Cheque payments may not be as popular as UPI or instant bank transfers anymore, but they still play a crucial role in financial transactions across India. From business payments and property deals to salaries and school fees, cheques continue to be widely used. When a cheque bounces, it can create serious problems, including financial loss, legal stress, and damaged relationships.

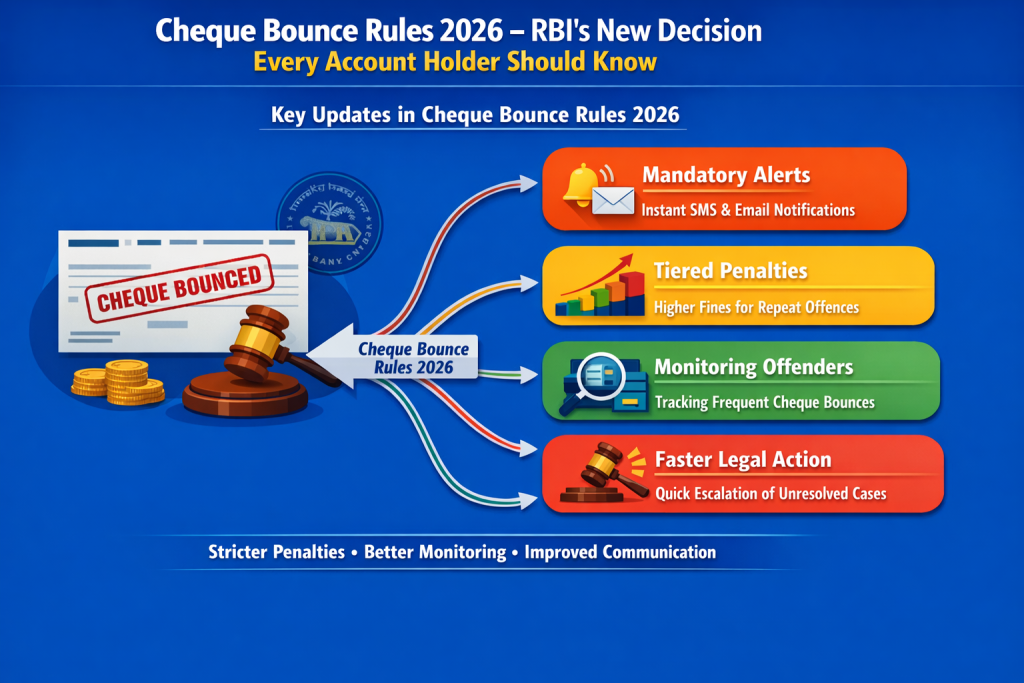

This is exactly why the Cheque Bounce Rules 2026 have become such an important topic for every bank account holder. The Cheque Bounce Rules 2026 bring significant changes that aim to make cheque transactions more disciplined and transparent. These rules are not just for businesses or professionals. Even individuals who issue cheques occasionally must understand how the system is changing. With stricter penalties, faster alerts, and better monitoring, ignorance of these rules could turn a small mistake into a major headache.

The Cheque Bounce Rules 2026 introduce a more structured and uniform approach to handling cheque dishonour cases. Earlier, different banks followed slightly different processes, which often confused customers. Under the new rules, the focus is on accountability, quicker communication, and discouraging repeated negligence. These changes are designed to protect genuine payees while also giving cheque issuers a fair opportunity to fix mistakes. The Cheque Bounce Rules 2026 emphasize timely action, clear information, and responsible banking behaviour. Whether you use cheques frequently or only once in a while, these rules directly affect how your bank account is managed when a cheque fails.

Cheque Bounce Rules 2026

| Aspect | Details |

|---|---|

| Effective Year | 2026 |

| Applicable Accounts | Savings, Current, Business |

| Customer Notification | Mandatory SMS and Email Alerts |

| Penalty System | Tier Based on Frequency |

| Repeat Offender Tracking | Yes |

| Legal Escalation | Time Bound Process |

| Main Objective | Reduce Cheque Misus |

The Cheque Bounce Rules 2026 represent a major step toward improving financial discipline and reducing disputes related to cheque transactions. With stricter penalties, mandatory alerts, and better monitoring, the rules leave little room for careless cheque usage. For account holders and businesses alike, awareness and responsibility are the keys to staying safe under the new system. Understanding these rules now can help you avoid penalties, legal trouble, and unnecessary stress in the future.

What is a Cheque Bounce?

- A cheque bounce occurs when a bank refuses to process a cheque presented for payment. This means the payment mentioned on the cheque is not transferred to the recipient. The cheque is returned unpaid along with a reason explaining why the transaction failed.

