LIC FD Scheme 2025 offers safety, predictable returns, and simple payout choices through LIC Housing Finance’s Sanchay Public Deposit, but a ₹6,500 monthly income from a ₹1 lakh deposit is not achievable under the current card rates and payout rules in 2025. For a non-cumulative monthly payout, the realistic income on ₹1 lakh is roughly ₹550–₹565 at around 6.50%–6.75% per annum, and monthly payout options commonly require higher minimum deposits such as ₹2 lakh, which invalidates the viral ₹6,500 claim on ₹1 lakh in practical terms.

LIC FD Scheme 2025 is the Sanchay Public Deposit from LIC Housing Finance Limited, a CRISIL AAA Stable rated public deposit program that allows both cumulative and non-cumulative interest options across tenures from 1 to 5 years for conservative savers seeking guaranteed outcomes in 2025. The scheme provides monthly, quarterly, and annual payouts in non-cumulative mode, while cumulative deposits compound and pay at maturity, with senior citizens generally receiving an extra 0.25% per annum over the standard card rate across eligible tenures in the current cycle. Rate cards, payout minima, and tenor-linked slabs are periodically updated, so investors should align expectations to the latest schedule when evaluating monthly cash flow or maturity proceeds in 2025.

LIC FD Scheme 2025

LIC Public Fixed Deposit Scheme

The LIC Public Fixed Deposit scheme lets savers choose non-cumulative monthly payouts for steady cash flow or cumulative compounding for a higher, single maturity value, helping match the product to liquidity needs and time horizons in 2025. Eligible investor categories include resident individuals, NRIs, HUFs, firms, societies, trusts, and companies, reflecting the program’s broad access and trust positioning as a safety-first solution backed by a strong credit profile.

LIC Fixed Deposit Interest Rates Effective From 2025

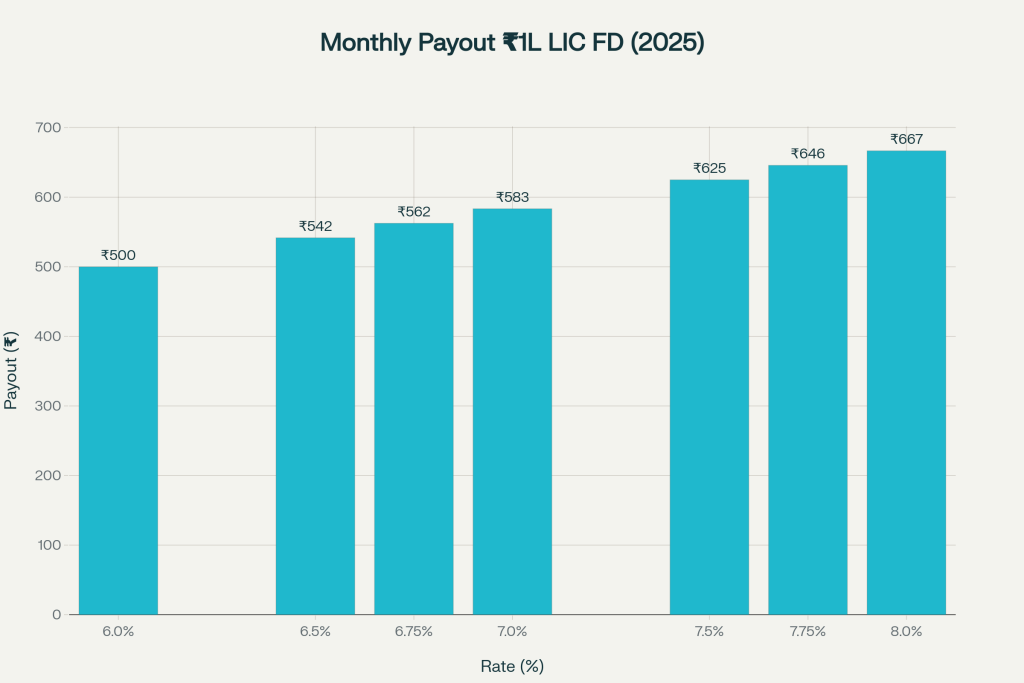

In 2025, realistic market card rates on LIC Housing Finance deposits cluster around 7.25%–7.75% on select cumulative slabs, with non-cumulative monthly payouts typically quoted slightly lower to account for payout frequency and tenor effects across the card. Where monthly payout is available, applying the simple interest math Monthly Interest = Principal Annual Rate12 Monthly Interest =12 Principal x Annual Rate on ₹1,00,000 at 6.75% gives roughly ₹562.50 per month, which demonstrates why the ₹6,500 claim on ₹1 lakh is mathematically off by an order of magnitude in 2025.

