As we enter 2026, many families are looking for ways to ensure financial stability in their retirement years. One of the most effective tools for achieving this goal is a pension plan. The New Pension Rules 2026 bring significant changes that promise to offer families a more secure future with guaranteed monthly pension payouts, increased flexibility, and better tax benefits. These changes are designed to help individuals and families invest in their future, ensuring that they can enjoy a comfortable retirement without worrying about financial instability. The new pension system is more accessible and reliable, enabling families to plan ahead with confidence.

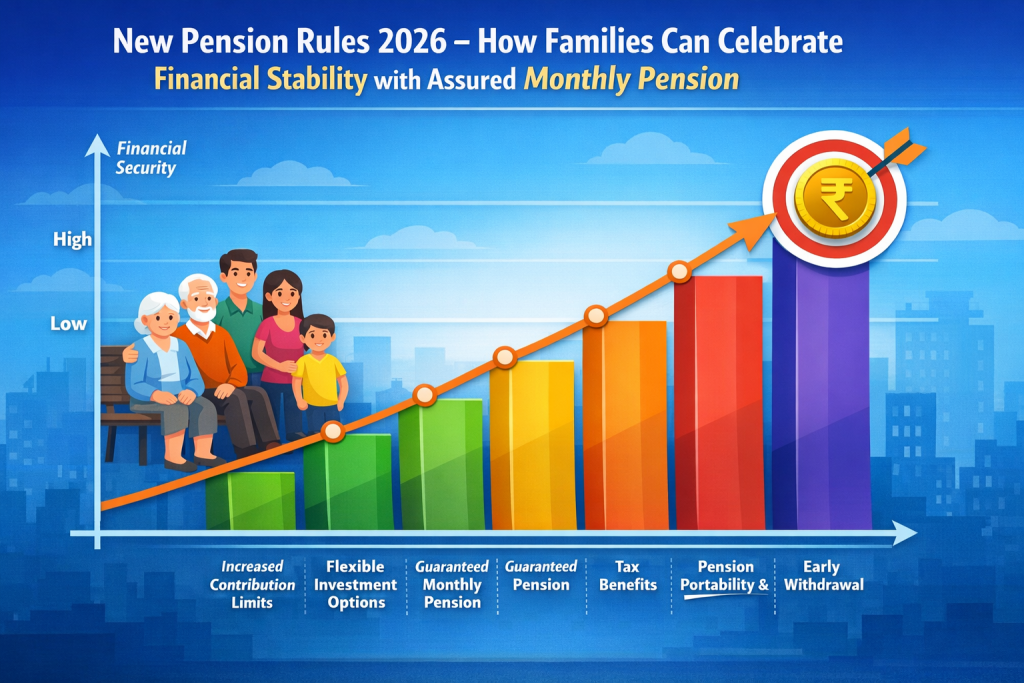

The New Pension Rules 2026 offer a range of benefits that can help families strengthen their retirement plans. From increased contribution limits to guaranteed monthly pensions and tax relief, these new rules are set to reshape the way individuals and families think about retirement savings. With more investment options and flexibility, the new pension rules provide an opportunity to grow your savings while securing a steady income during retirement. In this article, we’ll explore these new rules in detail, highlighting how families can use them to achieve long-term financial stability.

New Pension Rules 2026

| Feature | Description |

|---|---|

| Increased Contribution Limits | Higher contribution limits for both individuals and employers to boost savings. |

| Flexible Investment Options | A wider array of investment options, including equity, debt, and hybrid funds. |

| Guaranteed Monthly Pension | Assurance of regular monthly pension payouts based on accumulated contributions. |

| Tax Benefits | Enhanced tax deductions for contributions to the pension plan. |

| Pension Portability | Easier transfer of pension benefits between jobs or across employers. |

| Early Withdrawal Flexibility | Greater flexibility for early withdrawals, subject to certain conditions. |

| Digital Management | Full integration with digital platforms for tracking, managing, and updating pensions. |

The New Pension Rules 2026 are a significant step forward in making retirement planning easier and more secure for families. By offering increased contribution limits, more flexible investment options, guaranteed monthly pension payouts, and enhanced tax benefits, these new rules provide families with the tools they need to plan for a financially stable future. The introduction of pension portability and the flexibility for early withdrawals further ensure that families have the freedom and security to manage their retirement savings effectively. As we look to the future, these new pension rules offer families the opportunity to celebrate financial stability with confidence. With guaranteed income, tax advantages, and the ability to transfer pensions across jobs, the New Pension Rules 2026 are a game-changer for families seeking a more secure and prosperous retirement.

Increased Contribution Limits

- One of the standout features of the New Pension Rules 2026 is the increased contribution limits. Under the old pension rules, the amount individuals and employers could contribute to a pension plan was limited. However, the new rules allow for higher contribution limits, which will enable families to save more money for their future. This increase in contributions is significant for families who want to build substantial retirement savings, as it allows them to set aside more funds over time. The higher contribution limits will also lead to higher pension payouts, making retirement more financially secure.