- Under the updated rules, banks must clearly inform customers about the exact reason for the cheque bounce. This makes the process more transparent and helps both the issuer and the receiver understand what went wrong and what needs to be done next.

Main Reasons for Cheque Bounce Cases

- There are several common reasons why cheques get dishonoured. The most frequent reason is insufficient balance in the account. When the available funds are lower than the cheque amount, the bank has no option but to return it unpaid.

- Other common reasons include signature mismatch, overwriting on the cheque, mismatch between the amount written in words and figures, damaged cheques, or expired cheque validity. In some cases, cheques bounce because the account is inactive or frozen due to compliance issues. The Cheque Bounce Rules 2026 clearly highlight that most of these reasons are preventable with basic care.

New Penalty Structure Under Cheque Bounce Rules 2026

- One of the biggest changes introduced is the revised penalty structure. Under the Cheque Bounce Rules 2026, penalties are no longer random or unclear. Banks will follow a tier-based penalty system. A first-time cheque bounce may attract a relatively small charge, but repeated dishonour within a short period will lead to higher penalties.

- The idea behind this system is not to punish genuine mistakes but to discourage careless or habitual misuse of cheques. Customers will be informed in advance about the applicable charges, ensuring transparency and reducing disputes.

Mandatory Alerts and Customer Communication

- Communication is a key focus area under the new rules. Banks are now required to inform customers immediately if a cheque bounces. Alerts will be sent through SMS, email, or banking apps, clearly stating the reason for dishonour.

- This timely communication allows customers to act quickly, whether it is adding funds, correcting errors, or contacting the payee. The Cheque Bounce Rules 2026 aim to eliminate delays that previously caused unnecessary escalation of issues.

Impact On Account Holders and Businesses

- For individual account holders, the new rules mean greater responsibility while issuing cheques. Even occasional users must be careful, as repeated cheque bounces can lead to penalties and closer monitoring of accounts.

- For businesses, the impact is even more significant. Cheque bounces can damage reputation, delay payments, and disrupt cash flow. Under the Cheque Bounce Rules 2026, businesses with frequent cheque failures may face stricter scrutiny, making financial discipline more important than ever.

Legal Consequences of Cheque Bounce After 2026

- Cheque bounce cases can still lead to legal action if the issue is not resolved within the prescribed time. If a cheque bounces due to insufficient funds and the issuer fails to make the payment after receiving a notice, legal proceedings may be initiated.

- However, the new rules aim to reduce unnecessary legal cases by improving communication and encouraging faster resolution. With timely alerts and clear timelines, many disputes can be settled before reaching the courts.

How Banks Will Monitor Repeat Offenders

- Banks will now maintain better records of customers who frequently issue dishonoured cheques. Repeat cheque bounce cases may trigger enhanced monitoring of the account. In serious cases, banks may impose temporary restrictions or require corrective measures.

- This does not mean immediate account closure, but it does indicate that repeated negligence will not be ignored. The Cheque Bounce Rules 2026 are designed to promote responsible banking behaviour over the long term.

How To Avoid Cheque Bounce Under the New Rules

- Avoiding cheque bounce issues is not difficult if basic precautions are followed. Always ensure sufficient balance before issuing a cheque. Double-check the cheque details, including date, amount, and signature.

- Avoid overwriting and use fresh cheques when possible. Keep track of issued cheques and respond promptly to bank alerts. By following these simple steps, most cheque bounce problems can be completely avoided.

Free Silai Machine Yojana 2026 – How Women Can Get Government Support to Earn from Home

Why Cheque Bounce Rules 2026 Matter More Than Ever

- In an era where digital payments are growing rapidly, cheque transactions are often used for high-value or legally sensitive payments. This makes cheque reliability more important than ever. The Cheque Bounce Rules 2026 are meant to ensure that cheques remain a trustworthy payment method.

- By introducing clearer rules, better communication, and structured penalties, the system encourages fairness for both payers and payees.

FAQs on Cheque Bounce Rules 2026

What Are the Cheque Bounce Rules 2026

These are updated guidelines that introduce stricter penalties, mandatory alerts, and better monitoring of cheque bounce cases.

Will First Time Cheque Bounce Attract A Penalty

Yes, banks may charge a small penalty even for the first instance, but repeat cases attract higher charges.

How Will I Know If My Cheque Bounces

Banks must send immediate alerts through SMS or email explaining the reason for the cheque bounce.

Who Should Be Most Careful Under These Rules

Business owners, professionals, and frequent cheque users should be especially careful under the Cheque Bounce Rules 2026.