For people who believe in steady savings rather than risky shortcuts, the Post Office RD Scheme 2026 remains one of the most trusted financial options in India. In an era where market-linked investments can fluctuate sharply, many investors still prefer government-backed schemes that offer stability, predictability, and peace of mind. That is exactly where the Post Office RD Scheme 2026 fits in it rewards discipline, patience, and consistency. What truly makes this scheme attractive is how manageable monthly contributions can turn into a meaningful lump sum over time. You don’t need a large one-time investment. Instead, a fixed monthly deposit, such as ₹8,000, can quietly grow into a sizeable amount over five years. For salaried professionals, small business owners, and families planning future expenses, this scheme offers a practical and low-stress way to build savings.

The Post Office RD Scheme 2026 is a recurring deposit plan run by India Post under the government’s small savings framework. It allows individuals to deposit a fixed amount every month for a tenure of five years. These monthly deposits earn interest that is compounded quarterly, helping your money grow at a steady and predictable pace. Unlike market-driven investments, this scheme does not depend on economic conditions or stock market performance. Once you open the account and fix your monthly deposit amount, the process becomes automatic and simple. This makes it especially suitable for people who prefer a set-it-and-forget-it style of saving. The scheme is accessible through post offices across urban and rural areas, ensuring wide reach and convenience.

Post Office RD Scheme 2026

| Feature | Details |

|---|---|

| Scheme Type | Recurring Deposit |

| Tenure | 5 Years (60 Months) |

| Minimum Monthly Deposit | ₹100 |

| Maximum Monthly Deposit | No Limit |

| Interest Compounding | Quarterly |

| Risk Level | Very Low |

| Account Ownership | Single or Joint |

| Eligibility | Individuals and Minors (via Guardian) |

The Post Office RD Scheme 2026 continues to be a reliable and practical savings option for individuals who value consistency and security. With disciplined monthly deposits of ₹8,000, investors can build a substantial corpus of around ₹5.7 lakh over five years without worrying about market risks or volatility. In a world full of complex financial products, this scheme stands out for its simplicity, safety, and predictable growth. If your goal is steady wealth creation through regular savings, the Post Office RD Scheme remains a smart and dependable choice.

What Is the Post Office RD Scheme?

The Post Office RD Scheme is designed to help individuals save money regularly by depositing a fixed amount every month. Each deposit earns interest, and since the interest is compounded quarterly, both your principal and interest continue to grow over time. At the end of the five-year tenure, you receive a maturity amount that includes your total deposits plus interest.vOne of the strongest features of this scheme is its simplicity. There are no complex calculations, no monitoring of market trends, and no fear of capital loss. You decide the monthly amount, stick to it, and let time and compounding do the work. The scheme is open to adults, joint account holders, and even minors through guardians, making it suitable for long-term family planning.

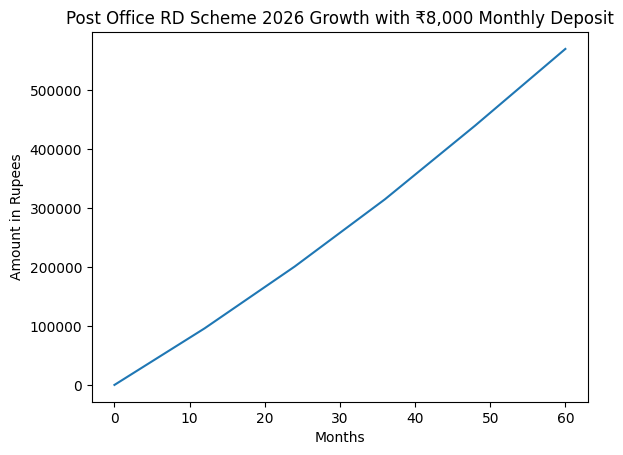

How ₹8,000 Monthly Deposits Can Add Up To ₹5.7 Lakh

The real power of the Post Office RD Scheme 2026 becomes clear when you look at the numbers. If you invest ₹8,000 every month for 60 months, your total contribution over five years comes to ₹4.8 lakh. Thanks to quarterly compounding, the interest earned during this period significantly boosts the final maturity value. By the end of the tenure, your investment can grow to approximately ₹5.7 lakh. This additional amount is purely interest earned on your disciplined monthly savings. While this may not sound dramatic compared to high-risk investments, the key advantage lies in certainty. You know exactly how much you’re investing and what you’ll receive, making financial planning far easier and stress-free.