- These new contribution limits encourage families to prioritize retirement savings, ensuring that they can accumulate the necessary funds for a comfortable post-retirement lifestyle. Whether you are contributing through an employer-sponsored plan or managing your own retirement account, these new rules offer more opportunities to build wealth.

Flexible Investment Options

- Another important update under the New Pension Rules 2026 is the expanded range of investment options available for pension funds. The new rules provide individuals with more flexibility by offering a wider variety of investment options, including equity, debt, and hybrid funds. This means that families can tailor their pension plans based on their investment preferences and risk tolerance.

- For example, families that prefer stability may choose to invest in debt funds, which offer lower risk but more predictable returns. On the other hand, families with a higher risk appetite may opt for equity investments, which have the potential for higher returns but also come with greater market volatility. Hybrid funds provide a balanced approach, offering a mix of both equity and debt investments. The expanded range of options allows families to choose the best strategy for their retirement goals, providing more control over how their money grows.

Guaranteed Monthly Pension

One of the most appealing aspects of the New Pension Rules 2026 is the introduction of a guaranteed monthly pension payout. Unlike traditional pension systems, which may offer lump sum payouts or variable income, the new system guarantees a fixed monthly pension for retirees based on their accumulated contributions. This guaranteed income stream provides families with a sense of financial security, ensuring they will receive regular payments throughout their retirement years. The assurance of a monthly pension eliminates the uncertainty that often comes with retirement planning. Families can plan their post-retirement budgets with confidence, knowing that they will have a reliable income stream to cover their living expenses. This change is particularly important for those who worry about outliving their savings or experiencing a sudden drop in income during retirement.

Tax Benefits in New Pension Rules 2026

The New Pension Rules 2026 also offer enhanced tax benefits for individuals contributing to their pension plans. Under the new rules, families will enjoy higher tax deductions for their pension contributions, which can significantly reduce their taxable income. This tax relief encourages individuals to contribute more to their pension plans, which ultimately benefits their long-term financial security. By offering these tax advantages, the government is helping families maximize their retirement savings while minimizing their tax burdens. This is especially valuable for middle-income families who may find it challenging to save for retirement while balancing other financial responsibilities. The tax benefits of the new pension rules make it easier for families to contribute more to their retirement savings without facing a significant tax penalty.

Pension Portability

In today’s rapidly changing job market, individuals often switch jobs or employers. One challenge many people face is maintaining their pension benefits when changing jobs. The New Pension Rules 2026 address this issue by introducing pension portability, which allows individuals to transfer their pension benefits from one employer to another without losing their accumulated savings. For families, this is a crucial feature. It ensures that their retirement savings remain intact, even if they change jobs or move across different employers. Pension portability allows families to build consistent retirement savings over time, regardless of employment changes. This feature helps safeguard their long-term financial security, making it easier for them to plan for the future.

Early Withdrawal Flexibility

While pensions are primarily designed for long-term retirement savings, there may be times when families need to access their funds earlier. The New Pension Rules 2026 offer greater flexibility for early withdrawals, allowing individuals to access their retirement savings before reaching the standard retirement age. This feature is particularly beneficial for families facing unexpected financial needs, such as medical emergencies or education expenses. Under the new rules, early withdrawals can be made under specific conditions, ensuring that individuals can access their savings when needed without facing excessive penalties. The flexibility in early withdrawals gives families peace of mind, knowing they can tap into their pension funds if life’s unexpected challenges arise.

Digital Management of Pension Plans

- The New Pension Rules 2026 also embrace technology by allowing individuals to manage their pension plans digitally. This means that families can track their contributions, monitor investment performance, and make changes to their pension plans using online platforms. The digital management of pension plans offers convenience and transparency, making it easier for families to stay informed about their retirement savings.

- With digital tools, families can access their pension information anytime and from anywhere, ensuring they are always up to date on the performance of their investments. This digital integration simplifies the process of managing pensions, making it more accessible for people who are busy balancing work and family responsibilities.

FAQs on New Pension Rules 2026

What is the primary benefit of the New Pension Rules 2026?

The main benefit of the New Pension Rules 2026 is the introduction of guaranteed monthly pension payouts, offering a reliable income during retirement.

How do the New Pension Rules 2026 affect tax deductions?

The new rules provide enhanced tax deductions for contributions to pension plans, reducing taxable income and encouraging individuals to save more for retirement.

What are the flexible investment options under the New Pension Rules 2026?

The new rules offer a wider range of investment options, including equity, debt, and hybrid funds, allowing families to customize their retirement savings strategies.

Can I transfer my pension benefits if I change jobs?

Yes, the New Pension Rules 2026 allow for pension portability, meaning you can transfer your pension benefits from one employer to another without losing accumulated savings.