RBI EMI Rules 2026 is the phrase many borrowers are searching right now because everyone wants the same thing: a smaller EMI and a little breathing room in the monthly budget. RBI EMI Rules 2026 has also become a hot topic because floating-rate home loans and many personal loans react to policy rates, and even a small drop in rates can change the EMI math meaningfully. Your EMI won’t fall just because headlines say new rules. But RBI EMI Rules 2026 is still important because it pushes lenders to be more transparent during rate resets, tell you clearly what’s changing, and give you options to manage the impact. That makes it easier to avoid silent tenure extensions, compare choices, and act at the right time.

RBI EMI Rules 2026 is being used as a broad label for RBI’s borrower-centric approach to floating-rate resets and disclosures especially for EMI-based personal loans, and by extension, the way borrowers evaluate floating-rate loan changes in general. In plain language, it means lenders are expected to communicate rate changes properly, explain how your benchmark works, and show you the real numbers in periodic statements so you can take informed decisions. If you’ve ever felt confused about why your EMI didn’t change even after rates moved, these rules matter because they focus on clarity what rate you are on, what changed, when it changed, and how it affects EMI, tenure, and total interest.

RBI EMI Rules 2026

| Topic | What It Means | Why It Can Help Your EMI |

|---|---|---|

| Repo rate movement and transmission | Floating-rate loans generally move based on benchmarks influenced by the policy rate and system liquidity. | If effective lending rates fall, EMIs can reduce or tenure can shorten (depending on the option selected). |

| Reset transparency | Lenders are expected to clearly inform borrowers about rate resets and their impact. | Helps borrowers spot whether EMI increased, tenure increased, or both so they can respond quickly. |

| Borrower options at reset | Borrowers should be offered choices like EMI increase, tenure increase, or a mix, and in some cases switching rate type. | You can choose what fits your cashflow instead of being forced into long tenure creep. |

| Regular statements with key details | Periodic statements should show principal and interest recovered, current EMI, EMIs left, and effective annualised rate. | Makes it easier to track true loan cost and plan part-prepayments. |

| Applicability to existing borrowers | The approach is meant to cover ongoing loans too, not only new sanctions. | Existing borrowers can also benefit from clearer communication and options. |

Communications To Borrowers Envisaged in the Circular Are

This is the part that quietly changes a borrower’s experience. A big reason people feel cheated on floating-rate loans is not always the rate itself it’s the lack of clear explanation of what exactly changed in the loan schedule. Under the RBI EMI Rules 2026 framework, the expectation is that borrowers get clear communication at the time of sanction and also during the loan tenure.

What should feel different for you in 2026:

- You should be able to see the annualised interest rate (APR-style disclosure) in your key documents.

- When the benchmark changes and your loan resets, the impact should be communicated especially if it changes your EMI, your tenure, or both.

- Periodic statements should clearly show how much principal you have repaid, how much interest you have paid, what your current EMI is, and how many EMIs are left.

Why this matters for EMI reduction: when you can actually see the cost, you make better decisions. Many borrowers stay stuck in high-interest phases simply because they don’t track the amortisation properly. Once the data is visible, the borrower can ask sharper questions, negotiate, refinance, or prepay strategically.

What Are The Different Options Available To Borrowers

This is where RBI EMI Rules 2026 becomes actionable, not just informational. When interest rates rise, lenders commonly adjust loans in ways that protect EMI affordability often by extending the tenure. That may feel comfortable short-term, but it can increase the total interest you pay across the life of the loan.

The options that borrowers are generally guided to be offered include:

- Increase EMI: You pay a higher EMI so the tenure doesn’t stretch too much.

- Increase tenure: EMI stays similar, but you pay for longer.

- Combination approach: EMI increases a bit and tenure also extends slightly.

- Switching rate type (where offered): Some lenders may offer a fixed-rate switch for the remaining tenor.

- Part-prepayment or full prepayment: Paying extra principal to reduce outstanding amount and interest burden.

How to use these options to push EMIs down in 2026:

- If rates are expected to soften or have already started softening, many borrowers prefer keeping the same EMI and letting the tenure reduce. This reduces total interest and finishes the loan sooner.

- If cashflow is tight, temporarily choosing tenure extension can help, but it should be monitored so you don’t end up paying years of extra interest.

- If you receive a bonus, incentives, or have surplus savings, part-prepayment (even once or twice a year) can make a bigger difference than people realise because it attacks the principal.

RBI EMI Rules 2026 is useful because it supports informed choice. The best option depends on your income stability, emergency fund, and how close you are to major goals.

Whether The Circular Be Applicable To Existing Borrowers

Yes, existing borrowers matter here because the biggest pain is usually felt by people already paying EMIs, not only new borrowers. In 2026, if you already have an EMI-based loan, the expectation is that communication, disclosures, and borrower options should not be limited only to fresh disbursals.

For an existing borrower, this is especially important if:

- The loan is on a benchmark that resets slower.

- The tenure has been extended earlier without you fully noticing.

- The EMI didn’t reduce even after you heard about rate cuts.

- You are considering a balance transfer or renegotiation.

Once you treat your loan like a product you can actively manage rather than a fixed monthly burden you can genuinely reduce the overall cost and sometimes reduce the EMI too.

