Goat farming has quietly become one of the most dependable income sources for rural India. With rising demand for goat meat, milk, and breeding stock, more farmers are now looking at livestock as a serious business rather than a side activity. To support this shift, the government has introduced and expanded the Bakri Palan Yojana 2026, a scheme that focuses on providing financial assistance to people who want to start or scale goat farming.

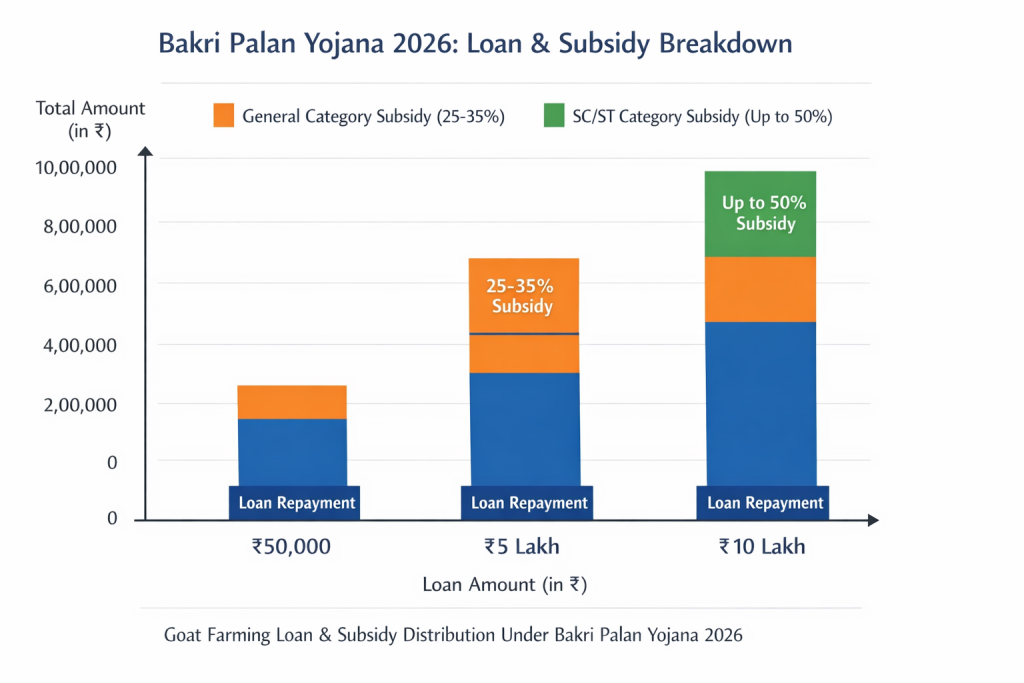

This scheme is especially attractive because it combines bank loans with subsidies, making the initial investment much more affordable. Under the Bakri Palan Yojana 2026, individuals can access loans ranging from ₹50,000 to ₹10 lakh depending on the size of their project. The scheme is designed to support small farmers, rural youth, women entrepreneurs, and unemployed individuals who want a stable source of income. With proper planning and basic knowledge, goat farming under this scheme can become a long-term, sustainable business rather than a risky venture.

The Bakri Palan Yojana 2026 is not just a single loan scheme but a broad initiative that works through banks and livestock development programs. Its main objective is to encourage goat rearing as a self-employment opportunity and improve rural livelihoods. Goat farming is considered low-risk because goats require less space, adapt easily to local climates, and reproduce quickly. These qualities make the business suitable even for people with limited land and resources. Through this yojana, farmers can get financial support for purchasing goats, constructing sheds, arranging feed, and managing healthcare expenses. Subsidies play a crucial role in reducing the overall financial burden, especially for applicants from weaker sections of society. With proper execution, the scheme helps farmers generate regular income while contributing to the growth of the livestock sector.

Bakri Palan Yojana 2026 Overview Table

| Details | Information |

|---|---|

| Scheme Name | Bakri Palan Yojana 2026 |

| Loan Amount | ₹50,000 to ₹10,00,000 |

| Interest Rate | As per bank norms |

| Subsidy Range | 25% to 50% (category based) |

| Eligible Age | 18 years and above |

| Target Beneficiaries | Farmers, women, rural youth, unemployed |

| Loan Purpose | Goat purchase, shed, feed, healthcare |

| Application Mode | Offline through banks |

| Business Type | Small to commercial goat farming |

The Bakri Palan Yojana 2026 offers a powerful opportunity for individuals looking to build a stable income through goat farming. With financial support, subsidies, and increasing market demand, the scheme makes livestock farming accessible even to small farmers and first-time entrepreneurs. Those who approach the scheme with proper planning and commitment can turn goat farming into a profitable and sustainable livelihood for years to come.

