Saving money is not just about putting cash aside, it’s about choosing the right place so your money grows safely. In recent years, many people have moved away from risky investments and returned to trusted savings options. This is where Post Office FD 2026 comes into the picture. It combines stability, guaranteed returns, and government backing, making it a popular choice for cautious investors.

If you are thinking about investing a small amount like ₹10,000 and want to know exactly what it will turn into after one year, this article will give you a clear and honest answer. We will also explore interest rates, rules, benefits, and who should consider this scheme in 2026. The Post Office FD 2026 scheme is a fixed deposit option offered through India Post. It allows individuals to invest their savings for a fixed period at a predetermined interest rate. Once you invest, the rate remains locked for the entire tenure, which means there are no surprises later.

This scheme is designed for people who prefer safety over high-risk returns. Since it is backed by the Government of India, it carries almost zero risk. You don’t need to worry about market ups and downs, economic slowdowns, or bank failures. Your capital stays protected, and you earn steady interest. One of the key reasons Post Office FD remains relevant even in 2026 is its simplicity. There are no complex conditions, no hidden charges, and no confusing calculations. Anyone—from a first-time investor to a retiree can understand and use this scheme comfortably.

Post Office FD 2026 Overview Table

| Feature | Details |

|---|---|

| Scheme Type | Fixed Deposit |

| Interest Rate (1 Year) | Around 6.9% Per Year |

| Compounding Method | Quarterly |

| Interest Payment | Annually |

| Minimum Investment | ₹1,000 |

| Maximum Investment | No Upper Limit |

| Risk Level | Very Low |

| Government Guarantee | Yes |

| Premature Withdrawal | Allowed After 6 Months |

| Tax Benefit | Only On 5-Year FD |

Post Office FD 2026 continues to be a strong and reliable savings option for people who value security and predictable returns. Investing ₹10,000 for one year may not make you rich overnight, but it guarantees steady growth without any stress. If your goal is to protect your capital, earn assured interest, and avoid market risks, Post Office FD deserves serious consideration in your financial plan.

Why Post Office FD Is Considered One Of The Safest Investments

Safety is the biggest reason why people choose Post Office fixed deposits. Unlike shares, mutual funds, or cryptocurrencies, Post Office FD does not depend on market performance. The returns are fixed and guaranteed. In times when inflation, interest rate changes, and global economic issues create uncertainty, investors prefer instruments where their principal is fully secure. Post Office FD 2026 meets this requirement perfectly. Since the government itself stands behind the scheme, the risk of default is practically nonexistent. This makes it especially suitable for senior citizens, salaried individuals saving for short-term goals, and families looking to park emergency funds safely.

Current Interest Rates Under Post Office FD 2026

Interest rates under Post Office FD depend on the tenure you choose. The rates are reviewed periodically but remain fixed once you invest. As of 2026, the approximate interest rates are one-year FD around 6.9 percent per annum, two-year FD around 7.0 percent, three-year FD around 7.1 percent, and five-year FD around 7.5 percent. Among these, the one-year FD is the most popular for short-term investors who want decent returns without locking their money for too long.

