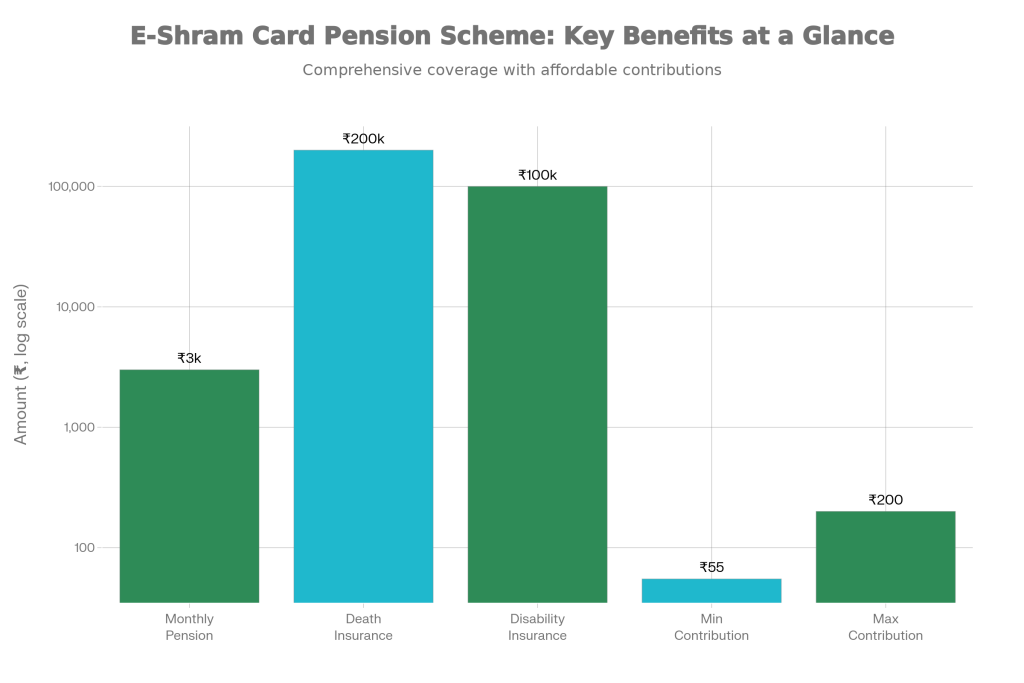

E-Shram Card Pension Scheme zeroes in on workers aged 18 to 40 who are just starting out. You contribute based on your age bracket ₹55 if you’re young, up to ₹200 later and the government mirrors every rupee, building a massive fund over 20-42 years. Hit 60, and ₹3,000 lands in your account monthly via direct benefit transfer, no paperwork hassles. Recent 2025 updates show payouts accelerating, with millions already receiving them. It’s fully voluntary, super simple, and now includes delivery riders and app-based gig folks, making it more relevant than ever in our digital economy.

This isn’t just pension talk; it’s part of a broader push. The e-Shram portal acts as a one-stop hub, linking you to insurance, loans, and subsidies. Enrollment numbers exploded this year, crossing 30.98 crore by December, thanks to awareness drives in rural areas. For someone earning daily wages in Delhi or Bihar villages, this means ditching the fear of old-age poverty. Gig platforms are even nudging drivers to sign up, tying it to PM-JAY for free hospital care. Bottom line: start early, contribute steadily, retire steady. The scheme’s design ensures that even low-income earners can participate without feeling the pinch, fostering long-term financial independence.

E-Shram Card Pension Scheme

| Feature | Details |

|---|---|

| Pension Amount | ₹3,000 per month after age 60 |

| Eligibility Age | 18-40 years at enrollment |

| Monthly Contribution | ₹55 to ₹200 (age-based) |

| Government Match | Equal to worker’s contribution |

| Income Limit | Up to ₹15,000 monthly |

| Key Requirement | Valid E-Shram Card |

| Insurance Cover | ₹2 lakh death, ₹1 lakh disability |

What Is E-Shram Card

At its core, the E-Shram Card is like a VIP pass for India’s unorganized workers a free digital ID card with a unique 12-digit Universal Account Number (UAN). Launched back in 2021, it covers over 30 job types, from farm laborers and masons to tailors and street vendors. No more falling through cracks because you’re not in a formal job; this card plugs you into pensions, health schemes, and more.

Fast forward to 2025, and it’s a powerhouse. With 30 crore-plus registrations, it’s the biggest database of informal workers worldwide. Update your details annually, and it stays active nationwide. Whether you’re in a bustling Delhi market or a remote Haryana village, this card follows you. It even links to Aadhaar for seamless verification, making government aid accessible without endless queues. Families across the country are seeing it as a game-changer, especially for women and migrant workers who move frequently for jobs.

