Millions of private employees retire with a pension that feels too small for today’s expenses, which is why pension updates from EPFO draw instant attention. The latest buzz is around a possible increase in the minimum monthly EPS pension, with the number ₹5,000 repeatedly appearing in public discussions largely because trade unions have demanded that minimum level. If this moves from discussion to implementation, it could directly improve monthly income for retirees who depend heavily on EPS as a steady post-retirement support. EPFO Pension Update 2026 is trending because it combines two things people care about most\, how much pension will I get and how soon will I see the benefit when I retire. EPFO Pension Update 2026 is also being searched by employees close to retirement who want clarity on whether new rules will apply to them and what they should keep ready to avoid delays. The practical approach is simple: follow only official communication for confirmation and keep your EPFO details clean so that whenever an update becomes official, you do not lose time in corrections.

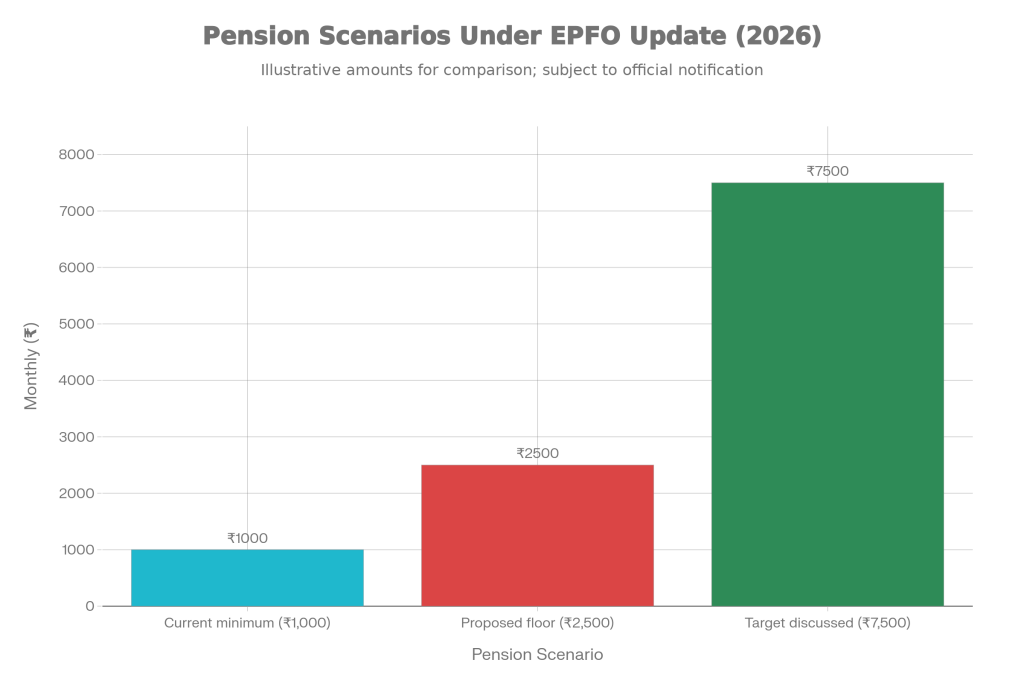

EPFO Pension Update 2026 is being used as a shorthand for the larger discussion around improving EPS pensions for private sector workers, especially those who end up with low monthly payouts. The most talked about figure in the current news cycle is ₹5,000, but it is important to understand why it appears so frequently: it is strongly linked with union demands and public pressure rather than a final, notified decision. In other words, EPFO Pension Update 2026 is best treated as a developing story until an official notification clearly states the new minimum pension, effective date, and eligibility conditions. One more reason this topic stays hot is that pension updates affect long term planning in a very real way. A change of even a few thousand rupees per month can alter how a family budgets for medicines, rent, groceries, and other recurring costs after retirement. That’s why readers should focus less on viral claims and more on what official EPFO guidance says about implementation timelines and documentation requirements.

EPFO Pension Update 2026

Retirement Boost For Private Employees

- This update is resonating because EPS is supposed to be the safety net for private employees after retirement, yet many retirees feel the payout is not keeping pace with living costs. The renewed demand to raise the minimum pension has once again pushed the topic into headlines and finance discussions. That public pressure is also why the phrase may raise appears so often, because the conversation is active but not yet a finalized, notified rule.

- It also helps to separate three layers of information. First, there is the demand and expectation layer, where groups and unions propose a higher minimum pension. Second, there is the policy discussion layer, where boards and departments evaluate cost, feasibility, and implementation approach. Third, there is the execution layer, where EPFO publishes instructions that actually change what pensioners receive and how claims get processed.

What This Means For Private Employees Planning Retirement

For employees in their 30s and 40s, news like this is a reminder that retirement planning cannot rely on a single income stream. EPS can be a helpful base, but many households still need additional savings and investments to meet long term goals. Still, if the minimum pension floor is increased in the future, it can improve the baseline security for people who have limited additional retirement savings. For employees close to retirement, this is more urgent because the window to fix records is smaller. If your EPFO profile has a mismatch in name, date of birth, bank account details, or KYC, pension related processing can become slow and stressful at the worst possible time. So even while the larger policy decision is awaited, cleaning up your profile and documentation is a smart move that pays off regardless of the final pension amount.

Who Could Benefit The Most If Minimum Pension Is Raised

- A higher minimum pension would be most meaningful for retirees who currently receive lower monthly payouts. This typically includes pensioners who had lower pensionable wages across their career or shorter eligible service compared to long tenure employees. For such retirees, a minimum floor increase can feel like a direct income upgrade rather than a small incremental change.

- It may also help families where the retiree is the primary or major financial support. In many households, a predictable pension becomes the “fixed income pillar” that keeps regular expenses manageable even when other income sources are uncertain. That is why people follow these updates so closely and why misinformation spreads quickly around pension hike numbers.

What To Do Right Now to Avoid Claim Delays

Even without a confirmed hike, there are a few practical steps that can keep you ready. These steps do not guarantee a higher pension, but they do help ensure faster processing and fewer rejections when you apply for benefits or when rule updates roll out.

- Verify that your KYC is updated and accurate in your EPFO profile.

- Ensure your bank account details are correct and active for benefit credits.

- Check your personal details like name and date of birth for mismatches across records.

- Keep proof of employment and service history handy, because pension benefits depend on service linked records.

- Track official EPFO FAQs and updates for any change in pension rules and implementation instructions.

Khet Talab Yojana 2026 – Farmers Can Get Up to 90% Subsidy for Farm Ponds, Online Applications Open

Common Confusions Readers Have

- Many readers assume that once a number appears in news, it is final and applicable to all pensioners. In reality, pension changes usually come with conditions such as an effective date, eligibility criteria, and implementation instructions that define who gets what and from when. That is why the best habit is to wait for official clarification and avoid making big financial decisions based on social media forwards.

- Another confusion is expecting automatic increases the moment an announcement happens. Even after a decision, operational rollout can take time because EPFO has to issue instructions, update systems, and align processes with banks and field offices. Keeping records accurate helps you benefit smoothly when changes finally reflect in actual credits.