Cheques may feel old-school in a world dominated by UPI and instant transfers, but they still play a major role in India’s financial system. From business payments and rental agreements to school fees and security deposits, cheques are widely used where trust, documentation, and delayed payments matter.

That’s exactly why the Cheque Bounce New Rule 2026 has grabbed so much attention. The rules around cheque dishonour have become stricter, clearer, and far less forgiving for negligence. Under the Cheque Bounce New Rule 2026, issuing a cheque without sufficient balance is no longer seen as a casual mistake. Banks, courts, and regulators are aligned on one message: if you write a cheque, you must honor it. With penalties going up to ₹10,000 and faster legal processes, cheque users need to be more alert than ever.

The Cheque Bounce New Rule 2026 is not a brand-new law but a stronger enforcement and interpretation of existing cheque dishonour provisions. Authorities observed that cheque bounce cases were clogging courts and causing unnecessary financial distress, especially for small businesses and individuals who rely on timely payments. To fix this, the rules now emphasize quicker accountability, defined penalties, and reduced tolerance for repeat defaulters. Courts are encouraged to impose structured fines, including fixed penalties in smaller cases, instead of prolonged litigation. Banks, on their part, have improved monitoring systems and customer alerts to reduce “I didn’t know” excuses. The goal is simple: make cheque payments reliable again.

Cheque Bounce New Rule 2026

| Category | Key Details |

|---|---|

| Governing Law | Negotiable Instruments Act |

| Section Applied | Section 138 |

| Maximum Monetary Penalty | ₹10,000 or up to twice the cheque amount |

| Possible Imprisonment | Up to 2 years |

| Cheque Validity | 3 months from issue date |

| Legal Notice Timeline | Within 30 days of bounce |

| Payment Grace Period | 15 days after notice |

| Bank Bounce Charges | Varies by bank |

| Applicable To | Individuals and businesses |

The Cheque Bounce New Rule 2026 sends a clear signal: cheques are a commitment, not a casual promise. With defined penalties, faster processes, and stricter enforcement, both individuals and businesses must treat cheque issuance seriously. If you still rely on cheques, 2026 is the year to become more careful, more informed, and more responsible. A little attention today can save you from financial loss, legal trouble, and stress tomorrow.

What Is a Cheque Bounce and Why It Matters

A cheque bounce happens when the bank refuses to process a cheque and returns it unpaid. The most common reason is insufficient funds, but it can also happen due to signature mismatch, overwriting, incorrect date, or expired validity. Under the Cheque Bounce New Rule 2026, the reason behind the bounce matters less than the responsibility of the issuer. Even technical errors can land you in trouble if negligence is proven. For the receiver, a bounced cheque can disrupt cash flow and business planning. For the issuer, it can escalate into legal action, fines, and long-term reputational damage. This is why cheque discipline has become a serious matter in 2026.

Legal Framework Behind Cheque Bounce Cases

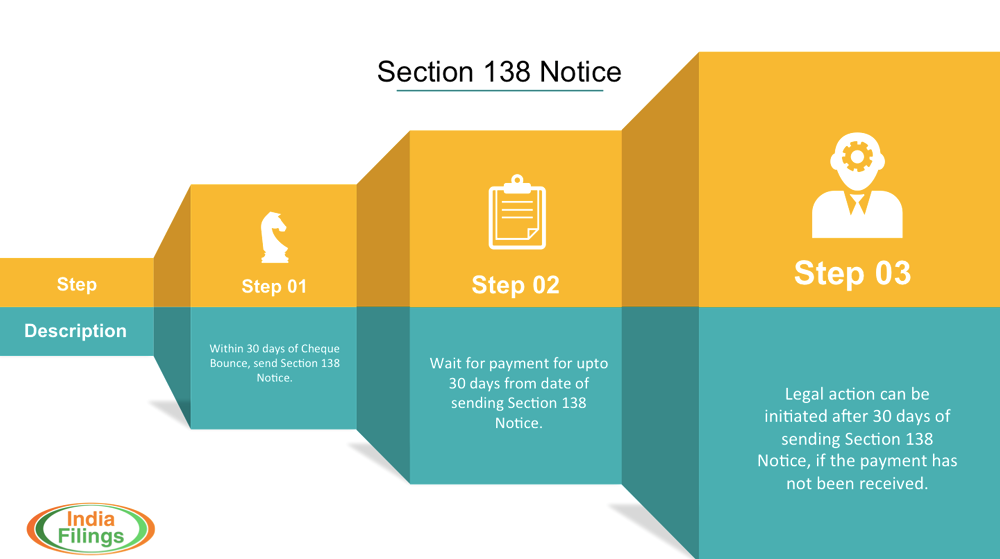

Cheque dishonour is treated as a criminal offence under Indian law when certain conditions are met. The process starts with the cheque being returned unpaid and ends, in extreme cases, with court-ordered penalties or imprisonment. The Cheque Bounce New Rule 2026 reinforces the importance of timelines in this process. If the recipient fails to send a legal notice within the allowed period, the case weakens. If the issuer ignores the notice, the consequences intensify. This structured approach protects genuine mistakes while penalizing deliberate or repeated defaults.

