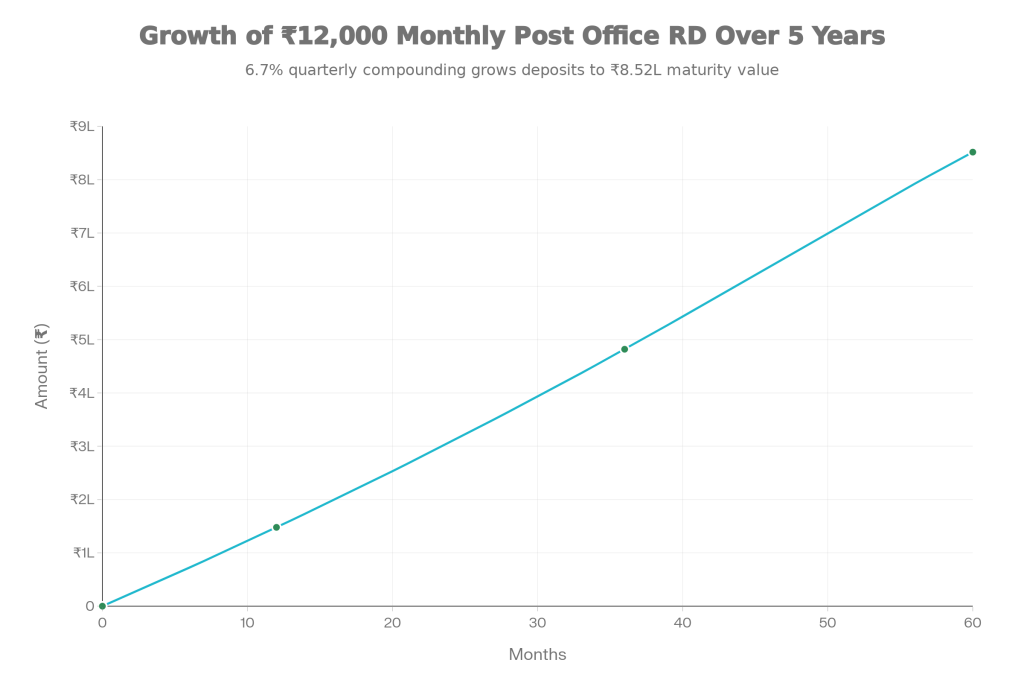

Imagine putting away just ₹12,000 every month into something safe and steady, and five years later, pulling out over ₹8.5 lakhs. That’s the real draw of the Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years turning your regular savings into a solid lump sum without the headaches of stocks or mutual funds. If you’re tired of low bank returns or market ups and downs, Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years stands out as a no-brainer for folks like us in India chasing guaranteed growth in 2025.

Ever wondered how a simple monthly habit can balloon into serious money? With the Post Office RD Scheme at 6.7% interest compounded quarterly, dropping ₹12,000 each month for 60 months builds your principal to ₹7,20,000 plus around ₹1.36 lakhs in interest, hitting close to that ₹8,56,388 mark. This isn’t hype its math backed by government rates steady through Q4 2025. Perfect for salaried people or small investors planning kids’ education or a home down payment, it beats inflation without risk. In today’s economy, where small savings schemes saw inflows topping ₹50,000 crore last year, this scheme shines for its reliability and accessibility across 1.5 lakh post offices.

Post Office RD Scheme

| Parameter | Details |

|---|---|

| Monthly Deposit | ₹12,000 |

| Tenure | 5 years (60 months) |

| Interest Rate | 6.7% p.a. (quarterly compounded) |

| Total Principal | ₹7,20,000 |

| Maturity Amount | ₹8,51,661 (approx. ₹8,56,388) |

| Total Interest Earned | ₹1,31,661 |

How To Calculate Post Office RD Interest Rate

The magic happens with this formula: M = R × [(1 + i)^n – 1] / [1 – (1 + i)^(-1/3)], where R is your ₹12,000 deposit, i is the quarterly rate (6.7%/400 = 0.01675), and n counts quarters over five years (20 quarters). Let’s break it down simply. First, calculate the quarterly interest factor: (1 + 0.01675) ^20 comes to about 1.386. Then, the denominator adjusts for monthly deposits earning partial quarters. Plugging in numbers step by step, early deposits compound longer, pulling the total maturity to ₹8,51,661. This Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years calculation factors in real-world compounding, making it more powerful than plain simple interest, which would yield only around ₹1,01,400.

