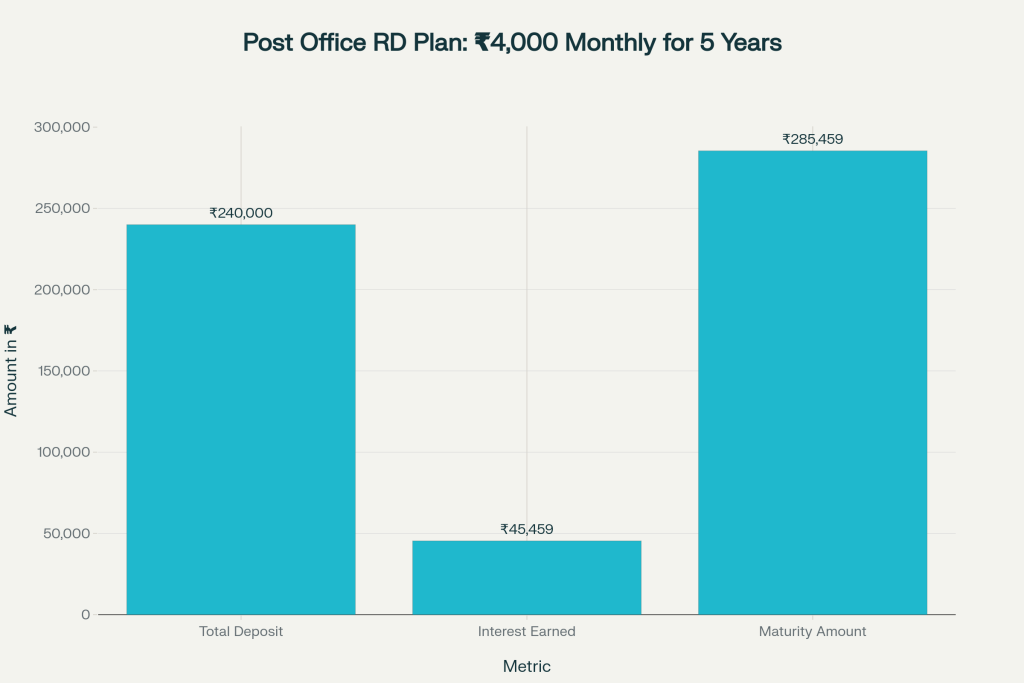

The Post Office RD Plan lets you put away ₹4,000 every month for 5 years and walk out with ₹2,85,459 at maturity ₹45,459 pure interest over your ₹2,40,000 contribution. It’s steady, predictable, and backed by India Post under the small savings framework. If you’ve been meaning to build a disciplined habit for education, a travel fund, or a cushion against future expenses, this is one of the most straightforward ways to make it happen. The Post Office RD Plan is built for clarity, with fixed rules on deposits, defaults, premature closure, and even a loan facility for emergencies.

The Post Office RD Plan is simple by design: invest a fixed amount each month for 60 months, earn quarterly‑compounded interest at the notified rate, and receive your principal plus earnings at maturity. You’re not second‑guessing the market here the rate is announced for the quarter and stays locked in for your account’s tenure. For a ₹4,000 monthly deposit, the 5‑year maturity comes to ₹2,85,459, which means your money quietly earns ₹45,459 while you stay consistent. It’s particularly useful for first‑time savers, retirees looking for safe options for dependents, or anyone who values certainty over speculation. The Post Office RD Plan also includes small but important conveniences like advance‑deposit rebates and a loan facility after one year.

