Indira Mahila Shakti Udyam Yojana offers Rajasthan’s women entrepreneurs a real shot at government loans to kickstart or grow their businesses. If you’re dreaming of launching that boutique in Jaipur or scaling up a food processing unit in Udaipur, the Indira Mahila Shakti Udyam Yojana could be your game-changer with loans up to 50 lakh rupees and hefty subsidies. In 2025 alone, over 40,000 applications poured in, with around 4,000 approvals dishing out loans and subsidies that have created jobs and boosted local economies. It’s all about empowering you to stand on your own feet, breaking free from financial barriers and building something lasting.

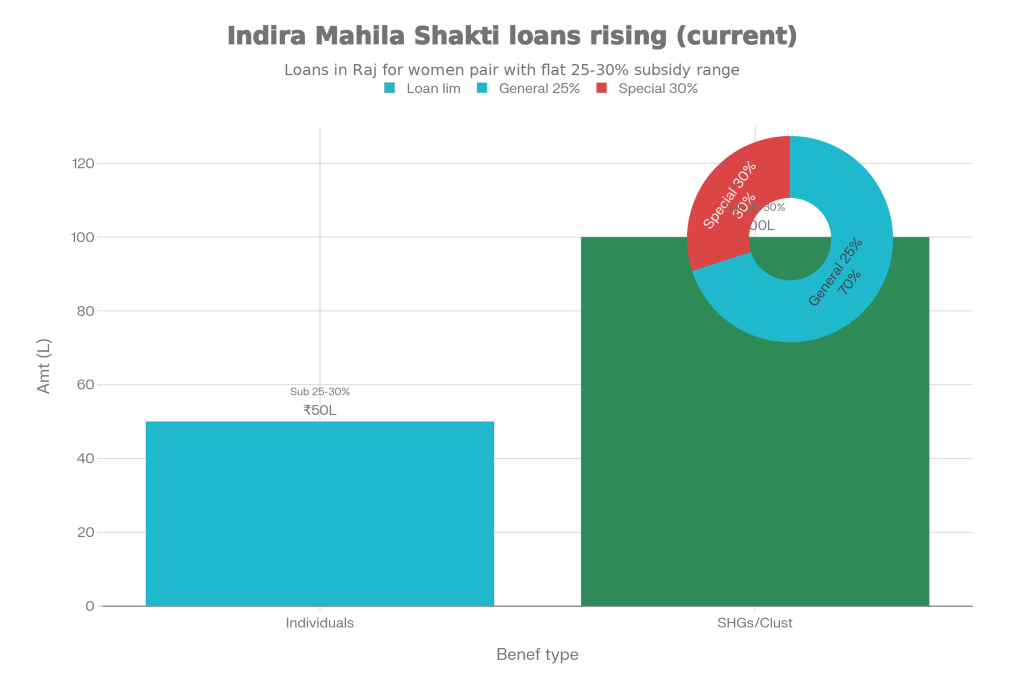

Rajasthan women eyeing business growth find the Indira Mahila Shakti Udyam Yojana a straightforward path to loans up to 50 lakh for individuals or 1 crore for self-help groups. Subsidies hit 25 percent for most, jumping to 30 percent for widows, SC/ST, disabled, or violence survivors, credited straight to your loan account post-disbursement. Apply online via SSO portal if you’re 18 plus and a local resident, no collateral needed under 10 lakh, targeting manufacturing, services, or trade. Recent stats show 1,400 women benefited in 2023-24, with the scheme extended to 2029 under its new name for ongoing support. This setup makes the Indira Mahila Shakti Udyam Yojana not just a loan program but a launchpad for real economic independence.

Indira Mahila Shakti Udyam Yojana Overview Table

| Feature | Details |

|---|---|

| Loan Limit (Individuals) | Up to ₹50 lakh |

| Loan Limit (SHGs/Clusters) | Up to ₹1 crore |

| Subsidy | 25% general; 30% for widows, divorced, violence victims, disabled, SC/ST |

| Collateral | Exempt up to ₹10 lakh |

| Sectors | Manufacturing, services, trade, agribusiness |

| Validity | Ongoing (renamed Mukhyamantri Nari Shakti Udyam Protsahan Yojana) |

| Application Portal | SSO Rajasthan (ssoapps.rajasthan.gov.in/imsupy) |

Scheme Structure

This credit-linked setup from the Women and Child Development Department backs solid projects with market promise. Banks release loans first, then subsidies follow after verification, keeping things moving fast for genuine starters. Vulnerable women get front-row seats, aligning with Rajasthan’s drive for economic inclusion. With a 1,000 crore corpus, it’s fueled thousands of MSMEs, cutting unemployment and sparking self-reliance in 2025. The Indira Mahila Shakti Udyam Yojana stands out by blending bank financing with government backing, ensuring women don’t just get money but the tools to succeed long-term. Think of it as a partnership where your hustle meets official support, turning rural dreamers into urban success stories.

Eligibility Criteria For Indira Mahila Shakti Udyam Yojana

You qualify as a Rajasthan resident over 18, whether solo, in a women’s SHG, cluster, or majority-female firm. No defaults on your record, and no family subsidies from similar schemes in five years. Street vendors, migrant returnees, or award-winning entrepreneurs jump the queue, no degree or prior experience required. This opens doors wide for rural women in handicrafts or dairy eyeing Rajasthan women entrepreneur loans via Indira Mahila Shakti Udyam Yojana. Even if you’ve dabbled in small-scale trading from home, this scheme levels the playing field. Families with multiple women can apply separately, as long as projects differ, making it family-friendly for collective progress.

