Saving money consistently is one of the smartest financial habits you can develop, especially in a time when expenses are rising and market-linked investments feel unpredictable. Many people want a solution that is safe, easy to understand, and capable of delivering steady returns without sleepless nights. That is exactly why the Post Office Recurring Deposit continues to attract millions of investors across India.

It offers a simple way to turn monthly savings into a meaningful corpus over time. The Post Office Recurring Deposit is especially popular among salaried individuals, small business owners, and families planning future expenses. By investing a fixed amount every month, such as ₹11,000, you create a disciplined savings routine backed by the Government of India. There is no exposure to market risk, no complicated rules, and no need for a large lump sum at the start. Over five years, this simple habit can help you build a strong financial cushion.

The Post Office Recurring Deposit is a government-backed small savings scheme that allows individuals to deposit a fixed amount every month for a period of five years. The scheme is designed for people who prefer predictable returns and capital safety over high-risk investments. It is suitable for both short-term and medium-term financial goals and works well for those who want to save regularly rather than invest a lump sum. What makes this scheme stand out is its accessibility and simplicity. You can open an account at almost any post office in the country with minimal documentation. The deposit amount remains fixed throughout the tenure, which helps maintain financial discipline. Interest is compounded quarterly, allowing your money to grow steadily over time without any active management.

Post Office Recurring Deposit

| Feature | Details |

|---|---|

| Scheme Name | Post Office RD Scheme |

| Minimum Monthly Deposit | ₹100 |

| Deposit Tenure | 5 Years |

| Interest Compounding | Quarterly |

| Risk Level | Very Low |

| Account Types | Single and Joint |

| Premature Withdrawal | Allowed After 3 Years |

| Loan Facility | Up To 50% Of Balance |

| Tax Benefit | No Section 80C Benefit |

The Post Office Recurring Deposit is a powerful savings tool for those who believe in consistency and financial discipline. Investing ₹11,000 every month may feel like a commitment, but over five years, it can turn into a substantial and reliable corpus. With government backing, predictable returns, and flexible features, this scheme continues to be a smart choice for secure and stress-free savings.

How The Post Office RD Scheme Works

- The Post Office RD Scheme operates on a simple monthly deposit model. Once you choose your monthly contribution, you must deposit the same amount every month for 60 months. This fixed structure helps investors plan their finances better and build a consistent saving habit.

- Interest is calculated on a quarterly compounding basis, which means you earn interest not only on your deposits but also on the interest already earned. If you miss a monthly installment, a small penalty is charged. However, the account is not closed immediately, which gives investors flexibility during temporary financial difficulties.

Post Office RD Scheme Interest Rate

- The interest rate on the Post Office Recurring Deposit is reviewed and announced periodically by the government. The rate remains competitive among fixed-income savings options and is higher than a regular savings account. Although it may not match the returns of equity-based investments, it offers stability and guaranteed growth.

- Because interest is compounded quarterly, the effective return over five years becomes attractive for conservative investors. The certainty of returns is one of the main reasons why people continue to choose this scheme even in 2026.

