If you want to continue your studies after Class 12 but rising tuition fees, hostel charges and other expenses are holding you back, the MNSSBY Bihar Student Credit Card can be a powerful support for you. This scheme offers up to ₹4 lakh in funding without any collateral so that money does not become a barrier between you and your college education. The MNSSBY Bihar Student Credit Card is not just a loan; it is a structured tool that lets you focus on your education, provided you clearly understand the terms, responsibilities and the real “catch” behind it. The main aim of the MNSSBY Bihar Student Credit Card is to give students in Bihar a financing option that is more affordable and student-friendly than regular education loans. Under this scheme, the amount you receive can be used for tuition fees, books, laptops, hostel charges and other academic needs, but it is not free money or a scholarship. It is a subsidised education loan. That’s why understanding EMIs, interest, and the long-term impact on your finances is essential before you apply.

The MNSSBY Bihar Student Credit Card is a flagship scheme launched by the Bihar government to support students who have passed Class 12 or an equivalent examination and want to pursue higher education. Under this scheme, students can get up to ₹4 lakh as an education loan for recognised courses. It has been designed especially for families who want their children to study further but find it difficult to arrange a large amount of money at once or to take a high-interest loan from a bank. This scheme is not only for students in big cities; it also targets those from villages and small towns who often lack financial backing despite having talent and ambition. The MNSSBY Bihar Student Credit Card is particularly helpful for first-generation college students whose families have never had the chance to send anyone to a professional or higher education programme. With lower interest rates, longer repayment periods and government support, this card becomes a reliable option for parents who are otherwise hesitant to take loans.

MNSSBY Bihar Student Credit Card

| Point | Details |

|---|---|

| Scheme Name | Bihar Student Credit Card Scheme (MNSSBY) |

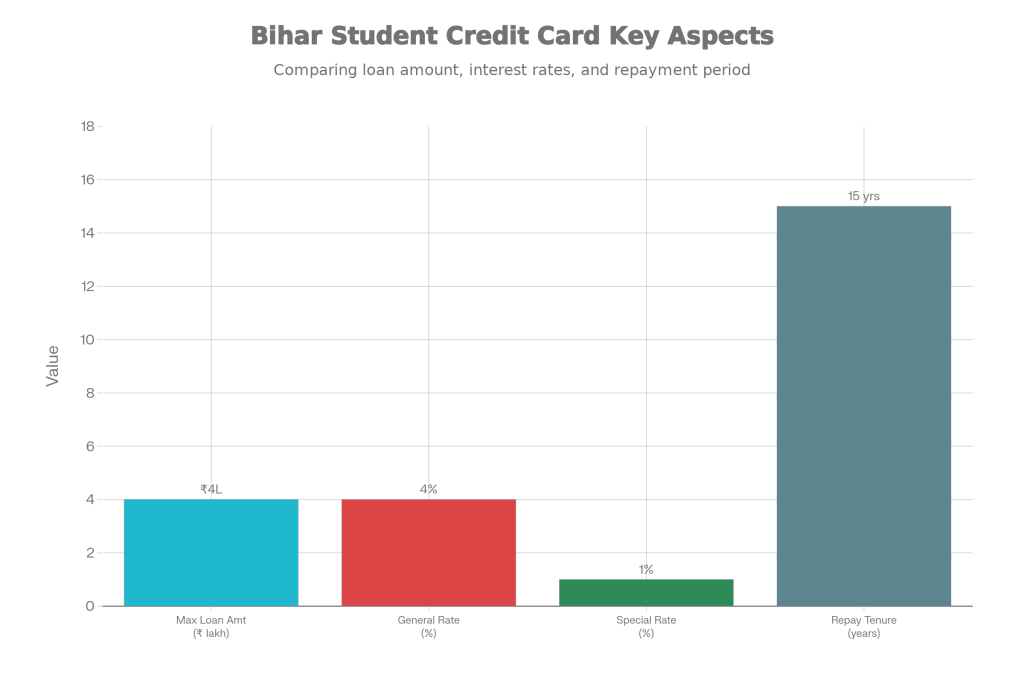

| Maximum Loan Amount | Up to ₹4,00,000 for higher education |

| Main Objective | To provide affordable higher education financing to meritorious but financially weak students |