Application Process For Indira Mahila Shakti Udyam Yojana

Head to SSO Rajasthan, log in or sign up, and hit new application for the scheme. Plug in personal info, project costs including term loans and working capital, pick your bank, and upload docs; sub-10 lakh apps sail through office nods. Monthly camps at district offices guide you, with SMS updates till bank sanction. In 2025, digital tweaks made it smoother, drawing 38,000 plus applicants as women learned the ropes for Indira Mahila Shakti Udyam Yojana access. Start early in the month to catch camp dates, and double-check bank details to avoid delays. Many first-timers find the portal intuitive, with Hindi options easing language worries for non-urban applicants.

Required Documents

Keep Aadhaar, residence proof, photo, and bank details ready; education certs help if you have them. Over 10 lakhs? Add a project report on costs, revenues, and markets, no CA stamp needed for basics. SHGs submit ID, formation date, and rep details. This simple list ensures quick processing for Indira Mahila Shakti Udyam Yojana government loans in Rajasthan, saving trips and time. Scan everything clearly on your phone mobile uploads work fine and keep originals handy for verification camps. For groups, get society registration if over a year old, but new SHGs qualify too with basic linkage proofs.

Loan Disbursement Process

Officers check viability through chats on your skills, market, and payback plans. Up to 10 lakh gets deputy approval; bigger sums hit district panels before banks wire funds. Update progress online for subsidy drop 25 or 30 percent right into your account. Success stories from Jaipur tailors or Udaipur agro units show how personal equity (5-10 percent) speeds things up under Indira Mahila Shakti Udyam Yojana. Expect 30-60 days from submission to first tranche, faster for small loans. Banks like Rajasthan Gramin Bank partner closely, offering training post-disbursal to boost repayment rates above 95 percent.

Indira Mahila Shakti Udyam Yojana Project Details

Spell out fixed assets like machines (20 percent max on buildings) and working capital for materials or wages. Project jobs created and sales from local to national levels, cap at 1,000 words. Strong stories on venture success tip scales. Women scaling Udyam-registered outfits love the interest subvention up to seven years, a 2025 perk boosting Rajasthan’s women-led startup wave. Break down costs realistically say, 15 lakh for a pickle unit’s equipment and 5 lakh working capital and highlight local demand like Jaipur’s tourist spice craze. Include scalability plans, like online sales via apps, to impress reviewers.

Let’s dive deeper into real-life wins. Take Sunita from Jodhpur, who snagged a 20-lakh loan through Indira Mahila Shakti Udyam Yojana for her spice grinding business. Starting from a backyard setup, she now runs a 1,000 sq ft unit employing 12 women, exporting to Delhi markets. Her subsidy cut repayments by 30 percent, letting her reinvest in packaging machines. Or consider the Kota SHG of 15 weavers who pooled for a 75-lakh loan, modernizing looms and hitting Flipkart shelves. These aren’t outliers in 2025, the scheme supported over 5,000 units, generating 25,000 jobs amid Rajasthan’s 7 percent MSME growth.

- Why does Indira Mahila Shakti Udyam Yojana work so well? It skips heavy paperwork for starters, focuses on viability over credentials, and ties subsidies to actual progress. Banks conduct site visits pre-approval, ensuring funds fuel real assets. Repayment spreads over 7-10 years at 8-12 percent interest, subsidized further for specials. Compare this to private loans: no collateral hassles, quicker nods, and women-only priority. In districts like Barmer or Bikaner, where migration bites hard, it’s reversed trends, with 60 percent rural approvals.

- Training camps now include digital marketing sessions, teaching UPI payments and GST filing. Entrepreneurs report 20-30 percent profit margins post-setup, thanks to subsidy buffers. Challenges? Competition in popular sectors like beauty parlors means unique ideas shine like eco-friendly jute bags in Alwar. Helpline 181 resolves 80 percent queries same-day, from doc scans to status checks.

- For expansions, Udyam-registered women get bonus points, bridging to PMEGP seamlessly. 2025 updates added EV charging stations and solar units as eligible, tapping green trends. Groups forming clusters access composite loans, sharing machinery for cost savings. Track record shows 85 percent ventures sustainable after two years, far above average startups.

Minimum Balance Rules Finalized for SBI, PNB, and HDFC Customers — Check Complete Details

FAQs on Indira Mahila Shakti Udyam Yojana

Who can apply for Indira Mahila Shakti Udyam Yojana?

Rajasthan women 18+, SHGs, or female-majority firms without recent subsidies or defaults qualify easily.

What is the maximum loan under Indira Mahila Shakti Udyam Yojana?

Individuals get up to 50 lakh: SHGs or clusters up to 1 crore, collateral-free below 10 lakhs.

How long does Indira Mahila Shakti Udyam Yojana approval take?

Sub-10 lakh apps process at office level quickly; others via task force, with SMS tracking.

Is subsidy guaranteed in Indira Mahila Shakti Udyam Yojana?

Yes, 25-30 percent post-loan and verification, higher for special categories.