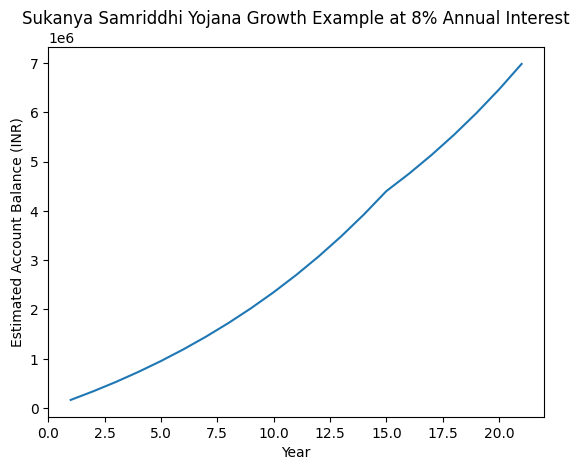

Every parent wants financial security for their daughter’s future, but knowing where to invest safely and wisely can feel confusing. With rising education costs and life expenses, choosing a long term savings plan is more important than ever. That’s why many families are actively reviewing Sukanya Samriddhi Yojana 2026 updates and checking how the latest interest rate changes affect their savings goals.

The scheme is built specifically for girl children and is designed to reward disciplined investing over time. Because Sukanya Samriddhi Yojana 2026 combines safety, compounding, and tax benefits, it continues to attract attention from parents who prefer low risk and predictable growth. If your goal is secure, government backed returns with structured rules and strong long term value, this guide will walk you through everything that matters. From eligibility to deposits, withdrawals to maturity, and the newest rate outlook, here is the complete, practical breakdown you can actually use.

Sukanya Samriddhi Yojana 2026 remains one of the highest yielding small savings options available to parents of girl children. The interest rate is declared quarterly and compounded annually, which helps long term investors benefit from growth on growth. The structure is simple: invest every year within the allowed range for 15 years and let the account run for 21 years. The maturity amount can be used for higher education or marriage expenses. Because of tax deductions under Section 80C and tax free maturity proceeds, many families include Sukanya Samriddhi Yojana 2026 in their child education planning portfolio along with PPF and other fixed income tools.

Sukanya Samriddhi Yojana 2026

| Feature | Details |

|---|---|

| Scheme Type | Government small savings scheme |

| Beneficiary | Girl child only |

| Account Opening Age | Before 10 years |

| Minimum Yearly Deposit | ₹250 |

| Maximum Yearly Deposit | ₹1.5 lakh |

| Interest Rate | Revised quarterly |

| Current Rate Range | Around 8 percent plus |

| Compounding | Annual |

| Deposit Period | 15 years |

| Total Tenure | 21 years from opening |

| Partial Withdrawal | Up to 50 percent after age 18 |

| Tax Deduction | Section 80C |

| Tax On Returns | Tax free if conditions met |

| Account Locations | Post office and authorized banks |

What Is Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana is a long term savings scheme created specifically to support the financial future of a girl child. It encourages families to build a dedicated fund instead of depending on loans later. The account is opened in the child’s name, and a parent or guardian manages it until she becomes an adult. Unlike market investments, this scheme is not affected by stock market ups and downs. Returns are declared by the government and credited annually. That makes it especially suitable for conservative investors who want stability. For parents comparing safe investment options for daughters, Sukanya Samriddhi Yojana 2026 stands out because of its focused purpose and structured benefits.

Sukanya Samriddhi Yojana Interest Rate

- Interest rate is the most watched feature of this scheme. It is reviewed every quarter and announced officially. Historically, the rate has stayed higher than many bank fixed deposits and even some other small savings plans.

- The latest rate heading into Sukanya Samriddhi Yojana 2026 remains above 8 percent annually with yearly compounding. Over a long horizon, compounding makes a major difference. Parents who invest regularly and early benefit the most. Even small yearly increases in contribution can significantly raise the maturity value. Because the rate can change, it is smart to check quarterly updates and align your yearly deposit timing accordingly.

Who Is Eligible To Open The Account

The eligibility rules are strict but simple, ensuring the benefit is used for its intended purpose.

Key eligibility conditions:

- Only a girl child can have the account

- The account must be opened before she turns 10

- Only one account per girl child is allowed

- A family can open accounts for two daughters

- Exception cases for twins or triplets may be approved with proof

The account must be opened by a parent or legal guardian. Proper documents are required to verify identity and date of birth.

Minimum And Maximum Deposit

One strong advantage of Sukanya Samriddhi Yojana 2026 is deposit flexibility within limits. It allows both small and large yearly contributions.

Deposit structure:

- Minimum deposit per year is ₹250

- Maximum deposit per year is ₹1.5 lakh

- Deposits can be made in multiple installments

- Contributions are required only for the first 15 years

If the minimum amount is not deposited in any year, the account becomes inactive. However, it can be revived later by paying a small penalty and the required minimum contribution. Many parents automate deposits to maintain continuity.

Account Tenure and Maturity

The account runs for 21 years from the opening date, but you only invest for 15 years. After that, no further deposits are needed, and the balance continues earning interest.

Maturity rules include:

- Full maturity at 21 years

- Early closure allowed for marriage after age 18

- Documentation required for early closure

This timeline aligns well with higher education and marriage planning, which is why Sukanya Samriddhi Yojana 2026 is often used as a goal-based savings tool.

Partial Withdrawal Rules

Although this is a long term scheme, partial withdrawal is allowed for education needs.

Withdrawal conditions:

- Girl child must be at least 18 years old

- Up to 50 percent of balance can be withdrawn

- Must be used for higher education expenses

- Can be taken in stages within limits

This feature makes the scheme practical, since education costs usually begin before full maturity.

Tax Benefits of Sukanya Samriddhi Yojana

Tax treatment is one of the biggest strengths of this scheme. It qualifies under the exempt exempt exempt category.

Tax advantages include:

- Deposits qualify for Section 80C deduction

- Interest earned is tax free

- Maturity amount is tax free

For families planning tax saving investments along with child future funds, Sukanya Samriddhi Yojana 2026 offers dual benefit.

Where To Open the Account

Opening an account is straightforward and widely accessible.

You can open it at:

- Post offices across India

- Authorized public sector banks

- Selected private banks

You need the child’s birth certificate, guardian identity proof, and address proof. Once opened, deposits can usually be made through branch visits or linked banking channels.

Free Sauchalay Yojana 2026: Get ₹12,000 for Toilet — Apply Online Now

Why Parents Should Review Sukanya Samriddhi Yojana 2026 Now

Interest rates, education costs, and financial goals change over time. That is why periodic review matters. Parents using Sukanya Samriddhi Yojana 2026 should check whether they are depositing close to the maximum limit and whether the scheme still fits their broader financial plan.

A quick annual review helps you:

- Adjust contribution amounts

- Track interest rate changes

- Estimate maturity value

- Align with education timelines

Small adjustments today can lead to a much larger fund later.

FAQs on Sukanya Samriddhi Yojana 2026

Is Sukanya Samriddhi Yojana 2026 Good for Long Term Child Planning

Yes. It is designed specifically for long term goals like higher education and marriage and offers strong compounding with government backed safety.

How Many Years Do I Need To Deposit Money

You need to deposit for 15 years. The account continues earning interest until 21 years from opening.

Can I Deposit More Than the Maximum Limit

No. Deposits above ₹1.5 lakh per year are not accepted under scheme rules.

What Happens If I Miss A Deposit Year

The account becomes inactive but can be reactivated by paying a small penalty and minimum deposit.