| Expenses Covered | Tuition fees, books, laptop, exam fees, hostel/living and other academic expenses |

| Interest Rate (General) | Around 4% simple interest (with government subsidy) |

| Interest Rate (Girls/Divyang/Transgender) | Around 1% simple interest |

| Repayment Relief | Course duration + about 1 year moratorium before EMIs start |

| Maximum Repayment Tenure | Up to around 15 years through instalments |

| Collateral / Guarantee | No collateral; parents/guardian must be co-borrower |

| Application Mode | Completely online through the official portal |

| Target Beneficiaries | Residents of Bihar, Class 12 pass, admitted to approved courses/institutions |

Scheme Objective and Who Really Benefits From MNSSBY Bihar Student Credit Card

The core objective of this scheme is to ensure that no deserving student is stopped from entering college just because their family cannot afford the fees. For years, the gross enrolment rate in higher education in Bihar has been lower than the national average, and this scheme is an effort to close that gap. Whether a student wants to study engineering, medicine, management, law or a regular graduation course, the idea is to remove financial fear from the decision-making process. The biggest beneficiaries are lower middle-class and economically weaker families. In such homes, where income is limited and sometimes more than one child is studying, arranging ₹50,000–₹80,000 at once or paying ₹1–2 lakh annually towards fees is extremely difficult. In these situations, the MNSSBY Bihar Student Credit Card allows the entire course to be financed in a structured way so that the family is not crushed under immediate financial pressure and the student can study with peace of mind.

Which Courses Are Covered Under the MNSSBY Bihar Student Credit Card Scheme?

- The scheme covers a wide variety of courses rather than just one or two specific degrees. It includes general graduation programmes like B.A., B.Sc. and B.Com, along with professional and technical courses such as B.Tech/B.E., MBBS, BDS, BAMS, BHMS, Nursing, Pharmacy, BCA, BBA, B.Ed., Law (LLB or integrated courses), Hotel Management, Journalism, Fashion Designing, Fine Arts, Agriculture and several diploma programmes. The list is updated from time to time so that it stays aligned with job market trends and new in-demand fields.

- However, there is a crucial condition: both the course and the college must be recognised and included in the approved list under the scheme. Taking admission purely because a private college is advertising aggressively, without checking its recognition status, can create major problems later if the institution is not on the official list. So, checking whether your college and course are approved under the MNSSBY Bihar Student Credit Card scheme should always be your first step. This will help you avoid rejection or delays during loan processing.

Interest Rate, Benefits and The Real “Catch”

- On the surface, the biggest advantage of the MNSSBY Bihar Student Credit Card is its low interest rate. While traditional education loans from banks often carry interest rates of 10–12% or even higher, this scheme keeps the rate around 4% for general students. For girls, differently abled students and transgender students, the rate can be as low as around 1%. The government subsidises a significant portion of the interest, which reduces the direct burden on the student and their family.

- But this is also where the real catch lies. The money you receive is not a grant or a one-way benefit; the MNSSBY Bihar Student Credit Card is still a loan and must be repaid in full. You usually get a moratorium period that covers the duration of your course plus roughly one additional year, during which you generally don’t need to pay EMIs. After that, you must repay the entire loan within a period that can extend up to about 10–15 years. If you choose a course with poor demand in the job market, or if you do not secure a stable income after graduation, this loan can quickly turn into a long-term financial burden and stress point. Treating it as a serious responsibility rather than “easy money” is essential.

How To Apply for MNSSBY Bihar Student Credit Card: Step-By-Step Process

The application process for the MNSSBY Bihar Student Credit Card is fully digital, making it easier and more transparent. Here is a simple breakdown of the steps:

- Visit the official portal and register as a new applicant by providing basic details like your name, mobile number, email and Aadhaar.

