For most people working in the unorganized sector, retirement planning is rarely discussed. Daily income covers daily needs, and long term security often takes a back seat. But things are slowly changing. With structured social security programs now linked to worker databases, retirement support is becoming more accessible. One such growing support system is E-Shram Pension Yojana 2026, which aims to provide steady monthly income after the age of 60.

If you are an informal worker, this is something you should understand clearly. The real strength of E-Shram Pension Yojana 2026 lies in its simplicity and affordability. It is built for workers who do not receive provident fund, gratuity, or employer pensions. With small monthly contributions and matching government support, workers can build a retirement cushion over time. In this guide, you will learn how E-Shram Pension Yojana 2026 works, who can apply, how much you contribute, how pension is calculated, and how to enroll correctly without confusion.

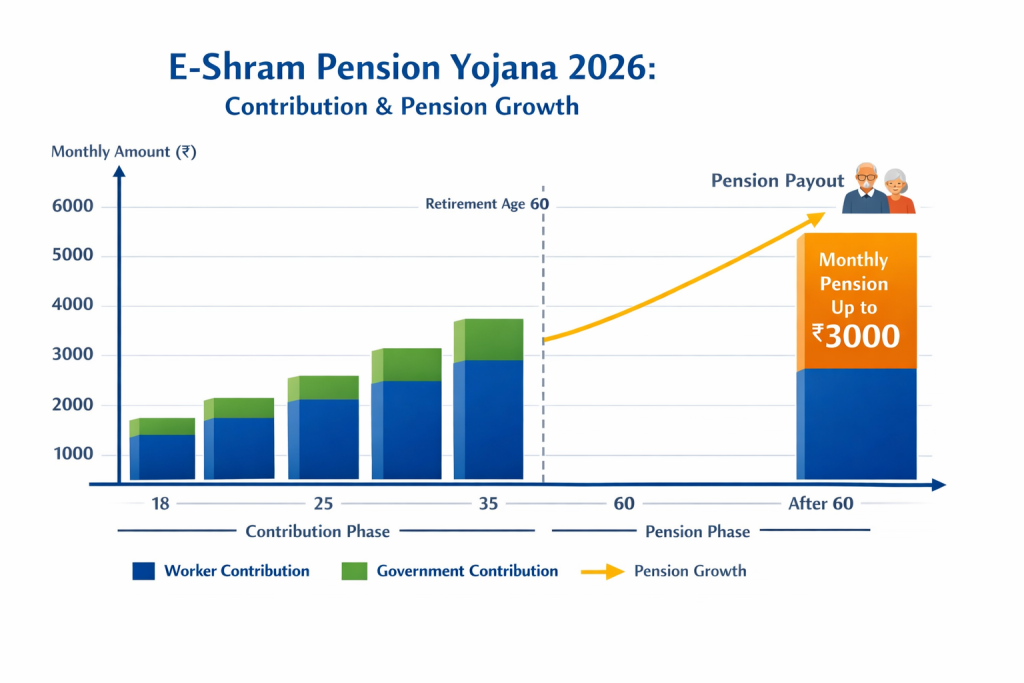

E-Shram Pension Yojana 2026 is a contribution-based retirement support model designed for unorganized sector workers registered under the national worker database. The scheme structure allows eligible workers between 18 and 40 years to contribute a fixed monthly amount until age 60 and receive up to ₹3000 per month as pension afterward. The government contributes an equal amount alongside the worker’s share, which doubles the effective savings each month. The system is Aadhaar linked, bank linked, portable across states, and designed for long term financial stability. For workers without formal retirement coverage, this creates a predictable post retirement income stream.

E-Shram Pension Yojana 2026

| Feature | Details |

|---|---|

| Scheme Name | E Shram Card Pension 2026 |

| Common Reference | E-Shram Pension Yojana 2026 |

| Target Group | Unorganized sector workers |

| Entry Age | 18 to 40 years |

| Pension Start Age | 60 years |

| Maximum Monthly Pension | Up to ₹3000 |

| Contribution Type | Monthly worker payment plus equal government share |

| Enrollment Mode | Online and service centers |

| Identity Requirement | Aadhaar linked |

| Payment Mode | Direct bank transfer |

| Portability | Valid across India |

What Is E Shram Pension Linked Benefit

- The pension linked benefit connected with worker registration is meant to convert informal income earners into retirement ready contributors. Instead of depending on uncertain assistance later, workers contribute small amounts regularly during their earning years.

- Under E-Shram Pension Yojana 2026, the pension amount is predefined based on the contribution track. If the worker continues payments without long gaps, the monthly pension after 60 can reach ₹3000. The structure rewards consistency and early joining. It is not a lottery or subsidy model. It is a disciplined co contribution pension path.