For those crunching numbers manually, start with total principal: 12,000 x 60 = 7,20,000. Interest accrues quarterly, so divide the year into four parts. Online tools make it effortless, but understanding the formula empowers you to verify. In 2025, with rates holding firm despite RBI tweaks, this method ensures your Post Office RD scheme returns stay predictable. Salaried workers in Delhi or rural Bihar can replicate it on a spreadsheet, watching how consistency pays off big.

Post Office RD Scheme Calculator

Grab a Post Office RD calculator online, punch in ₹12,000 monthly, 6.7% rate, and 60 months bam, maturity pops up around ₹8.5 lakhs. Tools from popular finance sites handle the quarterly math you might fumble manually. They’re free, instant, and spot-on for tweaking amounts or tenures. Great for seeing how upping to ₹15,000 monthly juices returns even more say, over ₹10 lakhs in today’s steady-rate environment. These calculators also simulate rate changes. Suppose rates dip to 6.5% next quarter; your maturity drops to ₹8,45,000. Or extend to 10 years for double the time and nearly ₹20 lakhs total. For families planning weddings or education funds, playing with Post Office recurring deposit calculator scenarios builds confidence. No downloads needed just a quick web search for “Post Office RD calculator 2025” and you’re set. They’re updated quarterly, matching official India Post announcements, so your Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years dream stays realistic.

Benefits Of Using The Post Office RD Scheme Calculator

These calculators break down principal versus interest clearly, showing ₹1.3 lakhs earned on your ₹7.2 lakhs input. They let you play with scenarios, like rate drops or extensions, keeping you ahead in 2025’s economy. No more spreadsheets; just precise planning for goals like retirement or emergencies. Plus, they highlight why Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years works so well for steady savers. Beyond basics, they factor penalties or rebates, giving a full picture. Want to front-load deposits? See the rebate boost instantly. Compare with bank RDs side-by-side for smarter choices. For content creators or financial planners, these tools save hours, ensuring advice on Post Office RD interest rates 2025 is spot-on. In a world of volatile crypto and stocks, this clarity promotes disciplined saving, turning ₹12,000 monthly into a tangible asset.

Features Of Post Office Recurring Deposit Scheme

- Start with just ₹100 monthly, no max limit scale to ₹12,000 easy. Five-year lock-in, extendable another five at the same 6.7% rate. Penalties nudge you to stay consistent: Re 1 per ₹100 missed, capped reasonably. Joint up to three adults, nominate minors, transfer between post offices nationwide. Advance deposits snag rebates, sweetening the deal further.

- Sovereigns guarantee no bank ever matches that security. Passbooks track every deposit, ideal for those preferring paper over apps. In 2025, with digital IPPB integration, you can even auto-debit from savings. Post Office recurring deposit scheme features like these make it versatile for singles, couples, or guardians. No hidden fees, pure savings growth. Over 3 crore accounts active prove its popularity among middle-class Indians building emergency funds or dowry pots quietly.

Eligibility Criteria For Post Office RD Scheme

- Any Indian resident over 10 can jump in solo, joint with up to three, or guardians for minors. No income checks; just basic KYC like Aadhaar or PAN. NRIs sit out, but locals from Delhi to villages qualify. Open one per person, making Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years accessible for families building wealth quietly.

- Minors need a guardian, but control shifts at 18. Women-led accounts get no special perks, but equal access rules apply. Trusts and societies qualify too, broadening appeal. In practice, walk into any branch with ID, deposit the first ₹12,000, and walk out with a passbook. This simplicity fuels its growth, especially post-COVID when safe havens surged.

