Agriculture has always been the lifeline of India’s rural economy, yet for generations, farmers have struggled with one persistent issue: access to fair and timely finance. While cities witnessed rapid banking expansion, villages were often left to depend on informal lenders who charged high interest and offered little flexibility. This gap is exactly where How Cooperative Banks Empower Farmers becomes a powerful story of change.

Cooperative banks were created with farmers in mind, and over time, they have become trusted financial partners rather than distant institutions. How Cooperative Banks Empower Farmers is not just about money; it is about stability, dignity, and long-term rural growth. What makes cooperative banks unique is their deep connection with the communities they serve. Farmers are not treated as mere account holders but as members and stakeholders. This relationship builds trust, encourages participation, and ensures that financial services are designed around real agricultural needs. From crop planning to post-harvest support, cooperative banks have steadily reshaped how rural India manages finance.

Understanding How Cooperative Banks Empower Farmers requires looking beyond traditional banking models. Cooperative banks operate on mutual ownership, meaning farmers collectively own and manage these institutions. This structure allows banks to focus on service rather than profit maximization. Loans are designed around cropping cycles, local climate conditions, and regional farming practices. Because decision-making happens locally, farmers benefit from faster approvals and realistic repayment schedules. Cooperative banks also act as financial educators, helping farmers understand savings, credit discipline, and risk management. Over time, this approach has reduced dependence on moneylenders and improved overall financial confidence in rural areas.

How Cooperative Banks Are Strengthening Farmers

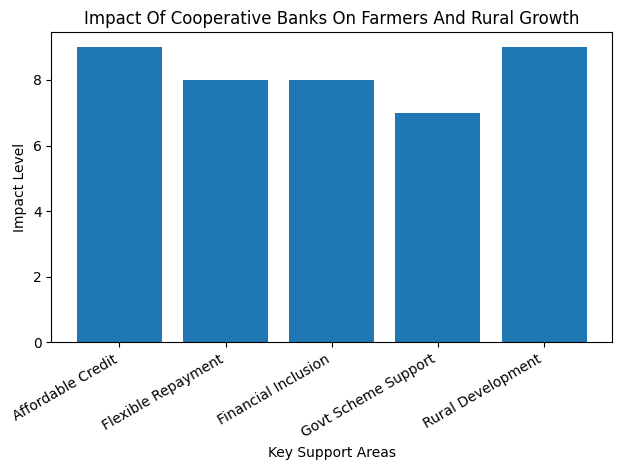

| Focus Area | How Cooperative Banks Support Farmers |

|---|---|

| Credit Access | Provide affordable loans for crops, inputs, and equipment |

| Repayment Structure | Align repayment schedules with harvest cycles |

| Financial Inclusion | Serve small and marginal farmers in rural regions |

| Government Programs | Act as channels for subsidies and insurance |

| Rural Economy | Support allied activities and local enterprises |

Cooperative banks have proven to be more than financial institutions; they are partners in rural progress. Through affordable credit, inclusive practices, and community ownership, they have transformed how farmers interact with the financial system. The story of How Cooperative Banks Empower Farmers is ultimately a story of trust, resilience, and shared growth. As India continues to modernize its agricultural economy, cooperative banks will remain a vital force in ensuring that progress reaches the grassroots. With continued innovation and reform, they will keep empowering farmers and strengthening rural India for generations to come.

Role Of Cooperative Banks in Agriculture

The role of cooperative banks in agriculture goes far beyond basic lending. These banks are deeply embedded in farming communities, allowing them to understand seasonal income patterns and agricultural risks. Farmers often require funds at specific stages such as sowing, irrigation, or harvesting. Cooperative banks step in at these critical moments, ensuring that financial delays do not disrupt productivity. This role directly explains How Cooperative Banks Empower Farmers by enabling timely investment in seeds, fertilizers, and modern farming tools. When farmers receive funds at the right time, crop quality improves, yields increase, and income becomes more predictable. Over the years, this consistent support has strengthened agricultural stability across many rural regions.