Post Office RD Plan

| Item | Value |

|---|---|

| Monthly Deposit | ₹4,000 |

| Tenure | 5 years 60 installments |

| Interest Rate | 6.7% per annum, compounded quarterly |

| Total Deposit | ₹2,40,000 |

| Maturity Amount | ₹2,85,459 |

| Interest Earned | ₹45,459 |

| Safety | Government‑backed small savings scheme |

| Premature Closure | Allowed after 3 years subject to rules |

| Loan Against RD | Up to 50% after 12 installments and 1 year |

| Due Date Cycle | Opened by 15th: dues by 15th; 16th or later: dues by month‑end |

The Post Office RD Plan is about steady wins. Put in ₹4,000 every month, let quarterly compounding do the heavy lifting, and you’ll see ₹2,85,459 at the 5‑year mark ₹45,459 earned without losing sleep over market cycles. With flexibility to pay in advance, borrow against your balance after a year, and even close after three years if life throws a curveball, it’s a practical, reliable way to move your savings from intention to impact. For anyone who values certainty, structure, and sovereign safety, this remains one of the most dependable routes to build a goal‑based corpus on time, every time.

Features Of Post Office Recurring Deposit Scheme

The RD is a 5‑year recurring deposit with quarterly compounding and a fixed monthly contribution you choose at the start. You can begin with as little as ₹100 in multiples of ₹10, and there’s no upper cap, so scaling is easy as income grows. The structure favors disciplined saving, and the Post Office RD Plan ensures every installment gets interest for its time in the account.

Eligibility Criteria

Resident Indian individuals aged 18+ can open a single or joint account up to three adults. Parents or guardians can open RD accounts for minors, and a minor aged 10 or above can operate their own account as permitted. There’s no restriction on the number of RD accounts you may open for different goals, making the Post Office RD Plan useful for structured family budgeting.

How To Open Post Office Recurring Deposit Account

You can start either online via India Post internet banking or by visiting your local post office branch. Submit the RD application with KYC documents and the first installment; use standing instructions or online banking to automate future deposits. The Post Office RD Plan supports e‑passbook access in eligible accounts, which makes tracking your corpus easy.

PORD Deposits, Cut‑Off Dates And Advance Deposit

If you open the account by the 15th, future installments fall due by the 15th each month; if opened on or after the 16th, your due date is the last day of every month. You can pay multiple months in advance and, in eligible cases, get a small rebate for 6 or 12 installments paid up front. This feature makes the Post Office RD Plan flexible for people with seasonal income or occasional cash surpluses.

Loan On Post Office Recurring Deposits

After at least 12 installments and one full year of account continuance, you can take a loan up to 50% of the RD balance. The interest charged is typically the RD rate plus a modest spread, and you can repay in EMIs or lump sum. This helps you avoid premature closure while keeping the Post Office RD Plan compounding in the background.

Premature Closure Of Post Office Recurring Deposit Account

Premature closure is permitted after 3 years from the date of opening and is processed as per the scheme’s rules. If you have paid installments in advance, closure usually isn’t allowed until the advance period completes. When in doubt, use the loan‑against‑RD feature instead of breaking the Post Office RD Plan.

Default And Revival Rules

If you miss an installment, a nominal default fee applies for each ₹100 of deposit. Four consecutive defaults can render the account discontinued, but you typically get a window to revive it by paying pending installments and charges. If defaults are not more than four in total, your maturity can be extended by the number of months missed, keeping the Post Office RD Plan intact.

Tax Treatment

Interest earned from RD is taxable as per your slab and may be subject to TDS when applicable thresholds are crossed. RD contributions generally do not qualify for Section 80C deduction, unlike some other small savings instruments. Consider the post‑tax result when comparing the Post Office RD Plan with alternatives.

Why ₹4,000 Per Month Works Now

At the current 6.7% quarterly‑compounded rate, ₹4,000 a month for 5 years is enough to build a focused ₹2,85,459 corpus without worrying about volatility. It’s a goal‑friendly, spreadsheet‑friendly number big enough to matter, small enough to maintain. The Post Office RD Plan gives you a clear maturity figure, which helps you plan around school fees, a two‑wheeler down payment, or a contingency fund.

Practical Tips to Maximize Value

- Automate payments through standing instructions aligned with your due date to avoid defaults.

- Use the advance‑deposit option for 6 or 12 installments if you have surplus cash and are eligible for a rebate.

