Central government employees and pensioners have a clear timeline now: the 8th Pay Commission will take effect from January 1, 2026, bringing a fresh pay matrix, a revised fitment factor, and recalibrated allowances that together point to a visible rise in take-home salary and pensions. The Union Cabinet has approved the Terms of Reference and set an 18-month reporting window, which means recommendations will be finalized before rollout, with arrears payable from the effective date.

The 8th Pay Commission is mandated to review pay, pensions, and service conditions for central government employees and pensioners, aligning compensation with economic conditions and fiscal prudence from January 2026. The new structure will replace the 7th CPC matrix, and Dearness Allowance/Dearness Relief will reset to zero on implementation, then rebuild as per the revised schedule. Allowances like HRA and TA will be recalculated on the updated basic pay, leading to higher nominal payouts even as the DA reset moderates the initial jump.

8th Pay Commission Update

| Key Point | Detail |

|---|---|

| Effective Date | January 1, 2026 (financial effect from this date) |

| Status | Terms of Reference approved; Commission constituted |

| Report Timeline | Recommendations due within 18 months of constitution |

| Coverage | ~50 lakh employees; ~65–70 lakh pensioners |

| Pay Structure | New pay matrix replacing 7th CPC levels |

| DA/DR At Rollout | Reset to 0% and rebuild thereafter |

| Allowances | HRA, TA and others recomputed on revised basic |

| Next Steps | Government examines report, issues notification, disburses with arrears |

What’s Officially Confirmed

- The government has formally approved the Terms of Reference and constituted the 8th Pay Commission with a chairperson, one part-time member, and a member-secretary.

- The Commission will submit its recommendations within about 18 months and may provide interim reports if specific recommendations are finalized early.

- The effective date for financial impact is January 1, 2026, maintaining the decade-cycle tradition of pay commission implementation.

Expected Impact on Salaries

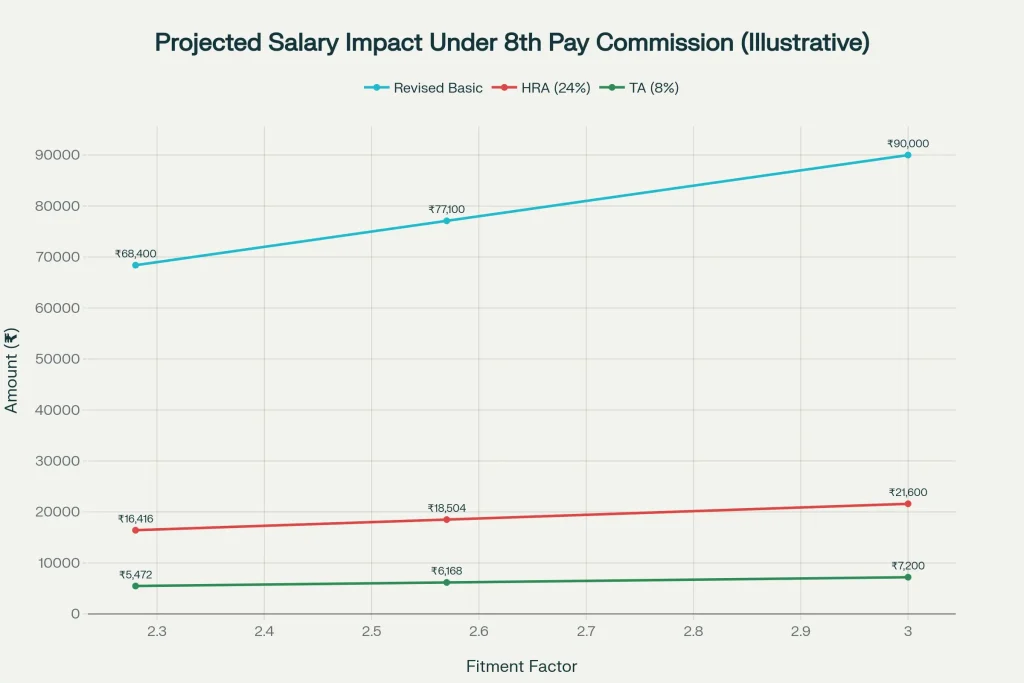

- The big driver of the initial salary jump will be the fitment factor applied to current basic pay to arrive at revised basic under the new pay matrix.

- Because allowances are calculated as a percentage of basic pay, a higher basic magnifies HRA and TA, even as DA resets to zero at implementation.