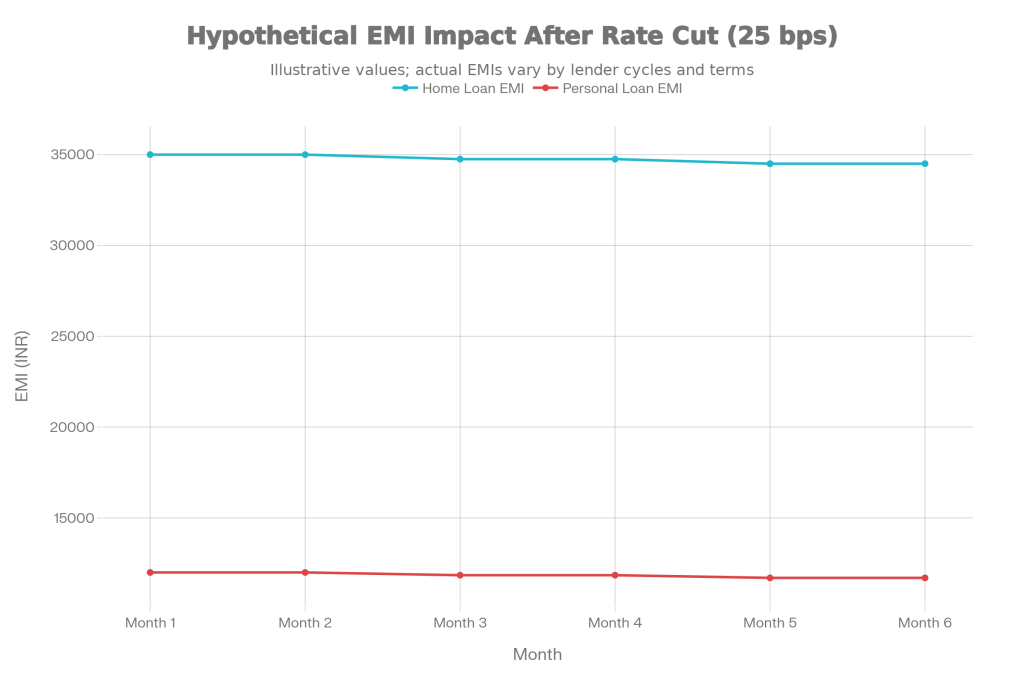

Why Home And Personal Loan EMIs Could Go Down In 2026

Let’s break this down like a borrower not like a textbook.

1 Rate Environment Can Turn Friendly

If the broader interest-rate cycle trends downward, floating-rate borrowers usually benefit first. But the timing depends on your benchmark and reset frequency. That’s why one person sees an EMI drop quickly while another sees it later.

2 Better Transmission and Clearer Reset Process

Even when the repo rate changes, what matters to your EMI is your effective lending rate and when your bank passes the change. With better reset communication and clearer statements, borrowers can track whether transmission is happening and question it if it’s not.

3 The EMI Vs Tenure Choice Becomes Clear

In many cases, lenders manage rate cuts by keeping EMI constant and reducing tenure, or manage rate hikes by keeping EMI constant and extending tenure. Once borrowers understand this mechanism, they can choose what benefits them most and avoid getting stuck with “never-ending EMIs.”

4 Smart Prepayment Becomes a Real Strategy

Even without dramatic rate cuts, prepayment is the most reliable way to reduce total interest. Many borrowers underestimate how effective it is to pay even one extra EMI per year or to do small quarterly principal top-ups. If your statements clearly show principal remaining and EMIs left, it becomes easier to plan and execute.

Khet Talab Yojana 2026 – Farmers Can Get Up to 90% Subsidy for Farm Ponds, Online Applications Open

Practical Steps To Actually Benefit In 2026

Here are the steps that work in real life:

- Check your loan type: floating or fixed, and what benchmark it follows.

- Ask your lender for your reset frequency and next reset date.

- Read your periodic statement and track: principal outstanding, interest paid, EMIs left.

- If rates fall, decide your goal:

- Lower EMI now, or

- Same EMI but shorter tenure (often better financially).

- If you have surplus, plan a structured part-prepayment (even small amounts).

- If you are offered a switch (fixed/floating), compare the total cost, not just the EMI.

FAQs on RBI EMI Rules 2026

Will RBI Emi Rules 2026 Reduce My Emi Automatically

Not automatically. Your EMI changes only when your lending rate resets and the lender passes changes through your benchmark cycle, and sometimes the lender adjusts tenure instead of EMI.

What If My Emi Doesn’t Reduce Even After Rates Fall

This can happen due to reset timing, benchmark type, or because the bank adjusted tenure instead of EMI. The best move is to check the statement and ask the lender what changed in the amortisation schedule.

Is It Better to Reduce EMI Or Reduce Tenure

If your income is stable, keeping EMI the same and reducing tenure usually saves more interest overall. If cashflow is tight, reducing EMI can provide immediate relief, but it may increase total interest paid.

Can Part Prepayment Really Make A Big Difference

Yes. Part-prepayment directly reduces principal, which reduces future interest calculations. Even occasional prepayments can shorten tenure and cut total loan cost significantly over time.