Penalty Structure Under the New Rule

One of the most discussed aspects of the Cheque Bounce New Rule 2026 is the clearer penalty framework. Courts now have more guidance on imposing fines without unnecessary delays. Penalties may include a fixed monetary penalty up to ₹10,000, compensation to the cheque recipient, a fine up to twice the cheque amount, and imprisonment in severe or repeat cases. The introduction of a fixed upper penalty helps reduce uncertainty, especially in low-value disputes, and encourages quicker settlements.

Bank Charges vs Legal Penalties

Many cheque users mistakenly believe that paying bank bounce charges settles the matter. In reality, bank charges and legal penalties are completely different. Bank charges are administrative fees deducted immediately when a cheque bounces. Legal penalties arise only when the recipient pursues legal action. Under the Cheque Bounce New Rule 2026, ignoring a legal notice is the turning point that transforms a simple bounce into a criminal case. Understanding this difference can help you act at the right time and avoid escalation.

Step By Step Process After a Cheque Bounces

Once a cheque is dishonoured, the bank issues a return memo stating the reason. The recipient must then decide whether to pursue recovery. The next step is sending a legal notice within 30 days, demanding payment. The issuer has 15 days to clear the dues. If payment is made, the issue usually ends there. If not, the recipient can approach the court. The Cheque Bounce New Rule 2026 promotes early resolution to avoid unnecessary court cases, benefiting both parties.

Why The Cheque Bounce New Rule 2026 Matters For Businesses

For businesses, cheques are often tied to invoices, contracts, and scheduled payments. A bounced cheque can affect supplier relationships and operational cash flow. The Cheque Bounce New Rule 2026 provides stronger protection to businesses by discouraging casual defaults. It also pushes companies to improve internal payment checks before issuing cheques. Small businesses, in particular, benefit from faster recovery and clearer penalties.

Impact On Individuals And Salaried Employees

Individuals often issue cheques for rent, loans, school fees, or personal obligations. Many assume a single mistake won’t matter. In 2026, that assumption is risky. Under the Cheque Bounce New Rule 2026, even a one-time lapse can lead to legal stress if not resolved promptly. Salaried employees must ensure adequate balance and accurate cheque details, especially with post-dated cheques.

How Banks Are Enforcing the New Rules

Banks now play a proactive role in reducing cheque bounce cases. Improved SMS and app alerts notify customers immediately after a cheque is dishonoured. Some banks track repeat offenders and may restrict cheque book issuance. These steps align with the Cheque Bounce New Rule 2026, which focuses on prevention as much as punishment.

How To Avoid Cheque Bounce Problems

Avoiding issues under the Cheque Bounce New Rule 2026 is mostly about discipline. Maintain sufficient balance before issuing a cheque, avoid post-dated cheques unless funds are guaranteed, double-check signatures, dates, and amounts, respond immediately to bounce alerts or legal notices, and keep written records of settlements. Simple habits can prevent serious consequences.

Pension Update 2026 – Widow, Senior Citizen & Disabled Pension Hike Talked About, What’s Changing?

Common Myths About Cheque Bounce Cases

Many people believe cheque bounce cases automatically lead to jail. That’s not true. Imprisonment is usually reserved for repeated or intentional defaults. Another myth is that verbal promises after a bounce are enough. Under the Cheque Bounce New Rule 2026, only actual payment within the notice period can stop legal action.

FAQs on Cheque Bounce New Rule 2026

What Is The Cheque Bounce New Rule 2026?

It refers to stricter enforcement and clearer penalties for cheque dishonour, including fines up to ₹10,000.

Is The ₹10,000 Penalty Mandatory in All Cases?

No, it is an upper limit. Courts decide penalties based on the case and cheque amount.

Can I Avoid Court If My Cheque Bounces?

Yes, paying the amount within the legal notice period usually prevents court proceedings.

Does A Cheque Bounce Affect My Banking Profile?

Repeated bounces can affect trust with banks and future credit approvals.

Are Digital Payments Replacing Cheques Completely?

No, cheques are still widely used for formal and high-value transactions.