- Net take-home depends on city classification, level, deductions, and tax slab; however, most employees will see a clear increase in gross and a meaningful rise in take-home after recalculations.

Pension Recalibration

- Pensions will be revised in line with the final fitment factor and the new pay matrix, with DR resetting and then resuming under the new base.

- Minimum pension and parity issues are typically part of the review, but final contours will only be known after the recommendations are accepted and notified.

- Retirees should anticipate changes to commutation values only indirectly via the revised basic, while timing of DR increments will follow the new cadence.

Timeline And Process

- The Commission’s report is due within 18 months of constitution; the government will then examine and notify accepted recommendations.

- Disbursement usually follows notification, but arrears would be payable back to the effective date January 1, 2026.

- States often adopt the central recommendations with modifications; timelines can vary for state employees.

Fitment Factor Basics

- The fitment factor is a uniform multiplier applied to current basic pay to compute the initial revised basic under the new matrix.

- The 7th CPC used 2.57; the 8th CPC’s factor will be finalized in the report and government decision, and it will define the headline jump in basic.

- Employees can model scenarios with conservative and moderate assumptions to plan cash flows and tax impact.

DA Reset and Allowances

- At rollout, DA/DR resets to zero because the revised scales already incorporate inflation up to the implementation point; subsequent revisions start from the new base.

- HRA and TA will be recalculated based on the updated basic and city/grade slabs, preserving structure but lifting nominal amounts due to the higher base.

- Special, risk, and hardship allowances may also be reviewed for rationalization or consolidation, as seen in past commissions.

Who Benefits and How

- All central government employees and covered pensioners under the pay matrix will benefit, with level-wise changes filtering into gross and net pay.

- Entry-level staff often see a visible bump due to the combination of revised basic and recalculated HRA/TA, even with DA resetting.

- Middle and higher levels gain from compounding across multiple allowance heads tied to the basic.

How To Plan Ahead

- Model your revised basic with two or three fitment scenarios to understand gross salary bands and probable HRA/TA outcomes; factor in a DA reset at Day 1.

- Review your tax slab, deductions (HRA exemption, NPS, standard deduction), and reimbursements to estimate take-home accurately.

- Pensioners should revisit last-drawn pay trajectories, commutation plans, and DR restart pacing to align cash flows and investments post-revision.

What Remains Provisional

- The exact fitment factor, level-wise pay cells in the new pay matrix, and final allowance formulas will be known only after the Commission’s recommendations are formally accepted and notified.

- Any projected matrices or calculators circulating today should be treated as indicative. Build budgets with conservative assumptions to avoid over-commitment.

- Implementation sequencing such as whether certain allowances are rationalized or merged will depend on the final notification.

Key Takeaways

- Effective Date: Financial effect from January 1, 2026.

- Structure: New pay matrix, fitment-based basic, DA reset to 0% at rollout.

- Impact: Higher basic cascades into bigger HRA/TA; pensions revised accordingly; arrears likely upon notification.

- Status: Terms of Reference approved; report due within 18 months; final numbers to be confirmed via notification.

Aadhar Card Holders Alert – New November Rule Brings Major Change, Check Latest Update Now

How This Affects You Practically

- If you’re an employee: prepare a three-scenario spreadsheet using low, base, and high fitment multipliers; recalculate HRA/TA on the new basic; set aside a conservative estimate for tax; and plan SIP or debt repayment increases once arrears are credited.

- If you’re retiring soon: track your last 10 months’ basic under the new matrix for pension calculation relevance; decide commutation with the revised basic in mind; and align DR restart expectations with your monthly expense plan.

- If you manage payroll: map current levels to anticipated new levels, build “what-if” tests for city wise HRA slabs, and create a DA restart calendar to forecast salary budgets accurately.

FAQs on 8th Pay Commission Update

Is The 8th Pay Commission Definitely Effective From January 1, 2026?

Yes, the financial effect is set from January 1, 2026. The Commission’s report will arrive earlier, and arrears for the gap between the effective date and rollout will be settled after notification.

Will DA Reset To Zero When The New Pay Matrix Is Implemented?

Yes. DA/DR resets to 0% on implementation because inflation up to that point is embedded into the revised pay; future DA/DR builds from the new base.

How Many Employees and Pensioners Will Be Covered?

Roughly 50 lakh central employees and around 65–70 lakh pensioners fall within the scope, though exact counts vary slightly across sources and over time.

When Will the Final Fitment Factor Be Known?

It will be confirmed only when the Commission submits its report and the government decides and notifies the accepted recommendations.