy compliance. |

The headline is straightforward: a low or zero CIBIL score no longer slams the door on first-time borrowers by default. Decisions must consider the full financial picture, while quicker bureau updates reward good habits sooner. Keep documents tight, lower your FOIR, improve banking hygiene, and, if needed, start with secured or smaller-ticket products. With inclusion and discipline moving in tandem, thoughtful preparation can turn a thin or low score into an approval-ready profile under 2025 norms.

What CIBIL Score Rule Exactly Changed

Earlier, many applications stalled at the first hurdle because lenders leaned on a single number to screen borrowers. The new approach asks lenders to consider the borrower’s real repayment capacity cash inflows, expense patterns, and existing EMI loads before deciding. For first-time borrowers, this removes an artificial barrier and opens a pathway to formal credit, especially in Tier-2/3 geographies and among young earners or small business owners who previously lacked a record.

CIBIL Score Rule Change for Borrowers with Low Scores

If your CIBIL score is low, it’s not the end of the road. Approval can still be possible when other strengths are present steady income, controlled FOIR, clean banking hygiene, adequate collateral, or a co-borrower. Lenders may still price the loan based on risk or offer smaller limits or tighter terms, but the core message is clear: a low number alone shouldn’t shut the door if the rest of your file makes sense.

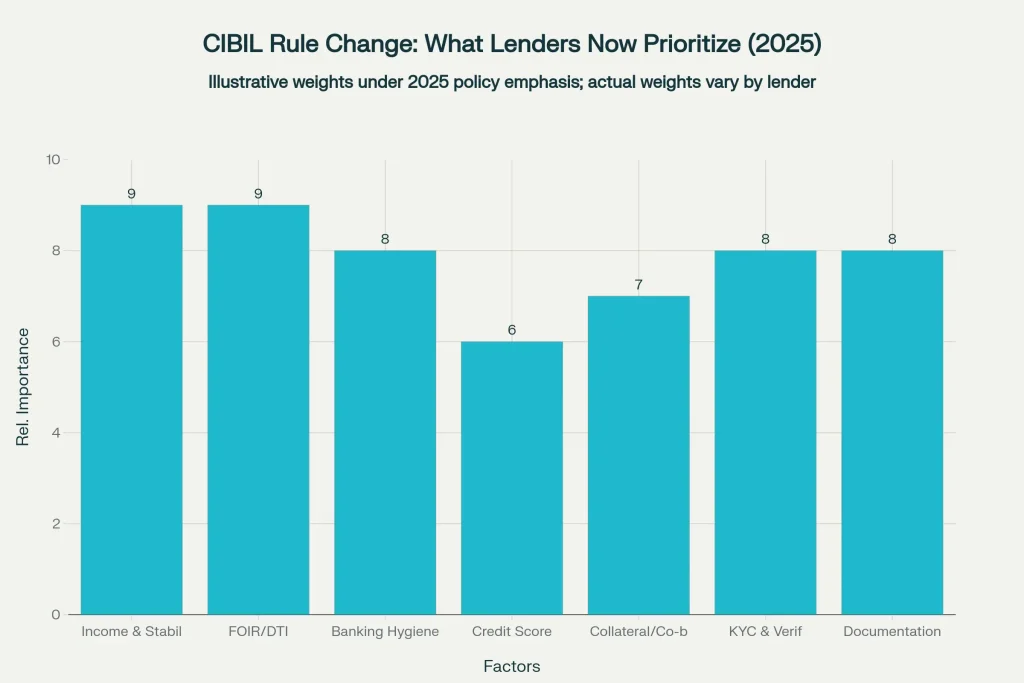

How Lenders Will Assess Now

- Income Evidence: Salary slips, bank credits, ITRs, and GST returns to verify inflows and stability.

- Affordability Metrics: FOIR/DTI thresholds, existing obligations, and room for a new EMI within policy limits.

- Banking Hygiene: Consistent balances, no frequent cheque bounces, and predictable cash flow patterns.

- KYC And Background: Identity, address, and policy-driven verification remain non-negotiable.

- Risk Mitigants: Collateral, guarantors, or co-borrowers where appropriate to balance risk and pricing.

Fresh 2025 Updates That Matter

One of the biggest improvements is speed and transparency in reporting. With credit data refreshing twice a month, on-time EMIs and corrections reflect sooner, helping diligent borrowers gain from their good behavior without long delays. Lenders and bureaus are also moving toward more consistent formats and clearer notifications so you can track changes promptly, dispute errors faster, and maintain a healthier credit profile with fewer surprises.

Practical Steps to Improve Approvals

- Tighten FOIR: Aim for a conservative EMI-to-income ratio; if possible, reduce high-interest card balances before applying.