- Prefer the loan‑against‑RD route for short‑term liquidity instead of premature closure.

- If you miss installments, revive quickly to avoid the account being discontinued and your timeline getting stretched.

- Track interest yearly for tax planning, and consider aligning your RD maturity with your financial goal dates.

Quick Context on Rates and Safety

The RD sits under India Post’s small savings ecosystem, which is considered among the most dependable for principal safety. Rates are notified quarterly by the government, and each new RD opened locks the prevailing rate for its full tenure. That’s why the Post Office RD Plan appeals to savers who want predictable outcomes without the stress of market timing.

Post Office RD Interest Rate

The 5‑year RD rate is currently 6.7% per annum with quarterly compounding for accounts opened in the ongoing quarter. Once you open your account, that rate remains applicable for the full 60‑month tenure. This predictability makes budgeting and goal‑based saving easier for anyone using the Post Office RD Plan.

Overview Of Costs And Benefits

- Deposit Structure: Fixed monthly installments for 5 years; ₹100 minimum, multiples of ₹10; no upper limit.

- Compounding: Quarterly, which boosts earnings compared to simple interest.

- Liquidity: Loan facility after one year and 12 installments; premature closure after 3 years.

- Safety: Government‑backed small savings scheme under India Post.

- Administration: Clear rules on due dates, defaults, revival, and advance‑deposit rebates.

How To Use It in a Real Plan

Treat the Post Office RD Plan as the anchor of your short‑ to medium‑term savings. Map a 5‑year goal school admission fees, a small car down payment, a relocation fund and reverse‑engineer the monthly installment you can stick to. If income allows, front‑load six or twelve months via the advance‑deposit option for convenience and possible rebate. If you anticipate a temporary crunch, plan for the loan facility after one year so you don’t disrupt compounding or incur penalties from premature closure.

Who Should Choose This

- First‑time savers who want guaranteed growth with simple rules.

- Families building goal‑wise buckets across multiple RD accounts.

- Conservative investors diversifying away from equity volatility.

- Retirees or guardians preferring sovereign‑backed instruments for dependents.

- Salaried professionals looking to automate a disciplined “pay yourself first” strategy.

What To Watch Out For

- Missing the due date regularly can add costs and extend your maturity timeline.

- RD interest is fully taxable; compare post‑tax returns against alternatives.

- If you plan to exit before 3 years, this may not be the right vehicle; consider more liquid options.

- Don’t confuse RD with tax‑saving instruments; contributions here generally do not get Section 80C benefits.

Smart Pairings

- Pair the Post Office RD Plan with a savings account buffer equal to one month of expenses to handle minor shocks and avoid RD defaults.

- Use a goal tracker: pick a target amount and date, then set the RD installment accordingly.

- On maturity, either ladder into a new RD aligned with your next goal or redeploy into a suitable fixed deposit or debt fund based on horizon and tax profile.

FAQs on Post Office RD Plan

Q1: How much will ₹4,000 monthly become in 5 years?

A: With 6.7% interest compounded quarterly, 60 installments of ₹4,000 mature to ₹2,85,459. That’s ₹45,459 in interest on your ₹2,40,000 total deposit, assuming on‑time payments and no defaults.

Q2: Can I close my RD before 5 years?

A: Yes, premature closure is allowed after 3 years under scheme rules. Do note that early closure may reduce interest benefits compared to holding till maturity.

Q3: Can I get a loan against my RD?

A: After 12 installments and one year of continued operation, you can typically borrow up to 50% of the balance. This helps handle short‑term cash needs without breaking the RD.

Q4: What happens if I miss a few installments?

A: A nominal default fee applies per missed month. Up to four missed months can be adjusted by extending the tenure; after four consecutive defaults, the account may be discontinued unless revived within the allowed window.

Q5: Is the interest from RD tax‑free?

A: No, RD interest is taxable as per your slab and may attract TDS if thresholds apply. Plan for post‑tax returns and keep yearly records for smooth filing.