Handling personal finances has become more dynamic than ever. From sudden medical needs to planned expenses like education, travel, or family functions, the need for quick and reliable funding is common. This is where Bank of Baroda Personal Loan 2026 becomes relevant. It is designed for individuals who want fast access to funds without the stress of pledging assets or arranging guarantors.

The loan focuses on ease, speed, and flexibility, which are essential factors for borrowers today. What truly sets Bank of Baroda Personal Loan 2026 apart is the trust factor combined with modern banking convenience. As a well-established public sector bank, Bank of Baroda offers security and transparency, while its digital-first approach ensures that borrowers don’t get stuck in long queues or complicated paperwork. Whether you are salaried or self-employed, this loan aims to meet real-world financial needs in a simple and practical way.

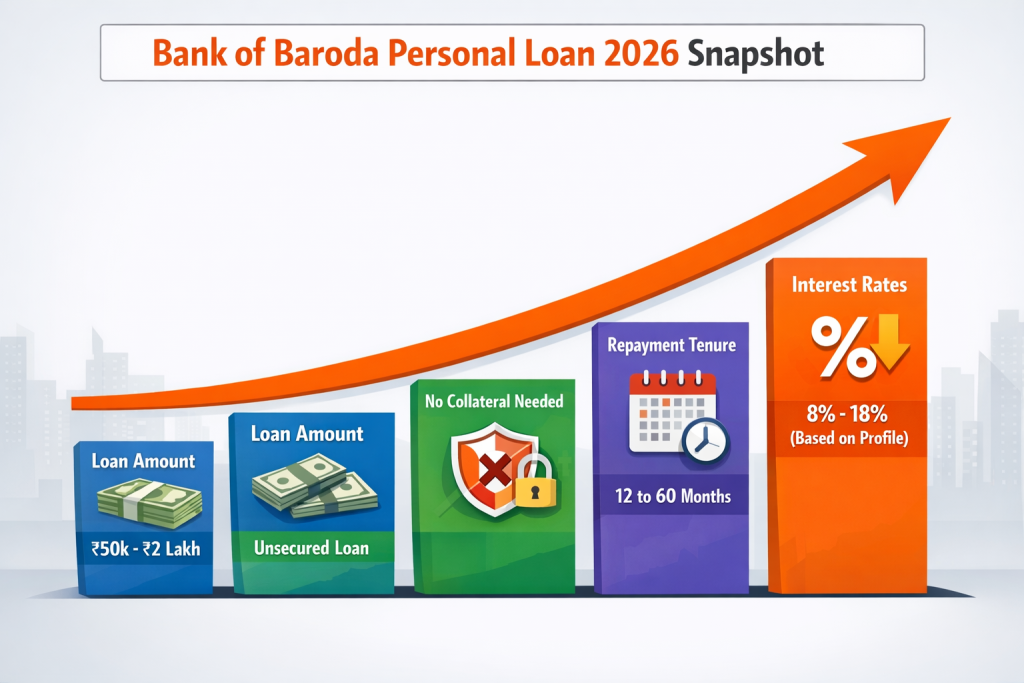

Bank of Baroda Personal Loan 2026 is an unsecured loan option that allows eligible individuals to borrow up to ₹2 lakh without any guarantee. The loan can be used for almost any personal purpose, including emergencies, lifestyle expenses, education, or debt consolidation. Since there is no restriction on end use, borrowers enjoy complete flexibility in how they utilize the funds. The application process has been simplified to suit modern borrowers. Most steps can be completed online, from submitting details to document verification. For eligible applicants, approvals are quick, and the loan amount is credited directly to the bank account. With flexible repayment tenures and structured EMIs, Bank of Baroda Personal Loan 2026 helps borrowers manage repayments without disturbing their monthly budget.

Bank of Baroda Personal Loan 2026

| Feature | Details |

|---|---|

| Loan Amount | ₹50,000 to ₹2,00,000 |

| Loan Type | Unsecured personal loan |

| Guarantee Required | No |

| Interest Rate | Based on credit profile |

| Repayment Tenure | 12 to 60 months |

| Eligible Applicants | Salaried and self-employed |

| Application Mode | Online and offline |

| Disbursement | Direct to bank account |

Bank of Baroda Personal Loan 2026 is a practical and reliable option for individuals seeking quick funds without security. With a simple application process, flexible repayment options, and the backing of a trusted public sector bank, it meets the financial needs of modern borrowers. For those looking to manage expenses confidently and responsibly, this personal loan offers a balanced mix of convenience, transparency, and trust.

