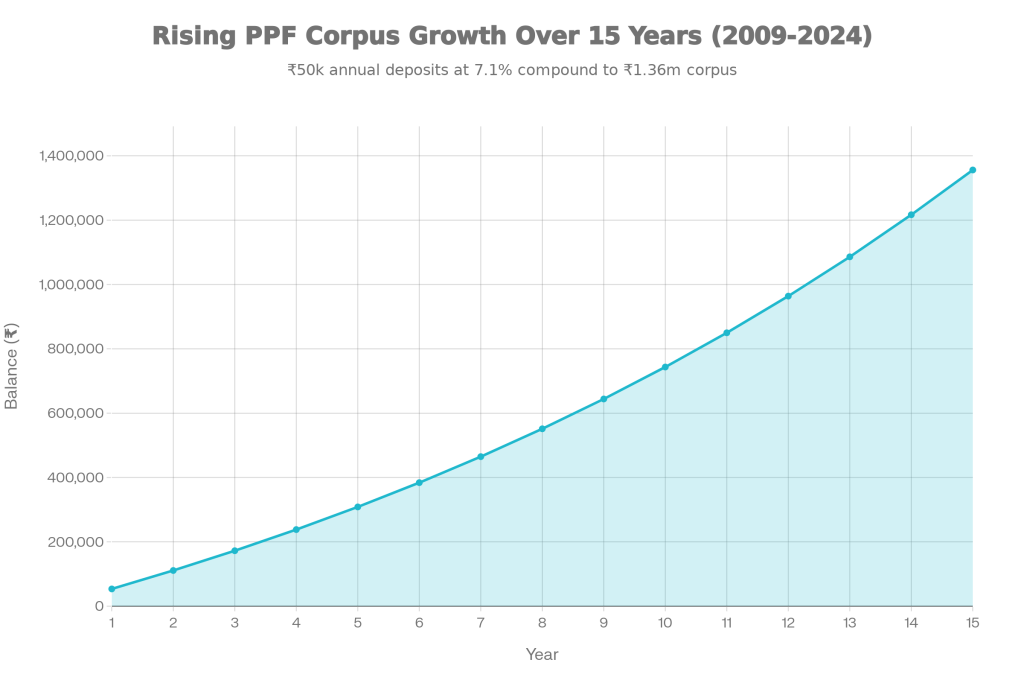

When people first hear that they can create around ₹14.5 lakh from a simple government savings scheme, it often sounds too good to be true. But once you understand the structure of PPF and how interest compounds over time, the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh starts to look very practical.

The core idea is simple: you deposit a fixed amount every year (or every month), the government credits interest at a fixed rate every year, and that interest itself earns more interest over the 15-year period. With consistent contributions and patience, your total maturity amount becomes much larger than the sum of your deposits. That is the real power behind the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh.

Post Office PPF Breakdown

| Detail | Key Information |

|---|---|

| Scheme Name | Public Provident Fund (PPF) – available at post offices and most banks |

| Current Interest Rate (2025) | 7.1% per annum, compounded annually |

| Minimum Yearly Deposit | ₹500 per financial year |

| Maximum Yearly Deposit | ₹1.5 lakh per financial year |

| Lock-In / Tenure | 15 years (with an option to extend in 5-year blocks) |

| Deposit Frequency | Once a year or in up to 12 installments (monthly style) |

| Tax Treatment | EEE – Tax deduction on investment, tax-free interest, tax-free maturity amount |

| Typical Mid-Range Example | Around ₹13–₹14.5 lakh from disciplined mid-level yearly contributions for 15 years |

| Risk Level | Very low, sovereign-backed |

What Is PPF and How Does It Work

PPF, or Public Provident Fund, is a long-term small savings scheme backed by the Government of India. It is designed especially for conservative investors who want a combination of safety, steady returns, and strong tax benefits. You can open a PPF account at a post office or authorised bank branch with basic KYC documents and a small initial deposit. Once the account is open, you can deposit any amount from ₹500 up to ₹1.5 lakh in a financial year. The money in your PPF account earns interest at the notified rate, currently 7.1% per annum, which is compounded annually. The catch and the advantage is the 15-year lock-in period. This long tenure forces discipline and allows compounding to work fully in your favour.

How Regular Savings Turn Into ₹14.5 Lakh

- Now let’s connect this to the headline idea: Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh. The maturity amount in PPF is largely driven by three things: how much you invest every year, when you invest during the year, and how long you remain invested.

- Imagine you decide to invest a mid-range amount every year, something like ₹50,000–₹70,000. Over 15 years, your total contribution will be far less than ₹14.5 lakh, but because each year’s deposit earns interest for the remaining years, the final amount balloons. This is classic compound growth in action.

