In India, registering property in a wife’s or husband’s name is no longer a simple, routine formality. From 2025 onwards, the government, registration authorities, and courts have started treating such transactions very differently, especially where property is put in a spouse’s name only for tax benefits, benami parking, or to show “paper ownership” in the name of a woman. If you are planning to buy land or a flat in your spouse’s name, signing documents without understanding the new rules can turn into a serious legal risk. It is a clear warning that now registry, declaration, fund trail, and title proof together will decide who the real owner is. In simple words, merely writing the spouse’s name on the sale deed is no longer enough to prove exclusive ownership later; authorities will also look at who paid for the property, why it was bought, and how it has been treated within the family structure.

Under Land Registration Alert: New Rules for Property Registered in a Spouse’s Name, the biggest shift is that spouse‑name registries are now treated as a “high scrutiny zone.” It is no longer automatically assumed that a property registered in a wife’s or husband’s name is purely that person’s individual asset. Instead, authorities will examine declarations, income proof, and the overall family situation to decide whether it is a self‑owned asset or a family asset. Another major change is that registry by itself is no longer treated as final proof of ownership unless the same status is reflected in revenue records, digital land records, and mutation entries as well. This means that if you register property in your spouse’s name but do not follow up with proper updates in other government records, you may face serious hurdles later for loans, resale, or inheritances.

New Rules for Property Registered in a Spouse’s Name

Understanding Land Registration Rule 2025

The core aim of Land Registration Rule 2025 is to convert land registration from a simple paper ritual into an evidence‑based, fully digital process. Earlier, many people registered property in the wife’s name mainly to save stamp duty or avoid future disputes, while the real control and money came from someone else. Now this very model has been brought under questioning. These new rules focus specially on spouse‑linked registries because that is where benami arrangements and later matrimonial disputes are most common. The government wants every spouse‑name registry to clearly state from day one who the real owner is and what share other family members may have in future.

Essential Information Required In Declaration Form

- In the new system, the declaration form is not a mere formality; it is a primary piece of evidence for any future dispute. It does not stop at basic details like name and address of the spouse. It also requires clear information on the spouse’s income source, actual contribution to the property, and role in the decision‑making.

- If the property is fully funded by the husband, the declaration may need to clarify whether the asset will be treated as the wife’s personal property or as a family asset. Similarly, if the woman is earning and contributing through her own savings or loan, her contribution percentage, bank details, and repayment pattern can also be captured in the declaration. In future court cases, this very language can tilt the decision one way or the other.

What a New Spouse-Name Rules Affect Your Property Planning

In the past, many buyers put property in a spouse’s name assuming they would automatically get tax benefits, lower stamp duty, and better safety for family assets. Those advantages can still exist, but only if documentation and transparency are strong. Otherwise, the same structure can backfire. One practical trend now is the growing use of joint ownership. When husband and wife are both made co‑owners, not only does legal security improve, but loan eligibility, resale, and inheritance become clearer and smoother as well. If you register only in the spouse’s name but keep the real funding and control with yourself, courts in the future may view this arrangement very differently than you expect.

Registry Is Not Ownership Anymore: Why Title Proof Matters

Many buyers still assume that once the sale deed is registered and the registry copy is in their hands, they or their spouse become the “final owner.” New land rules are directly challenging this mindset: registry is only one step, not the whole journey to full ownership. Ownership will be treated as strong only when, after registry, mutation is completed, the name is updated in revenue records, digital RoR or the state’s online land portal, and the property is correctly mapped with a Unique Land ID wherever applicable. If you register in your spouse’s name but skip these follow‑up actions, banks, buyers, or even courts may later say that the title chain is incomplete.

Benami Risk And Marital Disputes: What Courts Are Indicating

Recent judgments have made it clear that a registry in someone’s name does not automatically give that person exclusive ownership. In cases where the spouse has little or no independent income and the entire money has come from the other partner, courts often tend to treat such property as a marital or family asset. On the other hand, if the woman has a strong income track record, clear bank records showing her contribution, and a declaration stating her status as real owner, her ownership becomes significantly stronger. That is why every spouse‑name registry will now be examined through three lenses: fund trail, declaration language, and family structure.

Practical Checklist Before Registering Property in a Spouse’s Name

- Decide clearly within the family whether the property will be treated as a personal asset of the spouse or as a family asset; draft the declaration accordingly.

