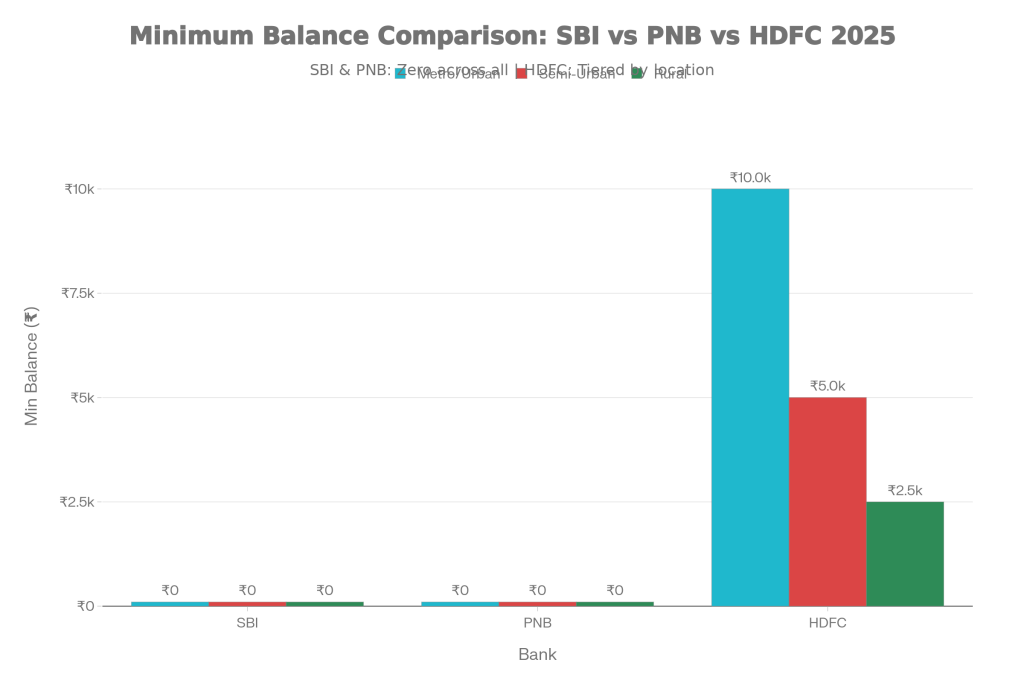

SBI, PNB, or HDFC, the minimum balance rules finalized for SBI, PNB, and HDFC customers are making waves right now, and they could mean big savings or surprises in your account. Imagine waking up to a sneaky penalty charge just because your balance dipped a bit it’s a headache million have faced, but 2025 updates are changing the game for over 60 crore savings accounts across India. These tweaks come straight from RBI’s push for fairer banking, blending customer relief with bank sustainability amid rising digital transactions.

The minimum balance rules finalized for SBI, PNB, and HDFC customers spell freedom for public sector fans while keeping private banks structured. SBI says zero balance everywhere, no catches. PNB wiped penalties from mid-2025, embracing rural users fully. HDFC holds tiered averages but smart workarounds like fixed deposits keep it flexible. With India’s savings deposits hitting ₹150 lakh crore this year, these rules boost inclusion rural accounts surged 15% as low earners jumped in without fear. Urban folks, check your branch; one small shift could save you ₹500-600 yearly. This setup matches RBI’s 2026 goal of universal banking access.

Minimum Balance Rules Finalized

| Bank | Metro/Urban Minimum | Semi-Urban Minimum | Rural Minimum | Zero Balance Option | Penalty For Shortfall |

|---|---|---|---|---|---|

| SBI | None | None | None | Yes (all savings) | No penalty |

| PNB | None | None | None | Yes (all savings) | No penalty (post-July 2025) |

| HDFC | ₹10,000 monthly | ₹5,000 monthly | ₹2,500 quarterly | Yes (special types) | 6% shortfall or ₹600 max |

State Bank of India (SBI): Zero Balance for All

- SBI has always been the people’s bank, and its zero minimum balance policy shines brighter in 2025. No matter if you’re in a crowded Mumbai metro branch or a quiet village outpost, regular savings accounts demand nothing no average monthly balance, no penalties sneaking up. This covers basic accounts, PMJDY zero-balance schemes, student wallets for kids under 10, minor accounts, pensioner setups, and even government scheme-linked ones.

- Picture a farmer in Bihar or a daily wager in Delhi: they deposit irregular amounts from sales or gigs, and SBI lets it ride without deductions. Locked in since 2020 and doubled down recently, this policy supports 50 crore users, fueling a 10 million new account boom among low-income groups. Families save on average ₹300 yearly that used to vanish in fees. Plus, with YONO app tracking, you focus on growth, not guarding every rupee. SBI’s edge? Nationwide uniformity no urban-rural divide hassles. If stability matters, this is your pick.

- Expanding on perks, SBI ties into UPI seamlessly, where transactions don’t touch balance rules. Recent stats show 40% of users now rely on it for bills and EMIs, dodging shortfalls naturally. For seniors, pension credits auto-maintain peace, no manual top-ups needed.