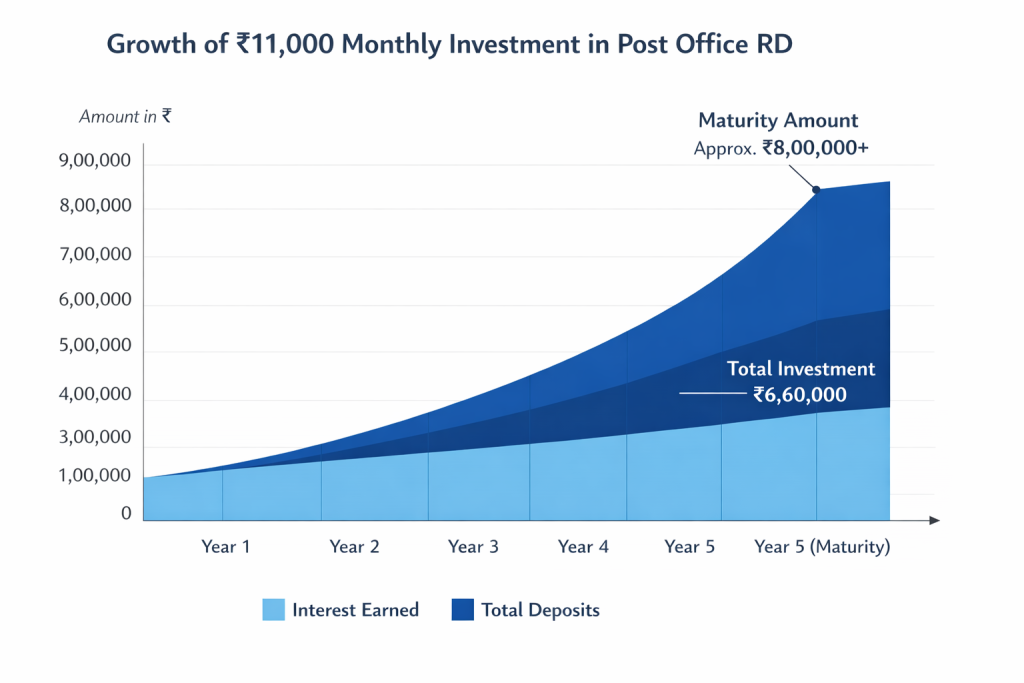

₹11,000 Monthly Investment Strategy

Investing ₹11,000 every month in a Post Office Recurring Deposit is a practical strategy for individuals with a stable income. Over five years, the total investment amounts to ₹6.6 lakh. With quarterly compounding, the maturity value becomes significantly higher than the total deposited amount. This approach works well for people planning future expenses such as children’s education, marriage, home improvement, or building an emergency fund. Since the deposit amount is fixed, budgeting becomes easier, and savings happen automatically without much effort.

Maturity Amount And Growth Potential

The maturity amount of a Post Office RD depends on the interest rate applicable during the investment period. Since the scheme uses compound interest, the final amount is always higher than the sum of monthly deposits. For investors who do not need the funds immediately after maturity, the account can be extended for another five years. This extension allows your savings to continue earning interest and further increases the overall returns.

Eligibility Criteria For Opening An Account

- The Post Office Recurring Deposit is open to all Indian residents. An individual can open a single account, or two adults can open a joint account. Parents or guardians can also open RD accounts on behalf of minors.

- There is no maximum age limit, which makes the scheme suitable for senior citizens as well. This wide eligibility makes it one of the most inclusive savings options available.

Account Opening Process

- Opening a Post Office RD account is straightforward. You need to visit your nearest post office with basic documents such as identity proof, address proof, and photographs. The initial deposit is made at the time of account opening.

- Many post offices also offer the option to link your RD account with a savings account, allowing automatic monthly deposits. This feature reduces the chances of missing installments and helps maintain consistency.

Premature Withdrawal Rules

The scheme allows premature withdrawal after completing three years from the date of account opening. While this option provides liquidity in emergencies, early withdrawal may slightly reduce the interest earned. It is advisable to keep the account active for the full tenure to enjoy maximum benefits. Premature withdrawal should be considered only when absolutely necessary.

Loan Facility on Post Office RD

One of the lesser-known benefits of the Post Office Recurring Deposit is the loan facility. After completing one year, account holders can take a loan of up to 50 percent of the balance in their RD account. This feature is helpful during short-term financial needs, as it allows you to access funds without closing the account or disturbing your long-term savings plan.

Taxation On Post Office RD

- Interest earned from a Post Office RD is fully taxable. It is added to your total income and taxed according to your income tax slab. Unlike some other small savings schemes, this RD does not offer deductions under Section 80C.

- Despite the lack of tax benefits, many investors still prefer this scheme due to its safety and assured returns. For individuals in lower tax brackets, the tax impact is relatively limited.

Why Post Office RD Is Still Relevant In 2026

In an era dominated by digital investments and volatile markets, the Post Office Recurring Deposit remains relevant because of its reliability. It offers peace of mind, guaranteed returns, and ease of access across the country. For people who value capital protection and steady growth, this scheme continues to be a trusted financial tool. It is especially suitable for conservative investors and those who are new to investing.

Ideal Financial Goals for Post Office RD

This scheme is well-suited for goals that are planned five years in advance. These may include saving for education, planned purchases, family events, or creating an emergency fund. Since the investment amount is fixed and returns are predictable, it becomes easier to align your savings with specific financial goals.

New Bank Offers for SBI, PNB, BOB, HDFC & Canara Account Holders — Check What’s Available

Common Mistakes to Avoid

One common mistake investor make is missing monthly deposits frequently, which leads to penalties and reduced returns. Another mistake is withdrawing the amount prematurely without a genuine need. Planning your monthly budget carefully and committing to the full tenure helps you get the most out of your Post Office Recurring Deposit.

FAQs on Post Office Recurring Deposit

Is Post Office Recurring Deposit safe for long-term savings?

Yes, it is backed by the Government of India and is considered one of the safest savings options.

Can I increase my monthly RD amount later?

No, the monthly deposit amount remains fixed once the account is opened.

What happens if I miss a monthly installment?

A small penalty is charged, but the account continues to remain active.

Is Post Office RD better than bank RD?

Post Office RD offers more security, while bank RDs may offer slightly higher interest rates.