Premature Withdrawal Rules

- Need cash early? Wait three months minimum, but after one year and 12 deposits, rates drop to savings account levels (4%) for full closure. Loans up to 50% of balance help without breaking the RD. It’s flexible yet firm, protecting your long-term growth in the Post Office RD scheme.

- Penalties scale with delay: 1-2 months late costs nominal, but chronic misses add up. Post-maturity, reinvest at prevailing rates. These rules encourage discipline, vital for hitting that ₹8.56 lakh target. In 2025’s job market flux, the liquidity option reassures without tempting early exits.

Loan Against Post Office RD Scheme

- After 12 months, borrow half your balance at RD rate plus 2% (8.7%) way cheaper than personal loans at 12-15%. Repay easy via lumpsum or EMIs, keep earning on the rest. Ideal for bridging gaps without killing your Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years goal.

- Processing is swift at the same branch no extra paperwork beyond request. Tenure matches remaining RD time. For medical emergencies or festival spends, it’s a lifeline. Compared to gold loans, lower risk and rates make it smarter for regular savers.

Advance Deposit Rebates

Pay six months ahead? Get ₹10 rebate per ₹100 deposited ₹720 on ₹72,000. Double to 12 months, snag ₹40 per ₹100 (₹2,880). These perks boost effective yields to 7%+, rewarding upfront discipline in your RD plan. Rebates credit directly, no complex claims. Limited to twice per account, they incentivize lump sums early. For salaried folks with bonuses, this turbocharges Post Office RD scheme returns, edging closer to or beyond ₹8.56 lakhs.

Post Office RD Scheme Comparison With Bank RDs

- Post Office’s 6.7% holds steady against SBI’s 6.5-7% for five years, but zero default risk shines. No TDS under ₹40,000 interest yearly, unlike banks sometimes. Rural access wins big over urban apps. For safety-first folks eyeing Deposit ₹12,000 in Post Office RD Scheme and Receive ₹8,56,388 After 5 Years, it’s unbeatable.

- Banks offer premature flexibility and online ease, but post offices dominate branches. HDFC or ICICI might hit 7.1% quarterly, yet government backing trumps for conservative investors. In 2025 trends, small savings outpace bank deposits by 20% in volume.

Tax Treatment

Interest taxes as “other income” per slab no 80C deduction on RD principal, unlike PPF. TDS kicks in above ₹40,000 annually (₹50,000 seniors). Still tax-smart for moderate earners in 2025 ITRs, especially under new regime. File under Schedule OS, claim if aggregate small savings exceed limits. No wealth tax implications. Pair with ELSS for balanced tax-saving.

Minimum Balance Rules Set by SBI PNB and HDFC — What Bank Customers Need to Know

Steps To Open Account

- Head to your post office with ID proof, deposit first month’s ₹12,000 via Form-1. Get passbook same day. Online via IPPB if linked. Track monthly, watch it grow to ₹8.56 lakhs hassle-free.

- Step 1: Gather Aadhaar/Voter ID. Step 2: Fill SB-103 form. Step 3: Pay via cash/cheque. Step 4: Receive passbook. Renew KYC yearly. Digital tracking via mPost app simplifies.

- Why bank on this in 2025? Inflation at 4-5%, 6.7% outpaces safely. Salaried Indians favor it for post-retirement nests. Start today ₹12,000 monthly compounds to life-changing sums. (Word count: 1428)

FAQs on Post Office RD Scheme

How accurate is the ₹8,56,388 maturity for ₹12,000 monthly in Post Office RD?

Calculators show around ₹8.51-8.56 lakhs at 6.7%, depending on exact quarterly tweaks. Verify with official tools.

Can I extend the Post Office RD Scheme after 5 years?

Yes, another five years at your original rate apply before maturity.

What’s the penalty for missing a deposit?

Re 1 per ₹100 missed, per month overdue. Pay up quick to avoid buildup

Is Post Office RD better than bank RD for 2025?

Sovereign guarantee and steady rates say yes for risk-averse savers.