Affordable Credit Access For Farmers

- One of the strongest ways cooperative banks empower farmers is by offering affordable credit. High-interest loans from informal sources have historically trapped farmers in cycles of debt. Cooperative banks address this issue by providing loans at reasonable interest rates with transparent terms.

- This affordability allows farmers to invest confidently in better inputs and technology. They can upgrade irrigation systems, purchase machinery, or experiment with improved crop varieties. Such investments are essential for increasing productivity and income. This financial safety net clearly demonstrates How Cooperative Banks Empower Farmers by reducing stress and enabling long-term planning rather than short-term survival.

Support For Small and Marginal Farmers

- Small and marginal farmers often face the greatest challenges when accessing formal finance. Limited landholdings and irregular income make them less attractive to commercial banks. Cooperative banks, however, are built to serve this very group.

- By simplifying documentation and offering customized loan products, cooperative banks ensure that even the smallest farmers can access credit. Field-level staff often guide farmers through the process, making banking less intimidating. This inclusive approach highlights How Cooperative Banks Empower Farmers by ensuring that growth opportunities are not limited to large landowners but shared across rural society.

Promoting Financial Inclusion In Rural India

- Financial inclusion is a key outcome of cooperative banking. Many farmers who once relied entirely on cash transactions now have access to savings accounts, credit facilities, and insurance products. Cooperative banks actively promote savings habits, helping farmers build emergency funds and financial resilience.

- This gradual integration into formal banking systems reduces vulnerability during crop failures or unexpected expenses. Financial literacy programs further support this transition by teaching farmers how to manage money responsibly. These efforts strongly reinforce How Cooperative Banks Empower Farmers by creating informed and financially secure rural communities.

Implementation Of Government Schemes

Government agricultural and rural welfare schemes are only effective when they reach the intended beneficiaries. Cooperative banks play a crucial role in this process. Their strong local presence and trusted relationships allow them to distribute subsidies, insurance claims, and financial assistance efficiently. Farmers often find it easier to approach cooperative banks for scheme-related support compared to distant administrative offices. This seamless implementation ensures that policy benefits translate into real improvements on the ground. In this way, cooperative banks strengthen How Cooperative Banks Empower Farmers by bridging the gap between government initiatives and rural households.

Contribution To Rural Development

The impact of cooperative banks extends beyond agriculture. By financing allied activities such as dairy farming, fisheries, poultry, and small rural enterprises, these banks help diversify income sources. This diversification is critical in reducing risk and improving overall economic stability. When rural households earn from multiple sources, they are better equipped to handle agricultural uncertainties. Employment opportunities also increase, reducing migration to urban areas. This broader contribution to rural development further illustrates How Cooperative Banks Empower Farmers by strengthening entire village economies, not just individual farms.

Challenges Faced By Cooperative Banks

- Despite their importance, cooperative banks face several challenges. Limited capital reserves can restrict their lending capacity, especially during widespread crop failures. Rising loan defaults can strain financial health, making sustainability a concern.

- Operational challenges such as outdated technology and governance issues also affect efficiency. To continue supporting farmers effectively, cooperative banks must adopt digital tools, improve transparency, and strengthen professional management. Addressing these challenges is essential to ensure that How Cooperative Banks Empower Farmers remains a sustainable and evolving model for rural finance.

The Future Of Cooperative Banking In India

The future of cooperative banks depends on modernization without losing their community-focused identity. Digital banking, mobile services, and data-driven credit assessment can improve efficiency while maintaining personal relationships with farmers. With the right reforms and support, cooperative banks can expand their reach and impact. Their ability to adapt while staying rooted in rural values will determine how strongly How Cooperative Banks Empower Farmers in the years ahead.

FAQs on How Cooperative Banks Are Strengthening Farmers

1. Why are cooperative banks important for farmers

They provide affordable credit, flexible repayment options, and local support tailored to agricultural needs.

2. Can small farmers access loans from cooperative banks

Yes, cooperative banks focus heavily on small and marginal farmers with simplified procedures.

3. Do cooperative banks only support farming activities

No, they also finance allied activities like dairy, fisheries, and small rural businesses.

4. How do cooperative banks promote financial inclusion

They encourage savings, offer insurance products, and provide financial literacy to rural communities.