The PAN Card New Rule is one of the most important financial updates Indian citizens need to pay attention to in 2026. If you use a PAN card for filing income tax, opening bank accounts, investing in mutual funds, trading in shares, or even for high-value purchases, these changes directly affect you. The government has tightened rules to make PAN a stronger and more reliable financial identity and ignoring these updates could lead to your PAN becoming unusable.

What makes the PAN Card New Rule especially important is that it impacts almost every working individual and business in the country. From Aadhaar linking to digital verification, the process around PAN cards has changed significantly. This article explains everything in simple terms so you know exactly what’s new, why it matters, and what actions you should take right away.

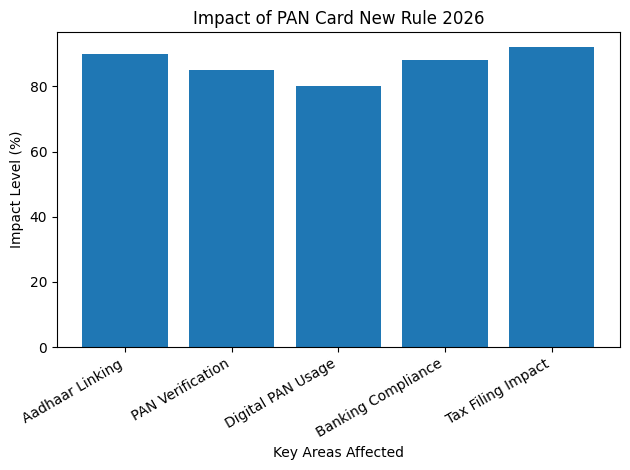

The PAN Card New Rule introduced for 2026 focuses on making PAN more secure, transparent, and digitally verified. The biggest change is stricter enforcement of Aadhaar linking, along with tighter checks by banks and financial institutions. PAN is no longer treated as just a tax number; it is now a core financial identity linked to multiple systems. Under these new rules, PAN cards that are not properly linked or verified may become inoperative. This means you could face issues while filing income tax returns, receiving refunds, or completing banking and investment-related transactions. The government’s goal is to ensure one person has only one PAN and that it is fully verified through Aadhaar.

PAN Card New Rule

| Key Aspect | Details |

|---|---|

| Aadhaar Linking | Mandatory for all PAN holders |

| PAN Status | Unlinked PAN may become inoperative |

| New PAN Issuance | Aadhaar authentication required |

| Digital PAN | e-PAN treated as fully valid |

| Financial Transactions | Stricter PAN verification |

| Penalties | Late linking may attract a fee |

The PAN Card New Rule is a major step toward a more transparent and secure financial system in India. While the changes may seem strict, they are designed to protect genuine users and eliminate misuse. By understanding the rules and taking timely action, PAN holders can avoid penalties and enjoy seamless access to financial services. Staying compliant today ensures peace of mind tomorrow.

Mandatory Aadhaar Linking

One of the most critical elements of the PAN Card New Rule is mandatory Aadhaar linking. While Aadhaar linking was encouraged earlier, it has now become compulsory. PAN cards not linked with Aadhaar within the specified deadline risk becoming inoperative. Linking PAN with Aadhaar helps eliminate duplicate and fake PAN cards. It also allows authorities to track financial activities more accurately. For users, the process is simple and can be completed online in a few minutes. However, even small mismatches in name, date of birth, or gender between PAN and Aadhaar can cause the linking to fail, so details must be checked carefully.

PAN Card Becoming Inoperative

A major concern under the PAN Card New Rule is the concept of an inoperative PAN. Once a PAN becomes inoperative, it cannot be used for most financial and tax-related activities. This includes filing income tax returns, opening new bank accounts, investing in financial products, or completing KYC verification. An inoperative PAN can also result in higher tax deductions on income and delays in receiving refunds. While reactivation is possible, it usually requires completing Aadhaar linking and paying a penalty. To avoid unnecessary trouble, PAN holders should ensure their PAN remains active at all times.

