Women across India are increasingly looking for meaningful work opportunities that offer income security, flexibility, and long-term growth. Keeping this need in mind, the government, along with LIC, has introduced a powerful initiative aimed at financial empowerment and skill development for women.

Bima Sakhi Yojana 2026 is designed to provide a steady monthly income while opening the door to a respected professional career in the insurance sector. This scheme is especially attractive because it does not demand high qualifications or previous experience. Women from different backgrounds, including homemakers, rural women, and those seeking part-time or flexible work, can participate. With income support of up to ₹7,000 per month and structured training, the program helps women become self-reliant while contributing to financial awareness in their communities.

Bima Sakhi Yojana 2026 is a women-focused employment and training program introduced by LIC to strengthen insurance outreach and create income opportunities for women. Under this scheme, eligible women are appointed as LIC insurance agents, known as Bima Sakhis. During the initial phase, they receive a fixed monthly stipend along with professional training to help them settle into the role confidently. The core objective of the scheme is to empower women economically while expanding insurance coverage at the grassroots level. By working within their own localities, Bima Sakhis become trusted financial guides for families, helping them understand life insurance and long-term financial protection.

Bima Sakhi Yojana 2026 Overview Table

| Particulars | Details |

|---|---|

| Scheme Name | Bima Sakhi Yojana 2026 |

| Implementing Authority | Life Insurance Corporation of India |

| Target Group | Women |

| Job Role | LIC Insurance Agent |

| Monthly Income Support | Up to ₹7,000 |

| Training | Mandatory and Provided |

| Minimum Qualification | Class 10 Pass |

| Age Limit | 18 to 70 Years |

| Application Mode | Online and Offline |

| Work Nature | Field Based with Flexible Hours |

Bima Sakhi Yojana 2026 stands out as a meaningful initiative that combines employment, skill development, and women empowerment. With assured initial income, professional training, and the backing of LIC, the scheme offers a strong foundation for women looking to achieve financial independence. For women who want flexible work, stable income, and long-term growth, this scheme provides a practical and empowering opportunity to build a secure future while contributing positively to society.

What Is Bima Sakhi Yojana

Bima Sakhi Yojana is a structured initiative that allows women to work as licensed insurance agents for LIC. After selection, candidates undergo formal training that covers insurance products, customer communication, ethical selling practices, and basic financial planning. Once training is completed, women begin working as Bima Sakhis in their local areas. Their role includes educating people about LIC policies, helping customers choose suitable plans, and assisting with policy-related services. The scheme provides income support initially so that women can focus on learning and building a client base without financial pressure.

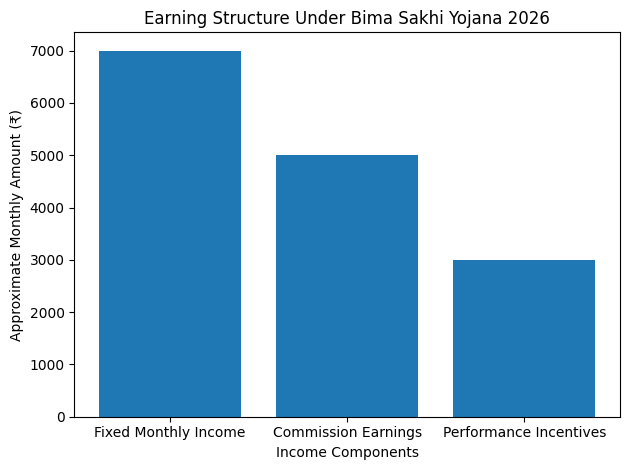

Monthly Income Structure and Earning Potential

One of the biggest highlights of Bima Sakhi Yojana 2026 is the assured monthly income during the early stage of employment. Women selected under the scheme can earn up to ₹7,000 per month as fixed support. In addition to this income, Bima Sakhis also earn commissions on policy sales and performance-based incentives. As they gain experience and increase their sales, their overall income grows. Over time, many women can earn significantly more than the initial fixed amount, making this a long-term career opportunity rather than a temporary job.