Punjab National Bank (PNB): Penalty-Free from July 2025

- PNB flipped the script in July 2025 by axing all minimum balance penalties on savings accounts full stop. Dip below any old threshold? No charge from that date on, though settle prior dues to stay clean. This hits home for its 40% rural and small-town base: farmers, women self-help groups, and gig workers who see incomes fluctuate wildly.

- Before, shortfalls cost ₹10 to ₹600 based on location and gap now gone, mirroring Canara Bank’s lead. Rural deposits jumped 12% post-change, as trust rebuilt fast. Think a Haryana artisan: sells crafts weekly, no more monthly panic. PNB’s vast network, over 12,000 branches, makes it ideal for tier-2,3 towns where alternatives are slim.

- This waiver spans domestic savings, not current or premium accounts. Pair it with PNB’s free RuPay cards and insurance links value stacks up. Users report 20% more savings retention, channeling funds to FDs or SIPs. For migrants shuttling jobs, flexibility rules.

HDFC Bank: Tiered Balance System Still Applies

- HDFC keeps it tiered and predictable: ₹10,000 monthly average in metro/urban hubs like Delhi or Bangalore, ₹5,000 in semi-urban spots, and ₹2,500 quarterly for rural branches. Shortfall? Banks levy 6% of the gap or ₹600 urban/₹150 elsewhere whichever stings less. But smart twist: link a fixed deposit to cover it ₹1 lakh urban, ₹50k semi-urban, ₹25k rural, locked 1 year 1 day minimum.

- Salary accounts, student variants from colleges, minors, and pension setups often skip entirely. With 8 crore customers, HDFC balances perks like instant loans against these norms. Urban pros love it: salary hits, auto-EMIs flow, balance holds steady. Recent uptick? 18% more FDs from rule-savvy users, earning 7% interest while complying.

Pro strategy: blend spends with deposits. HDFC apps forecast averages real-time, alerting dips. For gig economy hustlers, quarterly rural leniency eases quarterly payouts.

Understanding Monthly/Quarterly Average Balance (Mab/Qab)

Core to these rules: MAB sums your daily closing balances over a month (or quarter), divided by days. Not the lowest point, but the trend matters a busy week of outflows averages out if topped later. SBI/PNB ignore it fully; HDFC enforces strictly.

Example: Urban HDFC with ₹8,000 average on ₹10k need pays on ₹2k gap. Track via statements or apps showing running totals. In 2025’s volatile job market, where 30% earn irregularly, this prevents one-off hits. Tools like SMS alerts or Excel trackers help casual users nail it.

Penalty-Free Banking: Who Is Eligible?

- SBI/PNB open the gates wide: all regular savings qualify post-updates, plus Jan Dhan, minors, students, pensions, salaries, and benefits. HDFC matches for BSBDAs, salary credits over ₹15k monthly, approved student lists, and elder accounts.

- First-timers or low earners thrive here zero barriers to entry. Confirm via branch visit, app dashboard, or helpline; many qualify unknowingly. Upgrading? Often instant zero-status. Across banks, 25% of accounts now penalty-proof, per recent trends.

Why Minimum Balance Rules Changes? Analysing The 2025 Reforms

- RBI’s inclusion mandate drove it: PSUs like SBI/PNB ditched fees to chase 100% adult coverage by 2026, adding 20 million zero-balance accounts since January. HDFC refines for costs, but FD hacks soften edges. Rural relief shines deposits up 18% YoY while urban stability holds.

- Bigger picture: digital boom, UPI at 15 billion transactions monthly, reduces cash needs. These minimum balance rules finalized for SBI, PNB, and HDFC customers bridge gaps, cutting complaints 30%. Public banks gain loyalty; privates, premium seekers.

PM Maternity Benefit Scheme Explained: How Eligible Women Can Receive ₹5,000 Direct Support

Tips To Avoid Minimum Balance Penalties

- Go zero-eligible: salary switch or BSBDA. Alerts on SMS/net banking flags lows. Auto-debit salary portions. HDFC? FD link for passive compliance. Monthly reviews catch drifts; small ₹500 top-ups save big.

- Link UPI wallets wisely don’t drain cores. Rural movers? Pick SBI/PNB branches. Habits like this reclaim ₹1,000+ yearly, funding emergencies or investments.

FAQs on Minimum Balance Rules Finalized

What is the exact minimum balance for SBI savings accounts in 2025?

None required zero average monthly balance across all branches, no penalties ever.

Has PNB really removed all minimum balance charges?

Yes, fully from July 2025 for savings accounts; clear old dues only.

Can I use a fixed deposit to meet HDFC’s balance rules?

Yes ₹1 lakh urban, ₹50,000 semi-urban, ₹25,000 rural, 1+ year tenure.

Which accounts get full exemption across these banks?

Salary, student, minor, pension, Jan Dhan, BSBDAs all zero requirements.