New PAN Card Application Rules

The PAN Card New Rule also changes how new PAN cards are issued. Aadhaar-based verification is now mandatory for most applicants. This means applicants must authenticate their identity using Aadhaar OTP or biometric verification. This change has made the PAN application process faster and more secure. It reduces paperwork, prevents misuse of identity documents, and ensures that PAN cards are issued only to genuine individuals. For first-time applicants, the process is now largely digital and user-friendly.

Digital PAN And E-PAN Importance

Digital PAN and e-PAN have gained much more importance under the PAN Card New Rule. An e-PAN is now considered just as valid as a physical PAN card. It can be downloaded online and used for KYC, banking, and investment purposes. The move toward digital PAN reduces dependency on physical documents and speeds up verification processes. Many banks and financial platforms now prefer digital PAN verification as it allows instant validation and reduces errors.

Impact On Banking and Financial Transactions

The PAN Card New Rule has significantly impacted how banks and financial institutions handle transactions. PAN verification has become stricter for opening accounts, applying for loans, investing in securities, and conducting high-value transactions. Banks may reject or delay transactions if PAN details are not updated or verified. This ensures that financial activities are traceable and compliant with regulations. While it may feel inconvenient initially, it ultimately creates a safer and more transparent financial system.

Penalties And Compliance Requirements

Non-compliance with the PAN Card New Rule can lead to penalties. If PAN is not linked with Aadhaar within the prescribed timeline, a late fee may be charged before the PAN can be reactivated. Until compliance is restored, users may face higher tax deductions and limited access to financial services. For businesses, non-compliance can result in operational delays, failed transactions, and regulatory issues. Staying compliant is far easier and cheaper than dealing with penalties later.

Who Needs to Be Extra Careful

While the PAN Card New Rule applies to everyone, certain groups need to be especially cautious. Salaried individuals, business owners, freelancers, investors, and professionals who regularly deal with financial transactions must ensure their PAN remains active and verified. Students and homemakers who use PAN for investments or savings accounts should also pay attention. Even if PAN usage is limited, keeping it compliant avoids future complications.

Steps To Stay Compliant with PAN Card New Rule

To avoid problems under the PAN Card New Rule, PAN holders should take a few simple steps. First, check whether PAN is linked with Aadhaar. Second, verify that personal details match across documents. Third, update any incorrect information immediately through official online portals. It is also advisable to keep a digital copy of your PAN and regularly check its status. Being proactive ensures uninterrupted access to financial services.

Why Government Introduced PAN Card New Rule

The PAN Card New Rule was introduced to improve transparency, reduce tax evasion, and prevent misuse of identity documents. By linking PAN with Aadhaar and strengthening digital verification, authorities can track financial activities more effectively. This move also aligns with India’s broader digital transformation goals. A unified and verified identity system helps build trust, improves compliance, and simplifies processes for both users and institutions.

Common Mistakes To Avoid

Many people assume that linking PAN once is enough, but mismatched details can still cause issues. Another common mistake is ignoring communication from banks or tax authorities regarding PAN status. Under the PAN Card New Rule, staying informed is crucial. Delaying updates or assuming the issue will resolve itself can result in PAN becoming inoperative. Simple checks and timely action can prevent most problems.

Unified Pension Scheme 2026: 7 Powerful Benefits That Can Secure Your Retirement

Future Of PAN Card System in India

The PAN Card New Rule signals a shift toward a fully digital and integrated financial identity system. In the future, PAN is expected to work seamlessly with banking, taxation, and investment platforms. Automation, real-time verification, and paperless processes will become the norm. For users, this means faster services, fewer errors, and better compliance tracking.

FAQs on PAN Card New Rule

What Is The PAN Card New Rule 2026

It focuses on mandatory Aadhaar linking, stricter verification, and digital validation of PAN cards.

What Happens If PAN Is Not Linked with Aadhaar

The PAN may become inoperative, restricting its use in financial and tax-related activities.

Is E-PAN Valid Under The New Rules

Yes, e-PAN is fully valid and accepted for KYC and financial transactions.

Can An Inoperative PAN Be Reactivated

Yes, by completing Aadhaar linking and paying the applicable fee.