Repayment

On maturity, cumulative deposits return principal plus compounded interest to the registered bank account via electronic credit, while non-cumulative deposits repay only the principal at maturity since the interest has already been disbursed periodically during the deposit term. Repayment follows the instructions recorded at account opening, ensuring predictable closure without paperwork and adhering to the KYC profile attached to the deposit folio in 2025.

Renewal

A renewal option can be provided at placement so the principal amount continues for the same tenor on maturity while the new interest rate resets to the prevailing card rate on the renewal date, allowing hands-off compounding across cycles. Renewal preserves the account’s operating features, bank mandate, and nomination parameters unless specifically changed, which makes long-horizon parking straightforward for conservative investors in 2025.

Premature Withdrawal

Early closure is governed by NBFC-HFC Directions with a graded grid: no interest before 3 months, a stipulated nominal rate between 3 and 6 months for individuals, and thereafter interest payable at 1% below the applicable card rate for the exact completed period or per fallback clauses where needed. This framework balances depositor liquidity with overall scheme stability, and investors should weigh the penalty effect against urgent cash needs before exercising premature withdrawal in 2025.

Loan Against Deposit

A secured loan facility up to 75% of the deposit becomes available after three months from the date of placement, usually priced 2% above the contracted FD rate and repayable either on demand or by adjusting against the maturity proceeds. Using the loan feature helps preserve the original card rate on the full tenor while addressing short-term liquidity without breaking the deposit prematurely in 2025.

Eligibility And KYC

Eligible entities include resident individuals, NRIs, minors through guardians, HUFs, partnerships, societies, trusts, and companies, which keeps the product accessible to a wide spectrum of savers seeking safety and consistency in returns. Standard documentation applies PAN, identity and address proofs, photographs, and the signed application while existing folios allow simplified processing if previously submitted KYC remains valid and unchanged in 2025.

Taxation And TDS

Interest from LIC Housing Finance FDs is fully taxable at the depositor’s slab rate, with TDS of 10% when PAN is furnished and 20% if not, subject to threshold rules and declarations prevailing during the financial year. Five-year deposits may qualify under Section 80C, while senior citizens can additionally leverage Section 80TTB for interest income relief, making tenure and payout choices integral to tax planning in 2025.

Points To Note

Senior citizens commonly receive an additional 0.25% per annum over the card rate, lifting monthly income or maturity corpus without adding market risk, which suits capital-preservation goals in retirement. The frequently shared claim of ₹6,500 per month from ₹1 lakh is not supported by current rate cards or payout minima, since monthly payout mathematics on ₹1 lakh at around 6.50%–6.75% translates to roughly ₹550–₹565, and monthly payout typically requires a higher minimum deposit such as ₹2 lakh to be permitted operationally.

Who Should Consider LIC FD Scheme 2025

LIC FD Scheme 2025 suits investors who prioritize guaranteed returns, steady cash flow options, and a top-grade safety profile over market-linked upside, especially retirees and families with near-term income needs. Savers comparing bank FDs, small finance bank FDs, and HFC deposits can regard this as a stable anchor holding to balance portfolio volatility and align cash flows with predictable household expenses in 2025.

How To Use LIC FD Scheme 2025 For Monthly Income

If monthly cash flow is the goal, select the non-cumulative monthly payout option and confirm the minimum deposit requirement for the month-frequency slab, which often starts at ₹2 lakh rather than ₹1 lakh in current schedules. To estimate income, apply Monthly Interest = Deposit Annual Rate12 Monthly Interest=12 Deposit Annual Rate and then validate the result against the published card rate and chosen tenor for accuracy in 2025.

Example Calculations In 2025

At a representative monthly payout rate near 6.75% and a deposit of ₹2,00,000, the monthly credit would be approximately ₹1,125, which scales proportionally with deposit size and confirms realistic earning bands versus exaggerated social claims. For accumulation, a 3–5 year cumulative option near 7.25%–7.75% has historically delivered competitive maturity values, with the exact corpus determined by the tenor-rate combination on the active card.

Practical Tips Before Investing

Verify the live rate card, payout minima for monthly frequency, and tenor slabs before placing funds, and document the bank mandate and nomination clearly to avoid settlement delays on maturity or repayment. Map the deposit tenor to known cash flow events and tax thresholds, blending cumulative and non-cumulative tranches to balance monthly needs with higher end-value compounding where appropriate in 2025.