Who Can Apply for E-Shram Pension Yojana 2026

Eligibility is focused and clear so that the benefit reaches the right workers. You can enroll if all these apply to you:

- You work in the unorganized sector

- You are registered under E Shram

- Your age is between 18 and 40 at joining

- You are not an income tax payer

- You are not covered by EPF or ESIC

- You have Aadhaar

- You have a savings bank account

- Your mobile number is active

Workers such as laborers, helpers, vendors, drivers, domestic workers, agricultural workers, and gig workers are typically included under E-Shram Pension Yojana 2026 eligibility rules.

Contribution Structure Based On Age

The monthly contribution is not the same for everyone. It depends on the age when you join. This is done to balance the total contribution period.

Here is a simplified contribution pattern concept:

| Entry Age | Worker Monthly Contribution | Government Contribution |

|---|---|---|

| 18–20 | Lowest slab | Equal match |

| 21–30 | Moderate slab | Equal match |

| 31–35 | Higher slab | Equal match |

| 36–40 | Highest slab | Equal match |

The later you join, the higher your monthly share because you contribute for fewer years. In E-Shram Pension Yojana 2026, the government always contributes the same amount you contribute, which significantly improves total retirement value.

How Pension Is Paid After Sixty

Once the subscriber turns 60, the contribution phase stops and the pension phase begins. There is usually no complicated claim filing if records are correct.

Pension payment features include:

- Monthly fixed pension credit

- Direct transfer to bank account

- Continues for lifetime

- Can go up to ₹3000 per month

- Spouse may receive partial pension after death

This makes E-Shram Pension Yojana 2026 similar in behavior to formal pension systems, but adapted for informal workers.

Documents Required For E-Shram Pension Yojana 2026 Enrollment

The scheme is designed to stay accessible and low paperwork. Most workers can enroll with basic documents.

Required items usually include:

- Aadhaar card

- Savings bank account

- Mobile number

- E Shram registration record

- Basic personal details

Because verification is Aadhaar based, physical documents are minimal. That removes a major barrier for rural and migrant workers under E-Shram Pension Yojana 2026.

Step By Step Application Process for E-Shram Pension Yojana 2026

Enrollment can be done online or through assisted centers. The process is designed to be user friendly.

Typical steps are:

- Register on E Shram portal

- Confirm Aadhaar and bank linkage

- Open pension enrollment page or visit service center

- Enter personal and age details

- System shows contribution amount

- Approve bank auto debit

- Verify through OTP

- Receive enrollment confirmation

Service centers are especially helpful for workers who are not comfortable with online forms.

Key Benefits For Unorganized Workers

The scheme offers practical long term advantages rather than short term relief.

Main benefits include:

- Guaranteed retirement income stream

- Government matching contribution

- Affordable monthly payments

- No employer dependency

- Portable across states and jobs

- Direct bank credit

- Simple joining process

For many workers, E-Shram Pension Yojana 2026 becomes the first structured retirement plan in their life.

Portability And Continuity Advantage

- One major strength is portability. Informal workers often change cities and job types. This scheme is not tied to one employer or one state.

- Because the account is Aadhaar linked and bank linked, your contribution record continues even if you migrate for work. That makes E-Shram Pension Yojana 2026 suitable for migrant laborers and gig workers.

Common Mistakes That Reduce Pension Value

Small mistakes can damage long term benefits. Many workers ignore these points:

- Letting bank auto debit fail repeatedly

- Changing mobile number without update

- Incorrect Aadhaar details

- Duplicate registrations

- Stopping contributions for long periods

In E-Shram Pension Yojana 2026, contribution discipline directly affects pension outcome. Treat it like a mandatory monthly bill.

Practical Tips Before Joining

Before enrolling, keep these practical tips in mind:

- Join as early as possible to reduce monthly contribution

- Use a bank account with regular balance

- Keep Aadhaar and mobile linked

- Avoid middlemen asking for large fees

- Check contribution debit messages monthly

Early joining gives maximum advantage in E-Shram Pension Yojana 2026 because the cost is spread over more years.

Ladli Behn Yojana 32nd Installment Date – ₹1,500 Payment Starts for Women Check District-Wise Status

Why This Matters In Current Times

The workforce pattern is changing fast. Gig work, contract work, and informal labor are growing. Traditional employer pensions are shrinking outside government and large corporations. That makes worker funded and government supported pension models more important than ever. E-Shram Pension Yojana 2026 fills a critical gap by giving informal workers a structured retirement pathway. It turns small monthly discipline into long term financial dignity.

FAQs on E-Shram Pension Yojana 2026

Is E-Shram Pension Yojana 2026 Only for Labor Workers

No. It is for all eligible unorganized sector workers including vendors, drivers, helpers, gig workers, and domestic workers.

Do I Need to Contribute Every Month

Yes. Regular monthly contribution is required to receive full pension benefits.

Can I Join After Forty Years Of Age

No. Entry is generally restricted to workers between 18 and 40 years old.

Is The Government Contribution Guaranteed

Yes. The government contributes an equal matching share along with your monthly contribution as per scheme rules.