For decades, post office saving schemes have been deeply woven into the financial habits of Indian households. They are trusted, familiar, and backed by the government, which makes them feel like the safest possible option. Even in 2026, whenever people think about low-risk investments, post office fixed deposits and the National Savings Certificate are often the first names that come to mind.

This is exactly why the Post Office FD Scheme Update has become such an important topic for investors today. The Post Office FD Scheme Update matters now more than ever because the financial landscape has changed significantly. Inflation is persistent, investors are more aware, and alternative investment options are easily accessible. Safety is still important, but it is no longer the only deciding factor. Returns, liquidity, and tax efficiency now play a much bigger role. This raises a genuine question: are Post Office FD and National Savings Certificate schemes still the smartest choice in 2026?

The Post Office FD Scheme Update highlights how these traditional savings products are currently positioned. Post Office Fixed Deposits and National Savings Certificates continue to offer guaranteed returns with almost zero risk. This makes them especially attractive to conservative investors, retirees, and those who cannot afford to take market-related risks. However, the update also reveals the limitations of these schemes. Interest rates are revised periodically and are closely aligned with government policies rather than market demand. This ensures stability but limits growth potential. While private banks and financial institutions actively adjust their rates to stay competitive, post office schemes move slowly. As a result, investors often find themselves locked into returns that may no longer be attractive when compared to newer options.

Post Office FD Scheme Update

| Feature | Post Office Fixed Deposit | National Savings Certificate |

|---|---|---|

| Investment Duration | 1, 2, 3, or 5 years | 5 years |

| Return Type | Fixed | Fixed |

| Capital Safety | Very high | Very high |

| Liquidity | Limited | Very limited |

| Tax Saving Eligibility | Only 5-year FD | Eligible |

| Interest Taxation | Fully taxable | Taxable |

The Post Office FD Scheme Update clearly shows that while post office fixed deposits and National Savings Certificate schemes remain safe and reliable, they are no longer the best all-round investment choice in 2026. Inflation, taxation, limited liquidity, and stronger competition from alternative instruments have reduced their overall appeal. Modern investors need strategies that combine stability with growth. Post office schemes can still play a role, but only as part of a diversified portfolio. Making informed decisions based on goals, time horizon, and risk tolerance is far more important than relying solely on tradition. In 2026, smart investing is about balance, not just safety.

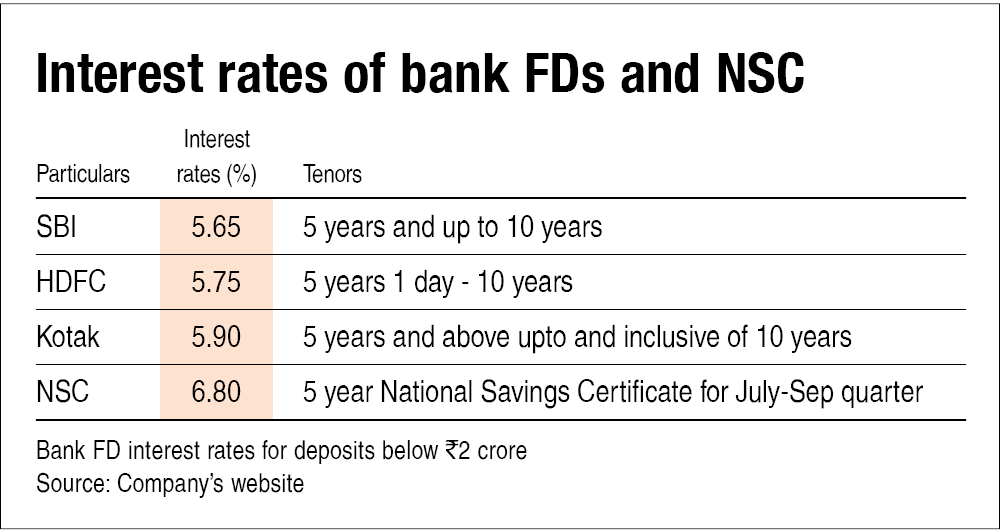

Changing Interest Rate Scenario

One of the most important elements of the Post Office FD Scheme Update is the changing interest rate environment. Over the past few years, banks and private financial institutions have aggressively revised their fixed deposit rates to attract customers. Many offer higher rates, especially for senior citizens or limited-period schemes. In contrast, post office FD rates tend to remain stable for longer periods. While this stability provides predictability, it also means investors may miss out on better earning opportunities. In a time when inflation is eating into purchasing power, earning slightly lower returns can have a long-term impact on savings. For investors who want their money to grow meaningfully, this stability may feel more like stagnation.