- Clean Bank Footprint: Keep adequate balances, avoid cheque bounces, and show consistent inflows for at least 3–6 months.

- Start Small, Build Fast: Consider secured or smaller-ticket products to establish a repayment track, then scale as scores and history improve.

- Prepare Documents: Keep KYC, salary slips, ITRs, GST returns, rent agreements, and business proofs ready for swift underwriting.

- Avoid Multiple Hard Pulls: Space out applications to prevent avoidable dips and to keep your credit file tidy.

What Hasn’t Changed

This isn’t a free pass to credit. Lenders still apply full due diligence and can decline if affordability is weak or documents don’t align with policy. The CIBIL score continues to matter it informs pricing, limits, and terms but it’s no longer the sole switch that turns approvals on or off, especially for first-time borrowers. Responsible credit use, on-time EMIs, and low utilization remain the foundation for better offers down the line.

Who This Helps

This update answers the core question: can a loan be approved with a low or no CIBIL score? Yes, provided the rest of the profile is strong and policy thresholds are met. For action-oriented borrowers, the steps above help optimize applications: tidy statements, lower utilization, strengthen documentation, and consider risk mitigants. For navigational intent, this guide outlines what’s changed, what remains, and where to focus effort before hitting apply.

The CIBIL Score Rule Change gives first-time borrowers a fairer shot by removing a mandatory score barrier and requiring lenders to judge the entire profile, not just a number. In 2025, faster bureau updates mean positive habits like on-time EMIs and lower utilization—show up quicker, improving approval odds and pricing where affordability is solid. If your file is thin or your score is low, build a clear income story, keep FOIR conservative, and maintain clean banking hygiene. Consider secured or smaller-ticket products to create a repayment footprint, then expand access as your profile strengthens. It’s inclusion with discipline: rigorous documentation and underwriting still apply, but score-only denials shouldn’t block new-to-credit applicants.

What The Policy Means For Different Borrowers

- New-To-Credit Professionals: Salary stability and clean bank flows can outweigh a missing score, especially for modest ticket sizes.

- Small Business Owners And MSMEs: GST returns, bank statements, and collateral can support approvals despite thin bureau files.

- Rebuilders After Past Issues: Documented course-corrections, closed disputes, and recent on-time patterns can help offset older blemishes.

- Rural And Tier-2/3 Applicants: With alternative proofs and stable inflows, access improves even when credit history is limited.

How To Position Your Application

- Time Your Application: A month or two of clean statements and lowered revolving debt can materially improve FOIR and perceived stability.

- Right-Size The Ask: Align the ticket size with verifiable cash flows; overshooting affordability triggers avoidable rejections.

- Use Risk Mitigants Wisely: Gold loans, FD-backed credit, or a credible co-borrower can unlock better terms when standalone risk is high.

- Keep Narratives Verifiable: Ensure job changes, business seasonality, or past delays are supported by paperwork and a sensible story.

Common Mistakes To Avoid

- Applying Everywhere At Once: Multiple hard inquiries in a short span can dent your standing and confuse underwriters.

- Ignoring Utilization: Running credit cards near limits suggests stress; aim for lower balances before you apply.

- Overlooking Small Errors: Address mismatches in name, address, or closed accounts ahead of time to prevent needless delays.

- Hiding Existing Debt: Full disclosure is mandatory; underreporting liabilities hurts credibility and can lead to immediate declines.

Aadhaar Update Made Easy: Link Your Mobile Number from Home in Just 2 Minutes

What Lenders Still Need to See

- Predictable Income: Salary slips and consistent deposits or steady business turnover evidenced by GST and bank statements.

- Manageable Leverage: A clear FOIR/DTI under policy thresholds with headroom for the new EMI.

- Stability Signals: Tenure in job or business, address continuity, and minimal red flags in banking behavior.

- Documentation Discipline: Up-to-date KYC, tax filings, and any collateral papers in proper order.

FAQs on CIBIL Score Rule Change

Is A CIBIL Score Mandatory for First-Time Borrowers In 2025?

No. First-time borrowers cannot be rejected only for lacking a credit history, and there is no fixed minimum score mandated by the regulator.

Will My Loan Be Approved If My CIBIL Score Is Low?

It can be, provided income, FOIR, and documentation meet policy; lenders may adjust pricing, limits, or tenure to manage risk.

How Often Do Credit Reports Update Now?

Every 15 days on the 15th and the last day of the month so positive changes and corrections reflect faster.

Does This Relax Due Diligence?

No. Lenders still conduct full KYC, background verification, and affordability checks before sanction.