If you are a salaried employee in India, chances are you have been contributing to EPF for years without giving much thought to the pension side of it. Yet, the pension you receive under EPFO can play a quiet but important role in your post-retirement life. Understanding EPFO EPS Pension Rules early can save you from last-minute confusion and help you make smarter financial decisions. The truth is, most people only start searching for EPFO EPS Pension Rules when retirement is just around the corner. EPS may not sound as exciting as stocks or mutual funds, but it offers something extremely valuable: a guaranteed monthly income for life. Knowing when this pension starts, how much you can expect, and what options you have around timing can make a big difference to your long-term financial security. In this detailed guide, we’ll walk through everything you need to know, without jargon or unnecessary complexity.

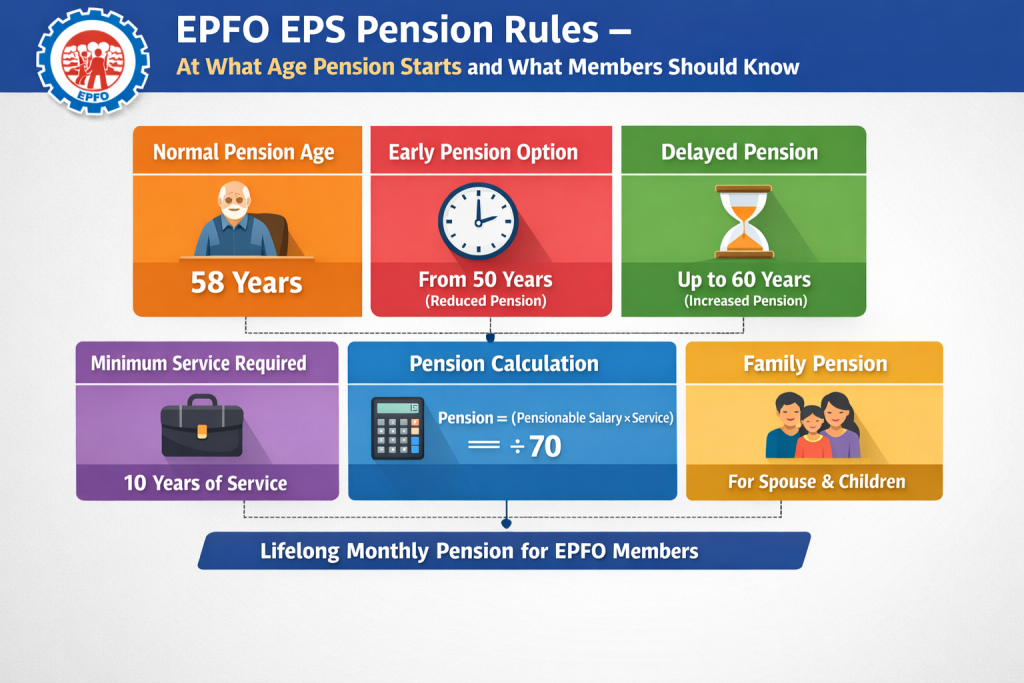

The EPFO EPS Pension Rules lay down how pension benefits are provided under the Employees Pension Scheme 1995. This scheme is linked to your EPF account and is meant to ensure that employees receive a steady income after retirement. Unlike EPF, which builds a lump sum over time, EPS focuses entirely on monthly pension payouts. Under these rules, pension eligibility depends mainly on your age at the time of claiming and the total number of years you have worked under EPF-covered employment. The scheme also gives you flexibility, allowing you to start pension early with a reduced amount or delay it for a higher payout. Understanding these rules well in advance gives you control over how and when you want your pension to begin.

EPFO EPS Pension Rules

| Particulars | Details |

|---|---|

| Scheme Name | Employees’ Pension Scheme 1995 |

| Administered By | Employees Provident Fund Organisation |

| Normal Pension Start Age | 58 years |

| Minimum Service Required | 10 years |

| Early Pension Option | From 50 years |

| Late Pension Option | Up to 60 years |

| Employer Contribution To EPS | 8.33 percent of wages |

| Nature Of Pension | Monthly lifelong pension |

Understanding EPFO EPS Pension Rules is not just about paperwork or compliance. It is about knowing your options, planning ahead, and ensuring financial stability during retirement. Whether you plan to retire early, on time, or later, EPS plays a meaningful role in providing predictable income for life. By staying informed and aligning your career and retirement decisions with these rules, you can turn EPS from an overlooked benefit into a dependable pillar of your retirement strategy.

What Is the Employees Pension Scheme EPS

- The Employees’ Pension Scheme was introduced to provide social security to employees after retirement. While EPF helps you accumulate savings, EPS ensures you have a predictable monthly income even after you stop working. This makes EPS especially useful for meeting basic living expenses during retirement.