- Make all payments through proper banking channels; cash funding or hidden third‑party payments can increase benami risk later.

- If opting for joint ownership, check in advance what stamp duty and registration fee benefits your state offers for women or joint registries.

- After registry, promptly complete mutation, municipal record updates, and digital land record changes.

- For high‑value deals, take written opinions from both a property lawyer and a tax consultant so that no heir later feels intentionally left out.

Long-Term Impact on Family and Inheritance Planning

Registering property in a spouse’s name is not inherently a bad decision. Done correctly, it can be a powerful tool for family security and women’s empowerment. Many state governments still offer stamp duty rebates when property is registered in a woman’s name to increase her direct stake in the house or land. But when the same model is used just for paper ownership, to park unaccounted money, or to quietly cut out certain heirs, both the government and courts are now far more aggressive. With the new rules, instruments like wills, family settlements, and nominations have become more critical than ever for clear inheritance planning.

PM Surya Ghar Yojana Progress Update: Nearly 24 Lakh Rooftop Solar Systems Installed So Far

Why Land Registration Alert Matters for Every Buyer In 2025 And Beyond

- Land Registration Alert: New Rules for Property Registered in a Spouse’s Name is not a niche topic affecting only big builders or ultra‑rich families. It applies across the board to small plots, flats, village land, gift deeds, and family settlements because spouse names are used everywhere.

- If you proactively collect the right documents, maintain a clean fund trail, use clear and legally sound declaration language, and keep all digital records updated, registering in your spouse’s name can become a strong, long‑term asset strategy. If you ignore these aspects, the same step can become a future headache in the form of loan rejections, resale problems, children’s claims, or marital disputes.

FAQs on New Rules for Property Registered in a Spouse’s Name

1. Why did the government tighten rules for property registered in a spouse’s name?

2. Does registering property in my wife’s name automatically make her the exclusive owner?

3. Is joint ownership better than registering property only in a spouse’s name?

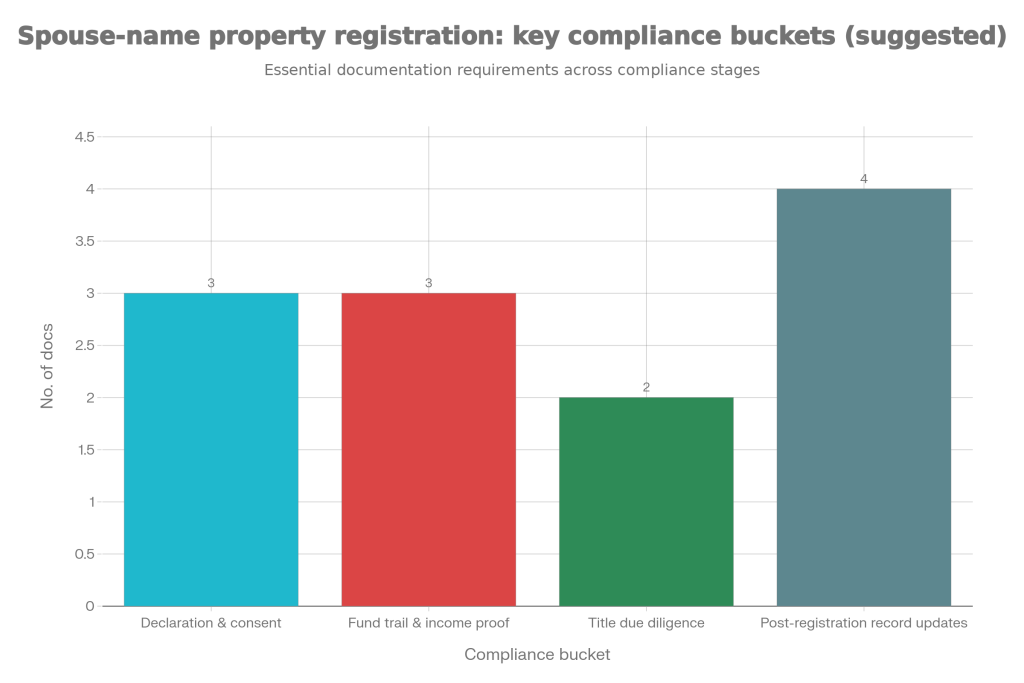

4. What documents are most important under the new land registration rules for spouse-name properties?

Key documents include a clear declaration form, bank fund trail, income proof, updated mutation records, and digital land records reflecting the same ownership details.