- For example, a yearly contribution around the mid-range level at 7.1% for 15 years can bring your maturity amount close to the ₹14.5 lakh mark. You are not doing anything complicated just taking advantage of time, interest, and discipline. That is the essence of the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh.

Monthly Vs Yearly PPF Contributions

A common question is whether you should contribute monthly or yearly. Technically, PPF works on a yearly interest calculation basis, but it allows you to deposit up to 12 times in a financial year. Most salaried investors prefer treating it like a monthly SIP because it aligns better with their income flow and makes saving easier.

From a pure interest-earning perspective, depositing your full yearly amount at the start of the financial year (in April) is slightly better. The longer your money stays in the account during the year, the more interest it earns. So, if your goal is aligned with the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh, a smart strategy is to fix a yearly target amount and try to deposit it as early as possible each year.

Latest PPF Interest Rate and Why It Matters

The current PPF interest rate has held steady at 7.1% per annum for quite some time. For a completely risk-free, government-backed product, 7.1% with annual compounding is quite attractive, particularly when you factor in the tax-free nature of both interest and maturity amount. Over a 15-year horizon, even a small change in interest rate can affect the final maturity value significantly. A stable, decent rate like 7.1% helps strengthen the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh because the compounding has a solid base to work from. As long as you stay consistent with contributions, the interest rate quietly keeps adding layers to your corpus in the background.

Tax Benefits and Safety Of Post Office PPF

One of the biggest reasons people love PPF is its “EEE” tax status Exempt at investment, Exempt on interest, and Exempt on withdrawal. Your deposits qualify for deduction under Section 80C, the interest is not taxed each year, and the entire maturity amount is tax-free. That makes the effective return much higher than what the nominal interest rate alone suggests.

On the safety side, PPF is backed by the Government of India. Unlike corporate deposits or market-linked products, the risk of default is negligible. When you are planning a long-term goal like your child’s education, retirement, or simply building a solid corpus, the combination of safety, tax-free compounding, and guaranteed returns makes the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh very compelling.

Practical Strategy To Reach Around ₹14.5 Lakh

Turning the theory into a workable plan is where most people get stuck. Here is a straightforward way to structure your Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh:

- Decide your time horizon: Use the full 15-year tenure. Do not treat PPF as a short-term parking space.

- Fix a realistic yearly contribution: For many middle-class families, a range of ₹50,000–₹80,000 per year is manageable if budgeted well.

- Convert yearly into monthly: Divide the annual figure by 12 and set up a standing instruction from your bank to your PPF-linked account.

- Avoid withdrawals and loans: While PPF does allow partial withdrawals and loans after certain years, use them only for genuine emergencies so compounding is not disturbed.

- Consider extension after 15 years: If you don’t need the money immediately, extending the account in 5-year blocks (with or without fresh contributions) can take your corpus well beyond the ₹14.5 lakh level.

By following these simple steps, the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh moves from concept to a personalised savings blueprint. You are essentially automating your wealth creation over the next decade and a half.

Unified Pension Scheme 2025: How the New Rules Change Retirement Options for Govt Employees

Who Should Use Post Office PPF for This Goal

- PPF is not for everyone, but it is perfect for certain types of investors. If you are risk-averse, do not understand or like the volatility of equity markets, and want a guaranteed long-term pot of money, PPF should be high on your list.

- It also works very well for disciplined investors who are okay with locking in money for 15 years and not touching it. If you fall into this category, using the Post Office PPF Breakdown: How Regular Savings Can Grow Into ₹14.5 Lakh as a benchmark can give you a clear, tangible target to stay motivated. You can combine PPF with mutual funds or other instruments too, but PPF can act as the stable backbone of your long-term plan.

FAQs on Post Office PPF Breakdown

How much should I invest in PPF annually to target around ₹14.5 lakh?

While the exact figure depends on interest rate changes and timing, a consistent mid-range yearly contribution (for example in the ₹50,000–₹70,000 band) over 15 years can bring you close to a ₹14.5 lakh corpus.

Can I open a PPF account only in the post office?

No, you can open a PPF account either at a designated post office or at selected public and private sector banks. The rules, interest rate, and tax benefits remain the same regardless of where you open the account.

What happens after the 15-year lock-in period ends?

At the end of 15 years, you can withdraw the full amount completely tax-free. Alternatively, you can extend the account in blocks of five years, with or without making fresh contributions, and keep enjoying compounding on your accumulated balance.

Is PPF better than mutual funds for long-term wealth creation?

PPF is safer and offers guaranteed, tax-free returns, but mutual funds especially equity funds have the potential to deliver higher returns over the long term, though with more risk.