Lock In Period And Liquidity Issues

Liquidity is one of the biggest concerns highlighted by the Post Office FD Scheme Update. National Savings Certificate comes with a strict five-year lock-in period. Once invested, the funds are not easily accessible. This can be problematic if an investor faces an unexpected financial emergency. Post office fixed deposits offer some flexibility, but premature withdrawals often result in penalties or reduced interest earnings. In today’s fast-changing world, financial needs are rarely predictable. Investors value flexibility more than ever, and rigid lock-in periods can be a serious drawback. Compared to modern financial products that allow partial withdrawals or easy exits, post office schemes appear inflexible.

Taxation And Its Impact On Returns

Taxation plays a crucial role in determining actual returns, and this is a key aspect of the Post Office FD Scheme Update. Interest earned on post office fixed deposits is fully taxable according to the investor’s income tax slab. This reduces net returns, especially for individuals in higher tax brackets. National Savings Certificate does offer tax benefits on the invested amount, but the interest earned is still taxable. Over time, this tax liability can significantly reduce the effective yield. When investors calculate post-tax returns, many realize that other instruments may offer better outcomes even with slightly higher risk.

Inflation And Real Return Concerns

Inflation is often underestimated by conservative investors. The Post Office FD Scheme Update makes it clear that fixed-return instruments struggle to deliver strong real returns when inflation remains high. Real return is what actually matters, not just the interest rate printed on paper. If inflation averages close to or above the interest earned, the purchasing power of savings barely improves. This becomes especially concerning for long-term goals such as retirement or education planning. Relying entirely on fixed deposits and NSC may protect capital, but it may not protect future lifestyle needs.

Competition From Modern Investment Options

The investment ecosystem in 2026 is far more diverse and competitive than before. The Post Office FD Scheme Update must be evaluated alongside the growing number of alternatives available to investors. Bank fixed deposits, corporate deposits, debt mutual funds, hybrid funds, and even conservative equity investments are increasingly popular. Many of these options offer better liquidity, higher potential returns, or improved tax efficiency. While they may involve slightly higher risk, they often provide a better balance between safety and growth. As awareness increases, investors are becoming more comfortable exploring these alternatives instead of sticking only to traditional schemes.

Suitability For Different Types Of Investors

The Post Office FD Scheme Update does not suggest that these schemes are useless. Instead, it shows that they are suitable only for specific types of investors. For senior citizens, risk-averse individuals, or those with short-term goals, post office FD and NSC can still be appropriate. However, younger investors or those planning for long-term wealth creation may find these schemes limiting. Fixed returns and long lock-in periods can restrict growth. For such investors, post office schemes should ideally be used as a stabilizing element rather than the main investment vehicle.

National Savings Certificate In 2026

National Savings Certificate continues to attract disciplined savers who want guaranteed returns and tax benefits. According to the Post Office FD Scheme Update, NSC remains relevant for individuals who can lock away funds for five years without needing liquidity. That said, NSC lacks flexibility and does not offer growth beyond its fixed rate. In a rapidly evolving economy, this can be a disadvantage. Investors aiming for higher long-term returns may find NSC insufficient as a standalone option.

Ladli Behn Yojana 32nd Installment Date – ₹1,500 Payment Starts for Women Check District-Wise Status

When Post Office FD Still Makes Sense

Post office fixed deposits still have their place in 2026. The Post Office FD Scheme Update confirms that they are ideal for parking money safely for short or medium durations. They are particularly useful for emergency funds or surplus cash that should not be exposed to risk. However, committing a large portion of one’s savings to post office FD without considering diversification can limit financial progress. A balanced approach is far more effective in meeting both safety and growth objectives.

FAQs on Post Office FD Scheme Update

Is Post Office FD Safe In 2026

Yes, Post Office Fixed Deposits remain one of the safest investment options in 2026 because they are backed by the government.

What Is the Current Interest Rate Under the Post Office FD Scheme Update

Interest rates vary based on tenure, but they generally fall in the range of medium single-digit returns.

Is National Savings Certificate Better Than Post Office FD

National Savings Certificate offers tax benefits under Section 80C and slightly higher fixed returns, but it comes with a strict five-year lock-in period.

Are Returns from Post Office FD and NSC Taxable

Yes, interest earned from both Post Office Fixed Deposits and National Savings Certificate is taxable according to the investor’s income tax slab, which can reduce actual returns.