Eligibility Criteria for Bima Sakhi Yojana 2026

The eligibility requirements for the scheme are simple and inclusive, ensuring that more women can benefit from it. Applicants must be women aged between 18 and 70 years. A minimum educational qualification of passing Class 10 from a recognized board is required. There are no restrictions based on marital status, income level, or previous employment history. This makes Bima Sakhi Yojana 2026 accessible to a wide range of women, including homemakers and first-time job seekers.

Training And Skill Development Program

Training is a key component of the scheme. All selected candidates must complete mandatory training conducted by LIC. This training focuses on insurance concepts, customer handling, communication skills, and professional ethics. The training program ensures that women are well-prepared before entering the field. It not only builds confidence but also equips participants with valuable skills that can be useful in other financial or service-based roles. This structured learning approach helps women transition smoothly into their new profession.

Documents Required for Bima Sakhi Yojana 2026

| Required Document | Purpose |

|---|---|

| Aadhaar Card | Identity Proof |

| Age Proof | Date of Birth Verification |

| Class 10 Certificate | Educational Qualification |

| Passport Size Photo | Application Record |

| Bank Account Details | Salary and Commission Payments |

| Address Proof | Residence Verification |

How To Apply for Bima Sakhi Yojana 2026

Women can apply for Bima Sakhi Yojana 2026 through both online and offline methods. For online applications, candidates need to visit the official LIC website and locate the section related to agent recruitment or Bima Sakhi enrollment. After filling out the application form and uploading the required documents, the form can be submitted for review. For offline applications, interested women can visit the nearest LIC branch and contact a development officer. The officer provides guidance, helps fill out the form, and explains the next steps in the selection process. After document verification, eligible candidates are enrolled for training.

Role And Responsibilities of a Bima Sakhi

A Bima Sakhi plays an important role in connecting LIC with customers at the community level. Her responsibilities include explaining insurance plans, helping customers choose appropriate policies, assisting with premium payments, and providing basic post-sales support. The role offers flexible working hours, allowing women to manage their personal and professional responsibilities effectively. This flexibility is one of the main reasons Bima Sakhi Yojana 2026 appeals to homemakers and women seeking work-life balance.

Benefits Of Bima Sakhi Yojana 2026

The scheme offers several benefits beyond income generation. Women receive professional training, steady initial income, and the opportunity to work with a trusted national institution like LIC. There is no requirement for upfront investment, making it a low-risk opportunity. Additionally, the scheme helps women gain financial independence, build confidence, and earn social respect within their communities. Over time, successful Bima Sakhis can establish a strong professional identity and stable income source.

Importance Of Bima Sakhi Yojana for Women Empowerment

Bima Sakhi Yojana 2026 is not just about employment; it is about empowerment. By providing women with skills, income, and professional recognition, the scheme helps them become economically self-sufficient. At the same time, it improves insurance awareness and financial literacy at the grassroots level. Women, as trusted community members, are more effective in educating families about financial protection and long-term planning.

Unified Pension Scheme: Secure Your Future with These 7 Incredible Benefits!

Long Term Career Opportunities Under The Scheme

Women who perform well as Bima Sakhis can build a long-term career in the insurance sector. With experience, they can earn higher commissions, qualify for incentives, and gain recognition within LIC’s agent network. The scheme offers scope for continuous learning and income growth, making Bima Sakhi Yojana 2026 a sustainable career option rather than a short-term employment solution.

FAQs on Bima Sakhi Yojana 2026

What Is Bima Sakhi Yojana 2026

It is a women-focused employment scheme by LIC that provides training and income support for insurance agent roles.

How Much Can Women Earn Under This Scheme

Women can earn up to ₹7,000 per month initially, along with commissions and incentives.

Can Homemakers Apply for Bima Sakhi Yojana 2026

Yes, the flexible work structure makes it suitable for homemakers.

Is This a Permanent Job

It is a commission-based professional role with long-term earning potential rather than a fixed government job.