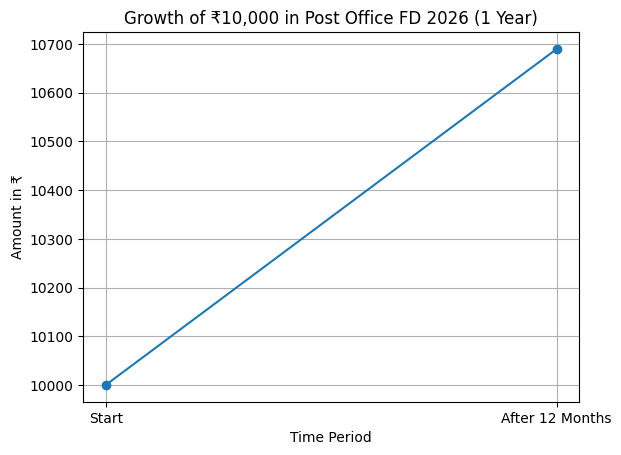

How Much ₹10,000 Becomes After 12 Months

Now let’s answer the most important question. Suppose you invest ₹10,000 in a one-year Post Office FD at an interest rate of about 6.9 percent. Since the interest is compounded quarterly but paid annually, your money grows steadily throughout the year. At the end of 12 months, your ₹10,000 becomes approximately ₹10,690. This means you earn around ₹690 as interest in one year. While the amount may not look huge, it is completely risk-free and guaranteed. For many investors, this peace of mind matters more than chasing higher but uncertain returns.

Understanding Compounding In Simple Terms

Compounding simply means earning interest on interest. In Post Office FD, interest is compounded quarterly. This allows your money to grow slightly faster compared to simple interest. Even though the interest is paid once a year, the quarterly compounding ensures that the interest earned during earlier months also earns interest. Over longer tenures, this effect becomes more noticeable, especially in three-year and five-year deposits.

Tenure Options and Their Benefits in Post Office FD 2026

Post Office FD offers four tenure options: one year, two years, three years, and five years. Each tenure serves a different financial purpose. A one-year FD is suitable for short-term savings or emergency funds. Two and three-year FDs work well for medium-term goals like buying a vehicle or planning a vacation. The five-year FD is ideal for long-term savers and also offers tax benefits. Many investors use a mix of different tenures to balance liquidity and returns.

Tax Rules on Post Office FD 2026 You Should Know

Taxation is an important factor while choosing any investment. In Post Office FD, the interest you earn is taxable according to your income tax slab. However, there is no TDS deducted by the post office. This gives you more control, but you must remember to declare the interest income while filing your tax return. Only the five-year Post Office FD qualifies for tax deduction under Section 80C. One-year, two-year, and three-year FDs do not offer tax-saving benefits.

Premature Withdrawal Rules For Post Office FD 2026

Post Office FD provides flexibility in case you need your money earlier than planned. Premature withdrawal is allowed after six months from the date of deposit. If you withdraw between six months and one year, you may receive interest at a reduced rate. This rule encourages investors to stay invested for the full tenure while still offering some liquidity when needed.

Post Office FD Vs Bank FD

When comparing Post Office FD with bank FD, the biggest difference is safety. While bank FDs are generally safe, Post Office FD carries a direct government guarantee. Interest rates in Post Office FD are often comparable to or slightly better than many public sector bank FDs. However, banks may offer better digital access and quicker online services. For investors who prioritize security over convenience, Post Office FD 2026 often comes out ahead.

Who Should Invest in Post Office FD 2026

Post Office FD is not meant for everyone, but it is perfect for certain types of investors. It is ideal for people who want guaranteed returns, those who are close to retirement, conservative investors, and individuals saving for short-term or medium-term goals. It also works well for people who do not want to actively monitor their investments. If you are looking for aggressive growth, this may not be the right option. But if stability is your priority, Post Office FD fits well.

Mudra Loan Subsidy 2026 – Get Loans Up to ₹50 Lakh With 35% Government Subsidy, Apply Online

Common Mistakes To Avoid

Many investors make the mistake of investing all their savings in one place. While Post Office FD is safe, diversification is still important. Another mistake is ignoring tax implications. Since interest is taxable, it’s important to plan your investments based on your tax slab. Also, always choose the tenure based on your financial needs rather than just interest rates.

FAQs on Post Office FD 2026

Is Post Office FD 2026 Better Than Bank FD?

Post Office FD offers higher safety due to government backing. Bank FDs may offer convenience, but Post Office FD is considered more secure.

Can I Invest More Than ₹10,000?

Yes, there is no maximum limit. You can invest any amount as long as it is at least ₹1,000.

Is The Interest Rate Fixed For The Entire Tenure?

Yes, once you invest, the interest rate remains the same for the full duration of your FD.

Can I Hold Multiple Post Office FDs?

Yes, you can open multiple fixed deposits under Post Office FD 2026 without any restriction.