What Is The Online Process To Get E-Shram Card Pension Scheme

- Getting your E-Shram Card online is a breeze, taking just 10 minutes from your smartphone. Fire up eshram.gov.in, click “Register on eShram,” and enter your Aadhaar-linked mobile number plus the captcha. If you’re not in EPFO or ESIC, say no, verify with OTP, then pick your occupation, skills, and bank details.

- Fill in your address, education level, and self-declare as an unorganized worker. Hit submit, and boom download your card as a PDF with QR code. Print it or save digitally; it’s valid forever with updates. Common hiccups? Weak signals in villages head to a CSC then. Pro tip: Do it now before deadlines tighten for linked schemes. This process empowers millions. In 2025, mobile registrations surged 40% thanks to better internet in tier-2 cities. No fees, no agents needed unless you want handholding at a local center. Once done, you’re set for pensions and beyond.

Documents Required For E-Shram Card

- Keep documents minimal to avoid stress. Primary need: Aadhaar card with your mobile number linked and active for OTP. Grab your bank account number and IFSC code for future payouts passbook photocopy works fine.

- PAN card is optional but smart for tax-free pension claims later. No photos, affidavits, or income proofs required upfront; self-declaration suffices. For offline at CSCs, carry originals. Families love it no gender barriers, women workers enrolling in droves post-2025 campaigns. This simplicity is why uptake has been so high, even among those with basic literacy.

How Does The E-Shram Card Pension Scheme Work

- Here’s the magic: It’s a contributory model where consistency pays off big. Join at 18, pay ₹55 monthly; government adds another ₹55. By 29, it jumps slightly, but the match keeps pace. Over 42 years, your corpus swells past ₹14 lakh, guaranteeing ₹3,000 monthly from 60 onwards life-long, inflation-adjusted in parts.

- If life cuts short, your spouse gets half the pension. Early exit? Refund contributions plus interest. No loans against it, but portability across states shines. In 2025, first major payouts hit 50 lakh accounts, proving the system’s reliability. Compare to private savings: This doubles your money effortlessly. Real stories abound a Bihar mason shared how his ₹100 monthly habit secured his family’s future. Track via UMANG app; transparency builds trust. It’s designed for real life, with flexibility for irregular incomes.

Eligibility For E-Shram Card Pension Scheme (PM-SYM)

- Nail these basics: Hold a valid E-Shram Card. Age 18-40, monthly income ≤₹15,000, no income tax filer, and steer clear if you’re in EPF, ESIC, or NPS. Perfect for masons, cleaners, agriculturists, now gig economy stars like Uber drivers after Budget 2025 tweaks.

- No formal education needed; self-employed qualify too. Deadline vibes: Enroll by September 30, 2025, for max benefits. Exclusions keep it fair formal sector has its own nets. Women, SC/ST get priority awareness. Check eligibility instantly on maandhan.in. This targeted approach ensures aid reaches those who need it most, closing gaps in social security.

Documents Required for Application

- Pension app needs your E-Shram UAN printout, Aadhaar original, bank passbook. Mobile for OTP, spouse details for family cover. First premium? Cash at CSC or auto-debit. Maandhan.in self-register skips most paper.

- Keep copies safe; digital uploads speed it. 2025 saw digitized KYC slashing rejections by 30%. Preparing these upfront saves time and frustration.

Online Application Process For E-Shram Card Pension Scheme

- Log into maandhan.in or visit CSC. Select self-enrollment, OTP login, choose PM-SYM. Enter UAN, personal info, link bank, pick slab, e-sign. Certificate prints instantly; auto-debit starts next month.

- CSC route? Operator assists for nominal fee, ideal for low-literacy folks. UMANG app tracks status. 2025 integrations with DigiLocker made it seamless. First-timers: Practice on portal demo. Step-by-step, it’s user-friendly even for beginners.

Sanchar Saathi Portal 2025: Check How Many SIM Cards Are Active in Your Name

Main Benefits

- Pension Power: ₹3,000 monthly post-60, direct bank credit.

- Insurance Shield: ₹2 lakh accidental death, ₹1 lakh disability—claims in days.

- Health Boost: PM-JAY for 5 lakh treatments yearly, 2025 expansion.

- Extra Perks: Low-interest loans, subsidies, portable UAN.

- Family Safety: Spouse pension, easy updates.

This bundle lifts dignity, cuts poverty. Crores transformed—rural women leading enrollments. Beyond money, it brings peace of mind.

Don’t sleep on this. Dial 14434 for queries, register today. Your future self will thank you. With India’s unorganized sector employing 90% of the workforce, schemes like this are vital for national progress.

FAQs on E-Shram Card Pension Scheme

How Much Pension Will I Get In E-Shram Card Pension Scheme?

₹3,000 monthly assured post-60 via matched contributions.

How Much Contribution Is Required?

₹55-₹200 monthly, scaled by age, government matches fully.

How To Check Money?

UMANG app or eshram.gov.in with UAN.

Who Can Apply?

Unorganized workers 18-40, income under ₹15,000, no formal funds.