What is Bank of Baroda Personal Loan

- A Bank of Baroda personal loan is a financial product that provides funds without requiring any collateral. Approval is mainly based on your income stability, employment type, and credit score. Because it is unsecured, the bank evaluates the borrower’s repayment ability carefully before approving the loan.

- Under Bank of Baroda Personal Loan 2026, the focus is on quick access to money with minimal formalities. The loan is suitable for individuals who want predictable EMIs, clear terms, and a repayment schedule that aligns with their income flow. It offers a dependable solution for both planned and unplanned expenses.

Key Features of Bank of Baroda Personal Loan 2026

One of the biggest highlights of this loan is that it does not require any security or third-party guarantee. This makes it accessible to a wide range of borrowers, including those who may not own assets. The digital application process further reduces effort and saves time. Another strong feature of Bank of Baroda Personal Loan 2026 is flexibility. Borrowers can choose from multiple tenure options, allowing them to control EMI amounts. Competitive interest rates, transparent terms, and structured repayment plans make this loan suitable for responsible financial planning.

Eligibility Criteria For Bank of Baroda Personal Loan 2026

- Eligibility criteria for this personal loan are straightforward and designed to include a broad group of applicants. Borrowers must be Indian residents and fall within the specified age range, usually starting from early working age up to retirement.

- A steady source of income is essential, whether you are salaried or self-employed. A good credit score improves approval chances and may also help secure better loan terms. For Bank of Baroda Personal Loan 2026, consistent income and a healthy repayment history play a key role in the approval process.

Required Documents For Bank of Baroda Personal Loan 2026

The documentation process is simple and borrower-friendly. Applicants are usually required to submit identity proof, address proof, income proof, and recent bank statements. These documents help the bank assess eligibility and repayment capacity. Existing customers of Bank of Baroda may benefit from reduced documentation, especially if they have a strong banking relationship. Keeping documents ready in advance can speed up approval and ensure a smooth application experience.

Estimated EMIs For ₹2 Lakh Loan

- The EMI amount depends on the chosen tenure and applicable interest rate. Shorter tenures result in higher monthly EMIs but reduce the total interest paid. Longer tenures lower the EMI burden but increase overall interest outflow.

- Bank of Baroda Personal Loan 2026 offers enough flexibility for borrowers to select a repayment plan that suits their financial comfort. Calculating EMIs in advance helps in planning monthly expenses and avoiding financial strain during the repayment period.

How To Apply for Bank of Baroda Personal Loan 2026

Applying for this loan is simple and convenient. Borrowers can apply online through the official bank platform or visit a nearby branch. The online method is especially useful for those who prefer quick processing and minimal paperwork. After filling in personal and financial details, applicants upload the required documents and complete verification. Once approved, the loan amount is disbursed directly to the bank account. Pre-approved customers may experience even faster processing under Bank of Baroda Personal Loan 2026.

Advantages Of Choosing Bank Of Baroda Personal Loan

- One major advantage is the absence of collateral, which removes the risk of losing assets. The bank’s strong reputation ensures transparency and reliability throughout the loan tenure.

- Additionally, Bank of Baroda Personal Loan 2026 offers structured EMIs, flexible tenures, and a simplified digital process. These factors make it a preferred option for borrowers who want a balance between trust and convenience.

PM Free Laptop Scheme 2026: Apply Online, Check Eligibility, Last Date and Registration Details

Things To Consider Before Applying

Before applying, borrowers should assess their repayment capacity and existing financial commitments. Choosing the right tenure is crucial to keeping EMIs manageable. Maintaining a good credit score and stable income increases approval chances and improves loan terms. Understanding the repayment structure helps borrowers make informed decisions under Bank of Baroda Personal Loan 2026.

FAQs on Bank of Baroda Personal Loan 2026

Is Bank of Baroda Personal Loan 2026 unsecured

Yes, it is an unsecured loan and does not require any collateral or guarantee.

What is the maximum loan amount available

Eligible applicants can borrow up to ₹2 lakh depending on income and credit profile.

Who can apply for this personal loan

Both salaried and self-employed individuals who meet eligibility criteria can apply.

How long does loan approval take

Approval timelines vary, but many applications are processed within a few working days.