Retirement planning sounds boring until the numbers hit home. One of the most searched questions among salaried employees in India is how much pension they will actually receive after years of work. This is where the EPFO Pension Calculator becomes important. It gives you a realistic picture of your future monthly pension instead of vague assumptions. If you have completed or are close to completing 15 years of service, understanding this calculation can help you plan better and avoid unpleasant surprises later. Many people assume their EPF balance and pension work the same way. They don’t. While your EPF grows with interest, your pension follows a fixed formula. Using the EPFO Pension Calculator early helps you understand whether your pension will be enough or if you need additional retirement savings to stay financially comfortable.

The EPFO Pension Calculator is not just an online tool; it is a method of applying the Employees’ Pension Scheme formula to your own salary and service history. It tells you how much pension you are eligible to receive after retirement based on defined rules. Unlike mutual funds or the EPF corpus, the pension amount does not depend on market performance. It is calculated using a standard formula that considers your pensionable salary and pensionable service. This predictability is helpful, but it also means your pension has an upper limit. Knowing how the calculation works allows you to set realistic expectations and plan additional income sources if needed.

EPFO Pension Calculation

| Component | Details |

|---|---|

| Pension Scheme | Employees Pension Scheme (EPS) |

| Minimum Service Required | 10 Years |

| Normal Retirement Age | 58 Years |

| Early Pension Age | From 50 Years |

| Pension Formula | Pensionable Salary × Pensionable Service ÷ 70 |

| Maximum Salary Considered | ₹15,000 Per Month |

| Bonus For Long Service | 2 Additional Years After 20 Years |

What Is The Employees’ Pension Scheme

- The Employees’ Pension Scheme, commonly known as EPS, is linked to your EPF account. Every month, your employer contributes 12 percent of your basic salary and dearness allowance to EPF. Out of this, 8.33 percent goes towards EPS.

- Unlike EPF, this EPS contribution does not earn interest or build a visible balance. Instead, it creates your eligibility for a monthly pension after retirement. The goal of EPS is to provide a steady, lifelong income after you stop working, regardless of market ups and downs.

Eligibility Criteria For EPFO Pension Calculation

Before using an EPFO Pension Calculator, it’s important to know whether you qualify for a monthly pension.

- You must complete a minimum of 10 years of pensionable service. This service can be spread across multiple employers as long as your EPF account is transferred correctly. The standard retirement age for pension is 58 years. If you retire earlier, you can opt for an early pension from age 50, but with a permanent reduction.

- If you leave employment before completing 10 years, you are not eligible for monthly pension and can only withdraw the EPS amount as a lump sum.

Understanding Pensionable Salary

- Pensionable salary is often misunderstood. It is not your gross salary, take-home pay, or CTC. Under EPS rules, pensionable salary is calculated as the average of your basic salary plus dearness allowance over the last 60 months of service.

- There is also a salary ceiling. Even if your actual basic salary is higher, EPS considers a maximum of ₹15,000 per month. This cap plays a major role in limiting the final pension amount, which is why high earners often feel their pension is lower than expected.

What Is Pensionable Service

- Pensionable service refers to the total number of years you contributed to EPS during your working life. Service is calculated in completed years. If you have worked for more than six months in a year, it is rounded up to the next year.

- There is a major benefit for long-term employees. If your total service exceeds 20 years, EPS adds a bonus of two extra years to your pensionable service. This bonus significantly increases the pension amount and rewards long-term continuity.

EPFO Pension Formula Explained

- The formula used in the EPFO Pension Calculator is straightforward.

- Monthly Pension equals pensionable salary multiplied by pensionable service divided by 70.

- Once you know your pensionable salary and total service years, calculating your pension becomes simple arithmetic.

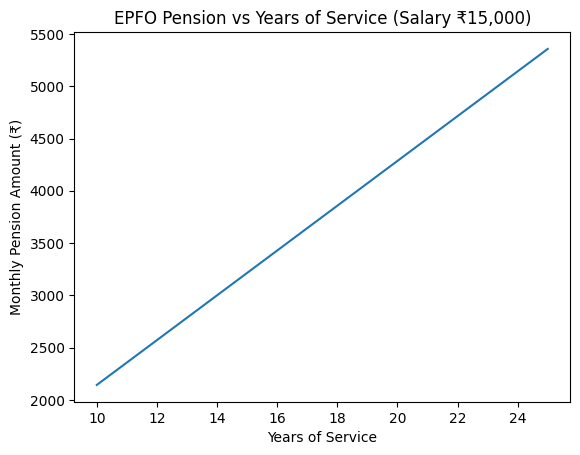

EPFO Pension Calculation For 15 Years Of Service

Let’s break down how the calculation works for someone with 15 years of service.

- Assume your average pensionable salary over the last 60 months is ₹15,000. Your pensionable service is exactly 15 years, with no long-service bonus.

- Using the formula, 15,000 multiplied by 15 divided by 70 comes to approximately ₹3,214.

- This means your monthly pension after retirement at 58 years would be around ₹3,200. If your pensionable salary is lower, say ₹10,000, the pension would reduce to roughly ₹2,140 per month.

- This example shows why both salary and service duration matter when using an EPFO Pension Calculator.

Impact Of Completing More Than 20 Years of Service

- Employees who complete more than 20 years of service receive a significant advantage. EPS adds a bonus of two years to the total service count.

- For example, if your actual service is 21 years, your pensionable service becomes 23 years. Using the same ₹15,000 salary, the pension would be close to ₹4,900 per month.

- This is a substantial jump compared to a 15-year service pension. Long-term employment continuity can make a meaningful difference in your retirement income.

Early Pension And Its Impact

If you choose to retire before 58 years, EPS allows early pension from age 50. However, the pension amount is reduced by 4 percent for every year before 58. For instance, retiring at 55 years leads to a 12 percent permanent reduction. While early pension may seem convenient, it significantly reduces lifetime income, making full retirement age a better option in most cases.

Limitations Of EPFO Pension

The EPFO Pension Calculator makes one thing very clear. EPFO pension is meant to provide basic income support, not replace your full salary. The salary cap and fixed formula limit how much pension you can receive. For most employees, especially those earning more than the salary ceiling, EPFO pension alone will not be enough to maintain their lifestyle. This is why additional retirement planning is essential.

Namo Shetkari Yojana 8th Installment Date Out? Farmers Waiting—Big Update Today

Key Takeaways For Employees

- Understanding the EPFO Pension Calculator helps you plan realistically. Completing at least 10 years of service is mandatory, while crossing 20 years gives a clear advantage. Salary above ₹15,000 does not increase pension benefits, and early retirement reduces pension permanently.

- Knowing these rules early allows you to take control of your financial future rather than relying on assumptions.

FAQs on EPFO Pension Calculation

How Accurate Is the EPFO Pension Calculator

It is highly accurate because it follows a fixed formula. Errors usually happen due to incorrect salary or service details.

Can I Increase My EPFO Pension Amount

You cannot increase it beyond EPS limits, but longer service and retiring at the standard age help maximize it.

What Happens If I Change Jobs Frequently

Frequent job changes do not affect pension eligibility as long as your EPF account is transferred correctly.

Is EPFO Pension Enough for Retirement

For most people, EPFO pension alone is not sufficient. It should be treated as a base income supported by other savings and investments.