Interest Calculation And Compounding Explained

Interest in the Post Office RD Scheme 2026 is calculated on a quarterly compounding basis. This means that every three months, interest is added to your account balance, and future interest is calculated on this increased amount. Over time, this compounding effect plays a crucial role in increasing the maturity value. Unlike simple interest, where interest is calculated only on the principal, compound interest allows your money to grow faster. Even though the interest rate may appear moderate, the quarterly compounding ensures steady growth. This makes the scheme more rewarding than keeping money idle in a regular savings account.

Key Benefits Of Post Office Rd Scheme 2026

One of the biggest benefits of the Post Office RD Scheme 2026 is safety. Since it is backed by the Government of India, there is virtually no risk of losing your principal. This makes it ideal for conservative investors. Another advantage is affordability. With a minimum deposit of just ₹100 per month, anyone can start investing. There is also no upper limit, which means higher-income individuals can invest larger amounts. The scheme promotes financial discipline by encouraging regular savings, and the fixed tenure helps investors stay committed to their goals. Additionally, the scheme offers flexibility through features like premature closure under certain conditions and loan facilities after a specified period. These features add liquidity while still maintaining the core objective of long-term savings.

Who Should Consider This Post Office RD Scheme 2026?

- The Post Office RD Scheme 2026 is suitable for a wide range of individuals. Salaried employees who receive monthly income can easily align deposits with their salary cycle. Self-employed professionals who want a low-risk savings option will also find it appealing.

- Parents planning for future expenses such as education or marriage often use this scheme to build a dedicated fund. Retirees and senior citizens who want predictable returns without market exposure can also benefit. Overall, anyone who values stability, guaranteed returns, and disciplined savings can consider this scheme.

Rules And Conditions You Should Know

Before investing in the Post Office RD Scheme 2026, it’s important to understand a few basic rules. Monthly deposits must be made on time, as delays may attract small penalties. Consistency is key to achieving the full maturity benefit. Premature withdrawal is allowed after a certain lock-in period, but it may result in reduced interest earnings. The interest earned is taxable according to the investor’s income tax slab. Also, interest rates are reviewed periodically by the government, so the applicable rate may change for new accounts.

Post Office Rd Vs Other Saving Options

- Compared to traditional savings accounts, the Post Office RD Scheme 2026 offers better returns due to quarterly compounding. While fixed deposits may offer similar safety, they usually require a lump-sum investment, which may not be convenient for everyone.

- Market-linked options like mutual funds may provide higher returns but come with higher risk. The Post Office RD strikes a balance by offering moderate returns with maximum safety. This makes it a preferred choice for risk-averse investors who still want their money to grow steadily.

Soil Health Card Scheme — How It Helps Farmers Use Fertilizers More Effectively

Tips To Maximize Returns from Post Office Rd Scheme

To get the most out of the Post Office RD Scheme 2026, start investing as early as possible. The longer your money stays invested, the more you benefit from compounding. Choose a monthly deposit amount that is realistic and sustainable, so you don’t miss payments. If your income increases over time, consider opening an additional RD account rather than missing out on higher savings potential. Staying consistent throughout the five-year tenure is the most important factor in maximizing returns.

FAQs on Post Office RD Scheme 2026

Is The Post Office Rd Scheme 2026 Risk-Free?

Yes, it is considered one of the safest savings schemes as it is fully backed by the Government of India.

Can I Change My Monthly Deposit Amount Later?

No, the deposit amount cannot be changed for the same account. However, you can open a new RD account with a different amount.

Is The Interest Earned Taxable?

Yes, the interest earned is taxable as per the investor’s income tax slab.

Can I Close the Account Before Five Years?

Premature closure is allowed after a specific period, but it may reduce the total interest earned.