- After registration, you receive a user ID and password, which you can use to log into your account.

- Once logged in, select the Bihar Student Credit Card scheme and fill in the detailed application form with your personal details, Class 10 and 12 marks, course name, college information, fee structure and family income details.

- Submit the form online. Your case is then forwarded to the District Registration and Counselling Centre (DRCC).

- At the DRCC, your documents are verified, and you may be called for counselling or clarification if required.

- If everything is in order, your file is sent to the financing agency or bank, which takes the final decision on loan approval.

- After approval, the loan is sanctioned and the MNSSBY Bihar Student Credit Card is effectively activated for your educational payments.

Eligibility Criteria, Conditions and Required Documents

The scheme is not open to everyone by default; there are fixed eligibility conditions that applicants must meet:

- The applicant must be a permanent resident of Bihar.

- The student must have passed Class 12 or an equivalent examination from a recognised board.

- The student must have taken admission or secured a confirmed seat in a recognised college and in a course approved under the scheme.

- There is usually an upper age limit for certain levels of courses, especially undergraduate programmes, based on official guidelines.

As for documentation, you generally need:

- Aadhaar card

- Residence certificate

- Income certificate

- Class 10 and 12 mark sheets

- Admission letter or provisional admission document

- Official fee structure issued by the college

- Passport-size photographs

- Bank passbook copy

- KYC documents of parents or legal guardian

One important condition is that parents or a legal guardian must be added as co-borrowers. This means that the responsibility to repay the MNSSBY Bihar Student Credit Card loan is legally shared by the student and the family, not borne by the student alone.

LIC Amrit Bal Policy Explained: Why Many Are Choosing It Over FD and RD Options

Is This Scheme Really Right for You?

Now comes the practical and most important question should you actually opt for this scheme? If you are serious about your studies, have chosen a course with clear demand in the job market, trust the quality of your college and are confident about working hard, then the MNSSBY Bihar Student Credit Card can be an excellent support system. It gives you the breathing space to complete your education without immediate financial pressure and allows you to repay the amount later in manageable EMIs with a comparatively low interest rate. However, if your only motivation is “I will easily get ₹4 lakh”, and you are taking admission in any random course or weak institute without proper research, then you might be walking into a trap. Poor placement records, weak course relevance and an unclear career plan can turn this loan into a heavy long-term burden. Before applying, ask yourself honestly:

- Will this course realistically help me earn enough over the next 5–10 years to repay the EMIs comfortably?

- Is my chosen college recognised, reputed and approved under the scheme?

- Am I ready to handle a long-term financial commitment after my studies?

If your answer is a confident “yes”, then the MNSSBY Bihar Student Credit Card can genuinely help transform your future. If not, it is wiser to rethink your options now rather than regret later.

FAQs on MNSSBY Bihar Student Credit Card

1. How much loan can I get under the MNSSBY Bihar Student Credit Card scheme?

You can get up to ₹4,00,000 as an education loan, which can be used for your tuition fees and other essential study-related expenses for the entire course duration.

2. Do I need to provide property or any collateral for this loan?

No, you do not need to provide any property or collateral. Your parents or legal guardian simply need to be added as co-borrowers, sharing the responsibility of repayment with you.

3. When do I need to start paying EMIs and interest?

Generally, you get a moratorium period covering your course duration plus about one extra year. After that, you must start repaying the loan through EMIs within the agreed tenure, usually up to around 10–15 years.

4. Can this loan be used for colleges outside Bihar as well?

In some cases, yes. If the college and course outside Bihar are recognised and included in the approved list under the scheme, the loan can be used. You should always verify this in advance.

5. What happens if I am unable to repay the loan on time?

If you miss EMIs or delay repayment, you may face penalties, an increase in outstanding dues and a negative impact on your credit score. This can make it difficult to get future loans such as home, car or personal loans, so timely repayment is very important.