Eligibility Criteria For Bakri Palan Yojana 2026

- To apply for a goat farming loan under the Bakri Palan Yojana 2026, applicants must meet certain basic conditions. These criteria ensure that the loan reaches genuine beneficiaries who can effectively run a goat farming unit.

- Applicants must be Indian citizens and should generally fall within the working age group. Having a valid bank account is mandatory since loan disbursement and subsidy benefits are routed through banks. Most banks also expect applicants to submit a simple project report explaining how the loan amount will be used and how income will be generated.

- While prior experience in goat farming is not always compulsory, having basic knowledge or training in animal husbandry can significantly improve approval chances. Preference is often given to small and marginal farmers, women entrepreneurs, and individuals from rural areas who aim to establish self-employment.

Benefits Of Bakri Palan Yojana 2026

- One of the biggest advantages of this scheme is the financial relief it provides during the initial phase of the business. Goat farming requires upfront investment, and the combination of loans and subsidies makes it easier to manage costs.

- Subsidies reduce the effective loan amount, meaning farmers repay less than what they initially borrow. This lowers monthly installments and reduces financial stress. The scheme also encourages organized farming practices, which leads to better productivity and higher profits.

- Additional benefits include employment generation for family members, improved use of rural land, and steady cash flow throughout the year. Goat farming also supports allied activities such as fodder cultivation and organic manure production, further increasing income opportunities.

Subsidy Structure and Financial Support

- The subsidy under the Bakri Palan Yojana 2026 depends on the applicant’s category and project size. General category applicants usually receive a subsidy of around 25% to 35%, while applicants from reserved categories may receive up to 50% subsidy.

- For example, if a farmer takes a loan of ₹4 lakh and qualifies for a 50% subsidy, only ₹2 lakh needs to be repaid to the bank. The remaining amount is adjusted as subsidy support. This structure makes the scheme extremely attractive for those who otherwise hesitate to take loans due to repayment concerns.

- Banks assess the project viability before approving subsidies, so maintaining proper documentation and a realistic business plan is essential.

How To Apply For Goat Farming Loan

- Applying for a loan under the Bakri Palan Yojana 2026 involves a straightforward offline process. Interested applicants should first prepare a basic goat farming project report that includes the number of goats, estimated costs, expected income, and repayment plan.

- After preparing the project report, applicants need to visit a nearby bank branch that offers livestock or agricultural loans. The loan application form must be filled carefully, and all required documents should be attached. Banks may conduct a simple verification or site visit before approving the loan.

- Once approved, the loan amount is credited to the applicant’s bank account, and subsidy benefits are applied as per guidelines. Timely repayment helps build a good credit record and allows farmers to expand their business in the future.

Documents Required For Bakri Palan Yojana 2026

- Applicants must submit standard documents during the application process. These usually include identity proof, address proof, bank account details, and passport-size photographs. A project report is a key document, as it explains the purpose of the loan and income potential.

- Some banks may also ask for land details or a lease agreement if the farming unit is set up on rented land. Keeping documents organized and accurate helps speed up the approval process.

Why Goat Farming Is A Profitable Business In 2026

- Goat farming continues to grow due to increasing demand for goat meat and milk across urban and rural markets. Goats mature quickly and reproduce faster compared to larger livestock, ensuring regular income cycles. Maintenance costs are relatively low, and goats can survive on locally available fodder.

- With proper management, disease control, and market planning, farmers can earn consistent profits. The Bakri Palan Yojana 2026 further strengthens profitability by reducing initial investment risks and supporting expansion plans.

Common Mistakes To Avoid

- Many beginners underestimate the importance of planning. Starting goat farming without a clear project plan or market understanding can lead to losses. Another common mistake is overcrowding goats or neglecting healthcare, which can affect productivity.

- Applicants should also avoid borrowing more than necessary. Choosing a loan amount aligned with actual needs helps maintain financial stability and ensures smooth repayment.

Bank of Baroda Personal Loan 2026 – Get Up to ₹2 Lakh Without Guarantee, Simple Apply Process

Future Scope Of Bakri Palan Yojana 2026

As livestock farming gains importance, schemes like Bakri Palan Yojana 2026 are expected to expand further. With increasing focus on rural entrepreneurship and sustainable agriculture, goat farming will continue to attract support through training, subsidies, and improved market access. Farmers who start early and adopt scientific practices can benefit the most from this growing sector.

FAQs on Bakri Palan Yojana 2026

What Is the Minimum Loan Amount Under Bakri Palan Yojana 2026

The minimum loan amount generally starts from ₹50,000, suitable for small goat farming units.

What Is the Maximum Loan Limit

Depending on the project size and bank norms, loans can go up to ₹10 lakh.

Is Subsidy Guaranteed for All Applicants

Subsidy depends on eligibility, category, and approval of the project plan.

Is Goat Farming Suitable for Beginners

Yes, with basic training and planning, beginners can successfully run a goat farming business.