- The funding for EPS comes from the employer’s contribution to EPF. Out of the employer’s total contribution, a fixed portion is diverted towards EPS. Employees themselves do not make a separate contribution to this scheme. Because EPS does not show visible balances like EPF, many members underestimate its value until retirement approaches.

Eligibility Criteria For EPS Pension

- To qualify for a monthly pension under EPS, a member must complete a minimum of ten years of eligible service. This service does not need to be continuous and can be accumulated across different employers, as long as EPF accounts are properly linked.

- If you exit EPF-covered employment before completing ten years, you will not be eligible for a monthly pension. In such cases, the rules allow you to withdraw the EPS amount as a lump sum. Under EPFO EPS Pension Rules, reaching the ten-year service milestone is crucial and should be a key consideration when planning job changes.

At What Age Does EPS Pension Start

- According to EPFO EPS Pension Rules, the normal age for starting pension is 58 years. Once you reach this age and meet the service requirement, you become eligible to receive full pension benefits. The pension is paid monthly and continues for your lifetime.

- It is important to note that pension payments do not start automatically. You must submit the necessary pension claim forms to initiate the process. Delays in documentation or service record mismatches can postpone pension payouts, so preparation is essential.

Early Pension Option Under EPS

- EPS allows members to start receiving pension as early as 50 years of age. This option is available for those who retire early or are unable to continue working due to personal or health reasons. However, choosing early pension comes with a cost.

- Under EPFO EPS Pension Rules, the pension amount is reduced by a fixed percentage for every year the pension is drawn before 58. This reduction is permanent and applies for the entire duration of the pension. While early pension offers immediate income, members should carefully weigh the long-term impact of a lower monthly amount.

Delayed Pension Benefits After 58

- If you choose not to start your pension at 58, EPS allows you to delay it up to the age of 60. For every year of delay, the pension amount increases by a specified percentage. This increase acts as an incentive for members who continue working or have other income sources.

- Delaying pension can significantly improve your monthly payout over time. Under EPFO EPS Pension Rules, this option is especially beneficial for individuals who do not immediately need pension income and want to maximise their lifelong benefit.

How EPS Pension Is Calculated

The EPS pension calculation follows a standard formula:

- Monthly pension equals pensionable salary multiplied by pensionable service divided by 70.

- Pensionable salary is usually the average salary earned during the last working period as defined under EPS guidelines. Pensionable service refers to the total number of years of eligible service, with certain rounding benefits for service periods exceeding six months.

- This simple formula makes it easier for members to estimate their expected pension and plan retirement finances accordingly.

Family Pension Benefits Under EPS

- One of the strongest features of EPS is the protection it offers to family members. If a pensioner passes away after retirement, the spouse becomes eligible for a monthly pension. In some cases, children may also receive pension benefits until they reach a specified age.

- Even if a member dies before retirement but has completed the minimum service requirement, the family can still receive pension benefits. This aspect of EPFO EPS Pension Rules ensures financial support for dependents during difficult times.

Common Mistakes Members Make

- A common misconception is assuming that EPS pension will be enough to meet all retirement expenses. In reality, EPS provides a basic income and does not adjust for inflation. It should be treated as a foundation, not a complete retirement solution.

- Another frequent mistake is ignoring service record accuracy. Missing service details, unlinked UANs, or employer errors can delay pension processing. Staying proactive and reviewing EPF records regularly can prevent issues later.

Taxation Of EPS Pension

- EPS pension is considered taxable income under current tax laws. The pension amount is added to your total income and taxed according to the applicable slab rate. Retirees should factor this into their financial planning and explore tax-saving options where applicable.

- Understanding the tax implications under EPFO EPS Pension Rules helps avoid surprises and ensures better cash flow management during retirement.

PNB Account Holder Update – Who Can Receive Up to ₹1 Lakh and How the Credit Works

Role Of EPS In Retirement Planning

- EPS may not provide large pension amounts, but it offers certainty. A guaranteed monthly income for life, combined with family pension benefits, makes EPS a reliable component of retirement planning.

- When combined with personal savings, investments, and other retirement income sources, EPS helps create a more balanced and secure post-retirement financial structure.

FAQs on EPFO EPS Pension Rules

At What Age Does EPS Pension Normally Start

EPS pension normally starts at 58 years, provided the member has completed at least ten years of eligible service.

Can EPS Pension Be Taken Before 58 Years

Yes, early pension can be started from 50 years, but the monthly amount is permanently reduced.

Is Delaying Pension Beneficial Under EPFO EPS Pension Rules

Delaying pension up to 60 years increases the monthly payout, which can be beneficial for long-term income.

Is EPS Pension Taxable In India

Yes, EPS pension is taxable as per the individual’s income tax slab.